III. The four scenarios

advertisement

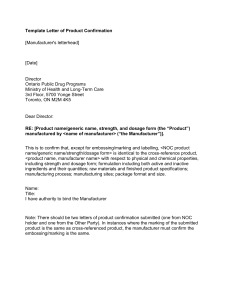

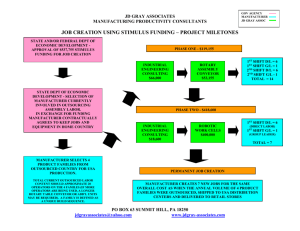

Co-op Advertising and Pricing Models In a Manufacturer-Retailer Supply Chain* Alexandre Neyret, Jinxing Xie Department of Mathematical Sciences, Tsinghua University, Beijing 100084, CHINA Abstract: This paper is concerned with co-op advertising strategies and equilibrium pricing in a two-members channel of distribution. Four different models are discussed which are based on three non-cooperative game (like the leaderfollower game and the Nash game) and one cooperative game. We identify optimal pricing and optimal advertising strategies (with co-op advertising policies) for both firms mostly analytically but we have to resort to numerical simulation in one case. Comparisons are made about the various outcomes in every case and especially profits. This leads to consider more specifically the cooperation case in which profits are the highest for both retailer and manufacturer and how they share the extra join profit achieved by moving to cooperation. Keywords: co-op advertising; pricing; supply chains; game theory; cooperation; bargaining problem I. Introduction Vertical co-op advertising is an interactive relationship between a manufacturer and a retailer in which the retailer initiates and implements a local advertisement and the manufacturer pays part of the cost. It is often used in consumer goods industry and plays a significant role in market strategy for many companies. The main reason for a manufacturer to use co-op advertising is to strengthen the image of the brand and to motivate immediate sales at the retail level. The manufacturer’s national advertising is intended to influence potential consumers to consider its brand and to help develop brand knowledge and preference whereas retailer’s local advertising is to stimulate consumer’s buying behavior. Most studies to date on vertical co-op have focused on a relationship where the manufacturer is the leader and the retailer is a follower, which implies that the manufacturer dominates the retailer. But today’s retail market for most consumer goods in dominated by large retail chains who retain equal or more power than most manufacturers. Hence, recently Jorgensen, Sigue and Zaccour [10] used differential game theory to study a two member channel in which a manufacturer and an exclusive retailer can make advertising expenditures that have both short and long term impact on the retailer’s sales and the manufacturer can also support retailer’s advertising efforts through a co-op advertising program. Two scenarios were considered: the manufacturer leader versus the retailer * follower game and the non-cooperative Nash game. Their results state that supporting both types of retailers’ ad provides more profit for both channel members. Lately, Huang and Li [3] and [4] explored the role of vertical co-op advertising efficiency with respects to transactions between a manufacturer and a retailer through brand name investments, local advertising expenditures and sharing rules of advertising expenses. Three co-op advertising models are discussed which are based on two-non cooperative games (the manufacturer is the leader and Nash) and one cooperative game, which can provide the highest profits for both manufacturer and retailer. Nevertheless, though a fundamental task for supply-chain managers is to determine wholesale and retail prices (see for example Choi [2], [3] and Ingene and Parry [5], [6], [7]), both studies assumed that the market demand is only influenced by the advertising level and not in any way by the retail price. In fact, the literature dealing with both pricing and advertising strategies at the same time is very sparse. See for example, Jorgensen and Zaccour [9] who only studied conflict and coordination case in a two-member channel of distribution through pricing and advertising but without any co-op advertising policy. That’s why this paper focuses on pricing and (co-op) advertising strategies in a manufacturer/retailer supply chain through all the possible (four) different cases: the manufacturer is the leader, the retailer is the leader, the conflict Nash case and the cooperation case. The paper proceeds as follows. Section II presents our model and our assumptions. Section III identifies analytical equilibrium solutions for all the cases except the one where the manufacturer is the leader. That’s why we have to resort to numerical simulation in Section IV, which also compares the outcomes under the different scenarios. Section V summarizes the results. II. Model and Assumptions We consider a single manufacturer-single retailer channel in which the retailer sells only the manufacturer brand within the product class. Decision variables of the channel members are their advertising efforts, their prices (manufacturer price and retail price) and the co-op advertising reimbursement policy. Denote by a and q respectively the retailer’s local advertising level and the manufacturer’s national brand name investments. The consumer demand function V depends on the retail price pr Supported by China 863 Plan Project No. 2001AA414230 and NSFC Project No. 69904007. and the advertising levels a and q in a multiplicatively separable way (see [9]), V (a, q, pr ) g ( pr )S (a, q ) where g ( pr ) is linearly decreasing and S (a, q) is the same function as in [3] to model in a static way advertising effects on sales: V (a, q, p r ) g ( p r ) S (a, q) ( p r )( A where , , B, , B (1) ) a q are positive constants, A>0 is the sales saturate asymptote. We denote by t , pm respectively: the fraction of total local advertising expenditures, which the manufacturer agrees to share with the retailer (that is to say the manufacturer’s co-op advertising reimbursement policy) and the manufacturer transfer price to the retailer. Then if we agree to denote by c=const>0 the manufacturer unit production cost and by d=const>0 the retailer unit production cost then the manufacturer’s, retailer’s and system’s profits are as follows: B m ( pm c)( pr )( A ) ta q a q B ) (1 t )a a q B m r ( pr c d )( pr )( A ) a q a q Now to handle the problem in a more convenient way, it could be shown that with an appropriate change of variables we can have: 1 m pm (1 pr )( A* ) ta q a q (2) 1 r ( pr pm )(1 pr )( A* ) (1 t )a a q 1 m r pr (1 pr )( A* ) a q a q r ( pr pm d )( pr )( A obvious that the manufacturer’s profit is increasing with p m. But pm can’t be equal to 1 otherwise there is no profit at all for both manufacturer and retailer… We have to add one more hypothesis: if the manufacturer and the retailer are in a symmetric relationship then we could assume that their respective margins are equal that is: ( pr pm ) pm (5) A Nash symmetric equilibrium is obtained by simultaneously solving the following three first-order conditions for the manufacturer and the retailer plus condition (5) (for the details of the calculus see [12]): pmN 1/ 3, prN 2 / 3 a N [( / ) / 9]1/( 1) , q N / a N tN 0 3.2 Stackelberg Retailer Equilibrium We now model the relationship between the manufacturer and the retailer as a sequential no cooperative game with the retailer as the leader and the manufacturer as the follower. The solution of this game is called Stackelberg (Retailer) equilibrium. The retailer, as the leader, first declares the level of local advertising expenditures that he is willing to pay and set the retail price for the product. The manufacturer, as the follower, then set its own brand name investments level and its manufacturer price. In order to determine Stackelberg retailer equilibrium, we first solve the manufacturer optimal problem (3) by finding optimal t, q and pm that is t t r , pm pmr , q q S S Sr . Once again we get t=0. As above, the manufacturer’s profit is increasing with pm but, especially in a follower position, it’s hard to set the manufacturer’s price as big as desired and the natural constraint is that the manufacturer margin should not be bigger than the retailer’s one so we add (5) again. Next, the optimal values of a a r , pr pr r (6) are S S determined by maximizing the retailer’s profit subject to the constraints imposed by equations (6). That is to say: III. The four scenarios Max r with t 0, pm pmSr , q q sr 3.1 Nash Equilibrium 0 a ,0 pr 1 In this section, we assume a symmetric relationship between the manufacturer and the retailer who simultaneously and no cooperatively try to maximize their own profits. It is called a simultaneous move game and the solution provided by this structure is called Nash equilibrium. Hence the manufacturer’s optimal problem and the retailer’s optimal problem are respectively: (3) Max m 0t 1,0 q ,0 pm 1 Max r pmSr 1/ 4, prSr 1/ 2 a Sr [( ( 1) S ) ]1/( 1) , q S a ( 1) 8( 1) r r t Sr 0 3.3 Stackeleberg Manufacturer equilibrium and 0 a ,0 pr 1 We finally find (for details of the calculus see [12]): (4) Now, it’s obvious that the optimal value of t is zero because of its negative coefficient in the objective. It’s also In this part, we model the relationship between the manufacturer and the retailer as a sequential no cooperative game in the same way than before but with the manufacturer as the leader and the retailer as the follower. The solution of this game is hence also called Stackelberg (manufacturer) equilibrium. We shall proceed exactly as above. In order to determine Stackelberg manufacturer equilibrium, we first solve the retailer optimal problem (4) by finding optimal values a values of Sm , prSm . Next, the optimal q, pm and t are determined by maximizing the manufacturer’s profit subject to a a We can get expressions of a Sm Sm Sm r , p , pr prSm . ,q Sm , t Sm function does also implicitly define the constant join extra-profit such as: com r mmax r ( com mmax ) ( cor rmax ) m r 0 that manufacturer and retailer achieved by moving to a cooperation game equilibrium and that they will have to share. Of course the more the manufacturer gets, the less the retailer and vice versa. So they will bargain over ( pm , t ) with boundaries defined by inequalities (7), (8), and 0 pm p co r 0 t 1 (see Fig. 1) . S of pmm but the problem is that in that case equation doesn’t S lead to a closed-form result for pmm so we have to use t numerical simulation: that’s the point of the fourth part (for details about equations see [12]). m r 3.4 Cooperation In the previous three sections, we analyzed two sequential move and one simultaneous move no cooperative game structures. In this part, we focus on a cooperative game structure that is to say manufacturer and retailer both agree to take decisions in order to maximize the total system profit (joint payoff maximization). We hence have the following optimization problem: Max 0 pr 1,0 a ,0 q pr , a and q . If pr , a, q are respectively equal to prco , a co , q co that is (see calculation details in [12]) p 1/ 2 co r a co [( / ) / 4]1/( 1) q co / a co Then the system profit is maximized with t and pm free to take any value between 0 and 1 (provided of course that pm prco ). But obviously, the manufacturer’s profit and the retailer’s profit are not independent of t and pm . More precisely, neither the manufacturer nor the retailer would be willing to maximize the system profit and accept fewer profits with cooperation than with no cooperation. We call a co r rmax 0 qco max m A* prco aco max r A* pm Fig. 1 Feasible solutions and the bargain problem m r We notice that it depends only on co Iso-profit line m max m co solution ( pr , a , q , pm , t ) feasible if and only if it satisfies both inequalities (7) and (8): com m ( prco , a co , q co , pm , t ) max( mSm , mSr , mN ) mmax (7) cor r ( prco , a co , qco , pm , t ) max( rSm , rSr , rN ) rmax (8) It could be shown (see [12]) that feasible solutions do exist and both manufacturer and retailer are willing to cooperate. But we should notice that inequalities (7) and (8) IV. Comparison between the different cases 4.1 Numerical Assumptions In the previous part, we failed to analytically solve the Stackelberg Manufacturer case. In order to solve it numerically we need an estimation of the following parameters: , and A*. Our four assumptions are: In most cases, studies found out that the average advertising expenditures level represent five percent of the net company sales so q a 5 /100 m r net sales If advertising effects are modeled by equation (1) then we can reasonably argue that good estimations for A and ( B / a q ) are A 2 and B / a q 0.5 that is to say the maximum advertising policy can’t increase the sales by more than 100% and the average usual advertising level already makes an 50% up. According to our previous results a good guess for pr is pr 1/ 2 . Those assumptions allow us to have a general idea about the value of A*. With regards to , , a good range of value could be from 0,1 to 3 to keep as much generality as possible. We now can calculate the manufacturer price for different values of , in the manufacturer Stackeleberg case. Simulation with Mat lab 6.1 show (see details in [12]) that the manufacturer price is quite stable with typical values ranging from 0.45 to 0.5 whereas the manufacturer participates in the local advertising expenditures of its retailer (that is to say t m 0 ) only if we approximately have 1 . This result is compatible with Proposition 1 of Huang and Li [3]. More exactly, as increases from 0 to S 1,the participation t Sm strictly decreases from 0.5 to 0. 4.2 Comparison What’s the influence of the scenario on the retail and manufacturer price, the advertising expenditures and the profits? If we agree to consider the manufacturer price in the Stackelberg manufacturer case approximately equal to 0.47, we have, according to our previous analytical results and our numerical simulation, the following interesting table (Fig 2.): pr Co-op Sr Nash Sm 0.5 0.5 0.66 0.73 ? 0.125 0.111 0.07 ? 0.25 0.33 0.47 ? 0.125 0.111 0.1245 Retailer margin ( pr pm )(1 pr ) pm Manufacturer margin pm (1 pr ) Fig 2. Influence of the four scenarios on prices and margins We notice that the highest retail prices occur at the Stackelberg Manufacturer (Sm) and Nash equilibrium whereas the lowest retail prices occur when both retailer and manufacturer cooperate or when the retailer is the leader (S r). The high value of the retail price in the conflict case versus the low value of the retail price in the coordination case is well known in the literature. Now, if the manufacturer is the leader, he will abuse of its position to impose a very high price to its retailer who have consequently no choice but to mark a high retail price and yet to obtain a miserable margin. On the other hand, if the retailer is the leader, he marks a low retail price to get a high margin and hence induce a small manufacturer price; the high manufacturer’s margin is due to our hypothesis on the equality of retailer and manufacturer in this case. In the same way, we could get a comparison between the different levels of advertising expenditures in the different models. Concerning the local advertising expenditure of the retailer, it is the highest in the cooperation case and the smallest in the Stackelberg retailer case. On the other hand, the manufacturer brand name investment is the highest in the Stackelberg retailer and cooperation case and the smallest in the Stackelberg manufacturer case. Indeed, if the retailer is the leader, he will manage to make the manufacturer pay the larger amount of the total advertising expense with a high brand name investment and a comparatively small level of local advertising to increase its own benefit. The same explanation stands for the manufacturer being the leader. In the same way, in a conflict situation, we have a free-ride problem where both manufacturer and retailer has the temptation to invest less in advertising and to benefit from the investment of the other whereas this problem is solved in the cooperation case. But of course, the most interesting results deal with profits. There are two striking results. The first is that the manufacturer always prefers to be the follower of the retailer than to be in a conflict situation with it!! The second surprising result is: for low values of , ( 0.6) , the manufacturer even prefers to be the retailer’s follower rather than to be the leader (though numerical simulation prove the difference of profits to be very small)!! There are mainly two explanations to those facts. First, when the retailer is the leader, we have assumed (5) that leads to a quite a fair bargain for the manufacturer since though being the retailer’s follower it gains the same relatively high margin (see Fig 2.). The second reason is closely linked to the structure of the stackelberg manufacturer equilibrium itself. Indeed, we have a manufacturer “margin” equal to 0.125 in the stackelbeg retailer case, which drops to 0.1245 in the manufacturer stackelberg case. So we have to reach a certain value of delta for which the loss of profit due to expensive brand name investment in the stackelberg retailer case compensates the slightly higher manufacturer margin. Anyway, for relatively high , we have the expected result that the manufacturer always prefers to be the leader. With regards to the retailer’s profits we have the following very simple result: for every couple ( , ) , the retailer always prefers to be the leader and if it can’t, it always prefers to be in conflict with the manufacturer rather than to be his follower. Indeed, in Fig. 2 we see that the retailer’s margin in the Stackelberg manufacturer equilibrium is so small compared to the retailer’s margin in the Nash case, that it could never be compensated by the manufacturer’s advertising allowance. The only way for the retailer to accept would be to have a relatively low margin compared to the manufacturer’s one as showed in Huang and Li [3], but our model assumes equality between both margins. But we have already shown the most classical result that is co-operation guarantees the highest profits for both retailer and manufacturer with regards to every other situation. We know from above that if the retailer has the possibility to be the leader, it will and the manufacturer will accept to be his follower. On the other hand, if the manufacturer has the possibility to be the leader, it will but the retailer won’t accept and we have a conflict situation (Nash). In the first case, numerical simulation reveals a join extra-profit varying from 1% to 3% (it depends on , ) of the total system profit. And in the second case we have a join extra-profit varying from 14% to 16%. If by any chance the manufacturer manage to make a follower of the retailer then moving to cooperation generates a join extra-profit of 34% to 39% of the total system profit. But how to share that extra-profit? We have a well-known bargain problem (see above the end of Section 3.4). The approach that could be used to solve this issue is the Nash bargaining model (see Nash in [11]) where the bargaining outcome is obtained by maximizing the product of individual marginal utilities (here m (t , pm ) and r (t , pm ) ) over the feasible solution area (see Fig. 1). Huang and Li [3] used that model to determine the advertising allowance t and find out that the more riskaverse a member is, the lower his share of the profit is. Our bargaining problem is also solved using that method in [12]. V. Conclusion This paper attempts to identify the optimal pricing and advertising (included co-op advertising) strategies in four classical types of relationship between a manufacturer and a retailer using the game theory modeling. We find again some classical results like the advertising expenditures of both members is generally higher in a coordinated situation that in a non-coordinated situation but this doesn’t come at the expense of consumers, since the retail price is the lowest in the coordinated case (and the highest in the case where the manufacturer is the leader…). In the same way, the leader will always manage to make the follower invest more in advertising that it usually does in other case while the leader itself pays a smaller amount. With regards to profits, the retailer always prefers to be the leader whereas the manufacturer needs a certain influence of its brand name investment on sales to choose to be the leader otherwise it always gains to be the retailer’s follower... Furthermore, in our model, the retailer always prefers to be in conflict with the manufacturer rather than to be its follower though it may get advertising allowance. This may sounds also surprising but our model doesn’t take into account others factors than profit that may lead the retailer to accept to be the manufacturer’s follower like the competition between retailers for example or the manufacturer’s brand fame…Anyway, we prove that coordination always guarantees higher profits for both manufacturer and retailer than in any other case. But they have to bargain over the manufacturer price and the advertising allowance to share the system profit gain achieved by moving to cooperation. The approach that could be used to solve this issue this bargaining problem is the Nash bargaining model. Other interesting issues would be to relax the classical two channel members situation to a three channel members situation (either two manufacturers and one retailer or two retailers and one manufacturer) to move one step towards the understanding of the role of competition and cooperation. This kind of study has only been done in the field of pricing (see Choi [2], [3] and Ingene and Parry [5], [6], [7]). Next, our model suffers from some limitations due to the choice of its demand function. Changing it may yield some interesting results. References [1] Choi S., Price competition in a channel structure with a common retailer, Marketing Science, Vol. 10, 271-296, 1991. [2] Choi S., Price competition in a duopoly common retailer channel, Journal of retailing, Vol. 72, No.2, 117-134, 1996. [3] Huang Z. and Li S.X., Co-op advertising models in a manufacturerretailer supply chain: a game theory approach, European Journal of Operations Research, Vol. 135, 527-544, 2001. [4] Li S.X., Huang Z., Zhu J. and Chau Y.K. P. Cooperative advertising, game theory and manufacturer-retailer supply chains, Omega, Vol. 30, 347-357, 2002. [5] Ingene C.A. and Parry M.E., Channel coordination when retailers compete, Marketing Science, Vol. 14, No.4, 360-377, 1995. [6] Ingene C.A. and Parry M.E., Coordination and manufacturer profit maximization: the multiple retailer channel, Journal of Retailing, Vol. 71, No.2, 139-151, 1995. [7] Ingene C.A. and Parry M.E., Manufacturer-Optimal wholesale pricing when retailers compete, Marketing Letters, Vol. 9, No.1, 6577, 1998. [8] Ingene C.A. and Parry M.E., Is channel coordination all it is cracked up to be? , Journal of Retailing, Vol. 76, No.4, 511-547, 2000. [9] Jorgensen S. and Zaccour G., Equilibrium pricing and advertising strategies in a marketing channel, Journal of Optimization theory and applications, Vol. 102, No.1, 111-125, 1999. [10] Jorgensen S., Zaccour G. and Sigue S.P. Dynamic cooperative advertising in a channel, Journal of Retailing, Vol. 76, No.1, 71-92, 2000. [11] Nash J.F.Jr., The bargaining problem, Econometrica, Vol. 18, 155162, 1950. [12] Neyret A., Xie J., Co-op advertising models and pricing models in a manufacturer-retailer supply chain, working paper. Alexandre Neyret received the B.Sci. degree in Mathematics and Physics from Ecole Centrale Paris in 2000. He is currently an M.Sci. student in Operations Research Group at the Department of Mathematical Sciences, Tsinghua University. Jinxing Xie is a professor of operations research at Tsinghua University. He received a B.S. in applied mathematics in 1988 and a Ph.D. in computational mathematics in 1995 from Tsinghua University. He has published in European Journal of Operational Research, Operations Research Letters, International Journal of Production Research, International Journal of Production Economics, Production and Operations Management, Production Planning and Control, Decision Sciences, Supply Chain Management, Computers and Mathematics with Applications, and other journals. His current research interests include Supply Chain Management, Production and Inventory Control Systems, Machine Scheduling and Sequencing, Mathematical Modeling and Optimization.