RISK ANALYSIS IN AN EXTENDED ENTERPRISE ENVIRONMENT:

advertisement

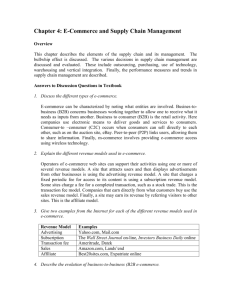

RISK ANALYSIS IN AN EXTENDED ENTERPRISE ENVIRONMENT: IDENTIFICATION OF KEY RISK FACTORS IN B2B E-COMMERCE RELATIONSHIPS Vicky Arnold University of Connecticut/University of Melbourne Clark Hampton University of Connecticut Deepak Khazanchi University of Nebraska-Omaha Steve G. Sutton University of Connecticut/University of Melbourne September 2003 Preliminary Draft Please Do Not Quote Without Permission We gratefully acknowledge financial support from the Institute of Internal Auditors. RISK ANALYSIS IN AN EXTENDED ENTERPRISE ENVIRONMENT: IDENTIFICATION OF KEY RISK FACTORS IN B2B E-COMMERCE RELATIONSHIPS SYNOPSIS In October 2001, the International Federation of Accountants (IFAC 2001) released a proposed International Audit Standard on the impact of electronic commerce on the audit of financial statements. The proposal was accepted as an International Audit Practice Statement (recommended procedures—not required) in March 2002. The audit statement focuses on four aspects of ecommerce risks: (1) legal and regulatory issues, (2) transaction integrity, (3) transaction security, and (4) process alignment (IFAC 2001, 2002b). Sutton and Hampton (2003) note that this statement is critical in two respects: (1) it is the first explicit recognition by an audit standards board of potential risks exuding from e-commerce activities, and (2) while the first three issues are arguably covered under general internal control standards, process alignment emerged for the first time as a fundamental risk category in the audit of financial statements. Within the U.S., the Sarbanes-Oxley Act has brought IT and e-commerce risks to the forefront as companies struggle to address Section 404 requirements related to reporting on internal controls. Organizations are slowly coming to the realization that requirements under Sarbanes-Oxley extend internal controls within the audit context from direct controls over financial activities to a broader enterprise risk management frame that includes strategic, operational, reputational, regulatory, and information risks (Katz 2003; Banham 2003). In a recent survey of CIOs, the largest planned increases in expenditures related to investments in security and e-commerce initiatives despite tight IT budgets (Ware 2002). Ware further notes, “Companies will take steps to shore up their security to give customers and business partners peace of mind. More than half (56%) of the panelists plan to increase their spending on security software and only 6% plan to decrease spending in this area.” In this study, the focus is on identifying the critical risk factors that can be used to assess the impact of B2B e-commerce on overall enterprise risks. The Khazanchi and Sutton (2001) framework for B2B e-commerce assurance is applied as the organizing conceptual model for the study. The framework focuses on three primary risk categories: (1) technical level risks, (2) application level risks, and (3) business level risks. These categories encapsulate, but broaden, the three categories identified by IFAC (2002a) in a white paper released around the same time as the e-commerce audit practice statement was accepted—the three categories being (1) IT infrastructure, (2) IT applications, and (3) IT business processes. To identify a critical set of B2B risk factors, structured focus groups were conducted with three internal constituency groups (corporate groups consisting of IS security, internal IT audit, and e-commerce development managers) and two external constituency groups (ecommerce consultants and external IT auditors). Tests of consistency between the internal constituency groups and then between internal constituencies and each of the external constituency groups confirm strong agreement on the identified critical B2B risk factors. Tests were also conducted on the relative importance of the critical B2B risk factors with the only substantial inconsistencies existing at the internal constituency groups versus external IT auditors group for the business-level factors. This would appear to indicate that internal business concerns over ecommerce might not have the same prioritization as do external auditors assessing enterprise risk in a financial audit environment. 1 BACKGROUND Since electronic data interchange (EDI) capability was first implemented in organizations over 30 years ago, interorganizational systems have evolved and have steadily tightened the bond between customers and buyers. The resulting relationships are often viewed as partnering or collaborative relationships—particularly in the current Internet-driven business-to-business (B2B) e-commerce environment where buyers are increasingly dependent on suppliers to perform (McIvor et al. 2003). Nonetheless, the bulk of these interorganizational systems has been EDI-driven; and, over the past decade, researchers have begun to examine the benefits and costs that arise in such situations. Researchers increasingly find that the benefits of basic B2B relationships are negligible and the true benefits come from collaboration (Lee et al. 2003); without widespread adoption of B2B application there is little payback (Iacouvou et al., 1995). The result has been that many organizations that are in a preferred power position with their suppliers (e.g., automotive manufacturers) have a tendency to force suppliers to implement B2B capability (Teo et al. 2003). Yet, forcing key suppliers to implement B2B may lead to distrust which can inhibit voluntary use and extensions of B2B applications (Hart and Saunders 1997) and in the worst case degenerate into conflict and yield a worse rather than better business linkage (Kumar and van Dissel 1996). Still, to sustain competitiveness in the contemporary business environment, B2B integration is imperative (Kurnia and Johnston 2000), necessitating a greater focus on assisting business partners in integrating new technologies and/or carefully considering the capability and willingness of new business partners to engage in effective B2B integration (Angeles and Ravinder 2000). 2 This selection and/or integration of business partners has become only more critical as organizations have implemented a variety of strategies for reducing business cycle time—such as vendor managed inventory (VMI), just-in-time (JIT) manufacturing and quick response retailing (QR) (Khazanchi and Sutton 2001). In short, the impact is that suppliers and customers become vital components of the value chains in the emerging business environment where competition is increasingly supply chain versus supply chain rather than company versus company (Papazoglou et al. 2000). This competition of supply chains induces organizations to become more selective of their business partners and to attempt to lock-in these suppliers to ensure stability of the supply chain (Grieger 2003). As a result, many companies are limiting their number of suppliers in order to improve the coordination of value/supply chains and create relationships that transcend specific transactional relationships—a concept referred to as relationalism (Grover et al. 2002). The challenge is to develop and integrate the technology across the value chain that will support the integration of business processes, information standards and information systems of all partners in the value chain (Shin and Leem 2002). While the process can be painful and costly, the implementation of such technology ultimately cements the relationship between business partners and provides stability in value chain partnering relationships (Grover et al. 2002). Despite all the perceived benefits of forging integrated business relationships, for many organizations there is still some trepidation in entering into these relationships (Iacovou et al. 1995). This trepidation can come from costs, but even more frequently is a result of perceived enterprise risks. Kumar and van Dissel (1996) summarize these risks as the costs associated with exposure to being exploited in the relationship. These risks include transaction specific capital (i.e., investment by one party that has little or no value outside of the business relationship), 3 information asymmetries (i.e., problems in monitoring performance which yields risk to shirking by a business partner), and loss of resource control (i.e., resources that are transferred in a relationship that cannot be returned or controlled in the event of termination of the relationship). These risks primarily center on loss of investment, however, which can have negative financial ramifications for an organization but are not likely in most cases to cripple an organization. Yet, in an era where the focus has been on enhancing core business processes, outsourcing activities that other organizations can do better, and developing integrated value chains, breakdowns in relationships may have far greater ramifications than simply financial losses and/or inefficiencies (Sutton and Hampton 2003). For instance, in a just-in-time environment where a vendor is responsible for managing the materials and parts inventory, failure by the vendor to deliver parts for a prolonged period of time can potentially lead to extended shutdowns of manufacturing processes. These interruptions can put the manufacturing company at risk due to the inability to produce goods, inability to meet obligations downstream in the supply chain, loss of other business partners’ trust, and decline in general reputation. Such risks could potentially jeopardize an organization’s long-term standing. Various organizations have recognized the increased prevalence of such risks and have endeavored to meet the needs of various information users wishing to mitigate the risk of ecommerce across the value chain. Harbinger, Inc., for instance has evolved from simply a valueadded network provider supporting EDI transactions to become an information source on preparedness of potential partner organizations. Within the automotive industry, Harbinger now provides reports that highlight the B2B capability and the degree of integration with underlying business processes of various small- and medium-sized enterprises (SMEs) that serve as suppliers to the major U.S. auto manufacturers. The reports help automobile manufacturers 4 identify potential suppliers that are more likely to be able to operate in their just-in-time manufacturing environments and to more effectively monitor internal business risk from partner relationships (Yost 1999). Similarly, the International Federation of Accountants (IFAC), which sets international audit practice guidelines, has recently released two documents that advise external auditors to evaluate the business risks that an organization assumes through e-commerce relationships. This risk assessment should be done as part of an overall assessment of the client organization’s business risks, financial viability, and going concern status (IFAC 2001; 2002a, 2002b). The wide variety of concerns in B2B integration led Massetti and Zmud (1996) to the conclusion, “What seems absent is a rich, tactical understanding that links strategic expectations regarding [B2B] with operational plans for potential implementation.” The focus of Massetti and Zmud’s study was on deriving factors for assessing the benefits from B2B linkage. As interorganizational systems have become more tightly coupled, a focus on the opposite side of the equation (i.e. associated business risks) seems particularly critical. While prior research has addressed a variety of general risk factors in interorganizational systems linkages (e.g., Papazoglou et al. 2000, Unal 2000, McIvor et al. 2003, Hempel and Kwong 2001, Westland 2002, Kumar and van Dissel 1996), a focused effort on identifying the specific risk factors within various general categories can aid managers in risk management, aid auditors and monitoring organizations in the measurement of potential risk, and inform future development and innovation in interorganizational systems. The purpose of this study is to explore and identify the key risk factors involved in ecommerce driven interorganizational systems that can potentially escalate an organization’s overall enterprise risk. This paper documents a study that targets directly the identification of the 5 key risk factors in B2B relationships. The paper uses the Khazanchi and Sutton (2001) model for B2B e-commerce assurance services as the conceptual model for viewing specific risk components. Initially, three structured focus groups were conducted with information systems security, IT audit, and e-commerce development staff from each of three large corporations that are heavy users of B2B e-commerce across the value chain in order to identify the key risks associated with these relationships and to determine whether a consensus exists across organizations as to what are the key risk factors. Two additional focus groups were conducted with an e-commerce consulting firm and an external audit firm in order to explore whether differences existed between corporate teams and external professionals. The results provide an agreed upon set of key risk factors for each of the three risk dimensions put forth by Khazanchi and Sutton (2001): (1) technical level risk, (2) application-user level risk, and (3) business level risk. The remainder of this paper is presented in four parts. First, an overview and discussion of the B2B e-commerce assurance service model is presented. Second, the structured focus group methodology applied in the study is discussed. The third part presents the results of the study and the fourth part discusses the implications of the results for e-commerce managers and researchers. THEORETICAL MODEL The Khazanchi and Sutton (2001) B2B e-commerce assurance model utilized in this study was developed based on an analysis of 90 SMEs that were engaged in EDI-based B2B relationships. The model was developed and refined using a combination of surveys, phone interviews and written descriptions from participating organizations and consists of three primary assurance components (see Table 1 and Figure 1): technical level assurance, application 6 user level assurance, and business level assurance. Each of these three levels is discussed further in the following subsections. [Insert Table 1 about here] [Insert Figure 1 about here] Technical Level Assurance Technical level B2B assurance deals with assisting decision makers in ensuring that the necessary technical B2B elements are in place and that integration with external and internal applications is feasible given the availability of financial and technological resources. This includes a variety of technical services such as selecting appropriate internal applications for B2B linkages, integrating multiple trading partners, mapping customer/supplier data for direct use in internal applications, ensuring that the business transaction process works and includes all electronic transaction sets, and using appropriate B2B intermediaries to support the processes. Review of B2B technical capability should also consider the level of integration with back office systems and the reliability of those systems in ensuring integrity and security of the data captured in B2B transmissions. (Khazanchi and Sutton 2001). As defined, technical level assurance captures a range of risks identified in various studies. The five key problems identified by Papazoglou and Tsalgatidou (2000) which hamper widespread use of e-commerce all fit in this category (i.e. incomplete implementations, rigid requirements for protocols, limited interoperability of systems, insufficient security, and lack of integration with business models). The technical level also embodies more general concerns such as cost effectiveness, reliability, security (Unal 2000), and trust in a partners control mechanisms (Tan and Thoen 2002). 7 Technical level risks may be of the greatest concern to SMEs who have been forced to adopt e-commerce with a limited number of partners (perhaps even one). It is also important to larger organizations that have significant concerns over partners’ controls related to data integrity and security which could lead to legal disputes over privacy and requirements for safe maintenance of data. Application-User Level Assurance The application-user level relates to ensuring that decision makers’ choices and rationale for B2B implementation are appropriate. Risks in this area focus on understanding potential benefits of B2B linkages, assessing the current business environment and internal processes, obtaining general information about B2B options, assessing organizational readiness for adopting B2B, relying on paper-based transactions for internal processes, dealing with impersonal nature of e-commerce transactions, and reliability of internal transaction processing. Finally, questions about the adequacy in preparation of an organization’s staff for B2B activities along with related education and training programs should be assessed. Application-user level risks include risks previously identified in the literature such as Angeles and Ravinder’s (2000) key factors for customers selecting among vendors for EDI relationships—i.e. readiness for high-level EDI, trading partner flexibility, and communication, and Iacovou et al.’s (1995) three factors affecting small organizations adoption of B2B ecommerce—i.e. perceived benefits of application, organizational readiness, and external pressure to adopt. These risks are of concern to SMEs who are considering adoption—including those under coercive pressures. However, larger organization may be particularly concerned about these risks relative to smaller business partners. Smaller organizations may not be able to integrate the 8 technology effectively in order to enhance flexibility in ordering and to further cut cycle times across the value chain. Weaknesses of a partner organization in either of these latter areas could warrant reconsideration by the dominant partner as to the long-term viability of the business relationship. Business Level Assurance Business level risks relate to an organization’s ability to appropriately reengineer traditional business processes to incorporate an e-commerce driven business . These risks may center around a variety of issues including the appropriateness of e-commerce for an organization, assessment of direct/indirect benefits actually being realized from e-commerce usage, adherence to legal requirements (electronic orders, signatures, trading partner agreements, information privacy laws, etc.), proper monitoring of data and transmission security/auditability, and appropriateness of workflow procedures to achievement of efficiency gains. Accordingly, internal control systems should be assessed for viability in assuring continuous maintenance of controls over privacy of data, reliability of systems, and security of electronic transmissions. (Khazanchi and Sutton 2001). The importance of the business level dimension has been noted in part in other recent research studies. Business model integration has been noted as a key concern by Papazoglou et al. (2000) and Hempel and Kwong (2001). Kumar and van Dissel (1996) emphasize the importance of individual partner’s performance when there is sequential interdependence among a chain of partners. Breakdowns by a single partner will inevitably affect adjacent partners in the sequential chain and may possibly impact all subsequent downstream partners in the value chain. Assessment of business level risks would appear to be of critical importance to organizations potentially at risk. All organizations should be concerned that their own systems is 9 properly implemented and that transactions are secure, electronic funds transfers are complete, internal recording of business transactions are accurate and complete, and inefficiencies are identified. At the same time, similar failures by business partners can also have major effects on an organization. Thus, risk assessment of partner systems is also of great importance— particularly as systems become increasingly complex and partners become increasingly dependent on each other for successful execution of the supply chain. Identifying Key Risk Factors The three components of the B2B e-commerce assurance model appear to provide a reasonable means for assessing risks associated with an organization’s B2B e-commerce activities. While the model provides a good conceptual foundation for examining e-commerce risks, understanding the key risk factors in each category is still general and non-specific. Identifying a set of specific factors for each of the three risk components could enhance the value of the model to managers and researchers assessing the riskiness of potential trading partners. Before the risks can be quantitatively measured, the specific risk factors that should be measured must be identified. The factors that make up the set of critical factors for assessing ecommerce risk within each of the three categories are unknown? Is there a consistent set of factors applicable to most or all organizations? In seeking to identify whether such a set of factors exist, this study adopts a philosophy consistent with that of total quality management (TQM). Such a philosophy is based on the belief that the best way to monitor and improve a process is to engage the individuals who regularly perform the process in the development of quality factors (Havelka et al. 1998). These individuals are in the best position to understand the key factors that affect a systems’ ability to function properly and in a quality manner (Lampe and Sutton 1994a). In the case of e-commerce 10 activities, five key constituencies are identified as being in a position to monitor and assess the processes. The three internal constituencies are e-commerce developers, IS security staff, and IT auditors. The external constituencies are e-commerce consultants (who develop, implement and maintain e-commerce systems) and external auditors (IT audit specialists who assess risk in assurance and audit engagements). Four key results are critical for risk factors identified by these various constituencies to be generalizable to other organizations. These four key results are: 1. Consistency among internal constituencies as to the critical risk factors for each of the three model components. 2. Agreement among internal constituencies as to the critical risk factors for each of the three model components. 3. Consistency between internal constituencies and each of the external constituencies as to the critical risk factors for each of the three model components. 4. Agreement between internal constituencies and each of the external constituencies as to the critical risk factors for each of the three model components. A methodology consistent with the TQM philosophy is proposed for purposes of identifying key risk factor. The proposed methodology is discussed in the following section. STRUCTURED FOCUS GROUP METHODOLOGY The research method used in this study has been adopted from Havelka et al. (1998). The methodology was originally adapted from Adam et al. (1986) and subsequently refined and validated in a series of studies examining key quality factors in auditing (Lampe and Sutton 1994a, 1994b, Sutton and Lampe 1991; Sutton 1993) and information requirements definition 11 (Havelka et al. 1998). The short form of the methodology as used by Havelka et al. is applied in this study for risk factor identification in e-commerce environments. Given the differences between quality factor identification and risk factor identification (albeit similar), validation testing is also completed using the data aggregated from the focus groups in this study. Focus Group Process The risk factor identification methodology uses a blend of focus groups with the structured approach of nominal group techniques (Van de Ven and Delbecq 1971; 1974). The method is based on the TQM concept that the important factors embedded in a process that impact success are most readily observable and identifiable by those individuals involved in the process (Adam et al. 1986). A four step structured focus group conducted over a single threefour hour session is used in this study to identify key risk factors impacting successful ecommerce processes across the three dimensions of technical, application-user and business level risk. The process is initially completed with internal constituency groups that include IS security staff, e-commerce developers, and IT auditors. Follow-up sessions are conducted with external constituency groups that include either external IT audit specialists or e-commerce consultants. The first step in the structured focus group is an open forum by the group participants to generally discuss their individual roles, the types of applications with which they have been involved, their perspectives on the success of e-commerce ventures, and the impact of ecommerce on their particular organization’s business and overall industry. This open discussion acclimates the various participants and group leaders (i.e. the researchers) to the terminology used by the various participants and their general perspectives as they enter into the group discussion. It also allows time to discuss the model for e-commerce and to assure there is consensus on the meaning of each of the model’s components. 12 The second step in the structured focus group consists of a silent brainstorming session at the individual level. The participants are provided with the component of interest (i.e. technical, application-user or business level risk) and asked to identify all factors that they believe have an impact on a successful e-commerce system/process. They are also instructed to consider all factors regardless of whether they may be characteristic of implementations at the initial start-up phase, integration phase, or mature phase (consistent with that prescribed by Khazanchi and Sutton 2001). The participants are further instructed that at this point they should focus on identifying all factors and not in trying to filter out any that they think might not be particularly critical.1 The participants list out their risk factors on a sheet of paper that includes a heading reminding them of the component of interest in the model at this stage of the process. The silent generation period provides time for adequate reflection, social facilitation (i.e. the tension created by watching others busily working and generating lists of risk factors), avoidance of interruption, avoidance of prematurely focusing on the first ideas generated by the group, sufficient time for search and recall, avoidance of competition, avoidance of status pressures, avoidance of conformity pressures, and avoidance of choosing between ideas prematurely (Delbecq et al. 1982). The third step is a round-robin recording of the ideas generated. An aggregate list of the participant’s identified risk factors is generated by taking one idea off each person’s list in a continuous around the room pattern until all participants’ lists are exhausted. As each risk factor is read out, one of the group leaders types the factor into a synthesizing document that is projected to the front of the room where all participants can view the composite list of risk factors. As each risk factor is read out, participants share in forming an understandable phrase 1 While participants are likely to focus on factors that mirror their personal experiences and, therefore, the industries in which they participate, the subjects were not instructed to limit their listing of factors to those they have faced nor those that would be specifically applicable to their industry. 13 representing the factor and an agreed upon definition of the factor (which is recorded off-screen by one of the researchers). The benefits of the round-robin approach to listing risk factors includes the following: equal participation in presentation of risk factor items, depersonalization of ideas from personalities as the list gets combined and grows, ability to deal with a large number of ideas, tolerance of conflicting ideas, encouragement of new risk factor generation based on fellow participant’s ideas, and provision of a written record and glossary of the risk factors presented (Delbecq et al. 1982). The second and third steps are briefly repeated to seek new risk factors that are identified based on ideas that derive from other participants’ generated lists of risk factors. The fourth step is to evaluate the long list of risk factors and identify a subset of factors that are considered particularly critical to the success of e-commerce processes. Each focus group participant, at the individual level, first sorts the list of risk factors into a list of critical factors versus those that are not critical risk factors. This process represents a Q-sorting approach (Kerlinger 1986). Subsequently, individual participants rank each of the critical risk factors s/he has selected based on importance to the model component being examined. This is an extreme version of the Q-sort whereby each item is essentially placed into a classification by itself (Sutton 1993). The four-step procedure is repeated for each of the three components in the model. After completion of the focus group, the researchers aggregate the rankings into a composite list of critical risk factors; and this composite list is used in subsequent analysis. There is evidence to support the use of this type of method for aggregating individual rankings into a composite group rating when the intent of the research is to generate a true group preference (Huber and Delbecq 14 1972; Sutton 1993). Thus, the output of the structured focus group is a consensus set of critical risk factors for each of the three components. Validation of the Methodology for Risk Factor Identification Recall from the discussion of the theoretical model that the robustness of the critical risk factors identified is contingent in large part by whether there is consensus between different organizations on the identified risk factors. The validity of the structured focus groups for risk factor identification is predicated on the belief that groups from different organizations will generate similar lists of critical risk factors for each of the model components. At the most fundamental level, there should be agreement among individuals in similar positions across different organizations—i.e. among IS security staff, e-commerce developers and IT auditors from each of the three organizations participating in the study. Stated in null form, the hypothesis relates specifically to the validation of the method and can be stated as: H1: The risk factors selected as critical by one organization’s focus group will be independent of those selected by another organization’s focus group. The perceptions regarding relative importance of each of the critical risk factors is also important as the two focus groups should not only feel similarly regarding the critical risk factors, but also the relative importance of the critical factors (i.e. the ranking). As such, H2 relates to the ranking of factors as a measure of the strength of agreement among the groups. H2: The importance placed on each of the risk factors selected as critical by one organization’s focus group will be independent of the importance placed on each of the risk factors by other organizations’ focus groups. From an analysis standpoint, each of the three components of the model is addressed separately since the focus groups also rank factors in each of the model components separately. This leads to three testable hypotheses: H2a: The importance placed on each of the technical level risk factors selected as critical by one organization’s focus groups will be independent of the 15 importance placed on each of the risk factors by other organizations’ focus groups. H2b: The importance placed on each of the application-user level risk factors selected as critical by one organization’s focus groups will be independent of the importance placed on each of the risk factors by other organizations’ focus groups. H2c: The importance placed on each of the business level risk factors selected as critical by one organization’s focus groups will be independent of the importance placed on each of the risk factors by other organizations’ focus groups. While the relationship among each of the organizations is important to the validity of the structured focus group in generating e-commerce risk factors, the breadth of the validity would be enhanced to the degree that an external e-commerce consulting group and an external IT audit group are also consistent in the identification of key risk factors. Similar to the examination at the internal constituency level, the relative ranking of risk factors further adds validity to the selected factors. Stated in null form, the hypotheses again relate specifically to extending the validation of the method and can be stated as: H3: The risk factors selected as critical by organizations’ focus groups will be independent of those selected by an e-commerce consultants’ focus group. H4: The importance placed on each of the risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an e-commerce consultants’ focus group. H5: The risk factors selected as critical by organizations’ focus groups will be independent of those selected by an external IT audit focus group. H6: The importance placed on each of the risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an external IT audit focus group. From an analysis standpoint, each of the three components of the model is addressed separately when considering the relative importance of the factors in H4 and H6. This leads to six testable hypotheses: 16 H4a: The importance placed on each of the technical level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an e-commerce consultants’ focus group. H4b: The importance placed on each of the application-user level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an e-commerce consultants’ focus group. H4c: The importance placed on each of the business level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an e-commerce consultants’ focus group. H6a: The importance placed on each of the technical level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an external IT audit focus group. H6b: The importance placed on each of the application-user level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an external IT audit focus group. H6c: The importance placed on each of the business level risk factors selected as critical by organizations’ focus groups will be independent of the importance placed on each of the risk factors by an external IT audit focus group. Focus Group Participants Completion and validation of the methodology for identifying key e-commerce risk factors within the framework put forth by Khazanchi and Sutton (2001) requires the involvement of internal constituency groups involved in the development, implementation and evaluation of corporate B2B systems and along with the relationships with external constituencies (ecommerce consultants and external IT auditors) who facilitate the development and implementation, and/or the audit and assurance of such systems. The internal constituency groups were designed to capture the perspectives of e-commerce developers, IS security staff, 17 and internal IT/B2B auditors. Three internal constituency groups were selected for participation in an effort to get a diversified set of perspectives. 1. Group 1 was from a large insurance company that interacts with a variety of service providers, medical entities, and co-insurance partners. Five individuals participated in the group process representing the director of internal audit, an IS security officer, an audit supervisor, and two information systems managers (one of whom was an EDI specialist). 2. Group 2 was from a large food manufacturer that interacts with a variety of suppliers as well as a variety of customers including a number of very large chains such as Wal-Mart. Seven individuals participated in the group process with two from web services, an information security officer, auditor in charge of infrastructure reviews, one B2B application developer, one tech support officer for B2B applications and the director of internal audit. 3. Group 3 was from a large railroad and transportation company that deals with a large number of customers and ancillary transportation providers. Five individuals participated including three IT auditors with B2B experience, a project manager for e-commerce implementations, and a programmer involved heavily with the development and maintenance of the pricing exchange. The external constituency groups were selected based on the desire for additional external risk factor validation via e-commerce consultants and external IT auditors involved in assessing the impact of IT risk on overall enterprise risk. Two additional groups participated: 1. Group 4 was from a regional e-commerce consulting company specializing in the design and implementation of e-commerce systems. Four individuals participated including the 18 lead project managers in infrastructure implementation, database management, application design, and marketing services. 2. Group 5 was from a Big Four audit firm and consisted primarily of the partners and managers in IT audit of one region in the U.S. Six individuals participated including one partner, four managers, and the associate CIO for global firm operations. The five groups (three internal constituency and two external constituency) provide a rich source of data for identifying the key e-commerce risk factors. Active involvement by all group members yielded a long list of potential key factors that should be considered in assessing the business risk evolving from B2B relationships with business partner organizations. RESULTS OF THE VALIDATION TESTING Data analysis was conducted in accordance with the two-phase validation procedure examining first, the consistency among internal constituency groups, and second, internal constituency groups’ consistency with external constituency groups. Specifically, Phase I validation using internal constituency groups relates to H1 and H2, while Phase II validation with external constituency groups relates to H3-H6. The results provide support for rejecting all six null hypotheses, consistent with the expectations underlying the applied methodology. Phase I Validation: Internal Constituency Groups The structured focus group processes were completed independently with each of the three internal constituency groups consisting of a variety of e-commerce interested participants. The first condition necessary for reliance on the identified set of key factors is the existence of a high level of agreement between different groups in different corporate environments as to the factors selected as critical. To test H1, a chi-square test of independence is used. Because the chisquare test is designed to compare two groups, all pair wise combinations of the three groups are 19 tested. The chi-square test of independence uses a 2x2 contingency table that focuses on both the commonalities (items selected/not selected by both groups) and the differences (items selected by only one of the two groups) between the two organizations being compared. The results provided in Table 2 indicate significant agreement between all pair wise combinations in the selection of key e-commerce risk factors, leading to the rejection of H1. [Please insert Table 2 about here] While agreement on the selection of factors captures one dimension of consistency between the groups, a second dimension should also be considered—the relative ranking placed on each identified factor by each of the groups. To test H2, a Spearman’s rank correlation test is used. Because the groups ranked each of the three dimensions of the risk model (i.e. technical level, application user level, and business level) separately, the Spearman’s rank correlation test must accordingly be used within each dimension (i.e. H2a-H2c). Using rank values provides greater statistical power than does categorization by selected/not selected as is used in the chisquare test. Similar to the tests for H1, all pair wise combinations of the three groups are tested. The results provided in Table 3 indicate significant agreement on rankings of the key ecommerce risk factors between all pair wise combinations of internal constituency groups, leading to the rejection of H2a-H2c, and therefore H2. [Please insert Table 3 about here] In combination, the results from testing H1 and H2 indicate that there is agreement among groups from diverse organizations (i.e. insurance, food manufacturing, and transportation/logistics) on a set of critical factors affecting the overall enterprise risk from ecommerce relationships. This also implies that these critical factors can be used to assess the risk inherent in conducting e-commerce relationships with other organizations. These critical factors 20 should also be important to the external auditors of such organizations in making their enterprise risk assessments during audit planning and by e-commerce consultants who inherit related liability during development and implementation of such systems. This leads to the Phase II validation testing. Phase II Validation: External Constituency Groups Two external constituency groups were identified as major stakeholders having interest in e-commerce risks associated with corporate systems—consultants and external IT auditors. First, many such systems are developed and implemented by outside consultants. By assuming a certain level of responsibility for specific applications, e-commerce consultants are expected to be particularly alert to risks arising at the technical level and application-user level. Second and as noted earlier, IFAC international audit statements specify the importance of the external auditor assessing the implications of the risk from e-commerce systems on the assessment of overall enterprise risk during a financial statement audit. External auditors are expected to be particularly concerned with business level risks and the corresponding effect on the financial condition of the organization. The results of the structured focus groups conducted with e-commerce consultants and external IT auditors are compared individually with the aggregate results of the three internal constituency groups. Testing of H3 and H5 are the equivalent to that used in testing H1, but examine agreement by the e-commerce consultant group with the internal constituency groups and by the external IT auditor group with the internal constituency groups. As such, the same chi-square test of independence using a 2x2 contingency table focusing on both the commonalities (items selected/not selected by the internal constituency groups and the consultants [external IT audit] group) and the differences (items selected by only one of the 21 constituencies) is used. The results displayed in Table 2 indicate significant agreement by both the consulting group (H3) and the external IT audit group (H5) with the internal constituency groups, leading to the rejection of both hypotheses. While agreement on the selection of factors captures one dimension of consistency between the groups, with both the e-commerce consultants and the external IT auditors, the relative ranking of each identified factor remains an important dimension for assessing agreement. As such, Spearman’s rank correlation tests are again used to test H4 and H6 (agreement between the e-commerce consultant group and external IT auditor group, respectively, with the internal constituency groups). The tests are run separately for each level of the risk model (i.e. technical, application-user, and business) based on the separate ranking processes (i.e. H4a-H4c and H6a-H6c). The results provided in Table 4 indicate significant agreement on rankings of the key B2B e-commerce risk factors between the e-commerce consultant group and the internal constituency groups for both the technical level (H4a) and application-user level (H4b), but not significantly related for business level (H4c) risks. The results provided in Table 4 also indicate significant agreement on rankings of risk factors between the external IT audit group and the internal constituency groups for technical level risks (H6a), but only marginally significant agreement at the application-user level (H6b) and business level (H6c). While there is mixed evidence, on an overall basis there does seem to be reasonable support for rejecting H4 and H6. [Please insert Table 4 about here] In combination, the results for testing H3-H6 indicate that there is a set of risk factors that can be agreed upon between internal constituency groups and varied external constituency groups (i.e. e-commerce consultants and external IT auditors) that represent the critical factors 22 affecting the overall risk from B2B e-commerce relationships. This reinforces the belief that a set of key risk factors exists that could be used in assessing the risk inherited from such relationships. These risk assessments should be of importance to both internal and external stakeholders. CRITICAL B2B E-COMMERCE RISK FACTORS While the robustness of the methodology for identifying critical e-commerce risk factors is important to adding legitimacy to the identified factors, the primary purpose of this study is to identify the critical set of factors. Completion of the five sets of focus groups resulted in the identification of 49 key risk factors with 18 at the technical level (see Table 5), 16 at the application-user level (see Table 6), and 15 at the business level (see Table 7). [Please insert Tables 5, 6 & 7 about here] The technical level factors are listed in Table 5 along with a marking of each of the items identified as critical by each of the participant groups. Note that consistent with the test results for consistency 8 of the 18 factors are identified by at least 3 of the 5 groups. A review of the factors selected by the most groups is indicative of broad concern over security of access to applications and networks along with the appropriate level of expertise and change management controls to ensure continued security. Also of interests are the concerns by external constituencies over robustness of systems over time (both in terms of systems and personnel) that are not as prevalent among internal constituencies. The application-user level factors along with a marking of each of the items identified as critical by each of the participant groups are listed in Table 6. Consistent with the test results for consistency, 8 of the 16 factors are identified by at least 3 of the 5 groups. The factors at this level are less concentrated than for the technical level factors as a broad range of application 23 related issues are identified by multiple groups as critical, including: staffing issues and management champions, architecture compatibility and capacity issues, partner benefits and market sustainability, and testing for/controls over application reliability. While the external constituencies have more unique factors at the technical level (see Table 5), they appear to be much more in-line with the internal constituency groups in selecting critical risk factors at the application level. The business level factors along with the marking of each of the items identified as critical by each of the participant groups are listed in Table 7. Consistent with the results of the tests for consistency, the factor identification at the business level yields good consistency among the groups for identification of key factors (9 of the 15 factors are identified by 3 or more groups). As would be expected, broad range of issues are covered at the business level, including regulatory, legal, cost/benefit analysis, business process integration, due diligence, risk management, monitoring controls and management leadership in IT. Yet, despite the breadth there is strong agreement on the critical factors affecting business level risks. On the other hand, as might be expected, there is not necessarily strong agreement between internal constituencies and external constituencies as to the relative importance of the individual factors identified. DISCUSSION AND IMPLICATIONS In the emerging Internet-driven B2B environment, the true benefits appear to come from tight collaboration with trading partners (Lee et al. 2003), but at the same time significant enterprise risks emerge from the corresponding increased dependence on a smaller set of trading partners (Khazanchi and Sutton 2001; McIvor et al. 2003; Sutton and Hampton 2003). While prior research raises many concerns and recognizes a variety of general risk factors related to the tight coupling of interorganizational systems (e.g., Papazoglou et al. 2000; Unal 2000; McIvor et 24 al. 2003; Hempel and Kwong 2001; Westland 2002; Kumar and van Dissel 1996), the extant research does not provide a focused examination of specific factors that can be utilized by corporate chiefs for effective enterprise risk management, nor for auditors and other monitoring organizations that must evaluate the riskiness of B2B activities to the viability of the organization. The research reported in this paper focuses on the identification of critical factors that can be used by management, auditors and other related parties to monitor and assess the overall enterprise risk arising from B2B interaction with a particular focus on interorganizational systems. The study applies the Khazanchi and Sutton (2001) framework for B2B assurance, focusing across the three levels of risk: (1) technical level, (2) application-user level, and (3) business level risks. Based on a series of structured focus groups with internal constituency groups representing information systems security, internal IT audit, and e-commerce development and representing three diverse industries, a set of critical factors were identified for each of the three levels in the framework. The set of critical factors were further refined and validated using two external constituency focus groups (e.g. e-commerce consultants and external IT auditors). The results of the study show strong consistency between all of the groups in the identification of critical risk factors, strong agreement between internal constituency groups on the relative importance of factors. The results also reflect some difference between internal constituency groups and external constituency groups as to the relative importance of the factors. These statistical results support the desired objective of identifying a set of critical factors that are applicable across a broad range of organizations having concerns related to ecommerce activities. The 49 critical factors consisting of 18 technical level factors, 16 application user level factors and 15 business level factors would appear to provide broad 25 coverage of the important factors to be considered while at the same time maintaining a relatively parsimonious set of factors at each level. There are limitations to the research that should be considered when reviewing the output of the factor identification process. First, application of the structured focus group methodology necessitates the use of small groups. While attempts were made to gather data from a comprehensive set of constituencies within each of the internal and external groups, generalizations to other organization members and to other organizations cannot be assured. However, the use of a diverse set of organizations from different industries along with two unique external entities (e-commerce consultants and external IT auditors) should help minimize this risk. Second, consensus based measures do not necessarily assure accuracy even when highly experienced and knowledgeable participants are included. Third, many of the factors that have been identified have been previously noted in prior research, the business press and textbooks. However, many of the factors that were excluded as key risk factors by the participating groups have also been identified in such sources. The research presented here provides the additional information necessary to better understand the relative importance of various risk factors mentioned in various publications and provides guidance to managers, ecommerce developers and auditors on the selection of a more parsimonious set of factors that capture the key risk dimensions. The results provide insights that should be useful to managers, developers, auditors and other researchers. Our results should be of particular value to both corporate chief officers in addressing enterprise risk management concerns and information systems managers concerned with secure and effective interorganizational systems. While the factors provide a specific frame for viewing B2B risks, measures for each of the factors will need to be developed and tailored to the specific 26 interorganizational system of interest. Consideration should also be given as to which factors might be automated, which factors require human monitoring, and how this human monitoring might take place. For those measures that can be automated, continuous assurance mechanisms should be considered. This type of automated continuous assurance would seem particularly feasible at the technical level. For those factors requiring human monitoring, consideration should be given to whether such monitoring is possible and most desirable from internal IT auditors examining trading partners systems and operations, external auditors or other independent providers assure/certify trading partners, or some other alternative method. The key is that it would appear to be critical that corporate chief officers and information systems managers consider the risks that exude from interorganizational systems and take appropriate steps to mitigate such risks to an acceptable level. With the recent global spate of corporate frauds and mismanagement, there is certainly a heightened focus on overall enterprise risk management. The focus on enterprise risk management goes beyond just the concerns of corporate chief officers to the auditors who are saddled with the responsibility to protect the public interest. The results of this study provide a framework of e-commerce risk factors that should be considered under the broad guidelines of the IFAC audit statements on e-commerce risk assessment. Further, in the U.S. where national standards take precedence in guiding audits, the results provide guidance for further revision of SAS 70 on assurance over service organizations and SAS 94 on the impact of IT on internal control systems to encompass the impact of e-commerce trading partners on enterprise risk—a step that the recent release of SAS 98 intended to update the standards to address a changing risk environment did not encompass. Yet, clearly contemporary audit approaches that our focused on 27 business measurement and enterprise risk models should include consideration of the risks absorbed from such interorganizational relationships. There are also implications for researchers as further research on e-commerce risk is still of great need. While the research presented in this paper documents specific risk factors across each of the three levels in the assurance framework, there may be other characteristics of trading partner relationships that provide insight into why such risks fluctuate. For instance, Hart and Saunders (1997) found that differences in trust and power within EDI-based relationships were related to the diversity of transactions used between trading partners and imbalances could affect voluntary use of EDI. Such factors certainly could also influence many of the identified risk factors as trading partners weigh the expense of maintaining secure, integrated, and wellmanaged interorganizational systems. Understanding these relationships would be highly beneficial in attempts to control variations in risks that may affect overall enterprise risk— particularly to the degree that such factors help assess risks associated with a potential trading partner prior to entering into a relationship. Design science based research examining the methods for implementing continuous assurance systems for automated monitoring would also be beneficial. One challenge for organizations wishing to implement measures of these risk factors through an automated monitoring process is to determine a feasible means by which to implement monitoring across internet linkages, embedded in trading partners’ systems, without increasing the trading partners’ risk of systems failure or reduced integrity. Instantiation of a working system could aid practical implementation by helping to establish feasible alternatives. 28 REFERENCES Adam, E.E., Jr., Hershauer, J. and Ruch, W. Productivity and Quality Measurement as a Basis for Improvement. University of Missouri College of Business Research Center, Columbia, Missouri, 1986. Angeles, R. and Ravinder, N. “An Empirical Study of EDI Trading Partner Selection Criteria in Customer-supplier Relationships,” Information & Management (37), 2000, pp. 241-255. Banham, R. 2003. Fear factor: Sarbanes-Oxley offers one more reason to tackle enterprise risk management. CFO Magazine (June 1). Delbecq, A.L., Van de Ven, A.H. and Gustafson, D.H. “Guidelines for Conducting NGT Meetings,” in Organizational Behavior and the Practice of Management (4th Ed.), D.R. Hampton, C. E. Summer, and R.A. Webber (eds.), Scott, Foresman, and Company, Glenview, IL, 1982, pp. 279-298. Greiger, M. “Electronic Marketplaces: A Literature Review and a Call for Supply Chain Management Research,” European Journal of Operational Research (144), 2003, pp. 280-294. Grover, V., Teng, J.T.C. and Fiedler, K.D. “Investigating the Role of Information Technology in Building Buyer-Supplier Relationships,” Journal of the Association for Information Systems (3), 2002, pp. 217-245. Hart P.J. and C.S. Saunders (1997) Power and trust: Critical factors in the adoption and use of electronic data interchange. Organization Science 8(1): 23-42 Havelka, D., Sutton, S.G. and Arnold, V. “A Methodology for Developing Measurement Criteria for Assurance Services: An Application in Information Systems Assurance,” Auditing, A Journal of Practice & Theory (17), 1998, pp. 73-92. Hempel, P.S. and Kwong, Y.K. “B2B e-Commerce in Emerging Economies: i-metal.com’s Nonferrous Metals Exchange in China,” Journal of Strategic Information Systems (10), 2001, pp. 335-355. Huber, G. and Delbecq, A.L. “Guidelines for Combining the Judgements of Individual Group Members in Decision Conferences,” Academy of Management Journal (15), 1972, pp. XXXXX. IFAC (2001) Electronic Commerce Using the Internet or Other Public Networks - Effect on the Audit of Financial Statements (Proposed International Auditing Standard—International Federation of Accountants) October. IFAC (2002a) e-Business and the Accountant, (International Federation of Accountants), March. 29 IFAC (2002b) International Audit Practice Statement 1013, (International Federation of Accountants). Iacovou, C.L., Benbasat, I. and Dexter, A.S. “Electronic Data Interchange and Small Organizations: Adoption and Impact of Technology,” MIS Quarterly (December), 1995, pp. 465-485. Katz, D.M. 2003. What you don’t know about Sarbanes-Oxley: Snares, pitfalls, and trapdoors. CFO.com (April 22). Khazanchi, D. and Sutton, S.G. “Assurance Services for Business-to-Business Electronic Commerce: A Framework and Implications,” Journal of the Association for Information Systems (1), 2001, pp. 1-53. Kumar, K. and van Dissel, H.G. “Sustainable Collaboration: Managing Conflict and Cooperation in Interorganizational Systems,” MIS Quarterly (September), 1996, pp. 279-300. Kurnia, S. and Johnston, R.B. “The Need for a Processual View of Inter-organizational Systems Adoption,” Journal of Strategic Information Systems (9), 2000, pp. 295-319. Lampe, J.C. and Sutton, S.G. Developing Quality Measurement Systems for Internal Auditing Departments, Institute of Internal Auditors Research Foundation, Altamonte Springs, Florida, 1994a. Lampe, J.C. and Sutton, S.G. “Evaluating the Work of Internal Audit: A Comparison of Standards and Empirical Evidence,” Accounting and Business Research (Autumn), 1994b, pp. 335-348. Lee, S.C., Pak, B.Y. and Lee, H.G. “Business Value of B2B Electronic Commerce: The Critical Role of Inter-firm Collaboration,” Electronic Commerce Research and Applications (1), 2003, www.ComputerScienceWeb.com. Massetti, B. and Zmud, R. “Measuring the Extent of EDI Usage in Complex Organizations: Strategies and Illustrative Examples,” MIS Quarterly (September), 1996, pp. 331-345. McIvor, R., Humphreys, P. and McCurry, L. “Electronic Commerce: Supporting Collaboration in the Supply Chain?” Journal of Materials Processing Technology (6736), 2003, pp. 1-6. Papazoglou, M.P., Ribbers, P. and Tsalgatidou, A. “Integrated Value Chains and Their Implications from a Business and Technology Standpoint,” Decision Support Systems (29), 2000, pp. 323-342. Papazoglou, M.P. and Tsalgatidou, A. “Editorial: Business to Business Electronic Commerce Issues and Solutions,” Decision Support Systems (29), 2000, pp. 301-304. Shin, K. and Leem, C.S. “A Reference System for Internet Based Inter-enterprise Electronic Commerce,” The Journal of Systems and Software (60), 2002, pp. 195-209. 30 Sutton, S. G. “Toward an Understanding of the Factors Affecting Audit Quality,” Decision Sciences (January-February), 1993, pp. 88-105. Sutton, S.G. and C. Hampton. 2003. Risk assessment in an extended enterprise environment: redefining the audit model. International Journal of Accounting Information Systems 4(1). Sutton, S.G. and Lampe, J.C. “A Framework for Evaluating Process Quality for Audit Engagements,” Accounting and Business Research (Summer), 1991, pp. 275-288. Tan, Y.H. and Thoen, W. “Formal Aspects of a Generic Model of Trust for Electronic Commerce,” Decision Support Systems (33), 2002, pp. 233-246. Teo, H.H., Wei, K.K. and Benbasat, I. “Predicting Intention to Adopt Interorganizational Linkages: An Institutional Perspective,” MIS Quarterly (27:1), 2003, pp. 19-49. Ünal, A. “Electronic Commerce and Multi-enterprise Supply/Value/Business Chains,” Information Sciences (127), 2000, pp. 63-68. Van de Ven, A.H. and Delbecq, A.F. “Nominal versus Interacting Group Processes for Committee Decision Making Effectiveness,” Academy of Management Journal (14:2), 1971, pp. 203-212. Van de Ven, A.H. and Delbecq A.F. “The Effectiveness of Nominal, Delphi, and Interacting Group Decision Making Processes,” Academy of Management Journal (17:4), 1974, pp. 605-621. Ware, L.C. 2002. Security and e-business will dominate 2003 IT spending. Computerworld (December 2). Westland, J.C. “Transaction Risk in Electronic Commerce,” Decision Support Systems (33), 2002, pp. 87-103. Yost, P. “E-Business Web Portals and Their Role in Supply Chain Management,” Presentation at Idea to Action: Numetrix’99, Atlanta, September 1999. 31 Figure 1: B2B Assurance Services (Khazanchi & Sutton 2001) B2B ASSURANCE SERVICES Application-User Level Business Level 32 Technical Level Table 1. B2B Assurance Services (Khazanchi and Sutton 2001) Category of Assurance Purpose of Assurance ApplicationUser Level The services at this level will focus on assuring that trading partners trust and use EDI for conducting B2B commerce. This may include assurance issues relating to establishing relationships with new trading partners, developing “good business practices” and related policies. Business Level The services at this level will focus on assuring that business processes, internal controls, and policies are amenable to EDI adoption and that the processes are altered to allow for seamless integration with the EDI application. This will include addressing legal, privacy of data, and administrative issues for conducting reliable, secure and safe electronic commerce with trading partners, transmission security and auditability of B2B (EDI) transactions. Technical Level The services at this level will focus on assuring that all technical elements of EDI are in place and that EDI is seamlessly integrated with internal applications. This will include issues relating to transaction integrity, choice of applications, expansion of trading partner base and transaction volume, system reliability, data security (risk assessment) and encryption, and transmission error. 33 TABLE 2 Results of Chi-Square Test of Independence for Key Factor Selection (H1, H3, H5) Internal Constituency (Corporate) Groups (H1) Organization 1 vs. Organization 2 Organization 1 vs. Organization 3 Organization 2 vs. Organization 3 External Constituency Groups (H3 and H5) Internal Constituency Groups vs. External Audit Group Internal Constituency Groups vs. E-commerce Consultant Group 34 Chi-Square 31.622 12.119 11.943 p-value <.001 .007 .008 48.083 <.001 44.567 <.001 TABLE 3 Results of Spearman Rank Correlation Tests for Internal Constituency Groups (H2) Technical Level (H2a) Organization 1 vs. Organization 2 Organization 1 vs. Organization 3 Organization 2 vs. Organization 3 Application-User Level (H2b) Organization 1 vs. Organization 2 Organization 1 vs. Organization 3 Organization 2 vs. Organization 3 Business Level (H2c) Organization 1 vs. Organization 2 Organization 1 vs. Organization 3 Organization 2 vs. Organization 3 35 Spearman’s rho .601 .716 .431 p-value <.001 <.001 .003 .293 .426 .443 .033 .003 .002 .588 .562 .681 <.001 <.001 <.001 TABLE 4 Results of Spearman Rank Correlation Tests for External Constituencies (H4, H6) Technical Level Internal Constituency Groups vs. E-commerce Consultants Group (H4a) Internal Constituency Groups vs. External IT Auditors Group (H6a) Application-User Level Internal Constituency Groups vs. E-commerce Consultants Group (H4b) Internal Constituency Groups vs. External IT Auditors Group (H6b) Business Level Internal Constituency Groups vs. E-commerce Consultants Group (H4c) Internal Constituency Groups vs. External IT Auditors Group (H6c) 36 Spearman’s rho .333 p-value .018 .324 .021 .717 <.001 .250 .060 .169 .177 .259 .076 TABLE 5 Critical Technical Level B2B E-Commerce Risk Factors Critical Risk Factor Change management processes in place to assure maintenance of security and integrity of systems as technology evolves rapidly. Trading partner’s security over all networks and network interactions ensure transmission integrity and provide guaranteed delivery transaction to the correct trading partner. Technology sophistication/expertise differential between trading partners and related selection of appropriate standards and hardware/software by the right people in this trading partner’s organization. Trading partner’s maintenance of data accuracy during systems conversion and application usage. Completeness and accuracy of trading partner’s data processing activities. Metrics related to capacity, resiliency, and monitoring in order to better predict/control performance by trading partner. Security of communication technology (infrastructure) --including vulnerability of ISP and/or public internet, vulnerability to malicious code (e.g. viruses), security vendors expected survival and the trading partner’s general security model. Trading partner’s vulnerability to loss of availability of data, systems, applications, etc., whether loss is accidental, intentional, or by poor design. Trading partner’s setting of appropriate user profiles to assure information is appropriately compartmentalized by information types and classified by access levels. Controls to enforce compliance with regulatory requirements and to enforce regulations Comprehensive access management to applications/operating systems protected via controls (e.g. firewalls) in place to assure confidentiality, availability, and integrity (e.g. unauthorized access). Channel security through appropriate controls (e.g. encryption implemented according to regulations) including validation and authentication of transaction partner. Ease of transition of information to new B2B systems, ease of integration with trading partner's systems, consistency in methods of partner, and ability to efficiently route B2B transactions to the right internal applications. Flexibility and scalability of the trading partner’s system (hardware/software independence). Redundancy and failover of trading partner’s systems (in relation to downtime tolerance). Adequacy of trading partner’s disaster recovery plan. Adequate staff expertise available on an as-needed basis. Comprehensive systems documentation of trading partner’s systems. 37 Transportation & Logistics Company Insurance Company Food Manufacturer Company E-Commerce Consultancy Firm ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● External IT Audit Firm ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● TABLE 6 Critical Application-User Level B2B E-Commerce Risk Factors Critical Risk Factor Appropriate level of training for trading partner’s users and related cost constraints. Will the target trading partner (TP) use a proposed B2B system (considering such issues of whether there is a champion for the project, sufficient IT sophistication to integrate within TP's systems environment, and ease of use of application)? When upgrading systems based on new technologies or business partner request, the trading partner has sufficient coordination and change control procedures in place to maintain reliability and protect transaction validation procedures. Trading partner’s understanding of and agreement on data structure/scope/business rules for exchange of information. Is there benefit of B2B ventures to the trading partner and is the e-commerce marketplace sustainable? Clear and sufficient contract documentation on policies, procedures, connectivity guidelines, limitations, review plan, etc. (Service Level Agreements). Application controls in place for completeness, accuracy, and processing integrity (i.e. trading partner’s applications function as intended). Trading partner’s implementation of new B2B applications include testing for assurances on hardware/software capability to support applications, availability of supporting applications 24/7, and performance and capacity of data exchange. Third party assurance of transaction validity. Marketing cost to sell the trading partner on a given B2B application Privacy of data agreements. Alignment of trading partner’s business processes with implemented B2B e-commerce technologies. Adequacy of the security over access to trading partner’s business application systems. Inaccurate, inadequate or outdated documentation on systems software/hardware provided by trading partner. Trading partner’s inability to have an enterprise view of the full range of trading partner relationships. Trust in trading partner (internal or external). 38 Transportation & Logistics Company Insurance Company Food Manufacturer Company E-Commerce Consultancy Firm External IT Audit Firm ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● TABLE 7 Critical Business Level B2B E-Commerce Risk Factors Critical Risk Factor Understanding by trading partner (TP) of their business processes, where e-commerce fits into those processes, value of business process integration with TPs, and where benefits are derived. Trading partner’s ability to assess the use/success of technology and the benefits of B2B implementation/technology investment (including return on investment). Trading partner’s costs of meeting regulatory requirements and their organization's understanding of associated risks of non-compliance (including inter- and Intra- state compliance issues). Trading partner’s technical understanding at a level that facilitates creation of a transformational vision for change and the ability to implement successful change management strategies to achieve objectives, gain acceptance, and support sustainability of the change. Trading partner’s understanding of the intended functionality of a system at the analysis/requirements stage and tying of the system to business processes that are evolved or engineered accordingly to meet the business objective. Trading partner’s level of adherence to contractual requirements including such things as product volume, sales prices, time/service commitments, and settlement (including legal agreements such as non-repudiation and the level of legal binding). Trading partner’s due diligence in implementing B2B relationships at the business, technology and security levels to assure users understand data classification/ownership/security when handling partner data and the partner maintains appropriate segregation of data to appropriate users. Trading partner’s understanding of risks associated with their projects and accordingly executing effective project management. Trading partner’s understanding of the technical complexities and associated costs of B2B development, implementation, and maintenance; and the legal ramifications, costs of implementing vs. not implementing non-repudiation agreements, costs of new business rules, and loss of personal marketing contacts. Trading partner’s team expertise for guiding all aspects of B2B e-commerce projects along with training for project teams and users. Trading partner’s broad management involvement in IT/business planning while maintaining independence in the selection of technology preferences. Trading partner’s integration of applications into organizational procedures and guidelines – including comprehensive documentation. Auditability of trading partner’s system based on effective monitoring controls and audit trail (history of electronic data, updates, changes). 39 Transportation & Logistics Company Insurance Company Food Manufacturer Company ● ● ● ● ● ● ● ● ● ● E-Commerce Consultancy Firm External IT Audit Firm ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● Trading partner’s ability to protect a distinguished Brand in an e-commerce environment. Trading partner’s resilience to a business interruption. 40 ● ●