JOE M - Emory Goizueta Business School Intranet

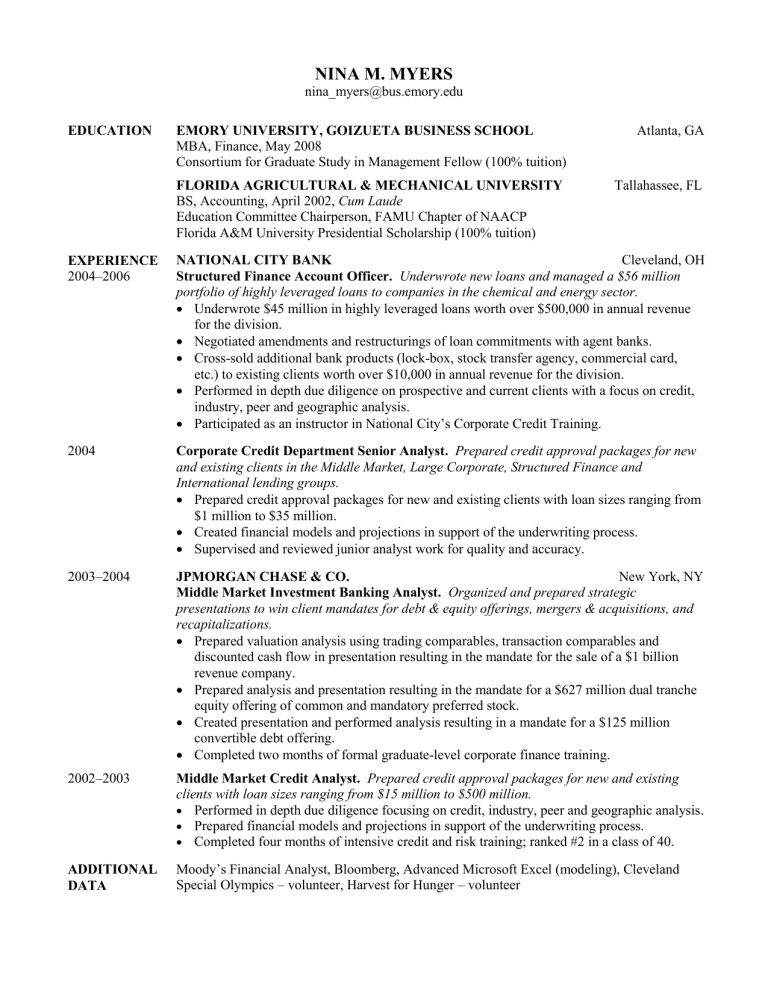

NINA M. MYERS

nina_myers@bus.emory.edu

2003–2004

2002–2003

EDUCATION EMORY UNIVERSITY, GOIZUETA BUSINESS SCHOOL Atlanta, GA

MBA, Finance, May 2008

Consortium for Graduate Study in Management Fellow (100% tuition)

FLORIDA AGRICULTURAL & MECHANICAL UNIVERSITY Tallahassee, FL

BS, Accounting, April 2002, Cum Laude

Education Committee Chairperson, FAMU Chapter of NAACP

EXPERIENCE

2004–2006

Florida A&M University Presidential Scholarship (100% tuition)

NATIONAL CITY BANK Cleveland, OH

Structured Finance Account Officer.

Underwrote new loans and managed a $56 million portfolio of highly leveraged loans to companies in the chemical and energy sector.

Underwrote $45 million in highly leveraged loans worth over $500,000 in annual revenue for the division.

Negotiated amendments and restructurings of loan commitments with agent banks.

Cross-sold additional bank products (lock-box, stock transfer agency, commercial card, etc.) to existing clients worth over $10,000 in annual revenue for the division.

Performed in depth due diligence on prospective and current clients with a focus on credit,

2004

ADDITIONAL

DATA industry, peer and geographic analysis.

Participated as an instructor in National City’s Corporate Credit Training.

Corporate Credit Department Senior Analyst. Prepared credit approval packages for new and existing clients in the Middle Market, Large Corporate, Structured Finance and

International lending groups.

Prepared credit approval packages for new and existing clients with loan sizes ranging from

$1 million to $35 million.

Created financial models and projections in support of the underwriting process.

Supervised and reviewed junior analyst work for quality and accuracy.

JPMORGAN CHASE & CO. New York, NY

Middle Market Investment Banking Analyst. Organized and prepared strategic presentations to win client mandates for debt & equity offerings, mergers & acquisitions, and recapitalizations.

Prepared valuation analysis using trading comparables, transaction comparables and discounted cash flow in presentation resulting in the mandate for the sale of a $1 billion revenue company.

Prepared analysis and presentation resulting in the mandate for a $627 million dual tranche equity offering of common and mandatory preferred stock.

Created presentation and performed analysis resulting in a mandate for a $125 million convertible debt offering.

Completed two months of formal graduate-level corporate finance training.

Middle Market Credit Analyst. Prepared credit approval packages for new and existing clients with loan sizes ranging from $15 million to $500 million.

Performed in depth due diligence focusing on credit, industry, peer and geographic analysis.

Prepared financial models and projections in support of the underwriting process.

Completed four months of intensive credit and risk training; ranked #2 in a class of 40.

Moody’s Financial Analyst, Bloomberg, Advanced Microsoft Excel (modeling), Cleveland

Special Olympics – volunteer, Harvest for Hunger – volunteer