Published - Office of Administrative Hearings

advertisement

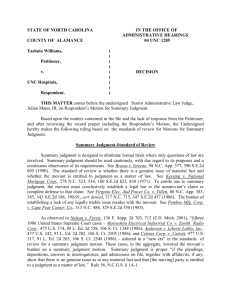

STATE OF NORTH CAROLINA IN THE OFFICE OF ADMINISTRATIVE HEARINGS 04 DHR 1800 COUNTY OF CAMDEN IVOLA BANKS, Executrix of the Estate of LAURA B. MERCER, Petitioner; vs. NORTH CAROLINA DEPARTMENT OF HEALTH AND HUMAN SERVICES, DIVISION OF MEDICAL ASSISTANCE, Respondent. ) ) ) ) ) ) ) ) ) ) ) DECISION A Petition for a contested case hearing was filed in the North Carolina Office of Administrative Hearings on October 27, 2004. The Petitioner contested the agency’s denial of her undue hardship claim as it relates to the estate of a deceased Medicaid recipient upon which Respondent had asserted its claim as a creditor of the estate for medical services provided to the decedent. A Notice of Contested Case and Assignment, Order for Prehearing Statements and Scheduling Order were filed on October 29, 2004. On November 15, 2004, Respondent filed a Motion for Enlargement of Time within which to file its Prehearing Statement. Such Order Extending Time was filed on November 17, 2004. Both parties filed Prehearing Statements. Respondent’s Prehearing Statement included a Motion to Dismiss based on insufficiency of process and service, and lack of personal jurisdiction. Such Motion was denied by Order filed on January 21, 2005. On January 27, 2005, Respondent filed its Motion for Summary Judgment alleging that there were no genuine issues as to material fact and that Respondent was entitled to judgment as a matter of law in that based on the facts specific to this matter Petitioner could not establish an undue hardship claim. Petitioner did not file a response to such Motion. Petitioner is represented by Katherine F. McKenzie, Attorney at Law of The Twiford Law Firm. Respondent is represented by Brenda Eaddy, Assistant Attorney General. Based upon a review of the documents of record and Respondent’s Motion with accompanying affidavit, the undersigned finds that Summary Judgment in favor of Respondent should be ALLOWED. The following constitute: UNDISPUTED FACTS 1. This is an appeal of an agency decision which denied the Petitioner’s request for a hardship waiver of an estate recovery claim asserted by Respondent (Medicaid) against the estate of a deceased Medicaid recipient. Petitioner is the executrix of the estate of the deceased Medicaid recipient. The person on whose behalf the hardship waiver is being requested is the daughter of the Medicaid recipient, and is the heir to this estate. 2. The decedent in this matter is Laura B. Mercer. Ms. Mercer died on January 16, 2004, at age 74. On March 22, 2004, Respondent informed Petitioner it was asserting a claim against the estate of Ms. Mercer to recover amounts paid on her behalf by Respondent for medical assistance made available to Ms. Mercer. The amount of Respondent’s claim against the estate of Laura Mercer is $26,778.24. 3. Petitioner responded to such and informed Respondent she intended to assert a hardship claim on behalf of Dorothy Mercer, the daughter of Laura Mercer. Pursuant to 10A N.C.A.C. 21D.0503, Petitioner submitted documents to Respondent in her ongoing communication with Respondent regarding this undue hardship claim. 4. According to the Affidavit of Anita Ray, Petitioner submitted the following documents to Respondent to substantiate her hardship claim: a. A State of New Jersey income tax return indicating Dorothy Mercer was a resident of the State of New Jersey from 1/1/03 through 5/31/03. b. a Wachovia Bank Statement for Dorothy Mercer indicating that the closing balance in this savings account was $18,376.02 as of January 30, 2004. c. Internal Revenue Service tax forms indicating a taxable income of $40,589.00 for tax year 2002; and a taxable income of $7,886.00 for tax year 2003. 5. The criteria used by Respondent as it relates to estate recovery is mandated by Federal and State authority. State authority indicates that in order to establish an undue hardship claim the survivor must show that the survivor has lived in the residence for at least 12 months prior to the death of the decedent, that the survivor’s assets are less than $12,000.00 and that the survivor’s net income is less than 75% of the federal poverty level. 6. The federal poverty level guidelines used by Respondent in applying the hardship criteria income levels are those promulgated by the United States Department of Health and Human Services. The federal poverty guidelines for 2003 was $8,980.00 - 75% of which is $6,735.00. The federal poverty threshold for 2003 was $9,573.00 - 75% of which is $7,179.75. Based on the foregoing undisputed facts, the undersigned makes the following: CONCLUSIONS OF LAW 1. The evidence provided by Petitioner to Respondent regarding this request for a waiver of estate recovery due to undue hardship show that Petitioner had lived in the home of the survivor for less than 12 months prior to the death of the Medicaid recipient; that she had over $12,000.00 in assets in her Wachovia Bank account at or near the death of the Medicaid recipient; and that her taxable income for the year immediately prior to the death of the decedent was higher than 75% of the federal poverty level. 10A N.C.A.C. 21D.0502. 2 2. The evidence Petitioner submitted to Respondent regarding her undue hardship claim is insufficient to substantiate such claim under the law. DECISION The Court, having considered the evidence of record, finds that there is no genuine issue as to any material fact and that Respondent is entitled to judgment as a matter of law. NOW THEREFORE, Respondent’s Motion for Summary Judgment hereby is GRANTED. ORDER It is hereby ordered that the agency serve a copy of the final decision to the Office of Administrative Hearings, 6714 Mail Service Center, Raleigh, NC 27699-6714, in accordance with N.C. Gen. Stat. §150B-36(b). NOTICE The decision of the Administrative Law Judge in this contested case will be reviewed by the agency making the final decision according to the standards found in N.C. Gen. Stat. §150B-36(b), (b1) and (b2). The agency making the final decision is required to give each party an opportunity to file exceptions to the decision of the Administrative Law Judge and to present written argument to those in the agency who will make the final decision. N.C. Gen. Stat. §150B-36(a). The agency that will make the final decision in this contested case is the Department of Health and Human Services. The agency is required by N.C. Gen. Stat. §150B-36(b3) to serve a copy of the final decision upon each party personally or by certified mail and to furnish a copy to each attorney of record and the Office of Administrative Hearings. This the 1st day of March, 2005. ___________________________________ BEECHER R. GRAY Administrative Law Judge 3