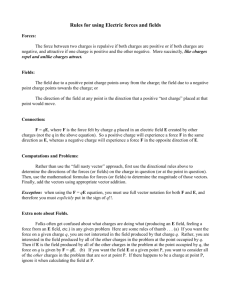

rate of interest

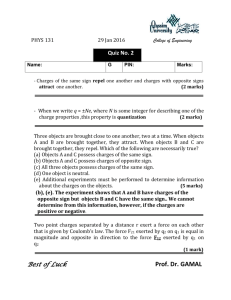

advertisement

SERVICE CHARGES AND INTEREST RATES AT A GLANCE RBI FORMAT 1. DEPOSIT ACCOUNTS NATURE RATE OF INTEREST Normal Sr. Citizen ACCOUNT 1 Savings Bank A/cs A .Domestic a. With Cheque book facility b. Without Cheque book facility c. No frills accounts B. Non Resident a. NRO b. NRE I. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. 4.00% p.a. Rural MINIMUM BALANCE Semi Urban urban Rs.500/ Rs.100/ Rs.50/- Rs.500/ Rs.100/ Rs.50/- Rs.500/Rs.100/Rs.100/- RevisedRates for Domestic Rupee Term Deposits w.e.f. 26.02.2014 (% p.a.) For Deposits of Less than Rs.1 Cr. For deposits of Rs.1 Cr & above but less than Rs.10 Cr Rate w.e.f. 24.02.14 Rate w.e.f. 26.02.14 (No Change) Rate w.e.f. 24.02.14 Rate w.e.f. 26.02.14 (No Change) 07 days to 14 days * 4.00 4.00 4.25 4.25 4.50 15 days to 30 days 4.50 4.50 4.75 4.75 31 days to 45 days 6.50 6.50 6.50 46 days to 90 days 6.75 6.75 91 days to 179 days 7.50 180 days to 269 days Maturity For deposits of Rs.10 Cr & above but less than Rs. 100 Cr Existing Revised w.e.f. Rate 24.02.14 w.e.f. 26.02.14 For deposits of Rs.100 Cr & above Existing Rate w.e.f. 24.02.14 Revised Rate w.e.f. 26.02.14 4.50 4.50 4.50 5.00 5.00 5.00 5.00 6.50 6.50 6.50 6.50 6.50 6.75 6.75 6.75 6.75 6.75 6.75 7.50 9.00 9.00 9.15 9.70 9.80 9.80 8.00 8.00 9.00 9.00 9.25 9.25 9.25 9.25 270 days to 364 days 8.00 8.00 9.00 9.00 9.25 9.25 9.25 9.25 1 Year Above 1Year to 15 Months Above 15 Months to less than 2 Years 2 Years to less than 3 Years 3 Years to less than 5 years 5 years to less than 8 years 8 years and above up to 10 Years 9.05 9.05 9.25 9.25 9.70 9.70 9.83 9.90 9.05 9.05 8.75 8.75 9.70 9.70 9.83 9.90 9.05 9.05 8.75 8.75 8.75 8.75 8.75 8.75 9.05 9.05 8.25 8.25 8.25 8.25 8.25 8.25 9.05 9.05 7.25 7.25 7.25 7.25 7.25 7.25 9.05 9.05 7.00 7.00 7.00 7.00 7.00 7.00 8.75 8.75 7.00 7.00 7.00 7.00 7.00 7.00 *Minimum Deposit Rs.1 Lac II. Interest rates on NRE Term Deposit Accounts – w.e.f. 25.11.2013. (PERCENTAGE PER ANNUM) Amount less than Rs.1 Cr Revised w.e.f 25.11.13 Period 1 Year Above 1Yr<2Yrs 2Yrs < 3 Yrs 3Yrs < 5 Yrs 5Yrs < 7Yrs 9.05 9.05 9.05 9.05 9.05 Rs.1Cr & above Rs.10 Cr and Rs.100 Cr and but less than above but less above Rs.10 Cr than Rs.100 Cr Existing Revised Existing Revised Existing Revised w.e.f w.e.f w.e.f w.e.f w.e.f w.e.f 21.10.13 25.11.13 21.10.13 25.11.13 21.10.13 25.11.13 9.00 8.50 8.25 8.50 8.50 9.10 8.75 8.25 8.50 8.50 9.00 8.50 8.25 8.50 8.50 9.00 8.50 8.25 8.50 8.50 9.00 8.50 8.25 8.50 8.50 9.00 8.50 8.25 8.50 8.50 Note: Branches should note to take permission from Treasury Branch for accepting deposits of more than Rs.100 crore in any bucket. As per extant Reserve Bank of India guidelines the interest rates on FCNR (B), RFC Deposits have been revised w.e.f. 01.02.2014based on the LIBOR / SWAP rates, prevailing on the last working day of January, 2014 (as advised by FEDAI): III. Rate of Interest on FCNR (B) Term Deposits :-w.e.f. 01.02.2014: MATURITY A 1 YR TO < 2 YRS B 2 YRS TO < 3 YRS C 3 YRS TO < 4 YRS D 4 YRS TO < 5 YRS E 5 YRS (Max.) USD 2.57 2.47 3.83 4.24 4.62 GBP 2.89 3.34 4.67 4.96 5.19 EURO 2.52 2.46 3.59 3.81 4.03 JPY 2.36 2.22 3.24 3.28 3.34 CAN$ 3.44 3.28 4.47 4.71 4.94 AUS$ 4.63 4.81 6.07 6.38 6.61 Note: (1) The rates are applicable to fresh and renewed deposits from the respective effective date. (2) The rates of interest are subject to change at any time as per RBI/ Bank’s policy. RETAIL LOANS – INTEREST RATES W.E.F. 20.01.2014 (All loans at floating ROI, p.a. at monthly rests except otherwise mentioned) RATE OF INTEREST PROCESSING CHARGES 1. Housing Loan Up to > Rs.30 lacs >Rs.75 For Individuals – Rs.30 below Rs.75 lacs lacs lacs For all loans amounts:Floating Category 0.25 % of loan amount Up to 5 years 10.20 10.30 10.45 Min. Rs. 1,000/- Max. Rs. 20,000/(All rates incl. ST.) More than 5 yrs. 10.20 10.30 10.45 and up to 10 yrs. For Partnership firms and Corporates: More than 10 10.20 10.30 10.45 Processing charges to be double that of yrs&upto 15 years applicable to individuals. Above 15 years 10.20 10.30 10.45 Fixed Rate of Interest 2. 3. For Rural areas:Processing charges 75% of that applicable to individuals in respect of loan availed by borrowers from rural branches. Not Offered Star Personal Loan Scheme I. Fully Secured 14.20 II. Clean/Unsecured 15.20 III. Financing secured under tie up 14.20 arrangements IV. For Senior Citizen aged 60 years & above for Loans Upto Rs.50,000/13.20 Int. concession to women beneficiary in respect of (i) & (ii) above 0.50%p.a. Star Pensioner Loan Scheme For Clean / Secured 2.00 % over Base Rate Advance Presently 12.20 % (In case of availability of liquid collateral security over 25 % of loan amountInterest concession to be extended @1bps for 1% security Max. 100 bps.) 4. Vehicle Loan RATE OF INTEREST Repayment a For New vehicles Upto 7 years (Four Wheelers) (Irrespective of Tenure) b For Old vehicles (Four Wheelers) C Two Wheelers 10.65 % Maximum Repayment period 3 years 11.45 % Maximum repayment period 5 years 14.20 % One time 2.00% of loan amount Min. Rs.1,000/Max. Rs.10,000/- Senior Citizen (60 years & above) No Processing Charges Pensioners: One time 2.00% of loan amount Min. Rs. 500/- Max.Rs.2,000/No Processing Charges for senior citizens (60 years & above) PROCESSING CHARGES Loans up to Rs. 25,000/Loans > Rs. 25000 up to Rs. 25 lacs One time Rs. 1000/One time 1 % of loan amount Min. Rs. 2000/Max.Rs.10,000/Loans > Rs. 25 lacs One time Rs. 15,000/In case of Partnership firms and Corporate borrowers, processing charges will be double that applicable to individuals. No processing charges for Senior Citizen, Retired Employees of the Bank and Pensioners drawing Pension from the Bank. For Rural areas: Processing charges will be 75% of that applicable to individual borrowers provided loan is availed by borrowers from rural areas/ from rural branches. 5. i. Education Loans:up to Rs.7.50 lacs Above Rs.7.50 lacs 13.20 % 12.70 % No processing charges. However, if there is change of institution either in domestic studies or in foreign studies due to any reason, a processing fee of Rs.250/- (Domestic studies) & Rs.500/- (Studies Abroad) is leviable. In respect of loans for foreign study, letter of sanction may be issued for obtaining VISA, upon recovery of processing Concessions*: a. for Girl Students: 0.50 % for loans charges of Rs.1,000/-. However, this can be refunded if the actual up to Rs. 50,000/- and 1.00 % for loan is availed. loans above Rs. 50,000/b. All students pursuing professional One time charges for any Deviations from the Scheme norms courses ( Like Engineering /Medical including approval of courses outside scheme – /Management etc.) are eligible for Up to Rs.4.00 lacs Rs. 500/0.50 % interest concession. Over Rs.4.00 lacs up to Rs.7.50 lacs Rs.1,500/*Maximum concession under (a) & Over Rs.7.50 lacs up to Rs.20.00 lacs Rs.3,000/(b) is 1 % p.a. ii.Star Vidya Loan: For studies in India 10.70 % NIL Max. Rs. 20.00 lacs 0.50 % interest concession for Girl students subject to base Rate iii. Star loan for 13.20 % NIL Vocational Studies for Girl Students: 0.50 % for loans up to Rs. 50,000/- and 1.00 % for loans above Rs. 50,000/6. Star Loan against Property – A. Individuals: Salaried/ Self Employed/Professional 11.70 Loan Up to Rs. 50 lacs B. Others- Traders & Businessmen 1 .Loan up to Rs 100 lacs 11.70 2. Overdraft up to Rs. 200 lacs Monthly Reducible 11.70 3. Non Reducible limit 12.20 One time @1 % of loan amount Min Rs. 5,000/Max Rs. 50,000/- One time @1 % of loan amount Min Rs. 5,000/Max Rs. 50,000/a) 0.50 % of sanctioned Limit Min Rs.5, 000/- and Max Rs. 30,000/- for 1st year at the time of original sanction. b) 0.25 % of the Reviewed limit min Rs. 2,500/- and Max Rs. 15000/- for subsequent years 0.50 % of the sanctioned /Reviewed limit min Rs. 5,000/and max. Rs. 30,000/- on annual basis For Rural areas: Processing charges will be 75% of those normal applicable charges in respect of loans availed by borrowers from rural areas from rural branches. 6. Access to own credit report – charges per report max. Rs.50/7. CERSAI registration Fees: As per Annexure I. Annexure I Table showing fees prescribed by CERSAI: Sr.No. 1. 2. 3. 4. 5. 6. Nature of transaction to be Registered Particulars of creation or modification of Security Interest in favour of secured creditors Satisfaction of any existing Security Interest Particulars of Securitisation or reconstruction of financial assets Particulars of satisfaction of Securitisation or reconstruction transactions Any application for information recorded/maintained in the register by any person. Any application for condonation of delay up to 30 days Amount of fee payable (without Service tax) Rs.500 for creation and for any subsequent modification of Security interest in favour of a secured creditor for a loan above Rs.5 Lakh. For a loan below Rs.5 Lakh, the fee would be Rs.250 for both creation and modification of security interest. Rs.250/- Amount of fees payable inclusive of service tax Rs.565/- for creation and for any subsequent modification of Security interest in favour of a secured creditor for a loan above Rs.5 Lakh. For a loan below Rs.5 Lakh, the fee would be Rs.285/- for both creation and modification of security interest. Rs.1000/- Rs.1125/- Rs.250/- Rs.285/- Rs.50/- Rs.60/- Rs.2500/- in case of creation of security interest for a loan up to Rs.5 Lakh and Rs.5000/in all other cases. Rs.2810/- in case of creation of security interest for a loan up to Rs.5 Lakh and Rs.5620/- in all other cases Rs.285/- 1. FEE BASED SERVICE CHARGES w.e.f. 01.10.2012 a. LOCKERS :- Type of Locker REVISED SERVICE CHARGES RENTALS OF SAFE DEPOSIT VAULT LOCKERS FOR PUBLIC Metropolitan Centre Urban Centre Semi-Urban & Rural Centres Revised Concession for Revised Concession Revised Concession 1 year Advance for 1 year for 1 year Payment Advance Advance Payment Payment (Amt. in Rs.) (Amt. in Rs.) (Amt. in (Amt. in Rs.) (Amt. in (Amt. in Rs.) Rs.) Rs.) A 1000 20 800 20 700 20 B 1200 20 1000 20 850 20 C 1500 20 1200 20 1050 20 D 1350 20 1100 20 950 20 E 1800 20 1450 20 1250 20 F 2800 20 2250 20 1950 20 G 3000 20 2400 20 2100 20 H 3500 30 2800 30 2450 20 H1 1800 20 1450 20 1250 20 L 5000 60 4150 30 3500 30 L1 4500 30 3600 30 3150 30 b. CREDIT CARDS:Membership Fee *and entrance fee * Chart Type Entrance Annual fee Membership fee* Princi Add-on pal India Card@ Credit Nil NIL NIL Taj Premium Card Credit Nil 800 400 BOI Navy Silver Credit Nil 350 175 BOI Navy Gold Credit Nil NIL NIL Gold (Visa) Credit Nil 600 350 Gold International (Visa) Credit Nil 1500 800 * Service tax extra Card Description of Charges * Finance charges / Interest ( Purchase/Cash) Finance Charges if overdue Cash Advances at our Branches Cash advanced at our ATMs Cash advance at other Bank ATM’s in India Balance enquiry at Overseas ATM Cash advance at Overseas ATM’s Merchant transactions at Overseas Late payment charges (per month) Over the Credit Limit usage Charge Cheque Return Charges Petrol Transaction Charges Railway Ticket Purchase or Cancellation Fee Reissue of Lost, Stolen or Damaged Card Amount 1.70% per month (APR 22.45% p.a. on daily balances) 2.5% per month (APR 30% p.a. on daily balances) 2.5% on advance amount (subject to a minimum of Rs 50) for each transaction. Interest on dues/overdue as described above 2% (minimum Rs. 50) for each transaction. Interest on dues/overdue as described above 2.5% (Minimum Rs. 75) for each transaction. Interest on dues/overdue as described above Rs.25/2.5% (minimum Rs. 125) for each transaction + 2% currency conversion charges. Interest on dues/overdue as described above 2% currency conversion charges in addition to interest charges if any. Rs. 100/= in addition to finance charges for minimum payment due > Rs. 1000 Rs. 10/= for each transaction Rs. 100/= per instrument 2.5%of transaction amount (Min Rs.10/) or Actual charges claimed by the acquirer bank Actual charges claimed by Railways / acquirer bank Rs100 for customers and Rs.50 for staff in respect of India card Rs.200 for public and Rs.100 for staff in respect of Visa Gold International card and Visa Gold card All other cards replacement fees is Rs.200 PIN replacement charges Copy of charge slip Duplicate copies of bills Hot Listing charges Service Tax Rs. 50/=per occasion Rs. 100/= or actual charges whichever higher Rs. 50/= per quarter NIL As applicable on all fees, interest and other charges c. DEBIT CARDS: The annual maintenance charges for debit card holders w.e f 1.4.2010 is as given below: ATM cum Debit card charges Charges for 1st year of usage FREE Charges for usage for subsequent year(s) and will be charged annually from the date of issue of card. Branches in Metro & Urban areas Rs 100/Branches in Rural and semi Urban Rs 50/Staff and Ex Staff NIL/Savings Bank Account holder maintaining Rs 10000/- quarterly average NIL/balance in Rural and Semi Urban Saving Bank Account holder maintaining Rs 25000/- quarterly average NIL/balance in Urban and Metro areas Senior Citizens and Pensioners NIL/- THE REVISED CHARGES PAYABLE BY CUSTOMERS (FOR USING OTHER BANK’S NETWORK) UNDER THE VARIOUS NETWORKS W.E.F 1.7.2011 ARE AS FOLLOWS: NETWORK CASH WITHDRAWAL BANCS STATE BANK OF INDIA NATIONAL FINANCIAL SWITCH * VISA-NATIONAL VISA-INTERNATIONAL MasterCard-National MasterCard-International RS. 20/RS. 20/RS. 20/RS. 20/RS. 125/Rs. 20/Rs. 125/- REVISED BALANCE INQUIRY Rs.10/Rs.10/Rs.10/Rs.10/Rs.15/Rs.10/Rs. 25/- d. DD/TT/MT : w. e. f. 05.08.2013 Issue of Demand Drafts :- UPTO Rs.10000/Non-Individuals : Rs.50/Individuals (Non-Rural) : Rs.40/Individuals (Rural) : Rs.30/ABOVE Rs.10000/- UPTO Rs.50000/Non-Individuals : Rs.200/Individuals (Non-Rural) : Rs.175/Individuals (Rural) : Rs.150/ABOVE Rs.50000/- UPTO Rs.1 LAC Rs.4.00 per Rs.1000/- Min.Rs.225/ABOVE Rs.1 LAC Rs.3.50 per Rs.1000/- Min.Rs.400/- Max.Rs.30000/NOTE - FOR STUDENTS : Issue of DDs upto Rs.1000/- : FREE UPTO Rs.10000/Non-Individuals : Rs.75/Individuals (Non-Rural) : Rs.60/Individuals (Rural) : Rs.45/ABOVE Rs.10000/- UPTO Rs.50000/Non-Individuals : Rs.300/Individuals (Non-Rural) : Rs.265/Individuals (Rural) : Rs.225/NOTE - FOR STUDENTS : Issue of DDs upto Rs.1000/- : FREE Upto Rs.100/- : Rs.20/Rs.100/- to Rs.500/- : Rs.40/Above Rs.500/- : Rs.100/Rs.100/- Issue of DD against Cash Revalidation/Cancellation of Drafts Issuance of Duplicate Demand Draft e. Outstation Cheque Collection A. Service (Processing) Charges for Local Clearing (by Clearing Houses from Member Banks) Clearing at MICRCPCs Cheque Truncation Existing (Rs.) Presenting Drawee Bank Bank 1.00 1.00 0.50 0.50 Revised (Rs.) Presenting Bank Drawee Bank 1.00 1.50 0.50 1.00 B. Service Charges outstation cheque collection Collection of Cheques a.Rs.500/- to Rs.5000/- : Rs.25/- per instr. b.Above Rs.5000/- &upto & incl.Rs.10000/- : Rs.50/- per instr. c.Above Rs.10000/- & upto & incldg. Rs.1 Lac : Rs.100/- per instr. d.Above Rs.1 Lac : Rs.150/- per instr. (REVISED W.E.F. 17.06.2011) Note : The above changes will be ALL inclusive. No additional charges such as courier charges, out of pocket expenses, etc.(other than service tax) shall be levied from the customers. Note : For collection between our bank and other banks, the commission will be shared on 50:50 basis, i.e., each branch will charge 50% of the stipulated commission / service charges at its end. Note : For Diamond Plus Current Account Customers, 50% Concession on Charges C. Collection charges under Speed Clearing (Charges applicable to speed clearing cheques deposited by customers of the branch for clearing and presented by the branches in their outward clearing as stipulated by RBI (speed clearing as introduced by RBI) EXISTING REVISED Non-Individuals Individuals Value Service Charges for all customers Non- Rural Rural Upto Rs.1 Lac – Same Same Upto and including Rs. NIL Rs.NIL Rs.1 Lac Above Rs.1 Lac – Same Same Above Rs.1 Lac Rs.100/- per Instr. Rs.150/- per instrument D. Cheque Return Charges : w.e.f. 05/08/2013 Cheques Return Charges – Cheques drawn on us Local Cheques : Upto Rs.10000/- : Rs.25/- per instrument Rs.10000/- to Rs.1 Lac : Rs.100/- per instrument Rs.1,00,001/- & above : Rs.150/- per instrument Cheques/ Bills deposited – returned unpaid Local & Outstation: Upto Rs.10000/- : Rs.25/- per instrument Rs.10000/- to Rs.1 Lac : Rs.100/- per instrument Rs.1,00,001/- & above : Rs.150/- per instrument E. Cheque Book Issue : Issue of MICR Cheque – SB Rs.3/- per cheque leaf and 50 leaves free in a year Issue of MICR Cheque– CD/CC/OD Rs.3/- per cheque leaf; F. No Due Certificate : NIL NOTE :1. Concessions/ facilities offered under various deposit schemes to continue until further notice, also concessions available for Staff and Ex-staff will continue. 2. Authority to offer concession in service charges to be exercised as per Branch Circular No. 98/26 of 21.05.2004 and 98/119 dtd.15.09.2004 3. Cash Deposit at other CBS branches will attract the same charges as given under ‘Cash Handling Charges” 4. New locker rentals would be applicable from the date of renewal. If the locker rent falls in arrears and is paid after the implementation of revised rates, the new/ revised rates will be applicable. 5. If any bills are sent by our upcountry branches for collection, charges to be shared by the branches in the ratio of 50:50. Postage will be actual. 6. Please refer to Br.cir.no.101/218 dtd.29.03.2008 SB Inoperative accounts. 7. Minimum Balance charges --- Item no.48 – - At present minimum balance charges are applied monthly. If the customer is unable to maintain the prescribed minimum balance for two months, the caution notice Should be issued and account should be closed after lapse of notice period. f. RTGS / NEFT / ECS Sl No 52 :- Item REMITTANCES RTGS - OUTWARD Below Rs.2 Lacs Rs.2 Lacs to Rs.5 Lacs Above Rs.5 Lacs RTGS -INWARD Existing & Proposed - Fixed By RBI NA Rs.25/-+applicable time varying tariff subject to a maximum of Rs.30/Rs.50/-+applicable time varying tariff subject to a maximum of Rs.55/(refer Cir.Ltr.no.2011-12/110 dtd.05.10.2011) NIL NEFT Upto Rs.1 Lac Above Rs.1 Lac to Rs.2 Lac Above Rs. 2 Lacs - NIL- (as per Circular Letter No.2012-13/75 dtd.02/07/2012) Rs.15/- Plus Service Tax per transaction Rs.25/- Plus Service Tax per transaction INWARD NIL ECS INWARD : NIL FOR ALL CENTRES Non-individuals : Credit Clearing (per entry/item) NCC Clearing House : No Charge Destination Bank : No Charge Sponsor Bank : Rs.5.50 (Min. Rs.2500/-) Debit Clearing (per entry/item) NCC Clearing House : No Charge Destination Bank : No Charge Sponsor Bank : Rs.4.00 (Min. Rs.2500/-) NIL ECS Returned Rs.100/- per instrument No charge No Charge Rs.5.50 (Min. Rs.2500/-) No Charge No Charge Rs.4.00 (Min. Rs.2500/-)