Women Moneylenders in Liverpool: 1920s to 1940s

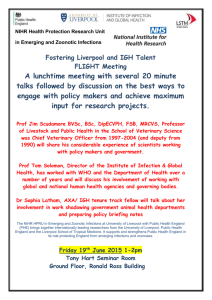

advertisement

Women Moneylenders in Liverpool: 1920s to 1940s

(Draft Paper)

Professor Peter Fearon

i

Working class families in Liverpool during the interwar years depended heavily, as they did

elsewhere, on the provision of emergency credit. Unfortunately the crises that drove borrowers to

the pawnbrokers, or to the tallyman, or those that required humiliating negotiations with the

owner of the corner shop happened with depressing frequency. Women whose husbands went

away to sea, and there were plenty of them in Liverpool, had to manage the family finances in

his absence but this responsibility extended beyond the wives of mariners. Housewives were

usually the managers of working class household budgets which, even in good times, could

prove too meagre to adequately support a family. Housewife/manager borrowing was sometimes

the result of financial mismanagement but more often than not it was a desperate response to a

monetary shortfall precipitated by, for example, death, sickness, or unemployment, or the loss of

income during a strike. But food had to be provided, the rent, medical bills or funeral expenses

paid, some already accumulated debts had to be at least partially discharged, children’s clothing

purchased, cash was needed for the gas and the electricity meter and essential items had to be

redeemed from the pawnshop. Living on the edge, constantly coping with financial crises,

cooped up in squalid living conditions with no chance of escape was a depressing but normal

feature of life for many Liverpool inner city dwellers. Families, unable to accumulate savings as

a protection against the frequent rainy days, needed to supplement their budgets to ensure that

they had necessities not luxuries. Fortunately, scholars have provided a number of excellent

accounts of the role of the pawn broker, the check trader and also of hire purchase in extending

inadequate working class budgets.ii However, little has been written on the influence of the

moneylender who played a crucial role in oiling the financial wheels for the inner city poor. This

paper analyses the significance of women as money lenders in Liverpool from the early 1920s to

the late 1940s. It also examines the impact of a crucial piece of legislation, the Money Lenders

Act(1927), which was introduced to regulate what many believed was a thoroughly disreputable

though necessary activity. The paper concludes with an account of the influence of World War11

in curtailing money lending in the city.

1

1

Unlike pawnbrokers who exchange cash for a pledge, money lenders advance cash without

security, though the lenders of large sums need some assurance that the borrower will have

sufficient resources to discharge the debt within an agreed time period. Working class families

usually borrowed only small cash sums so the lender had to judge if the loan and the interest

would be repaid. If it was not, the debt would have to be written off. Money lenders who dealt

with large sums could, and did, resort to the courts in the event of default but for small scale

lenders the expense of legal proceedings was too great to justify the effort. Prior to the

Moneylenders Act (1927) activities were regulated by the Moneylenders Act (1900) which

instigated a very light regulatory touch. This legislation required moneylenders to purchase a

license, but the cost was minimal: only £1.00 for three years, or 6shillings and 8 pence per

annum. The purchase of a license involved no examination by the authorities of the character, or

the suitability of the applicant. There was little protection for the borrower and no clear steer as

to the rate of interest that could be charged or, indeed, how it should be calculated. The Courts

were guided by the legal term ‘harsh and unconscionable’ when they had to judge if the demands

of the lender were excessive, or not. If the terms of the contract were judged ‘harsh and

unconscionable’, in other words, unreasonable, then the court could rule in the borrower’s

favour. But this was an imprecise concept and usually a very expensive means of pursuing or

defending a claim. Finally, although it was illegal to act as a lender without a license, there is no

doubt that many unlicensed operators were at work.

There was a link between pawnbroking and money lending other than the obvious one that many

people used both services. The Pawnbroking Act (1872) limited pawnbroker’s advances to

£10.00 in a single transaction. If a pawnbroker wanted to make an advance greater than this sum,

a money lenders license was necessary and a number of them felt it worthwhile to become

licensed. However, the majority of pawnbrokers who normally accepted goods such as bedding

or clothing, usually advanced sums of £2.00, or less. Any article on which no more than 10

shillings had been lent became the property of the pawnbroker if unredeemed at the end of the

agreed period. The disposal of goods in excess of 10 shillings was more complicated and

necessitated a public auction. Monday was the heaviest pledging day at the pawnbrokers; Friday

and Saturday were the busiest days for redemption. The astute pawnbroker who dealt with a

large number of pledges, faced only a small risk of making a loss. Some saw themselves as an

integral part of the local economy acting as ‘the poor man’s banker’.iii Many of their customers

would have been more inclined to stress the very unequal nature of the relationship.

For those with no goods to pledge and an income gap to address, the local moneylender was

often the only solution. But moneylenders, especially those who lent to the poor, attracted public

opprobrium. Social commentators were appalled by the large numbers of lenders, many of whom

touted for business, preying on vulnerable people and driving them into debt. When the

immediate debts could not be discharged the poor were forced to even more borrowing. Then

came the bullying, harassment and threats to cause humiliation by revealing indebtedness to

neighbors. Pat O’Mara recalls by name seven ferocious women who acted as money lenders

2

during his Liverpool childhood. They would enter the slum alleys with baskets of putrid fish and

those (usually women) who wanted to borrow money were also obliged to accept a quantity of

near inedible fish. To the cash advance of four shillings the lenders added two shillings worth of

fish. The total debt of six shillings was due at the end of the week, otherwise the unfortunate

borrower was subject to a beating. These women did not need the help of any males to deliver

their physical punishments.iv O’Mara was writing about events that occurred about 1910 but the

combination of hawking and money lending was still evident in Liverpool during the early

1920s.

As was common practice elsewhere, Liverpool working class husbands often surrendered control

of their household budgets to their wives and distanced themselves from home care and child

rearing responsibilities. Men would usually give their wives a fixed sum from their pay packets.

They were the bread winners and having deducted their spending money they expected their

wives to manage the household with thrifty efficiency.v Indeed, the wives themselves believed

that they should be able to deliver good and prudent management. This was seen as their role

and, if they were successful, it was a means of ensuring domestic harmony. They took pride in

their managerial skills. However, if they failed and the household plunged into debt, it was clear

who was to blame.vi

Unfortunately the earning powers of the breadwinner were often severely curtailed. High

unemployment left many families dependent upon unemployment benefit, which was relatively

generous in comparison with the provision in most other industrialized countries, but insufficient

to provide an adequate living standard for a family. In 1932 one out of every three insured men,

and one out of every seven of the insured women in Liverpool were unemployed. More than 70

per cent of the unemployment amongst insured workers was concentrated into three key

industrial groups: (1) shipping and related industries (2) transport and distribution and, finally,

(3) building. Liverpool’s economy was heavily reliant on the prosperity of its port which, in

turn, depended on flourishing international trade for the provision of full time jobs.vii When trade

declined in 1930, a rise in unemployment inevitably followed.

Going away to sea had always been an escape route for working class Liverpool men but in

1932, 44 per cent of the insured labour force in shipping was unemployed. Sea faring jobs were

lost by the switch from steam to oil power and they were further reduced by seasonal fluctuations

that saw north Atlantic sailings reduced by 60 per cent between October and April. The adverse

effects of the great depression on international trade worsened an already serious employment

situation. When men were away at sea, weekly payments, which averaged 25 shillings in 1931,

were made by the shipping companies to their wives. This sum, which was two thirds of the

sailor’s wage, was inadequate support for a family even in the absence of the husband, and more

so if the family was large. Major bills and rent payment were often neglected until the seafarer

returned. Fortunately, men were assisted between voyages by their eligibility for unemployment

benefit.viii Dock labour was another important source of work but dockers had the highest rate of

unemployment of any occupational group on Merseyside. In 1932, most dockers who worked

3

full time received 11 shillings and 2 pence per day, or £3 - one shilling and 5 pence per week.

However, a shortage of work meant that a high proportion of dock workers were restricted to, on

average, a three and a half day week. What they could earn was limited to between thirty three

shillings and forty three shillings per week, a paltry sum for a family. Some specially favoured

men would periodically earn extra pay for working with special cargo, though their wives might

not know that their pay packet was swollen.ix Wives whose husbands were obliged to, or chose to

keep the housekeeping budget to the bare minimum periodically faced financial difficulties and

they were forced to develop survival strategies in an attempt to steer the family through turbulent

times. Some managed their budgets with great skill. On the other hand, financial

mismanagement could lead to deep emotional distress, especially where husbands were prone to

violence. Most seafarers and dockers lived with their families in the densely crowded terraced

streets close to the river Mersey.

It was difficult for women to secure paid employment to supplement budgets. Traditionally,

Liverpool’s working class women left their jobs once they married as it was believed to be the

husband’s responsibility to support his wife. Once children arrived, and the Liverpool poor had

relatively large families, there was plenty of unpaid work for the wife and mother. Those women

who sought employment faced the reality that Liverpool had few factory jobs for unskilled

women and most female employment was concentrated in low pay service sector work. Some

women would find space for a lodger, or take in washing, or sewing, or find part time cleaning.

But for a woman with young children who wished to earn, the opportunities were limited and,

moreover, her husband might not want a working wife in case it was seen as a sign of his failure

to fully provide.

It is easy to understand why so many women were forced to visit the pawnshop or the money

lender and why women accumulated debts without the knowledge of their husbands.x The final

threat by the money lender to inform husbands led inevitably to marital discord or even violence.

While the large scale moneylenders were denounced as ‘Shylocks’, those at the bottom of the

scale were seen as positively evil. Melanie Tebbutt is on the mark when she compares the ethical

position of the street money lender to that of the back street abortionist. The lender was despised

but this was contempt expressed from a distance as one never knew when the service on offer

would be needed.xi An indication of the concern felt by social investigators can be seen in the

Annual Report (1927) of the Liverpool Personal Service Society, the city’s most prominent

welfare body. The Report’s condemnation of money lending was direct: “{P}robably no other

social evil inflicts greater distress and mental agony”.xii Strong words from an organisation

whose social workers had considerable experience with clients who had fallen foul of

moneylenders.

In the early 1920s, Dorothy Clarissa Keeling was Secretary of the Liverpool Council of

Voluntary Aid (renamed the Personal Service Society in 1922) and at the very beginning of what

was to be a nationally distinguished career in social work.xiii With the encouragement of the

Personal Service Society, Keeling quickly became involved in dealing with the effects of

4

borrowing from money lenders on Liverpool’s poor.xiv She became Chairman of the

Moneylending Committee which was appointed by the Liverpool Women’s Citizens Association

which gave her a detailed insight into indebtedness. In 1925 she organized a survey of licensed

moneylenders covering both Liverpool and Birkenhead. This was a carefully crafted survey, as

one would expect from someone in her position, and done by checking and recording the names

and addresses of all those who had been issued with a money lenders license in the city and over

the water in Birkenhead. She discovered that there were 1,380 registered lenders and that 80 per

cent of them were women. The figures confirmed what had long been common knowledge: that

small scale street lending was dominated by women. What particularly disturbed Keeling,

however, was that the usual rate of interest charged by the women lenders was one penny in the

shilling per week, which she calculated was 433 per cent per annum. Sometimes rates of two

pence for every shilling borrowed, or even higher, were paid for loans which the lender

perceived as very high risk. Loans were normally contracted on Mondays and repayment day

was Saturday. A charge of a halfpenny was made for late payment. Keeling was outraged by

what she believed was an extortionate interest rate and yet these were legal lenders who were

licensed to ply their trade. Indeed, she found few examples of unlicensed lending. The borrowers

were unimpressed with Keeling’s calculations and her anger. To them the issue was simple: the

cost of borrowing one shilling for one week was one penny. That did not seem unreasonable and

most were relieved that they had the opportunity to borrow. Another common arrangement saw

the borrower receive seventeen shillings and six pence after agreeing to a repayment schedule of

one shilling per week for twenty weeks. Taking the interest payment upfront was normal

practice.

A close colleague, Miss A.R. Caton, who was Honorary Secretary of the Liverpool Women’s

Citizens Association and who had been involved in Keeling’s survey, claimed that the ‘evil’ of

money lending was spreading and that one out of every three Merseyside wives and mothers in

‘the very poor class’ were in the hands of money lenders. She particularly deplored lending by

women who were of the same class as the borrowers themselves. Indeed, some were even

neighbours. Many of these women were also hawkers and sold fish and old clothes in addition to

lending money. Caton detailed the terrible financial tangles that engulfed many women who

borrowed without fully understanding the implications of the debts that they were accumulating,

a burden of which their husbands were unaware. Caught between bullying money lenders and

terrified of the reaction from their spouses these women endured a miserable existence.xv Keeling

and her colleagues were firmly of the view that legislative reform was necessary as the

Moneylenders Act (1900) was not fit for purpose.

In fact, the view that the legislation that governed money lending was unsatisfactory and should

be reformed had been gathering pace for several years. In 1925, a Joint Select Committee of the

Houses of Lords and the Commons was established to consider a Moneylenders Bill that had

been under parliamentary consideration for some time. The Joint Committee met in 1925 and of

the twenty six witnesses who were called to give evidence only one, Dorothy Keeling, was

5

female. Needless to say, the membership of the Joint Committee was entirely male. Not only was

Keeling the only female to be called, she was one of only a tiny minority of witnesses who had

direct experience of the effects of street money lending. Many of the other witnesses represented

large scale money lending enterprises, some of which had banded together into regional

associations and were able to present the Committee with expensively compiled glossy brochures

outlining their case.

Keeling gave evidence to the Joint Select Committee on 25 June 1925. She used this opportunity

to publicise what she saw as the current ”money lending evils” which included the exorbitant

rate of interest charged, the unsatisfactory method of licensing lenders and the vague character of

the agreements between borrowers and lenders. Keeling, who illustrated these points forcefully

with the findings of her Liverpool and Birkenhead survey, delivered a crisp and cogent attack on

the ethics of street money lending. Her response to questions was also clear and authoritative.

She advocated a rise in the annual registration fee for lenders to £10 and a maximum rate of

interest on unsecured loans of 60 per cent per annum but for adequately secured loans 15 per

cent would be sufficient. She wanted lenders to make a declaration of their financial

circumstances but she did not believe that a declaration of nationality was necessary. Keeling

was confident that the changes she advocated would bring about a desired reduction in the

numbers of licensed lenders, though she recognized the danger that this sort of regulation would

increase the number of illegal or unregistered lenders.xvi Keeling’s attack on moneylenders was

widely reported nationally and back in Liverpool.xvii She records that shortly after giving her

evidence she was physically attacked in a Liverpool back street by an irate money lender.xviii

Keeling’s testimony made a positive impression on Committee members and they frequently

referred to it as they questioned other witnesses. A Committee member, Captain Robert Gee,

concluded that Liverpool could be considered as “…one of the black spots in usury.”xix Other

witnesses confirmed the existence of predatory female money lenders and the dangers of

working class debts. Col. Watts Morgan, a Committee member, was in no doubt those women

offering small loans were “sapping the root of our social life”.xx Many examples of weekly loan

rates of two pence for each shilling borrowed and more, far in excess of rates which had caused

Keeling such concern, were quoted. There was general agreement that a steep rise in registration

fees was necessary to “cleanse the profession” by driving many small lenders out of business.xxi

It was clear that small lenders generally advanced sums of £5.00 or less and expected weekly

repayments. Witnesses revealed a variety of loan and repayment arrangements. For example, one

lender explained that he advanced £5.00 to borrowers which was repayable at 2 shillings in the £

per week over a twelve week period. He claimed that this represented an interest rate of 20 per

cent but the Committee claimed that the annualised rate was 160 per cent.xxii In fact it was clear

that there was considerable confusion concerning the calculation of interest rates and even highly

experienced professional accountants would produce very different answers when asked to

perform this task.xxiii In short there was widespread and valid criticism of the existing legislation.

6

The Joint Committee’s report was published in July 1925 but further debate and amendments in

both Houses meant that the bill did not become law until July 29, 1927. However, the

Moneylenders Act (1927) did not become operative until January 1, 1928. The new legislation

introduced radical changes.xxiv In an attempt to reduce the number of small scale lenders, the cost

of an annual license was sharply increased to £15 and the responsibility for registration was

transferred from the Board of Inland Revenue to the Commissioners of Customs and Excise.xxv

Each license was tied to a single address compelling lenders to purchase additional licenses for

every address where they traded. Moreover, the license had to be taken out in the true name of

the applicant. Restrictions were also imposed to limit the ways in which moneylenders could

generate business. They were not permitted to employ agents to tout for business, or to distribute

unsolicited circulars or advertisements. Licensed pawnbrokers paid a reduced annual fee of £7 10 shillings.

The Joint Committee originally favoured an attack on usurers with the imposition of low interest

rates of about 10-15 per cent. However, lenders argued with some force that, given the lack of

security and the level of bad debts that they had to accept, interest rates below 60 per cent would

render their businesses unprofitable. Moreover, they also mounted a compelling argument

against the proposal that small loan rates should be capped at a much lower level than larger

advances. The case against this division was that administrative charges were proportionately

greater for small loans than for large, that such a distinction would be arbitrary and difficult to

justify, and that lenders would have a vested interest in persuading clients to take out larger loans

than they needed. Moreover, an unacceptably low rate on small loans would reduce the number

of legitimate lenders and force working class borrowers to turn to illegal loan sharks.

The Act did not try to enforce a maximum rate of interest. Instead, 48 per cent was identified as

the point where lending could become “harsh and unconscionable” and it stipulated that only

simple interest, assessed on an annual basis, could be used in interest rate calculations.

Compound interest based calculations were declared illegal. When a default occurred, the lender

could only charge simple interest from the date of the default to the date of repayment. In fact, 48

per cent became the standard rate for most lenders and, for the benefit of both borrowers and

lenders, tables were produced by the Committee which showed clearly the repayments schedule

using simple interest. Under this unified system £1.00 borrowed for one week cost 2pence; if the

loan was for one month the interest charged was 9 ½ pence; the cost was for six months was

4shillings and 9pence. If £5.00 was borrowed for one week the cost was 9pence, the rate for one

month was 4 shillings; for six months the interest charge was £1.4shillings. It is important to

remember that 48 per cent was not the maximum rate that could be charged; it was the rate at

which the interest burden could be challenged. If the lender could demonstrate that the borrower

represented an unusually high risk, and that the repayment details had been fully explained, then

a Court could rule that a charge in excess of 48 per cent was justified.

7

There is no doubt, however, that the new rate considerably reduced the burden for small scale

borrowers and the transparency that followed the adoption of simple interest was also of great

benefit. Borrowers knew exactly how much they would pay and the time period of the debt.

Moneylenders Certificates Issued: Liverpool 1934-1949

Ltd. Liability

Males

Females

Total

1934-35

48

66

216

330

1935-36

44

63

200

307

1936-37

40

58

186

284

1937-38

37

49

165

251

1938-39

40

48

151

239

1939-40

37

48

138

223

1940-41

33

44

103

180

1941-42

29

33

53

115

1942-43

25

29

50

104

1943-44

21

28

53

102

1944-45

22

27

47

96

1945-46

21

19

48

88

1946-47

21

31

49

101

1947-48

**

**

**

106

8

1948-49

21

33

50

10

Source: Liverpool Record Office , 347 MAG/11/** Thirty names

and addresses missing from 1947-48 lists

We do not know if the combination of a high registration fee and the 48 per cent rate maximum

made lenders more cautious as they assessed potential borrowers. If it did, many poor and

vulnerable families would have been at the mercy of illegal lenders. There is no evidence that 48

per cent was chosen for any other reason than Parliament believed that this was the lowest rate of

interest that would allow licensed lenders to offer an appropriate service.

In a move that was designed to ensure that all money lenders were persons of good character,

every prospective license applicant had first to apply for a certificate. The applicant’s intention to

operate as a money lender had first to be publicized in a newspaper so that members of the public

who wished to object were given notice. The address which the applicant would use for lending

had to be stated and a separate certificate was required if more than one location was used. Then

an application had to be made to the petty sessions court and a date fixed for a personal

appearance before a magistrate. The applicant had to convince the magistrate that he or she was a

person of good character and was therefore a fit and proper person to operate as a money lender.

There was no attempt to assess the financial standing of the applicant, to judge financial

competence or to assess matters such as literacy.xxvi This was a character test pure and simple but

it was one that must be passed because the certificate was a necessary prerequisite for a money

lenders license application. The licensing period was from 1 August to 31 July. The Act,

therefore, sharply increased the annual registration fee, it laid down clear rules regarding interest

rates and, with the introduction of the certificate, it attempted to assess the character of future

lenders. One aim of this new regulatory regime was to reduce the number of licensed money

lenders and, given the increase in the fee, it would be surprising if this aim was not

accomplished. Its effect on illegal lending would be harder to judge.

2

9

Copies of the names and addresses of applicants for money lenders certificates in Liverpool from

1934-35 to 1948-49 are available in the Liverpool Record Office. The award of a certificate was

merely the first step in acquiring a moneylender’s license and it would be a mistake to confuse

the two. However, the process of certificate application was time consuming and involved a

public declaration of intent. The completion of this process demonstrated a determination to

apply for a license. The records show that no application for a certificate was rejected, which

indicates that the applicants were confident of success and that those who believed their

applications would be refused did not apply. It is not unreasonable to assume that the vast

majority (perhaps even all) of those who obtained certificates would go on to pay £15 for an

annual license.

I have divided the applicants for certificates into three distinct groups as is clear in the Table on

page 8. Firstly, I have isolated applications from individuals employed by finance houses which

were large enough to have acquired the protection of limited liability. These enterprises had

offices that were usually located in the financial quarter of the city and the companies specialised

in making relatively large loans. Money lending was only one of a range of financial services

that they offered. The second group I have identified are males who were awarded certificates.

Many men carried on money lending from commercial addresses and money lending was an

addition to their principle business activities. For example, if we examine the 66 males who were

awarded certificates for 1934-35 and whose occupations are listed in Kelly’s Directory, 16 were

pawnbrokers, 9 described themselves as financiers or agents, 6 were drapers and 5 ran furniture

stores. In addition, there was a plumber, a coal merchant, a commercial traveler, a grocer, a

painter, an engineer and a credit draper. In other words, male lenders could use the returns from

their business activities to provide capital for their money lending. Some of these lenders, for

example pawnbrokers and financial agents, would advance greater sums than a street lender

thought prudent.xxvii One would expect skilled workmen, such as painters and decorators,

carpenters or joiners who wished to purchase new tools to approach these lenders. This sort of

borrowing is, of course, an investment from which a stream of income will eventually flow

easing the burden of repayment. By contrast, small scale street borrowing was for consumption.

Finally, I identify women, who are by far the most numerous applicants.xxviii In contrast with

males, very few women operated from an address that was not their home. In 1934-35, no more

than 10 out of 216 applications provide commercial addresses, some of which are pawn broker

businesses. Of the total number, 11 were listed as shopkeepers, operating alone or with their

husbands. It is difficult to obtain information on most female certificate holders because they

lived in the courts and narrow streets that commercial city directories ignored. It is worth

mentioning, however, that where the occupations of husbands can be traced in 1934-35, most list

an unskilled occupation. There were 8 labourers, for example, 3 riggers, 2 carters, a ship’s scaler,

a seaman, a painter, a warehouseman and a coal dealer. This suggests that the means of the

lenders were modest and one did not need a substantial amount of capital to operate as a lender

in the inner city. It also identifies a close bond between lenders and borrowers as they lived in

10

the same sort of houses and in the same streets. There is a fourth group, unlicensed or illegal

moneylenders, on which information is lacking apart from the occasional prosecution.

Prior to 1927, a central register of licensed money lenders was kept at Somerset House.

Unfortunately the Moneylenders Act (1927) did not create the facility for a national count either

of certificates or licenses and, as a result, there is only sketchy national data. During the first six

months of 1928, for example, 4,086 Licenses were issued; between March 1931 and March 1932

the figure was 3,519.xxix It would appear that Liverpool had approximately 10 per cent of the

UK’s licensed lenders.xxx It seems clear that a principle aim of the legislators, namely a

significant reduction in the number of registered lenders, was achieved both nationally and in

Liverpool. Although the survey organized by Dorothy Keeling included Birkenhead, and the

figures in the Table relate to Liverpool only, the numbers have obviously been dramatically

reduced absolutely and in the case of women, relatively. In the Keeling survey, women lenders

were 80 per cent of the total but in 1934-35 only 65 per cent of the certificates were issued to

women. Payment of a £15.00 annual fee would not present a finance house, or a lender running a

business with a significant financial problem, but it was a considerable sum for a street lender.

However, the role of women remained very important not just in Liverpool but in all major

cities. In Liverpool they dominated the trade in street lending; they were part of the same

community as those who borrowed from them. It is rare to find a female lender operating in the

suburbs or, even in the new Corporation housing estates.xxxi The lender’s local knowledge was

crucial as each weighed up the credit worthiness of applicants for cash advances. This could be a

straightforward process for regulars or neighbours, or fellow Catholics or Protestants. Those

whom lenders did not know could show a paid up rent book, or produce some evidence of a

husband at work as a sign of their ability to repay. It is interesting to note in this context that

unemployment benefit increased the credit worthiness of the jobless. A call at the home of a

money lender was not a visit where anonymity could be guaranteed. In the courts and the

terraced back to back streets everyone knew where the money lenders lived and why non family

members would call. Visiting a distant lender could ensure privacy but it would also cause the

lender to treat the stranger with greater caution.

Most female lenders would be readily available to see prospective borrowers during the day or

the evening and be prepared to make an instant decision whether to advance cash. As the

majority of the borrowers were women, the interaction between them and female lenders,

especially as the request involved a house visit, was probably easier than it would have been if a

male was involved. Lenders needed very small capital sums to fund their activities and it was

even possible to function as a lender whilst in receipt of unemployment benefit. Some lenders

would have the cushion of an income from working husbands, or the security of a business such

as a corner shop. Others, for example those whose husbands were war casualties, were in receipt

of widows’ pensions. If there was a regular turnover of business, a continuous flow of lending

could be maintained. It was important to keep bad debts, and there were always some, to a

minimum. Lenders had to be hardnosed when refusing to lend, though embarking upon an

11

activity that met with so much disapproval indicates a lack of concern for local gossip. They had

to make friends and relatives aware that they were running a business not a charity. They had to

pursue poor payers by confronting them in the street, by calling at their homes, by informing

neighbours and other lenders of their delinquency and, of course, eventually involving their

husbands.xxxii Lenders did not resort to the legal system to recover their small sums as this course

of action was expensive and not part of their culture. It seems that women lenders dealt with the

fallout from bad debts themselves. There is no evidence of male pimping in moneylending.

If we examine the demand side of the equation it is easy to see why the market for loans in the

inner city remained strong. When the researchers for the Pilgrim Trust visited Liverpool during

the 1930s they were shocked by the level of deprivation they uncovered.xxxiii They found that the

incidence of long term unemployment was similar to that found in the depressed coal mining

community in the Rhondda which was also included in their survey. In Liverpool the long term

unemployed were concentrated in the dense packed slums of the inner city. The city was cursed

by having a relatively large proportion of its unemployed men in the youthful 18-35 years age

group. Added to that, the Liverpool unemployed had a relatively large number of dependents.

Every 100 long term unemployed men in Liverpool represented, with their families, 324 persons;

the figure for Rhondda was 254 and for Deptford it was only184. Put another way, 26 per cent of

Liverpool’s long term unemployed had more than three dependents: a similar calculation showed

that the figure for Rhondda was 17 per cent.xxxiv A combination of a high level of unemployment

amongst younger males, the burden of relatively large families and very low wage rates for

juveniles explain why there was a gap between family budgets and family needs. Investigators

noted poorly managed homes and concluded that the “Liverpool visit left such a deep impression

of poverty.”xxxv

Other studies showed that the Pilgrim Trust investigation was a true reflection of living

conditions in 1930s Liverpool. The detailed study of working class budgets on Merseyside

during the early 1930s, which was conducted by D. Caradog Jones and his team, shows how

difficult it was for low income families to avoid debt at the end of the week even with

expenditure pared to the bare minimum. Thanks to the introduction of unemployment benefit and

public assistance working class families were better off during the 1930s than they had been

before 1914. Indeed, the monetary gap between those out of work and the low paid employed

had considerably lessened. Nevertheless, in spite of this welcome improvement, many families

lived in persistent poverty.xxxvi

The key factors which must be emphasized in any study of Liverpool working class misery were

a lack of income from the chief earner of the household caused by unemployment, or casual

employment, or the lack of any earner in the family at all. It was a lack of income that was

responsible for overcrowding, for poverty and the feeling of despair which was its natural

accompaniment. Nationally unemployment declined from the particularly depressed peak of

1931 and the economy staged a recovery, though it remained a problem especially in regions

dominated by cotton textile manufacture, ship building and coal mining. In parts of the midlands

12

and south-east England, jobs became relatively plentiful; unfortunately, economic recovery in

Liverpool was less pronounced than for the country as a whole and while unemployment was

reduced, the reduction was depressingly modest.xxxvii

The number of moneylenders certificates issued between 1934-34 and 1939-40 shows a

significant decline for both males and for females. The decline cannot be explained by a

reduction in the need for this supplementary funding because the poverty, evident during the

1920s and early 1930s, is still present on the eve of World War11. Many women withdrew from

the licensed lending trade, possibly because the rate of return from a £15.00 license fee did not

sufficiently reward them. This withdrawal occurred in spite of the fact that the vast majority of

these women did not have paid employment. Certainly there are relatively few new entrants to

the trade and nowhere near enough to compensate for the leavers. It could be that some joined

the ranks of illegal money lenders but the number of prosecutions for this offence seems

modest.xxxviii The cost of a license is the most obvious explanation for the reduction in

certificates.

3

The fall in the number of certificate holders accelerated rapidly with the onset of war and failed

to recover when hostilities ceased. The decline is noticeable in all three categories though the

low totals reached by 1944-45 are proportionately greatest for women lenders. The Table on

page 8 shows that by the late 1940s the number of licensed female money lenders had been

reduced substantially compared with their presence in 1934-35. It is easy to suggest reasons why

the money lending market changed. The war induced a great deal of uncertainty, especially in the

centre of Liverpool where the blitz was intense. The bombing was at its worst during May 1941

when in a week of devastating raids the city’s docks were subject to sustained attack.xxxix During

these and other raids working class communities close to the river front found their homes

reduced to rubble and the casualties alarmingly high. Many occupants were forced to move while

others chose to do so. This disruption to close knit communities, made more intense by the

evacuation of children, was a one of a series of deep social shocks and may have led to a change

in the relationships between borrowers and lenders. The war also brought full employment.

Young men were conscripted into the armed forces, or sailed with the merchant marine.

Employment opportunities for women raised family income and the evacuation of children

lowered family costs. However, the introduction of rationing denied consumers the opportunity

to freely spend the money that they had earned. There was far less need to borrow during the war

years and far less incentive to provide the service.

It is clear that the war time reduction in licensed lenders is merely an acceleration of a trend

already evident before 1939. The eradication of so many lenders is not a radical change from the

13

pre war pattern so it does not need a special explanation. However, the failure of their numbers

to grow in the immediate post war years calls for comment. It is interesting to note that the

number of pawn broking establishments in Great Britain during the 1930s and 1940s also

declined, at much the same rate as the number of licensed money lenders. However, although the

fall in the number of pawnbroker shops was not as great in Liverpool and London as it was in

other major cities, it was still significant.xl By the late 1940s licensed street lenders were a rarity

and what had been a very important means of advancing working class credit had virtually

disappeared in Liverpool and elsewhere. If we consider the 1,380 licensed lenders identified by

Dorothy Keeling in her 1925 Survey of Liverpool and Birkenhead with the numbers offering

loans to working class customers during the 1940s, it is evident the provision of credit to poor

families had been completely transformed. Full employment, or certainly fuller employment

than in the 1930s, contributed to a reduction in the demand for loans; more generous social

services and the continuation of rationing also played their part. As did rehousing the inner city

poor, whose homes had been destroyed or damaged by the blitz, and the continuation of slum

clearance projects that had begun during the 1930s. The normality of the immediate post war

world for working class Liverpudlians was greater earning power and fewer visits to the local

moneylender.

Finally, instead of accepting the general criticism of licensed street lenders perhaps we should

see them as resourceful business women. Most of the lenders lived, and continued to live, in the

same mean streets as the borrowers. Their economic disadvantages were often similar to those of

their indebted neighbours yet they seized the opportunity to manage their business and family

budgets to maximum effect. They were prepared to endure public disapproval to carry on an

activity which required astute judgment and their constant attention. Once the regulation

introduced by the Moneylenders Act (1927) was in place, borrowers were protected against the

worst of the lender abuses which justifiably aroused the wrath of social workers during the early

1920s. Licensed lenders were not responsible for the misery that drove the poor to call at their

homes. They provided a valuable service the need for which, fortunately, withered away in the

1940s.

PETER FEARON

University of Leicester

14

ii

Paul Johnson, Saving and Spending. The Working-class Economy in Britain 1870-1939 (Oxford: Clarendon Press,

1985); Sean O’Connell and Chris Read, ‘ Working-class consumer credit in the UK, 1925-60: the role of the check

trader’, Economic History Review, LVII, 2(2005) 378-405); Peter Scott, ‘The Twilight World of Interwar British Hire

Purchase’. Past and Present. 177(2002) 195-225; Avram Taylor, ‘’Funny Money’. Hidden Charges and Repossession:

Working-class Experiences of Consumption and Credit in the Inter-war Years’, in John Benson and Laura Ugolini

(eds.) Cultures of Selling. Perspectives on Consumption and Society since 1700 (Aldershot: Ashgate 2006), Melanie

Tebbutt, Making Ends Meet. Pawnbroking and Working-Class Credit (Leicester: Leicester University Press, 1983)

iii

Pawnbroking can be divided into two activities: “city pawnbroking” which concentrates on watches, jewelry and

plate; “industrial pawnbroking” which concentrates on bedding and clothing. A.L. Minkes, ‘The Decline of

Pawnbroking’, Economica, 20(Feb. 1953) 12-17

iv

Pat O’Mara, The Autobiography of a Liverpool Irish Slummy, (London: Martin Hopkinson Ltd., 1934) 66-8.

London’s female money lenders also used violence as a means of encouraging repayment. V. de Vesselitsky and

M.E. Bulkley, ‘Money-Lending Among the London Poor’ The Sociological Review, IX(1917) 135-7

v

Their spending money included the cost of transport to and from work, meals at work, union dues and for many,

money for the football pools, the pub and for football matches at Goodison Park or Anfield.

vi

Pat Ayers and Jan Lambertz, ‘Marriage Relations, Money and Domestic Violence in Working-Class Liverpool,

1919-39’, in Jane Lewis, (ed.)Women’s Experience of Home and Family, 1850-1940 (Oxford: Basil Blackwell, 1986)

196-205, 208-12

vii

D. Caradog Jones (ed.), The Social Survey of Merseyside, Vol. 2, (London: Hodder & Stoughton and the University

Press of Liverpool, 1934) 8-9

viii

Ibid., 85-96

ix

Ibid., 123-29

x

The Times, February 10, 1925, 9; A suggestion that women’s loans should not be recoverable from their husbands

unless written consent had been gained for the loan was quashed in a letter by Miss A.R. Caton, the Hon. Sec of

the Liverpool Women Citizens’ Association who pointed out that many women were forced to borrow from slum

money lenders because their husbands had failed to provide vital support in the first instance. The Times, March

26, 1925

xi

Tebbutt, op.cit. 54

xii

Liverpool Personal Service Society: Annual Report, (1927). Liverpool Records Office, M364:3 PSS

xiii

Susan Pedersen, ‘Dorothy Clarissa Keeling, 1881-1967’. Dictionary of National Biography (Oxford: Oxford

University Press, 2004)

xiv

The Executive Committee of the PSS meeting in September 1923 instructed Keeling to gather information on

money lenders with a view to discussion at its General Meeting in October. The General Meeting agreed

unanimously that action must be taken regarding money lending to “prevent the evils which result from it”.

Executive Committee, Minutes of meeting September 28, 1923 M364 PSS. 1/1/1; General Committee Minutes of

Meeting October 26 1923 M364 PSS 1/1/2. Liverpool Personal Service Society Archive, Liverpool Record Office

xv

The Times, February 10, 1925, 9

xvi

Report by the Joint Select Committee of the House of Lords and the House of Commons on the Moneylenders

Bill and the Moneylenders (Amendment)Bill, (London: HMSO, 28 July 1925) evidence of Dorothy Clarissa Keeling,

19 June 1925 900-944

xvii

Liverpool Echo, June 18, 1925, 6

xviii

Dorothy C. Keeling, The Crowded Stairs (London: The National Council of Social Service, 1961) 112

xix

Robert Gee, 24 June, 1434. Joint Committee op.cit.

xx

Col. Watts Morgan, 17 June, 369. Joint Committee op cit

xxi

For example, the evidence of Mr Wells, 17 June, 197-8; Fred Ohlsen, 17 June, 346-53; Benjamin Astbury, 18

June, 708, Joint Committee ibid.

xxii

Mr R. W. Warnes, 25 June, 1483-98, ibid

xxiii

Albert Partridge, 17 June, 235-39 ibid

15

xxiv

See details in Dorothy Johnson Orchard and Geoffrey May, Moneylending in Great Britain, (New York: Russell

Sage Foundation, 1933) 115-148

xxv

It was possible to purchase a six month licence commencing on February 1 by payment of £7- 10 shillings. The

task of registering money lenders later passed from the Board of Inland Revenue to Local Authorities under the

Finance Act (1949)

xxvi

An illiterate money lender was awarded a certificate at Liverpool, The Times, December 21, 1927,4; another by

the Lambeth Police Court. The Times, December 22, 1927, 4; an unemployed man was awarded a certificate by

West Ham Police Court. The Times, August 12, 1930, 15.

xxvii

A point made by V.de Vesselitsky and M.E. Buckley, op. cit. 132-3

xxviii

Not just in Liverpool. Of 17 people applying for a Certificate at the Marylebone Police Court, 13 were women.

The Times, August 17, 1928, 9; in Glasgow, of the 57 women who applied for certificates most were married and

intended to carry out their business from their own homes. The Times, December 2, 1927, 7.

xxix

House of Commons Debates, v.223(1928-29) col. 1732; ibid v278 (1932-33) col. 1276

xxx

On the eve of World War 1 there were approximately 6-8,000 licensed lenders in Great Britain. Orchard & May,

op cit., 148

xxxi

Possibly because many of the new council estates were suburban locations situated miles from the city centre.

Madeleine McKenna, ‘The suburbanization of the working-class population of Liverpool between the wars’ Social

History 16 No.2(1991) 177-89; see also, Colin G. Pooley and Sandra Irish, The Development of Corporation Housing

in Liverpool 1869-1945, (Lancaster: Resource Paper of the Centre for North West Regional Studies, 1984)

xxxii

Sometimes money lenders would show sympathy after the difficulties over repayment had been explained by a

social worker. ‘Memories of the Personal Service Society’ (Typescript. Memoirs of Mrs Stapleton Liverpool 1930).

Liverpool Personal Service Society Archive. M364 PSS/11/5 Liverpool Record Office

xxxiii

Men without Work. A Report made to the Pilgrim Trust, (Cambridge: Cambridge University Press, 1938). This

investigation compared social and economic conditions in Blackburn, Crook, Deptford, Leicester, Liverpool and the

Rhondda.

xxxiv

Ibid, 90-98

xxxv

Ibid., 128; see also: University of Liverpool. The Social Survey of Liverpool, No. 3. ‘Poverty on Merseyside (Its

Association with Overcrowding and Unemployment)’, (Liverpool: 1931)

xxxvi

D.Caradog Jones, (ed) The Social Survey of Merseyside Vol.1, (London: Hodder & Stoughton Ltd. And University

Press of Liverpool, 1934). 208; 234-8. Chapter 12 contains a fascinating analysis of Merseyside working class

budgets. The majority of the families investigated lived in Liverpool.

xxxvii

D. Caradog Jones, Trade Revival in a Depressed Area (Liverpool: The University Press of Liverpool, 1937) 55-63

xxxviii

It was difficult to amass sufficient evidence to prosecute individuals suspected of illegal activity. Some claimed

that were collecting dues for Didlum Clubs or running a credit drapery business. Others concocted a dummy set of

accounts to show lending at 48 per cent. Letter from B.J. Hyde, London and Provincial Legal aid to Money Lenders

License Department, June 28, 1929 IR 40/3555. The National Archives

xxxix

For a full account see, John Hughes, Port in a Storm. The Air Attacks on Liverpool and its Shipping in the Second

World War (Birkenhead: National Museums and Galleries on Merseyside and Countyvise Ltd.: 1993)

xl

Minkes, op. cit., 19-22

16