Click here for BORDER ROAD REGULATIONS

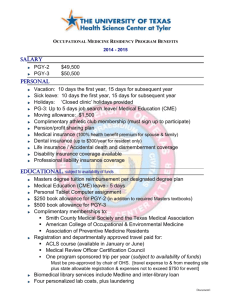

advertisement