DKT

MOZAMBIQUE

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

1

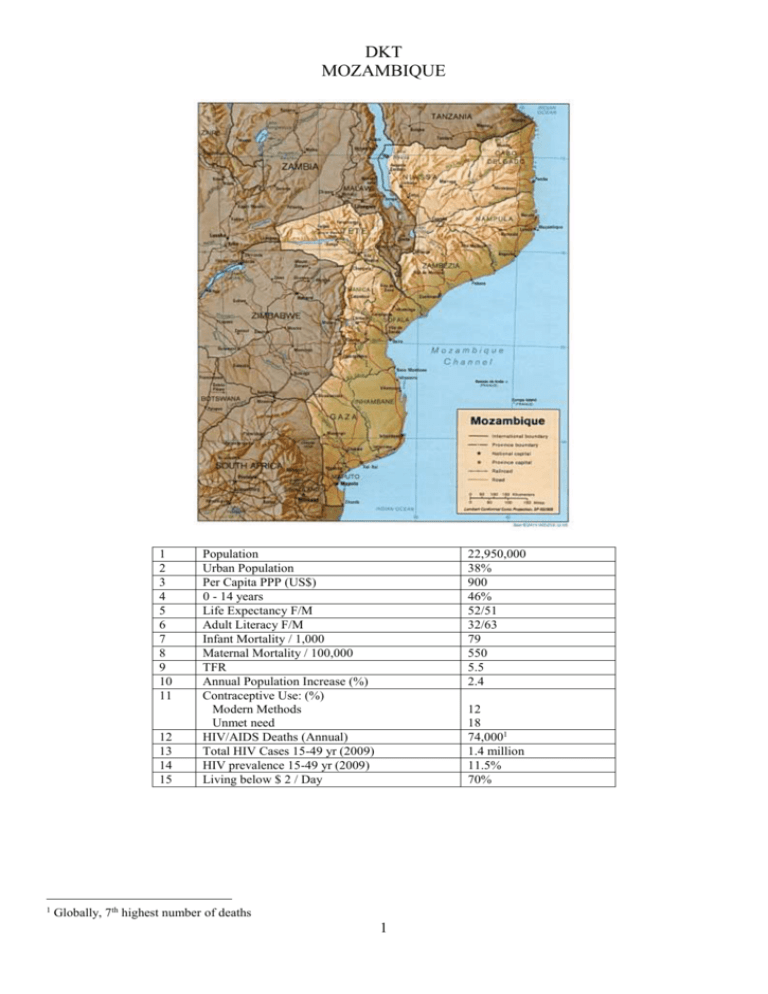

Population

Urban Population

Per Capita PPP (US$)

0 - 14 years

Life Expectancy F/M

Adult Literacy F/M

Infant Mortality / 1,000

Maternal Mortality / 100,000

TFR

Annual Population Increase (%)

Contraceptive Use: (%)

Modern Methods

Unmet need

HIV/AIDS Deaths (Annual)

Total HIV Cases 15-49 yr (2009)

HIV prevalence 15-49 yr (2009)

Living below $ 2 / Day

22,950,000

38%

900

46%

52/51

32/63

79

550

5.5

2.4

12

18

74,0001

1.4 million

11.5%

70%

Globally, 7th highest number of deaths

1

Introduction:

Almost five centuries as a Portuguese colony came to a close with independence in 1975.

Large-scale emigration by whites, economic dependence on South Africa, a severe drought,

and a prolonged civil war hindered the country's development until the mid 1990's. The ruling

Front for the Liberation of Mozambique (FRELIMO) party formally abandoned Marxism in

1989, and a new constitution the following year provided for multiparty elections and a free

market economy. A UN-negotiated peace agreement between FRELIMO and rebel

Mozambique National Resistance (RENAMO) forces ended the fighting in 1992. In

December 2004, Mozambique underwent a delicate transition as Joaquim CHISSANO

stepped down after 18 years in office. His elected successor, Armando Emilio GUEBUZA,

promised to continue the sound economic policies that have encouraged foreign investment.

Mozambique has seen very strong economic growth since the end of the civil war largely due

to post-conflict reconstruction.

Despite having one of the world’s highest economic growth rates, nearly 70% of

Mozambique’s population lives in extreme poverty, and the access to health and education

services are limited. While the national literacy rate is 45% it is only a dismal 32% among

females.

Much of the health infrastructure was destroyed during the long civil war and less than 50%

of the population currently lives within 5 km of fixed health services. The country also has a

severe shortage of trained professionals, particularly in the health sector. The majority of

health sector expenditures are financed by external sources, with USAID currently providing

the largest share of commodities for the sector. i.e. USG and UNFPA provide 100% of

contraceptives to GoM.

The latest national HIV prevalence rate is 11.5 % (2010), placing Mozambique in the ten

most affected countries. While the latest prevalence rate is lower than previous year’s reports,

the new survey was conducted using a different method from previous surveys. The latest

survey utilized antenatal sentinel sites that will enable regular updates of prevalence data.

The major causes of mortality in adults are tuberculoses and AIDS. Maternal mortality is

estimated at 550 maternal deaths per 100,000 live births (DHS 2009).

Progress in establishing a rural primary health care network and management system is

limited by various factors, including internal capacity, high rates of infectious disease and

malnutrition; growing prevalence of HIV/AIDS; inadequate access to potable water;

Mozambique has one of the most severe health personnel shortages in the world2.

There is increased consensus that a key driver of Mozambique’s HIV/AIDS epidemic is the

pervasive practice of multiple and concurrent partnerships. Other drivers are low rates of

condom use with non-regular partners (33.1 % for men and 23.5% for women) and low rates

of condom use were also reported between “regular” partners. Data from the UNAIDS 2008

Mozambique Modes of Transmission Study revealed that 48% of new infections occur

among adults reporting regular-partner heterosexual sex with an additional 18% of new

infections due to casual heterosexual sex. Mozambique’s HIV/AIDS prevalence is one of the

few remaining countries in the world which continues to increase.

2

World Health Report 2006: Working Together for Health. World Health Organization, 2006.

2

Planned Sales: 2012

Products

IUDs

Safe Load 380 A

Sleek 375

Implants

Misoprostol3

Oral Contraceptives4 (Coc, Pop, Diana-35)

Emergency Contraceptives

Injectable

MVA5

Prudence6

Fiesta7

Purchase

Price

2012

Franchise Private

Clinics

Sector

$0.85

$0.75

$9.47

$0.27

$0.29

$0.58

$0.68

$22.60

$5.93-7.02

$4.15

$1.10

$1.10

$1.10

$0.28

$0.33

$0.66

$0.77

$28.17

$12.41

$6.07

$5.50

$6.25

$10.75

$0.28

$0.33

$0.66

$0.77

$28.17

$12.41

$6.07

CYPs

CYPs

33,000

11,000

60,000

15,750

9,858

3,055

16,250

9,600

50,000

27,500

236,013

Manufacture

Prudence

Fiesta

NRS

TNR

Oralcon-F

(OC)

Pregnon

(EC)

Isovent

(Miso)

IUD

Zarin

(Implant)

Maputo

Health Care8

MHC

Enaf (Inj)

Progestyn

(OC)

Microlenyn

(OC)

Sekure (EC)

MVA

Total

Ponds

Ponds

2012 Target

CYP

% CYP Total

5,000,000

2,750,000

50,000

27,500

21%

14%

18,000

1,286

1%

7,500

833

0%

120,000

8,000

15,750

44,000

6%

18%

15,000

60,000

25%

65,000

16,250

7%

20,000

1,429

1%

100,000

20,000

150

7,143

2,222

9,600

236,013

3%

1%

4%

MHC

Pregna

Sino II

Ponds

Ponds

Ipas

3

tablets

Cycle

5

Kit of syringe and 8 cannulae

6

Gross

7

Gross

8

Mozambican distributor

4

3

Context and Analysis

Keys issues: HIV/AIDs, couple’s limited knowledge/understanding of FP, 12%

modern methods, high maternal mortality, lack of trained healthcare personnel, and

poorly developed small to medium sized businesses.

Activities

Prudence

Develop new premium Prudence SKU (Delay) to increase product segmentation and

higher margin product.

Community Awareness and partnerships

Development of FP knowledge is vital to increasing contraceptive prevalence in

Mozambique. A mixture of partnership, direct implementation, and radio programs

will be employed to develop the knowledge base. Teams will work in close

coordination with franchise clinics.

Medical Staff Training

To maintain training quality, follow up of 2010/11 trainees will continue.

Injectables

DKT will work with VSI and Pathfinder on a pilot study to evaluate distribution and

use of (DMPA) at the community level in Mozambique. The intent of the study is to

affect MoH policy decisions to allow community based persons to avail DMPA

directly to the community. DKT will be providing DMPA for the study and

participating in the development of community education.

Pharmaceutical Product Registration

DKT will submit two products for registration to the MoH in 2012.

Mifepristone/Misoprostol combo package and Misoprostol, both from Acme

Formulations, Lda.

The approval of DKT’s own Misoprostol brand will minimize product stockouts,

reduce COGs and packaging has been developed under the Íntimo umbrella brand.

4

Sales and Marketing Strategies: 2012

Corporate Business Strategies

1. Strengthen organizational

capability by building the right

competencies and culture.

2. GROWTH. Grow the business

through reach expansion, entry into

new channels and new business

development.

Priorities and Action Plans

1. Integrate processes and systems and improve

internal communication.

2. Ensure that Organization Quality Indicators are

in place: Measures/Scorecard, Performance Review

and Assessment.

3. Institutionalize rewards and recognition program

to increase employee motivation and help retain

high-performers.

4. Inculcate organizational culture of performance,

responsibility and integrity.

1. Achieve desired coverage reach and

development for all product categories nationwide.

2. Strengthen relationships with key influencers

and community gatekeepers.

5

Condoms

Background:

While condom sales increased 87% over 2011, sales were only 59% of 2011 targets.

The introduction of a new value for money brand, Fiesta, did not perform as expected

and sales were only 44% of 2011 targets. As a value for money brand, Fiesta is a

subsidized product and DKT’s only source of funds for condoms is DKT International

and sales revenue. Due to volume and a margin of 38%, Prudence generates

approximately 55% of sales revenue and this is expected to remain the same in 2012.

Strategies

Increased efficiencies of sales teams through training and planning (Barracas)

Increased volumes through targeted promotional campaigns

(Pharmacies/Convenience stores)

Develop new premium Prudence SKU (Release late 2012)

Brand

Prudence

Key Strategies

1. Continue to enhance the

brand image as sexy, fun

and increases sexual

pleasure

2. Become a primary source of

sexual health information

for youth (16 – 25)

3. Expand distribution

coverage in all

establishments

4. Market Segmentation

6

Key Activities

1. Continue advertising on Facebook

and maintaining consumer

attention

2. (FB) Announcing product

promotions & sale locations

3. Create local activities at bars &

high end discothèques to induce

trial, increase brand awareness,

and stimulate demand

4. Initiate merchandising contests in

key trade outlets

5. Identify additional sites to paint

outdoor “murals”

1. (FB) Continue offering sexual

health tips, challenging myths and

sexual misconceptions

2. Cross linkages between Íntimo and

Prudence Facebook pages

1. Increase number of distributors as

well as sales volumes

2. Increase number of POS

3. Stagger sales teams working hrs to

respond to night time only

establishments

1. Conduct marketing research

2. Develop before end of 2012

one new premium market

SKU

3. Based upon results of 1),

develop specific segmentation

strategy for Prudence SKUs

with differential SKU pricing

Fiesta

1. Continue to enhance the

brand image as an

affordable quality brand

1. (FB) Announcing product

promotions & sale locations

2. Identify additional sites to paint

outdoor “murals”

2. Become a primary source of 1. (FB) Continue offering sexual

sexual health information

health tips, challenging myths and

for youth (16 – 25)

sexual misconceptions

2. Cross linkages between Íntimo

and Prudence Facebook pages

3. Expand distribution

1. Increase number of distributors as

coverage in all

well as sales volumes

establishments, emphasizing 2. Increase number of POS

rural locations

Pricing Structure

2012

NRS

Prudence

New

SKU

Cost of

≈$6.50

9

Goods

DKT Selling

$26.67

to Retailer

Suggested

$44.44

Retail Price

Suggested10

$0.93

Retail Price

9

NRS

Prudence

Morango

NRS

Prudence

Maracuja

NRS

Prudence

Sensual

NRS

TNR

Prudence Fiesta

Classico

$7.02

$7.02

$6.59

$5.93

$4.15

$12.41

$12.41

$12.41

$12.41

$6.07

$17.78

$17.78

$17.78

$17.78

$8.89

$0.37

$0.37

$0.37

$0.37

$0.19

Gross (144 pieces)

One package of 3 pieces

10

7

Íntimo Umbrella Brand

Background

During 2011, products marketed and sold under the Intimo brand were IUD (safeload)

and Implants(Sino II). The CoC, PoP, EC, and injectable were approved with Intimo

brand on packaging, no products were purchased in 2011. 99% of IUD market is

provided free through the public sector as well as to private clinics. Until the

approval of DKT’s Implant in 2011, no Implant had been approved for sale in

Mozambique.

In late 2010, DKT Mozambique began franchise clinics in Maputo, where 85% of

Implant and IUDs were sold during 2011.

Strategies

Establish Íntimo as The Family Planning Brand

Continue creating interaction and noise on Facebook page expanding reach

Expand distribution and number of POS

Brand

Íntimo

Key Strategies

1. Introduce new product

lines

Key Activities

1. Launch new products

(Intimo: OC/EC/Inj)

2. Start discussions of new

products on FB

2. Continue to enhance the

1. (FB) Announcing product

brand image as an

quality, availability,

affordable quality brand

promotions & sale

locations

2. (FB) Linking sales

locations with special

product promotions

3. Become a primary source

1. Start product specific

of sexual health

discussions (Benefits,

information for youth (16

Myths)

– 25)

2. (FB) Continue offering

sexual health tips,

challenging myths and

sexual misconceptions

3. Cross linkages between

Íntimo and

Prudence/Fiesta Facebook

pages

4 Expand distribution

1. Pharmacies

coverage in all

2. Private Clinics

establishments

3. Franchise Clinics

5 Use mass media materials 1. Conduct basic survey to

identify product

consumers

2. Develop product specific

media material

3. TVC if approval is

obtained

8

Franchise Clinics

Background

In late 2010, DKT Mozambique began franchise clinics in Maputo. None of the

clinics were offering any family planning services. With the addition of Implants in

June, sales increased substantially. Primary activities were the training of medical

staff, provision of basic informational material to clinics and community educators,

and sale of IUDs and Implants at subsidized prices.

Strategy

Identify and begin activities with new clinics

Continue creating interaction and noise on Facebook page expanding reach

Expand available services at clinics

Brand

Íntimo:

IUD/Implant/OC/

EC/Injectable/

Misoprostol

Key Strategies

1. Expand available services

2. Continue to enhance the

brand image as an

affordable quality brand

3. Become a primary source of

sexual health information

for youth (16 – 25)

4. Increase knowledge of FP

methods

5. Explore key partnership

9

Key Activities

1. Launch new products (Intimo:

OC/EC/Inj)

2. Nurses sell products directly to

clients

3. Identify and open new franchise

clinics

4. New Ponds products, detail

medical staff

1. Continue advertising on Facebook

and maintaining consumer

attention

2. (FB) Announcing product

promotions & sale locations

3. Detailing medical personnel

1. (FB) Continue offering sexual

health tips, challenging myths and

sexual misconceptions

2. Cross linkages between Íntimo

and Prudence & Fiesta Facebook

pages

1. Continue community based FP

educational activities

2. Implant and IUD insertion training

when required

3. Ensure availability of educational

material at clinics and with

educational teams

1. Continue dialogue with PSI

Oral Contraceptives, Injectables, and Emergency Contraceptives

Background

While registering DKT products, CoC, EC and Misoprostol were sourced through a

local Mozambican pharmaceutical distributor and sold nationwide. While COGs

were high, this provided significant experience in detailing medical staff, selling to

pharmacies, and private clinics.

Strategy

Expand distribution and number of POS

Leverage Intimo’s price and quality advantage

Establish Íntimo products as The Family Planning Brand

10

Oral Contraceptives Pills

Brand

Key Strategies

Oralcon-F

1. Improve distribution

coverage

Microlenyn (Íntimo)

Progestyn (Íntimo)

Key Activities

1. Route maps are developed

2. Efficient detailing teams are retrained and deployed

2. Develop consumer

1. Conduct basic client product

profile

profile at POS

1. Product introduction and 1. Product Launch in Maputo, Beira,

launch

& Nampula

2. Detail doctors & nurses

2. Leverage the brand’s

1. Detail doctors and nurses at public

competitive pricing

health points

point & quality

2. Target users who are dependent

upon free contraceptive supply

and provide them with affordable

and better quality option

3. Expand distribution

1. Identify potential distributors:

coverage

Beira & Nampula

2. Efficient detailing teams are

trained & deployed

1. Product introduction and 1. Product Launch in Maputo, Beira,

launch

& Nampula

2. Develop detailing cards outlining

quality and pricing advantages

3. Detail doctors & nurses

2. Leverage the brand’s

1. Detail pharmacists, doctors and

competitive pricing

nurses at public health points

point & quality

2. Target users who are dependent

upon free contraceptive supply

and provide them with affordable

and better quality option

3. Focus on direct to

1. Conduct clinic based and/or

consumer education

community based education

activities

Pricing Structure

2012

MHC

Oralcon-F

(CoC)

Cost of Goods

$.70

DKT Selling to

Distributor

Distributor

$.74

selling to Retailer

Suggested Retail $1.43

Price

Íntimo

Microlenyn

(CoC)

$.29

$.315

Íntimo

Progestyn

(PoP)

$.42

$.45

Bayer

Microgynon

(CoC)

N/A

N/A

$.33

$.48

N/A

$.58

$.85

$8.15

11

Injectables

Brand

Enaf-150 (Íntimo)

Key Strategies

Key Activities

1. Product introduction and 1. Product Launch in Maputo, Beira,

launch

& Nampula

2. Develop detailing cards outlining

quality and pricing advantages

3. Detail doctors & nurses

2. Leverage the brand’s

1. Detail pharmacists, doctors and

competitive pricing

nurses at public health points

point & quality

2. Target users who are dependent

upon free contraceptive supply

and provide them with affordable

and better quality option (link to

Franchise Clinics)

3. Expand distribution

1. Efficient detailing teams are

coverage

trained & deployed

2. Create marketing collaterals that

capture consumers’ interest

4. Expand availability of

1. Work jointly with VSI and

injectables at

Pathfinder on “research” to effect

community level

MoH policy modification to allow

TBAs to provide injectables in

communities

Pricing Structure

2012

MHC

Nothing for

sale

Cost of Goods

DKT Selling to

Distributor

Distributor

selling to Retailer

Suggested Retail

Price

Íntimo

Enaf-150

$.68

$.71

$.77

$1.36

$40

Emergency Contraceptive

Brand

Key Strategies

Pregnon

1. Improve distribution

coverage

Sekure (Íntimo)

??

??

Key Activities

1. Route maps are developed

2. Efficient detailing teams are

deployed

2. Develop consumer

1. Conduct basic client product

profile

profile at POS

1. Product introduction and 1. Product Launch in Maputo, Beira,

launch

& Nampula

2. Detail doctors & nurses

2. Leverage the brand’s

1. Detail pharmacists, doctors and

competitive pricing

nurses at public health points

12

point & quality

3. Improve distribution

coverage and trade

visibility

4. Increase retailer and

consumer product

knowledge

Pricing Structure

2012

MHC

Pregnon

Cost of Goods

$2.22

DKT Selling to

Distributor

Distributor

$2.44

selling to Retailer

Suggested Retail $4.30

Price

Íntimo

Sekure

$.58

$.61

$.66

$1.16

13

1. Create marketing collaterals that

capture consumers’ interest

1. Conduct community based

education activities

2. Target pharmacists to dispel

myths and increase product

knowledge

Misoprostol

Brand

Isovent

Key Strategies

1. Improve distribution

coverage

2. Pilot small scale

community based sales

activity

3. Target key family

planning organizations

Pricing Structure

2012

MHC

Isovent

Cost of Goods

$.28

DKT Selling to

Distributor

Distributor

$.29

selling to Retailer

Suggested Retail $0.51

Price

Sigma

MisoTac

$.30

Key Activities

1. Route maps are

developed

2. Efficient detailing teams

are re-trained and

deployed

1. Identify manageable

location

2. Train community based

TBAs

3. Identify key pharmacies

1. Continue to develop

relationship with

Pathfinder, jpiego, and

FHI

Cytotec

N/A

N/A

N/A

$.60

$1.85

IUDs and Implants

The strategies for Iuds and Implants are contained in the Franchise clinic section. While none

of the products are Íntimo branded, an Íntimo sticker will be developed to identify both

products as part of the Íntimo line.

Other than the Government’s IUDs, which private clinics can obtain for free, no IUDs are

available in the private sector other than Government and DKT’s.

Pricing Structure

2012

Intimo

Safeload

(DKT)

Cost of Goods

$.85

DKT Selling to

$1.10

Franchise Clinics

DKT selling to

$5.50

non-FC Clinics

Suggested Retail ??

Price

Intimo

Sleek

.75

$1.10

Intimo

Zarin

(Implant)

$9.47

$1.10

$6.50

$10.75

??

$18.92

14

15

1

Funding Source

DKT

DKT Washington

STBF

$700,000

$795,655

STBF

Sales Revenue

$618,844

$2,114,499

Sub Total Income

2

Commodity Purchases

Misoprostol

$33,000

Oral Contraceptives

Emergency

Contraceptives

$87,000

Injectable

OC/EC (local

purchase)

$34,100

$26,250

Implants

$84,194

Prudence

$247,000

Fiesta

$162,000

$35,000

$57,806

Sub Total Commodities

3

$766,350

Media Promotion

Condom

Buffett (Purchased

Services)

$215,000

$150,000

$365,000

Sub Total Media Promotion

4

Program (Buffett)

Social Franchise Clinics

Training (Community

Education)

$155,133

$140,000

Sub Total Program

5

$295,133

Program Operational Costs

Condom Sales

Maputo

$109,500

Beira

$49,500

Nampula

$49,500

Pharmaceutical

General Administration

+Fees

$62,111

Travel

Monitoring & Evaluation

$101,800

$140,000

$85,000

$60,000

$30,605

$688,016

Sub Total Operational Costs

Total Costs

$2,114,499

16

Cash Transfer Schedule

DKT

STBF

Jan-12

$300,000

$100,000

Feb-12

$100,000

$50,000

Mar-12

$0

$250,000

Apr-12

$0

$0

May-12

$100,000

$0

Jun-12

$0

$100,000

Jul-12

$100,000

$0

Aug-12

$0

$150,000

Sep-12

$100,000

$0

Oct-12

$0

$145,655

Nov-12

$0

$0

Dec-12

$0

$0

Total Transfer

1,495,655

17