preprint version of 4-12-04 (MS Word

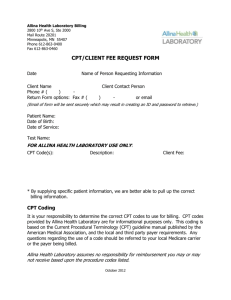

advertisement