Policy:

advertisement

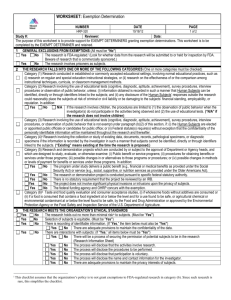

CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance ASSESSMENT AND TAXATION EXEMPTION POLICY PURPOSE This policy is intended to provide guidance in the processing of applications for exemption from property taxes pursuant to Section 339 and 341 of the Municipal Act. There are three principal areas of concern: Whether or not the City is indirectly subsidizing activities or facilities that are not its responsibility; Whether the agencies that are in receipt of tax exemptions require such exemptions; Whether the agencies that are in receipt of tax exemptions are providing a benefit to the City as a whole. Exemptions provided for in Sections 339(1)(g)(h)(l)(k) and 341 of the Municipal Act are at the discretion of Council. This policy is intended to establish general principles, which can serve as a guide in evaluation of applications for exemptions. POLICY General 1. Additional exemption under Sections 339(l)(g)(h)(l)(k) and 341 are at the discretion of Council. There is no obligation to give exemption. Exemptions cannot be granted if the owner does not qualify under the Municipal Act. 2. Sections 340 and 341 requires that the exemption be granted by bylaw, adopted by 2/3 of Council, prior to October 31 of the year preceding the year of exemption. 3. All exemptions are to be reviewed by Administration each year to ensure that, based on the most current available information, they continue to be qualified for the exemption. The results of that review are to be reported to Council. 4. Once granted, tax exemptions are likely to continue in effect (even though they are renewed each year by bylaw) so long as the property remains eligible under Section 340 and 341 and the applicant's condition is unchanged. It would be a sound practice to periodically review the exemptions to ensure that the original justification and purpose of the grant are unchanged and that continued exemption is compatible with City policy. Therefore, once every three years all the exemptions shall be reviewed by Council. The first such review will occur in the third year after the adoption of this policy. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 1 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance POLICY General (continued) 5. Application for tax exemptions (in respect of property not previously exempted) should be referred to Council as soon as they are received by Administration, so that Council may have adequate time to consider the exemption. When such exemptions are referred to Council, the application should be accompanied by an estimate of the value of the exemption. 6. The value of tax exemptions should be taken into consideration when the annual grants to organizations are considered, recognizing that the exemption is similar in effect to a cash grant. 7. Private Hospitals Community Care Facilities 8. 9. 7.1 Section 341(1)(g) allows for an exemption for property owner or held by a person or organization and operated as a private hospital licensed under the "Hospital Act" or an institution under the "Community Care Facility Act". 7.2 The general conditions for tax exemptions apply to these properties. Non-Profit Organizations in Occupation of School Premises 8.1 Section 341(2)(m) provides for exemption of the interest in school buildings held by a non-profit organization specified by Council which is a licensee or tenant of a board of school trustees. Section 341(2)(o) provides for exemption where a non-profit organization is sub-lessee of some other organization which has a lease of school properties, or where a school board is renting out a building for revenue purposes. 8.2 The general conditions for tax exemptions apply to these properties. Public Worship 9.1 Section 339(g) provides tax exemption subject to Section 340(1) for buildings and land used as public worship, together with an area of land surrounding the building determined by Council as being reasonably necessary in connection with the public worship. 9.2 Exemptions of land (other than the land on which the building stands, which is exempted by statute) will be limited to that land which is required for off-street parking, plus ancillary lands required to make a reasonably shaped parcel. 9.3 Exemptions will not be granted for land held for future development and land greater than normally required for buffer zones. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 2 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance POLICY General (continued) 10. 11. 12. Private Schools 10.1 Section 339(k) provides tax exemption for buildings and land used as private schools, together with an area of land surrounding the building determined by Council as being reasonably necessary in conjunction with the private school. 10.2 Exemptions of land (other than the land on which the building stands, which is exempted by statute) will be limited to that land which is required for off-street parking, playgrounds, buffer zones to screen the school from residential, commercial or industrial uses, plus ancillary lands required to make a reasonably shaped parcel. 10.3 Exemptions will not be granted for land held for future development and land greater than normally required for buffer zones. Recreational Facilities 11.1 Section 341(2)(b) provides for exemption of land "owned or held by an athletic or service club or association and used principally as a public park or recreation ground or for public athletic or recreation purposes". 11.2 The exemption may apply to the whole or a part of the taxable assessed value of land, improvements or both. 11.3 The general conditions for tax exemptions apply to these properties. Aid to Charitable or Philanthropic Organizations 12.1 Section 341(2)(1)(c) allows for an exemption for facilities "not being operated for profit or gain and owned by the charitable or philanthropic organization supported in whole or in part by public funds and used exclusively for charitable or philanthropic purposes. 12.2 The objective is to provide assistance to community organizations which provide services over and above those which are normally provided by the provincial ministries concerned with health and welfare, and which depend in large upon charitable contributions to sustain their operations. 12.3 Exemptions may be granted to such property subject to the following: 12.3.1 An exemption shall only be granted where: The organization can show a financial need for exemption; The organization can establish that it is a charitable or philanthropic organization; That the property is not operated for profit or gain and is used exclusively for charitable or philanthropic purposes; The organization can show that it is in receipt of public funding. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 3 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance POLICY General (continued) 13. 14. 12.3.2 An exemption will not be granted where there is a contract with the Province for the provision of specific services and where the contract covers virtually all of the operating costs of the facility. 12.3.3 Tax exemption will not be extended to organizations providing residential care unless the majority of the facility's residents were normally residents of the City. 12.3.4 Exemptions will not be granted where the service is one which is normally provided by the Provincial Government (homes for the handicapped or infirm, including the mentally challenged, homes for juveniles who have been judged delinquent or who are deemed to be in need of custody or rehabilitation services, etc.). Each instance will be reviewed to determine whether or not the application for exemption arises as a result of the "privatization" or "regionalization" program. 12.3.5 Where there is a mix of uses, some of which are supported by the Province and some, which are supported by private philanthropy, Council may determine the proportion of the assessment which is to be tax-exempt. Cultural 13.1 Section 341(2)(1) provides for exemption for properties "not being operated for profit or gain and owned by a charitable or philanthropic organization supported in whole or in part by public funds and used as an art gallery, museum or for other cultural purposes". 13.2 The exemption may apply to the whole or a part of the taxable assessed value of land, improvements or both. 13.3 The general conditions for tax exemptions apply to these properties. General Conditions 14.1 An exemption shall only be granted where the organization can show a financial need for the exemption. Determination of financial need would involve showing the lack of a tax exemption would seriously impair services to the community at large or would impose significant hardship on the users of the facilities (such as user fees which would be substantially higher than those charged for other activities involving similar levels of supervision, instruction or capital investment). 14.2 The purpose of the use to be exempted must be one which, in the opinion of Council, will result in an improvement in the quality of life within the community. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 4 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance POLICY General (continued) 14.3 The facility must be accessible by the public, but this is not to be taken as preventing: The imposition of admission fees or membership fees, provided that membership is available to any member of the community, without limitation as to numbers, and provided that admission is available to any member of the community (subject to limitations of the facility's capacity); and The granting of preferential rates or times of use for members as opposed to non-members. 14.4 The activities carried out on the land or in the facility must be of a type enjoyed by a significant proportion of the general public (that is, they must not be activities which cater only to a small minority). 14.5 The operators must be able to demonstrate that they actively seek to involve the general public in the facility's use and in particular that they encourage youth activities (where appropriate). 14.6 The facility must not be operated for profit. 14.7 Where a facility competes directly with privately owned facilities providing a similar service, Council may exempt only a portion of the assessed value of the land and/or improvements. In considering the proportion to be exempted, Council shall take into account the proportion of the use which is granted at nominal charges without charge to community groups (and especially youth organizations). 14.8 Where the facility contains service areas such as food services, licensed premises, retail facilities, or concession stands operated either by the owner or by tenants, the proportion of the assessed values of the improvement eligible for exemption shall be determined by Council. The objective is not subject such service areas to taxation. 14.9 If all or part of the facility is leased to commercial ventures, or to organizations not eligible for exemption, the proportion of the assessed values of the improvement eligible for exemption shall be determined by Council. The objective is subject to those portions of the facility to taxation. 14.10 Where the activity requires significant amounts of land, and where such land is deemed by Council to provide a desirable greenbelt for the enjoyment of the general public, exemption may be granted for the land only. 14.11 Where Senior Government funding is received by the applicant, Council will review the application and make its decision based on merit and ability of the applicant to pay property taxes. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 5 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance POLICY General (continued) 15. 16. Information Requirements 15.1 The information to be provided on the form attached as Schedule "A" by applicants may vary depending upon the nature of the appellant, and shall include the following exhibits: Financial statements most current actual and budget; A statement of the likely impact if tax exemption is not granted; A statement as to whether the facility is to be open to the public or to members only, and whether membership (if required) is available to any member of the community; Information on how the organization seek to involve members of the public and how the organization encourages youth activities; An explanation of any retail facilities (such as food, liquor, equipment sales, etc.) and details of the operating arrangements; Information on any leases of the property for commercial or private purposes; Information on the extent of use of the property, and the types of users; A statement explaining the use of the property; Information on any contracts with the Province for the provision of services. 15.2 Council reserves the right to request any additional information which may be required to enable Council to determine if property tax exemption is warranted. Application Deadline 16.1 All applications are to be received by the City Clerk's office no later than August 31, in the year prior to the year in which exemption is being requested. Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 6 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance Schedule A Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 7 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance Schedule A Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 8 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance Schedule A Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 9 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance Schedule A Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 10 of 11 CITY OF FORT ST. JOHN ASSESSMENT AND TAXATION EXEMPTION Council Policy No. 21/00 Records Management Number: 1970-00 Finance Schedule A Council Resolution Number: 158/00 Supersedes Council Resolution Number: 539/97, 357/95 Effective: August 14, 1995 Page: 11 of 11