cows 110

advertisement

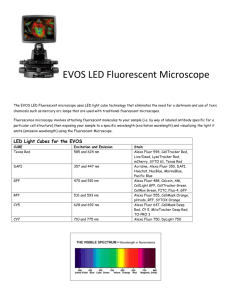

Chapter 18 SECURITIES REGULATION Practice Test 1. Christopher Stenger bought 12 Impressionist paintings from R. H. Love Galleries for $1.5 million. Love told Stenger that art investment would produce a safe profit. The two men agreed that Stenger could exchange any painting within five years for any one or two other paintings with the same or greater value. When Stenger’s paintings did not increase in value, he sued Love, arguing that the right to trade paintings made them securities. Is Stenger correct? The painting was not a security because there was no “common enterprise.” The investors did not pool funds or share profits with other investors. Nor did Love share in any profits earned on Stenger's paintings. Stenger v. R. H. Love Galleries, Inc., 741 F.2d 144 (7th Cir. 1984). 3. Fluor, an engineering and construction company, was awarded a $1 billion project to build a coal gasification plant in South Africa. Fluor signed an agreement with a South African client that prohibited them both from announcing the agreement until March 10. Accordingly, Fluor denied all rumors that a major transaction was pending. Between March 3 and March 6, the State Teachers Retirement Board pension fund sold 288,257 shares of Fluor stock. After the contract was announced, the stock price went up. Did Fluor violate Rule 10b-5? Because the company lacked scienter, the required state of mind, Fluor was not in violation. Fluor had no intent to defraud investors, it was simply making a good faith effort to comply with the terms of its contract. State Teachers Retirement Board v. Fluor Corp., 654 F.2d 843 (2d Cir. 1981). 5. Does this excerpt from the Boston Globe reveal any potential securities law problems? Berkshire Ice Cream’s down-home investment strategy is paying off for more than 100 people who last year put up $800 to $1,000 to “own” a company cow. Last month, the company sent out about $32,000 to investors who bought a total of 110 cows a year ago, with the expectation of a 20 percent annual return on their money. [I]nitially, there were 63 investors who agreed to finance the purchase of a cow—which the company then cares for—in return for a piece of the company’s profits.18 This ice cream company is selling a security and must comply with both state and federal securities laws. Ellen Lahr, “Investor Milks Profits of Ice Cream Firm,” Boston Globe, July 30, 1995, p. 38. 7. CPA QUESTION Pace Corp. previously issued 300,000 shares of its common stock. The shares are now actively traded on a national securities exchange. The original offering was exempt from registration under the Securities Act of 1933. Pace has $2.5 million in assets and 425 shareholders. With regard to the Securities Exchange Act of 1934, Pace is: (a) Required to file a registration statement because its assets exceed $2 million in value (b) Required to file a registration statement even though it has fewer than 500 shareholders (c) Not required to file a registration statement because the original offering of its stock was exempt from registration (d) Not required to file a registration statement unless insiders own at least 5 percent of its outstanding shares of stock C (b). The company is traded on a securities exchange. CPA Examination, May 1989, #41. 9. Consider this scenario from the periodical Investor’s Business Daily, Inc.: You’re in line at the grocery store when you overhear a stranger say, “That new widget is going to make XYZ Co. a fortune. I can’t wait until the product launches tomorrow.” What do you do? (a) Nothing? (b) Call your broker and buy as much XYZ Co. stock as you possibly can? This is how Investor's Business Daily, Inc. answered: “In this case, answer “(b)” shouldn't get you into trouble. But if that stranger happens to be talking to you and he's not a stranger at all, but a neighbor and XYZ's president, watch out. Geanne Perlman Rosenberg, “When a Tip Becomes a Trap,” Investor's Business Daily, Inc., June 14,1995, p. AI. 11. CoolCom, Inc., sends notice to all of its shareholders that its annual report and proxy soliciting materials are on its Web site. It provides investors with the Web address and a telephone number that they may call to request a paper copy. Is CoolCom in compliance with SEC rules? A company cannot presume that all shareholders are able to access the annual report and proxy materials via an Internet Web site. Therefore, unless the company had consent from all of its shareholders, this posting would not meet SEC requirements. The company is not prohibited from putting the materials on the Web site, but it must also provide a paper version. Use of Electronic Media for Delivery Purposes Securities Act Release No. 7233, Exchange Act Release No. 36-345 (October 6, 1995).