Review Problems – Decision Analysis

advertisement

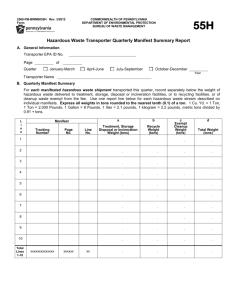

Review Problems – Decision Analysis 1. Given the following profit matrix, which alternative should be chosen using: a.) MAXIMAX c.) LAPLACE b.) MAXIMIN d.) MINIMUM REGRET Alternatives A B C D States of Nature 2 3 -200 50 290 -10 300 100 100 -75 1 500 100 -400 250 4 -150 100 -200 50 5 100 -20 100 10 2. A local company is trying to decide if it should stock a perishable product each week. The product costs the company $20 per unit, and can be sold for $25 per unit. Any product not sold by the end of the week can be sold for a salvage value of $5 per unit. The company charges itself $1 per unit for lost sales. There is a $20 per week fixed cost for stocking this product. The probability of demand for 50, 60 and 75 units is 0.6, 0.3, and 0.1, respectively. [Note: A more descriptive explanation of this problem is provided in the document, “Creating a Profit Matrix.”] Construct the decision matrix to help the company decide if they should stock this product and if so at what level, including the probability for each state of nature. DO NOT COMPUTE ANY EXPECTED VALUES. DO NOT MAKE A DECISION. 3. Given the following (profit) decision matrix and probabilities: a.) Calculate the expected value for each alternative. b.) Given that this is a repetitive decision, what do the expected values mean? c.) What alternative should be chosen using expected value? d.) What is the expected value of perfect information (EVPI)? e.) If your decision is followed, what profit can the company expect over time? f.) If your decision is followed, what profit can the company expect next period? Alternative A B C Probability 4. P(A1) = 0.2 P(A2) = 0.4 P(A3) = 0.4 1 300 -250 -40 .2 P(B1/A1) = 0.5 P(B1/A2) = 0.2 P(B1/A3) = 0.3 Find: a.) The joint probability table b.) P(A1/B3) States of 2 175 400 250 .3 Nature 3 250 300 100 .4 P(B2/A1) = 0 P(B2/A2) =0.5 P(B2/A3) =0.1 c.) P(A2/B3) d.) P(A2B3) 4 -120 25 50 .1 P(B3/A1) = 0.5 P(B3/A2) = 0.3 P(B3/A3) = 0.6 5. The MKA Company must decide which of two new stamping machines (the K223 and the H471) to purchase for the production of a new product. The product will sell for $5 per unit. The K223 costs $50,000, has a per unit cost of $1, and a has capacity of 100,000 units. The H471 costs $90,000, has a per unit cost $0.70, and has a capacity of 200,000 units. Demand for the new product will be either 100,000 units (probability of 0.6) or 200,000 units (probability of 0.4). If the company buys the K223 and demand is for 200,000 units, they can rush order a second K223 to meet this demand. The second K223 will have normal cost plus $15,000 for the rush order. If the company buys the H471 and demand is for only 100,000 units, the excess capacity will be wasted (but not charged for). The company wants to know which machine they should order to maximize profit. Draw the decision tree for this problem. Make sure to show all profits and probabilities. DO NOT FIND ANY EXPECTED VALUES. DO NOT MAKE A DECISION. 6. The Wave Wright Company is getting ready to add a new shipping route. They need to decide whether to buy a small (5000 ton), medium (10,000 ton), or large (15,000 ton) freighter. They estimate that the cargo available on this new route will be either 5,000 tons (probability of 0.3), 10,000 tons (probability of 0.6), or 15,000 tons (probability of 0.1). Each ton of cargo will generate a revenue of $500. It costs $100 per ton of capacity to operate a small ship, $80 per ton to operate a medium ship, and $60 per ton to operate a large ship. Once the company has bought a ship,, they are stuck with using it on this route. For example, if they buy a large ship, and the cargo available is only 5,000 tons, they will be operating the ship one-third full. However, if the cargo requirements are more than their capacity, they can buy more ships to cover this demand. If for example they buy a small ship and the cargo available is 10,000 tons, they can buy a second small ship to handle this demand. [Note: Costs are based on capacity, not cargo.] Draw the decision tree. Make sure to show all net profits and probabilities. DO NOT FIND ANY EXPECTED VALUES. DO NOT MAKE A DECISION. 7. A local firm is looking at introducing a new product. Marketing Research estimates that the product will be a failure with a probability of 0.4 and a loss of $900,000; the product will be moderately successful with a probability of 0.3 and a profit of $500,000; or the product will be very successful with a probability of 0.3 and a profit of $2,000,000. The company can of course choose not to introduce the product with a result of $0. It is possible for the company to test market the new product. Based on previous data, Marketing Research estimates that the probability of a positive test market result is 0.6. While payoffs remain the same, the probabilities change based on the outcome of the test market. If the test market is positive, the probabilities are Failure 0.3, Moderate Success 0.25, and Very Successful 0.45. If the test market is negative, the probabilities are Failure 0.5, Moderate Success 0.4, and Very Successful 0.1. Required: a.) Use a decision tree to determine what the company should do. b.) Calculate the EVPI. c.) Calculate the EVSI. d.) Calculate the efficiency of the survey.