Positioning – The Heart of Strategy

advertisement

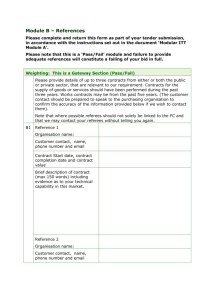

shoul4 M Eng Strategic & Change Management Session 3 - Approaches to the Search for Sustainable Competitive Advantage Why is Durham considered a successful university? Why does it attract students? Lots of factors might be identified, from the collegiate system to the sports facilities, but factors like reputation and the quality of its teaching and research are also likely to feature. In summary, the University’s success depends upon the resources to which it has access, the competences it possesses in undertaking particular functions and, above all, its ability to put these all together – its strategic capability. Business strategy is an on-going process. It is a process that involves constant revision in the face of changing circumstances. Thus, to understand the capability of the organisation to meet these challenges, we need to identify the resources at its disposal and its competence in using these resources. The Resources of the Organisation Using the classification of resources outlined in Johnson and Scholes, the main resources of an organisation like the University of Durham might be identified as: Physical - the departmental buildings and equipment in which teaching takes place; college facilities for accommodation of students; the books and information contained in the libraries. Human - the teaching and research staff; support staff like laboratory technicians and administrators; and the most visible output of the University, its students. Financial - government grants; student fees; research income. Intangible - publications and patents; the reputation of the University. Many of these resources will also be available to other universities, that is to say they are necessary resources for any academic institution. However, the unique resources on which Durham is likely to build a successful strategy might rest largely with the quality of its teaching/research staff and, particularly, its reputation. Intangible resources, like reputation, are frequently the most important assets that an organisation can possess because their very nature is difficult to copy by a competitor. One framework for the identification of intangible resources that links them to particular capabilities has been outlined by Professor Richard Hall, who works at Durham (R Hall, “A Framework for Identifying the Intangible Sources of Sustainable Competitive Advantage”, in Competence-Based Competition, G Hamel & A Heene (eds.), 1994, John Wiley & Sons). The diagram below summarises this framework. Intangible Assets and Resources Intangible Assets which are legally protected Intangible Assets which are not legally protected Trade Marks Patents Copyright Registered Designs Contracts and licences Trade Secrets Information in the public domain Reputation Organisational and personal networks These are the result of Regulatory Capabilities These are the result of Positional Capabilities Intangible Resources Functional skills Intangible Resources Cultural capabilities Employee know-how Supplier know-how Distributor know-how Servicer’s know-how e.g. advertising agencies These can be looked upon as Functional Capabilities Perception of quality standards Perception of customer service Ability to manage change Ability to innovate Team-working ability These can be looked upon as Cultural Capabilities Understanding Competences - The Value Chain Whilst the resources available to an organisation are important, the ways in which these resources are utilised by the organisation is also critical to strategic success. Michael Porter (in “Competitive Strategies”) outlines the use of value chain analysis as a means of understanding how an organisation could create competitive advantage. The value chain provides a systematic basis for analysing the activities that an organisation performs. Through these activities the organisation creates value. The organisation gains competitive advantage through reducing costs or increasing revenue more efficiently or more effectively than its rivals. An organisation's value chain is embedded in a value system. Figure 4.5 The value system Supplier value chains Channel value chains Customer value chains Organisation's value chain Source: Adapted from M. E. Porter, Competitive Advantage, Free Press, 1985. Used with permission of The Free Press, a division of Macmillan, Inc Copyright 1985 Michael E. Porter From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition Suppliers have value chains (upstream value) that create and deliver the purchased inputs used in a organisation's chain. Suppliers not only deliver a product but also can influence an organisation's performance in many other ways e.g. through quality control, meeting delivery dates and price. In addition, many products pass through distribution channels on their way to the buyer. Channels perform additional activities that affect the buyer (e.g. a dealer network in the case of automobiles), as well as influence the organisation's own activities. An organisation's product eventually becomes part of its buyer's value chain. Gaining and sustaining competitive advantage depends on understanding not only an organisation's value chain but also how the organisation fits in the overall value system of suppliers and buyers. The value chains of firms in an industry differ. The difference reflects their histories, strategies, and success at implementation. A firm's value chain may differ in scope from that of its rivals, representing a potential source of competitive advantage. Competitive scope describes the range over which a firm competes. There are at least four dimensions to this range: Segment scope - the product varieties produced and buyers served through differentiation; Vertical scope - the extent to which activities are performed in-house instead of by independent firms, through vertical integration; Geographical scope - the range of regions, countries or groups of countries in which a firm competes with a co-ordinated strategy; Industry scope - the range of related industries in which the firm competes with a co-ordinated strategy to gain scope economies. The Value Chain of an organisation can be broken down into various value activities that can be divided into two broad types. Figure 4.4 The value chain Firm infrastructure Margin Human resource management Support activities Technology development Procurement Inbound Operations Outbound logistics logistics Marketing and sales Service Margin Primary activities Source: M.E Porter, Competitive Advantage, Free Press, 1985. Used with permission ofThe Free Press, a division of Macmillan, Inc. Copyright 1985 Michael E. Porter. From: G Johnson and K Scholes, Exploring Corporate Strategy, 4th edition Primary Activities - the activities involved in the physical creation of the product and its sale and transfer to the buyer as well as after sale assistance. The five primary activities are divided into inbound logistics, operations, outbound logistics, marketing and sales, and service. Support Activities - primary activities are supported by purchased inputs, technology, human resources, and various organisation-wide functions. The dotted lines reflect the fact that procurement, technology development and human resource management can be associated with specific primary activities as well as support the entire chain. Firm infrastructure in particular supports the entire chain. Illustration CREATING CORE COMPETENCES AT BRASSERIES KRONENBOURG In the mid-1990s, Brasseries Kronenbourg was the main company within Kronenbourg SA, the beer division of the French food and packaging group, Danone. Along with Heineken and Carlsberg, Kronenbourg SA was one of the three largest brewers in Europe. Brasseries Kronenbourg, formed from the merger of Kronenbourg and Kanterbraü in the 1970s, aimed to become one of the most productive brewers in the world. Production facilities, along with human resources, finance and administration functions, were combined by the mid-1980s. There then followed a restructuring programme that reduced staffing by 570 jobs, mainly through voluntary redundancies. At the same time a major investment programme created larger, more efficient breweries capable of serving larger geographical areas, up to 1,000km2 for mass market brands. The distribution system in France was also developed through the acquisition of 60 warehouses via its subsidiary, Elidis. By merging the sales forces of Kronenbourg and Kanterbräu, the company brought together a unified product range of 28 brands. As product image and brand name are critical in this market, the company made key investments in this area. The company strengthened its links with its customers, particularly the retail chains, by introducing a merchandising system called “Pluton”, that improved the presentation of beers, adapting it to each retail chain, region and season. Kronenbourg also developed and launched a series of beers, to meet the needs of emerging customer segments, including: Tourtel Brune (1989); Tourtel Ambrée (1990) and Tourtel 100% malt (1994). Working with the packaging division of Danone Group it also developed new packaging for its products, winning awards for one bottle and developing a label that changed colour once the bottle was at the right temperature for its Kronenbourg 1664 brand. From 1993, the Loi Evin restricted beer advertising, so the company concentrated on the promotion of its products in cafés and the sponsorship of the Paris Saint Germain and Strasbourg football teams. As well as developing in its home market, Kronenbourg also sought to develop its international presence through a range of acquisitions and licensing agreements. For example it entered into a production agreement with Courage in the UK, as well as entering into agreement with local breweries in Italy, Belgium, Spain and Greece. Its strategy was to develop Kronenbourg 1664 and Tourtel as international brands brewed in each local market alongside the strongest brands of its partner. Source: based on R Calori & P Monin, “Brasseries Kronenbourg” in G Johnson & K Scholes, Exploring Corporate Strategy, Prentice Hall, 1999. To illustrate how the value chain can be used in practice, we can plot the key value activities within Brasseries Kronenbourg: A key aspect of organisations is the interdependence or linkages between their various activities. Whilst value activities are the building blocks of competitive advantage, linkages also can lead to competitive advantage in two ways: Co-ordination of linked activities such as procurement and assembly can reduce the need for inventory, for example. Reducing inventory is made possible by managing linkages better. Integration of activities can create the opportunity to lower the total cost of the linked activities or increases the value added. In copier manufacturing, for example, the quality of purchased parts is linked to the adjustment of copiers after assembly. Canon found it could virtually eliminate the need for adjustment in its personal copier line by purchasing higher precision parts. Managing the linkages in an organisation is therefore a key management task. Three kinds of linkages are considered: Linkages within the value chain of a strategic business unit (e.g. the Pluton merchandising system within Brasseries Kronenbourg); Linkages between the value chains of separate business units within the same firm (e.g. the support for Brasseries Kronenbourg on packaging developments by the Danone packaging division); Linkages between the value chains of different firms (e.g. sports sponsorship with football teams like PSG and Strasbourg, along with the production agreement in the UK with Courage). Positioning – One Approach to Creating and Sustaining Competitive Advantage In the last two weeks we have seen how a variety of tools and frameworks can be used to analyse the internal and external environments of the organisation. But how can these tools and frameworks be used to underpin viable strategies for the organisation - to allow it to find sustainable competitive advantage? One approach to this challenge is that associated particularly with Michael Porter, which has become known as the Positioning Approach. Porter argues that a company needs to understand the structure of its industry, in order to change its strategy (its position within the industry) in order to achieve improved performance by outperforming its competitors. This is referred to as sustainable competitive advantage. As originally outlined in the mid-1980s, this was essentially an outside-in approach to strategy, which stressed the positioning of the organisation within its environment – shaping the organisation to meet the externally imposed pressures. Once the company understands where competition comes from and why, using tools like the five forces framework and strategic group analysis (both tools outlined by Porter) it can look to position itself against these forces: by using its capabilities to provide best defence against force(s), by influencing the balance of forces through improved company position, by anticipating shifts in forces and reacting to exploit them quicker than the competition. Generic Strategies and Positioning Porter argued that positioning determined whether a firm's profitability was above or below the industry average. A firm that positions itself well may earn high rates of return even though industry structure is unfavourable and the average profitability of the industry is modest. Porter went on to argue that, in essence, competitive advantage came in only two types - low cost or differentiation. Usually, Porter argued, a company cannot do both; it needs to make a choice. The company also needs to make a choice over the scope of activities over which it seeks advantage - many segments of the industry or just one or two. When the type of advantage and scope are combined, three generic strategies can be identified cost leadership, differentiation or focus (low cost or differentiation). Porter argued that a firm that engages in each generic strategy but fails to achieve any of them will become “stuck in the middle”, possessing no advantage. This is “a recipe for strategic mediocrity”, as it will be out competed by companies following clearer strategies, be it cost leadership, differentiation or focus. Finally, he made the point that the chosen generic strategy needs to be sustainable. The company's competitive advantage must be able to resist erosion from competitors' behaviour or industry evolution. Sometimes this will mean that one or other of the generic strategies are not feasible in some industries. Using the Sources of Competitive Advantage to Achieve a Generic Strategy Porter argued that competitive advantage is the result of finding ways to lower costs or increase revenues more than the competition. The activities that the organisation undertakes, and the ways in which they are linked, as highlighted by the value chain, can all contribute to the strategy if they exploit the sources of cost efficiency or value added available. LOW COST STRATEGY DIFFERENTIATION STRATEGY Critical Activities Efficient operations Low cost logistics & distribution Process Design - efficient processes Product Design - easy to make products HRM - good labour supervision Critical Activities Product design - innovative products Marketing - brand image promotion Service - quality customer service HRM - staff training Operations - quality assurance Cost Drivers Economies of scale Economies of scope Experience curve Supply costs Differentiation Drivers Service quality and levels Product features Delivery times Image Cost Drivers Economies of scale arise for a number of reasons. Large-scale output levels often allow firms to utilise more efficient, capital-intensive methods - e.g. computer-controlled assembly lines, flexible manufacturing systems (FMS) and robotics. Methods of production that involve very high set-up, or fixed costs are uneconomic for small-scale production but large-scale production enables them to be spread over more units of output. Scale economies can be attained anywhere in the value chain, where there are costs which do not increase proportionally with output. These are often referred to as “indivisibilities” (an example is overheads) and can occur in any of the functional areas. For example, the film footage used for Coca-Cola advertisements is produced in one location, and then dubbed in several languages for distribution all over the world. Economies of scale do not exist in all industries. Where they do exist, however, they tend to result in an increase in concentration - that is, an increase in the market share of the largest firms, as has been the case in steel manufacturing, bulk chemicals and automobiles. Economies of Scope - In addition to economies from the size or scale of a firm's production of a single product, there is also the possibility that cost savings can result from the simultaneous production of several different outputs in a single enterprise, as opposed to their production in isolation each by its own specialised firm. Such costs savings are referred to as “economies of scope”. They occur when the joint costs of two or more products are less than the costs of producing them separately. The Experience Curve - The experience curve relates the cost per unit output to the cumulative volume of output since the production process was first started. Costs per unit tend to decline as the cumulative volume of output rises. As the production process is repeated, the firm learns from experience, and is able to adjust production process in accordance with this acquired knowledge, reducing costs. Empirical studies indicate that unit costs tend to decline at a relatively stable percentage each time cumulative volume is doubled. Differentiation Drivers Reducing costs are important to most organisations, but for many organisations competitive advantage comes from adding value to their products and services, for which customers are willing to pay more. This is best achieved if the customer perceives the product to be different from others on offer - this is achieved through differentiation. As with cost efficiency, the creation of value added depends upon the activities within the value chain and the ways in which they are linked. Illustration 10.3 in Johnson and Scholes outlines the way in which Marks and Spencer achieve this creation of added value. The Classical Positioning Approach Summarised As his article “Competitive Strategies” outlines, Porter’s approach involves using the five forces framework and strategic group analysis to understand the nature of competition within an industry and identify a sustainable position for the organisation to achieve within it. Achieving a sustainable position means making choices about the generic strategy to be followed in order to exploit the sources of advantage available to it. This means using the value chain to understand how the organisation creates value through the activities it performs and then identifying how these activities need to be restructured in order to achieve the desired strategy. However, this approach was increasingly critiqued during the 1990s, with much of the debate centring upon the need to make a choice between low cost and differentiation. The outside-in nature of the approach was also questioned - with critics arguing that this was too reactive in the modern business context. From this critique, a number of similar approaches emerged, which stressed the importance of understanding and exploiting the resources of the organisation. Resource-Based Approaches to Sustainable Competitive Advantage As mentioned above, a number of approaches developed during the 1990s, by various authors who, whilst using differing terms, took a similar view about the creation of sustainable competitive advantage as an Inside-Out approach to strategy. Sustainable competitive advantage depends on: Hard to imitate organisational capabilities based on business processes which distinguish a company from its competitors in the eyes of the customers Stalk, Evans & Shulman, “Competing on Capabilities”, 1992 Core competences based on skills and technologies - the collective learning of the organisation Prahalad & Hamel, “The Core Competence of the Corporation”, 1990 Possession of capability differentials which are fed from a feedstock of intangible resources Hall, “A Framework for Identifying the Intangible Sources of Sustainable Competitive Advantage”, 1994 Distinctive capabilities which are a feature of its relationships, which others lack or cannot easily reproduce Kay, Foundations of Corporate Success, 1995 In summary, resources and functional competences of the organisation are linked together by cross-functional strategic capabilities in ways which are difficult for competitors to copy and on which successful strategy can be based. Resource Based Approach in Practice Robert Grant has outlined a resource-based framework that can be used for strategy formulation, forming a useful link between the principles and process tools: Analyse the Firm’s Resources First, identify, classify and assess the resources of the firm. The most important resources are likely to be intangible resources. Hall’ framework is useful here. Once identified, managers need to assess how their resource base compares with that of their competitors and identify opportunities to use these resources more efficiently. Analyse the Firm’s Capabilities The next stage is to analyse the way in which the resources of the organisation are combined with its competences to potentially create strategic capabilities. The most useful tool available to help in this process of identification and analysis is the value chain. Capabilities are created in the way in which the organisation uses its resources in the activities it undertakes and in the linkages between these activities and other value chains. Grant again points out that the critical task for the manager is to assess these capabilities relative to those of its competitors. Appraise the Sources of Competitive Advantage The next stage is that firms should “appraise the rent-generating potential of resources and capabilities” - based on economic rent as a measure of competitive advantage. The sources of this competitive advantage come from opportunities to achieve cost efficiency or added value including economies of scale and scope, the experience curve and the ability to differentiate oneself from the competition. Grant identifies four characteristics of the resources and capabilities of the organisation that are likely to be important determinants of sustainability: Durability - resources and capabilities depreciate over time, so the rate of decline is important to the sustaining of competitive advantage. Technological change means that capital equipment and know-how can become obsolete. Brand names and reputation can also decline over time, as can the expertise of the company. Transparency - the ease with which competitors can identify, and subsequently duplicate or replace, a company’s sources of competitive advantage can be critical. Reverse engineering, where a competitor can dismantle products to see how they are designed and assembled, can reduce the length of time a company can maintain an advantage based on product technology. This has led to shorter product life cycles in many industries. Transferability - if a competitor can gain easy access to the resources and capabilities on which advantage is built, then sustainability is again reduced. The wholesale transfer of a dealing room team from one competitor to another is not uncommon in today’s financial markets. Similarly, if advantage is based on process technology that is available to all then it is likely to be short-lived. Replicability - the more difficult it is to copy the resources and capabilities of a company, the more sustainable their advantage is likely to be. The sophistication of an organisation’s value chain and its ability to manage complex linkages all contribute to the sustainability. In addition the firm also needs to consider the appropriability of the returns from this advantage can you get the benefits of access to resources without owning them or can you competitors do the reverse? An important issue when considering strategic alliances. Also an issue when a firm’s advantage comes as the result of the skills of a limited number of employees e.g. the introduction of the “Bosman Ruling” in football has led to increased players’ wages as clubs attempt to hold onto their stars or attract players from elsewhere. Select a Suitable Strategy Grant argues that the essence of strategy formulation is to design a strategy that makes the best use of a firm’s most important resources and capabilities. He identifies these key resources and capabilities as “those which are durable, difficult to identify and understand, imperfectly transferable, not easily replicated, and in which the firm possesses ownership and control”. For Grant, as with the other resource-based authors, this may well combine sources of cost efficiency and added value. Identify Resource Gaps and Develop Firm’s Resource Base The final stage of Grant’s framework is to identify ways in which the organisation can build on existing resources and capabilities in order to create future advantage. This means developing strategies which address resource gaps by enhancing current resources and capabilities, or acquiring new ones e.g. Honda and Rover alliance - Honda sought knowledge of European car styling, whilst Rover wanted access to expertise in manufacturing processes, particularly in quality management. As sustaining competitive advantage is critical, firms need to continually search for new ways in which to upgrade their resources and capabilities - finding new sources of cost efficiency or ways to add value. This can mean replacing existing sources of advantage even whilst the firm maintains an advantage over its competitors. For example, a consumer electronics company launches a new product innovation, despite being the market leader with the existing generation of products. Critiques of the Resource Based Approaches Michael Porter did not take this critique lying down and he is still playing a key role in the debate about sustainable competitive advantage. In an article published in 1996 called “What is Strategy?” he raised a number of issues: One Size Fits All? A colleague at Durham University commented on the companies frequently highlighted by proponents of the resource-based view, stating that “not one of them clothes you, feeds you or puts a roof over your head”. He graphically illustrated a point, made by Porter and others, that the resource-based approach may suit companies in certain industries - computer software, financial services and consumer electronics for example - but that it is dangerous to assume that similar strategies will suit all contexts. Indeed, the approach risks being attacked by one of the criticisms levelled at generic strategies, of a standard response irrespective of context. Operational Effectiveness and Strategy Porter draws a distinction between operational effectiveness and strategy. Operational effectiveness means performing similar activities better than rival competitors, whilst strategy, or strategic positioning is about performing different activities than rivals, or similar activities in different ways. Operational effectiveness means doing things better, whether that is improving value to the customer or improving the company’s relative costs. It is about better utilisation of resources reducing defects or developing new products faster. This is consistent with the typical resourcebased view that sees no conflict between pursuing cost efficiency and added value. Porter argues that operational effectiveness is a necessary but not sufficient condition for superior performance. He highlights this by reference to what he calls the productivity frontier: The productivity frontier shows the state of best practice at any moment in time achievable in terms of value added and cost efficiency. Company A can increase its operational effectiveness, by adopting techniques like TQM and benchmarking, to improve both its cost efficiency and value added. However, once the productivity frontier is reached, as with Company B, there may be a need to make a choice between further cost efficiencies or adding value - in other words, define a strategic position. Dangers of Hypercompetition For Porter, the risk of pursuing operational effectiveness alone is that the competitors merely shift the productivity frontier outwards over time. Whilst absolute operational effectiveness increases, there is no relative improvement for any one competitor. Further, competitors come increasingly to resemble each other as they seek the same improvements through benchmarking against each other. The result, argues Porter, is hypercompetition, with companies facing diminishing returns as they become increasingly homogenous - with similar cost structures, new product development times, product quality etc. Restructuring in the car industry, and the long list of alliances, reflects these pressures? Towards a Combined Approach Despite the critique of resource-based approaches, Porter has moved from his 1985 position. In “What is Strategy?” he argues that a company creates sustainable competitive advantage by delivering greater value, creating comparable value at lower cost, or by doing both. The stress is on the unique mix of value created by a different set of activities rather than the choice between low cost and differentiation. In this article, Porter also defines positioning differently to his work in the 1980s. From a supply side perspective, positioning depends upon a unique set of activities, based on cost, value or both. But, positioning does not always depend on differences in the demand side - customer differences, as with the latter two classifications below. Here positioning can be based on: Needs-based positioning - serving the needs of a particular group of customers with a tailored set of activities e.g. IKEA Variety-based positioning - producing a sub-set of an industry’s products, which attract customers some of the time e.g. Kwik Fit. Access-based positioning - by segmenting customers accessible in different ways. Customer needs are similar but a different set of activities can be used to reach them, based on customer geography or customer scale e.g. Carmike cinemas in rural USA. Porter is in effect arguing that the search for competitive advantage is both outside-in and insideout. Sustainable competitive advantage comes from a firm’s capability to innovate better than its competitors over time, but at any moment in time its position relative to the competition will be crucial, but this position is both defined by the firm’s activities and the market it seeks to serve. In effect, Porter has changed his own position, stressing both the need to be resource-based and to use positioning, albeit in a redefined sense, to sustain competitive advantage. This combination of approaches is also apparent in Bowman’s “Strategy Clock” which is outlined in Johnson and Scholes (Chapter 6). The key variables are those seen by the customer - price and perceived quality. Together, a range of options can be identified for an organisation within an industry, with five potentially successful routes and three routes ultimately likely to fail: Figure 6.4(i) The strategy clock: Bowman’s competitive strategy options High Differentiation Hybrid 4 5 3 PERCEIVED ADDED VALUE Focused differentiation Low price 2 6 7 1 Low price/ low added value 8 Low Low Strategies destined for ultimate failure PRICE High Source: Based on the work of Cliff Bowman. See C.Bowman and D.Faulkner. Competitive and Corporate Strategy, Irwin, 1996. Figure 6.4(ii) The strategy clock: Bowman’s competitive strategy options 1 Low price/low added value Likely to be segment specific 2 Low price Risk of price war and low margins/need to be cost leader 3 Hybrid Low cost base and reinvestment in low price and differentiation 4 Differentiation (a) Without price premium (b) With price premium Perceived added value by user,yielding market share benefits Perceived added value sufficient tobear price premium 5 Focused differentiation Perceived added value to a particular segment, warranting price premium 6 Increased price/standard Higher margins if competitors do not value follow/risk of losing market share 7 Increased price/low value Only feasible in monopoly situation 8 Low value/standard price Loss of market share As Johnson and Scholes outline, these strategy routes can be linked back to the combinations of low cost and differentiation necessary to deliver them. Low price/low quality – essentially a narrow scope strategy Lower price/same quality – a broad scope strategy sustained by a low cost base Lower price/higher quality – a hybrid – low cost base again critical, but differentiation also important Same price/higher quality – broad scope using differentiation to attract customers to achieve lower cost Higher price/higher quality – a narrow scope strategy. In conclusion, the search for sustainable advantage seems to be converging - at least until the next article!