Management of Cost Overrun in selected Building Construction

advertisement

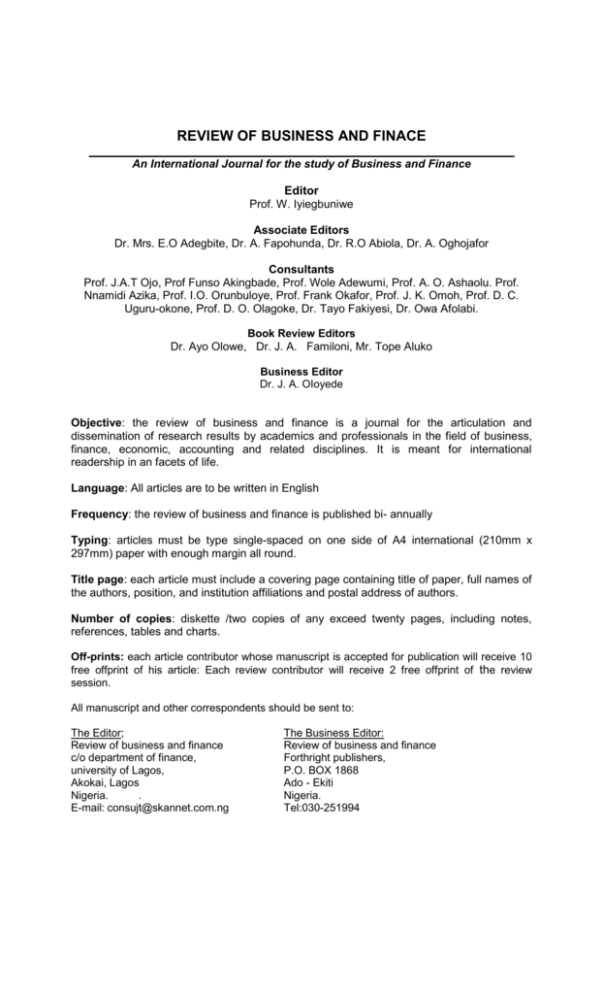

REVIEW OF BUSINESS AND FINACE An International Journal for the study of Business and Finance Editor Prof. W. Iyiegbuniwe Associate Editors Dr. Mrs. E.O Adegbite, Dr. A. Fapohunda, Dr. R.O Abiola, Dr. A. Oghojafor Consultants Prof. J.A.T Ojo, Prof Funso Akingbade, Prof. Wole Adewumi, Prof. A. O. Ashaolu. Prof. Nnamidi Azika, Prof. I.O. Orunbuloye, Prof. Frank Okafor, Prof. J. K. Omoh, Prof. D. C. Uguru-okone, Prof. D. O. Olagoke, Dr. Tayo Fakiyesi, Dr. Owa Afolabi. Book Review Editors Dr. Ayo Olowe, Dr. J. A. Familoni, Mr. Tope Aluko Business Editor Dr. J. A. OIoyede Objective: the review of business and finance is a journal for the articulation and dissemination of research results by academics and professionals in the field of business, finance, economic, accounting and related disciplines. It is meant for international readership in an facets of life. Language: All articles are to be written in English Frequency: the review of business and finance is published bi- annually Typing: articles must be type single-spaced on one side of A4 international (210mm x 297mm) paper with enough margin all round. Title page: each article must include a covering page containing title of paper, full names of the authors, position, and institution affiliations and postal address of authors. Number of copies: diskette /two copies of any exceed twenty pages, including notes, references, tables and charts. Off-prints: each article contributor whose manuscript is accepted for publication will receive 10 free offprint of his article: Each review contributor will receive 2 free offprint of the review session. All manuscript and other correspondents should be sent to: The Editor; Review of business and finance c/o department of finance, university of Lagos, Akokai, Lagos Nigeria. . E-mail: consujt@skannet.com.ng The Business Editor: Review of business and finance Forthright publishers, P.O. BOX 1868 Ado - Ekiti Nigeria. Tel:030-251994 Review of Business Finance Volume 3 Jan- June 2001 No 1 ARTICLES Management of cost overrun in selected building construction project in Ilorin. OLUJIDE Jackson and OWOSHAG8A Steven 1 The degree of confidence on the public sector audit exercises by ICAN and ANAN members. IZEDONMI O.I. F, OLADIPUPO A. O and OTAKEFE J. P 8 Gender as a determinant of advancement into managerial positions in Nigerian business organisations OMOLAYO, B. Oluwabunmi 18 Improving external bank auditing for soundness and growth of banks in Nigeria SUNNY M. Eke 22 Motivation and business success the relationship between entrepreneurs motivation and new business ventures success SIDIKAT Adeyemi 30 Assessment of the stages characterizing organizational capital equipment purchasing decisions in Nigeria ABIOLA, R. O 37 Modelling the spread of innovation in computer industry ADEWALE T. A and ARIBISALA B. S 42 Journal Announcement MANAGEMENT OF COST OVERRUN IN SELECTED BUILDING CONSTRUCTION PROJECT IN ILORIN _ OLUJIDE Jackson Department of Business Administration, University of llorin, florin & OWOSHAGBA Steven Federal Mortgage Bank Ltd, Lagos. Introduction The construction industry is a very important sector of the Nigerian economy. It contributes significantly to its Gross National Product. The rapid growth in Nigeria's economy and population, particularly during the oil-boom years, required additional physical infrastructures to accommodate additional inputs to various components of the TCSS national product. Thus, the construction industry has a weighted influence on all sectors of the Nigerian economy. Onabule (1991) described the building construction activities as the single largest investment sector in the Nigerian economy. In addition, appreciable percentage of the loans and advances of merchant and commercial banks, insurance companies e.t.c are invested in real estate and constructions. The promulgation of decree 53 of 1989, to establish Mortgage has also increased investment in real estate in recent times. Unfortunately, the per capita cost of building construction is increasing at a much faster rate than at which income grows for individuals, companies and governments. Houses are becoming more affordable. Closely associated with this high cost of construction is project overruns and abandonment of construction projects nationwide. The construction industry, unlike many manufacturing ventures, is concerned mostly with oneoff projects (Harris and McCaffer, 1979). This naturally creates difficulties for effective cost control because each new contract often has a fresh management team because labour transient and recruited on ad-hoc basis and sites and passed throughout the country. For construction company, the scenario described above tends to create problems of selecting communication with other parts of the company. Therefore, subcontracting and Labor are common. Added to all these are problems associated with changing conditions. The resultant effect of these problems of costing is cost overrun. Cost overrun can be considered as the difference between actual cost of a project and its Cost limit. It occurs when the resultant cost target of a project exceed its cost limits where Cost limit of a project refers to the maximum expenditure that the client is prepared to incur on a completed building project while cost target refers to the recommended expenditure for each element of a project. The ugly marks of these project cost overruns are seen in the numerous abandoned building project in the country. According to Akindoyemi (1988) projects are rarely completed in the country at scheduled time and cost. The problem of project abandonment is serious and pervading during the era of military rule. This situation has become so worrisome that the present Obasanjo administration had to set up a panel to look into cases of abandoned federal projects in Nigeria. This study is design to examine the incidence of project abandonment (Project cost overruns) in the building industry in old llorin states. This study will provide information that will serve as a basis for articulating public policy regarding project abandonment in Nigeria. This position Review of Business and Finance Volume 3, Number I , Jan - June 2001 1 has become very necessary because government and their agencies are the single most important client in this industry, they account for over 80% of projects in the industry. This study establish the incidence of cost overrun in building projects, determine the causes of project cost overruns in building and assess the management techniques to forestall overruns in the Nigeria building industry. Methodology For the purpose of this study, we shall examine the causes of project delay a abandonment in 30 building projects in Kwara and Kogi States. Thus, 30 building sited. constituted our sample, the building sites were subjected on the basis of the judgement of the researcher. llorin is one of the oldest cities in Nigeria; here there are a reasonable number of building construction projects by individuals, private and public sector organizations, llorin was: seat of government of llorin Province and it is now capital of Kwara State. It is the belief this study that the situation with respect to the building sector in llorin will reflect what obtain in other cities in Nigeria. Thus, this study is designed to probe into the operations of build practitioners in order to examine the management of project cost overruns. Data for this study were obtained from primary sources namely: Structured interviews v, 25 professionals respondents using a prepared questionnaire administered to them. Table 1: Distribution of professionals interviewed Number Frequency Architect 5 20 Quantity Surveyor 6 24 Builders 6 24 Contractors 5 20 Engineers 3 12 Total 5 100 Data obtained were analyzed using Gross tabulation analysis and test of significance. Data analysis and discussion of results 30 building sites were selected for examination at random. 25 questionnaires were give the professional actors on those sites. Among the 25 questionnaires distributed only 20 \, completed and returned. The professions of the respondents are as given by table 2 below Table 2: The professionals interviewed Title Number Frequency Architect 4 20 Quantity Surveyor 5 25 Builders 5 25 Contractors 4 20 Engineers 2 10 Table 2 above shows an event spread of questionnaires among the professional actor building designed to construction at the various sites. The capacity of respond participation is also studied and the resulted is presented in Table 4 below. Table 3: Respondents participation on projects Respondents Clients representative Contractor representative Contractor Clients Total Number 14 -5 1 20 Review of business and finance Volume 3, Number I, Jan -June 2001 Percentage 70 -25 5 100 2 70% of the professionals interviewed are clients' representatives. Table 4 below shows the employers of projected professionals on the site studied. Table 4; The employers of project Professional actors Respondents Government Public Liability Company Private individual World Bank Total Number 13 -5 1 20 Percentage 65 25 5 100 From table 4, Government at all levels, employs 65% of the respondents with a meager 35% share among the other employers in the industry. This further buttresses earlier statements that Government finances about 70% of constructions in the building industry. 95% of the Respondents have project experience of more than 10 years, and have supervised more than 20 building projects. This revelation from the questionnaire showed that respondents have sufficient experience to participate actively in this study. Table 5: Frequency of cost overruns in Building Projects Responses Always Sometimes Not at all Total Number 3 15 2 20 Percentage 15 75 10 100 From table 5, one can see that 75% of the respondents accepted that cost overruns have sometimes occurred in building projects, 15% said it always occurred, while 10% have not experience cost overruns at all. The frequency of occurrence of projects cost overruns is further probed into. The Table 6 below gives the response on frequency of occurrence. Table 6, below gives the response as to whether respondents have experienced cost overruns or not. Table 6: Cost overruns in Projects Responses Yes No Total Number 18 2 20 Percentage 90 10 100 From table 6 above, 90% of our respondents accepted that projects they have supervised have had cost overruns at one time or the other. The frequency of occurrence of project cost overruns is further probed into. Table 7 below gives the response on frequency of occurrence. Table 7 Frequency of cost in the industry Responses Very often Often Occasionally Not at all Total Number 4 5 9 2 20 Percentage 20 25 45 10 100 Table 7 shows that 45% of the 20 respondents accept that cost overruns occasionally occur in projects, 20% very often, 25% occurs often while 10% have not experienced it at all. Review of Business and finance Volume 3, Number I, Jan -June 2001 3 Table 8: Project client Federal Govt. Federal Govt. Federal Govt. Federal Govt. Federal Govt. Federal Govt. Federal Govt. Federal Govt. Federal Govt. State Govt. State Govt. State Govt. Local Govt. Public Liability company Individual TOTAL Project costs and the associated overruns Initial Cost '000 Naira 3100 265 361 30000 527 1087 240 4900 1440 5000 994 6500 2890 490 Final cost ‘000 Naira 5000 325 521 38000 527 1087 240 6500 240 8500 1325 12000 3200 490 Cost overruns '000 Naira 1900 60 160 8000 1440 3600 3600 331 3500 310 - Percentage cost overruns (%} 61.3 22.6 44 .3 26.7 32.5 73.5 287 60,000 287 80,935 20,855 - 73.5 33.3 41.2 10.7 - Table 8, shows that for a total of 15 project whose costs were known among the 30 projects studied, only 26.3% do not have project cost overruns. The planned cost of project overrun] is N20.855 million. The cost overrun is 34.7% of the initial project cost overruns of N20.85.' million. This cost overrun is 34.7% of the initial project costs. The above analysis shows that cost overruns in projects can be very enormous. It can rise as high as 73.5% of the project cost. The average overruns on the projects studied being 34.7%. Table 9: Projects cost overruns have specific advantages to the clients Response Number Percentage % Yes 4 20 No 16 80 TOTAL 20 100 We tried to find out from our respondents if cost overrun had any specific advantages. Table 9 shows that 80% of the respondents accepted that project cost overruns have no specific advantages to clients. 20% said it has advantages to the clients. Those who felt that cost overruns have specific advantages to client gave the following two advantages Increased floor area space of building and Faster completion In order to be able to put this problem of cost overrun into proper perspective, it was added to first identity at what level of the project cycle are cost overruns likely to occur. Second, the possible causes of project cost overrun into proper perspective, it was added to first identity then, the management action and techniques employed to control cost o projects were investigated. Table 10: Origin of cost overruns project cycle Project stage Competition and Design Tendering Construction All of the above Total Response 2 1 13 4 20 Percentage 10 5 65 20 100 From the table, the construction cost overruns, seem to have its genesis at construction stage as 65% of the respondents chose the stage, 20% of the respondents believe that cost overruns could originate at all stages, while 10% and 5% chose design and tendering stage; respectively. Review of Business and Finance Volume 3, Number 1, Jan -June 2001 4 The response to the possible causes of project cost overruns are as given in table 11. Table 11: Cause of Projects cost overruns Lack of proper appraisal of project Design complexity Unrealistic representation of clients needs Lack of time for effective design Selection of incompetent contractor Shoddy tendering procedure Lack of proper analysis of tenders Variation orders Ineffective and poor planning Miscalculation by contractors Inadequate tooling Fluctuations in prices of materials Lack of management tools such as Bar Chart and Bar Chart and PERT Delay in Honoring certificates 13 3 12 6 13 6 13 14 2 1 9 18 65 15 60 30 65 30 65 70 10 5 10 90 3 10 7 8 3 8 3 2 12 14 12 1 3 13 15 65 10 3 The major causes of project cost overruns identified from table 11 are as shown below: 1. Fluctuation in the prices of materials/Labour 2. Variation orders 3. Delay in honoring certificates 4. Lack of proper analysis of tenders 5. Selection of incompetent contractors 6. Lack of proper appraisal of projects 7. Unrealistic representation of clients needs When cost overruns have occurred in building projects management would take some actions. These actions are as reported in table 11 Table 12: Management reaction to cost overruns Action Ask for variation/fluctuations Ask for revision of projects Grant variations Do nothing Total Number 9 4 6 1 20 Percentage 40 20 30 5 100 Table 12 shows a diverse reaction to cost revenue. The contractor team which is about 45% could naturally seek for variations/fluctuations. Some of the respondents (20%) would however seek for revision of the project. 30% would grant variations and 5% would do nothing. The sites studied are conscious of the inherent dangers of cost overruns and they attempted at curtailing it by employing management techniques. Table 13 shows that the responses 10 the techniques respondents have used to control project costs. Table 13: Techniques used to control cost overrun Techniques Comparing estimate to clients budget Costing to design Cost planning Cost modeling Adoption of sound tendering techniques Unit costing PERT/Cost Building cost index Number of responses 6 4 7 3 12 6 2 5 Relative percentage 40 20 35 15 62 30 10 25 Review of Business and finance Volume 3, Number /, Jan - June 2001 Rank 2 6 3 7 1 4 8 5 5 From table 13, 60% of the respondents have used sound technique to manage cost, while 40% have compared projects estimates to clients' budget in order to control cost, 35% have used cost planning techniques and 30% have used the unit costing method. The least employed management techniques are FERT/Cost control techniques, and cost modeling. In the researcher's effort to further probe the exposure of respondents to modern cost control management techniques, respondents were asked to recognize some models and responses are given in table 14: Models Traditional costing technique Regression analysis Causal Or Empirical models Monte-Carlos simulations TOTAL Response 19 1 20 Percentage 95 0 5 0 100 It is evident from table 14 that modem operational research and Quantitative techniques are not employed in controlling projects costs in building projects in llorin. The traditional costing techniques are used widely by the professional actors. Conclusion Analysis of data and distribution of result point to the fact that project cost overruns in building projects have adverse effect on clients. It is another to the client's realization of dream houses at planned time and cost. From the foregoing therefore, one sees the necessity to manage cost planning at the conception and design state of projects. The computer age and increasing resort to computer use, in order to solve managerial problems has made it possible to employ cost planning models to predict costs of projects to a near accurate level. The cost planning models in this category include: Regression analysis, Causal or Empirical models and Monte Carlo simulation. When the cost of a building has been accurately determined cost control techniques should be employed to effectively monitor projects that are monitored in this manner are easier to control than other projects therefore, projects should be planned on network using the Project Evaluation and Review Techniques (PERT). This system allows for better monitoring of project costs. At conception and design stage, projects should be better appraised. Value Engineering should be created and empowered to monitor and publish materials. Some kind of body/agency should be created and empowered to monitor and publish, on a regular basis, building cost indexes. This will facilitate and enhance ability of manager to make better predictions of cost of material and labour. Thus, fluctuations on building sites will be eliminated and hence reduction of cost overruns achieved. The convincing professional development, CPD currently embarked upon by building professional bodies should be expanded to include current research areas in the development of managerial skills of members. Professional in government establishments and ministries should particularly be given refresher training to update their skills. Finally, if housing for all will ever be a reality in Nigeria, then all hands must be on deck to tackle as a matter of urgency and necessity, cost overruns and other barriers to the successful completion of projects. This can only be done by the employment of the right management tools to plan and control cost. Review of 'Business und finance Volume .1 Number I, Jan -June 2001 6 References Adekunle, L.T (1980) "The rising cost of Building construction", Shelter for Nigerians, Ed. By Omokhodion. A. NIA Publication May Pp 18-19 Akindoyeni, A. (1988): "The Management of Abandoned Projects." N.I.O.B Journal NIOB Pub. Aug. 1988 Maiden Ed. Pp. 16-20 Ayeni, J.O (1991): "Fluctuations and variation as they affect contract Cost", Contract Management in the construction industry NIOB Pub. Aug 1991 Ed. By Olateju Baum, W. (1962): "The Project Cycle" Publication of the International Bank for Reconstruction and Development, the World Bank. Washington D.C Pp 3-25. Bradon, P. And Newton, S. (1986) "Improving the Forecast" Chartered Quantity Surveyor Journal of RIQS. Aug. Pp 22-23. Federal Government of Nigeria (1992): "The Professional scale of fees for Consultants in the construction industry" FMW&H Lagos. Pp 46-48 Ferry, D. J and Bradon, P. S (1984):Cost Planning of Buildings, Granada Pp. 101-114, 225287,304-321. Isiadinso, E. (1990): "Construction cost control and project management-value engineering and analysis" Seminar on a 2 day workshop of NIQS., 29-30 August Nasir EI-Rufai (1989): "Causal-based Cost Modeling" The Nigeria Quantity Surveyor NIOS Pub. Dec. Pp 24-29 Odu, N.M (1980): "The rising cost of Building construction causes and solutions". Shelter for Nigeria Ed. Omokhodio NIA Pub Pp 20-24 Odusanmi, K.Y (1988): "An analysis of contractors bidding performance: A case study of some selected construction firms in Lagos" Unpublished. M.Sc thesis University of Lagos Oct. Pp 1-16 Onabule, G.A. (1991): "Fluctuations and variations in Building Constructions Contract Management in the construction industry.Ed. Olateju. NIQB Pub. Aug Rafter, J. (1987): "Cost models: An interim valuation: Chartered Quantity Surveyor RIQS Publication, May Pp .20. Review of Business and Finance Volume 3, Number I, Jan - June 2001 7 BIBLIOGRAPHY Akjndele R.I., Nassar M.L., Adetayo J.O. (1999): A Nigerian case Study of Performance and Leadership Styles. Ife Social Sciences Review Vol. 17 No. 2 pp. 125-130. Akindele R,l. (2000): An Examination of Self-esteem on Performance: An Analytical Approach to Nigeria, Manufacturing Industry, Advances in Management Vol. 2 No. 1 pp. 8-15 Camp R.C. (1989) Benchmarking Quality Press, Milwankee, Wisconsin Drucker P.P. (1986) Innovation and Entrepreneurship. Pan Books, London, pp. 42 Hattens S. Timothy (1996): Small Scale Entrepreneurship and Beyond. Prentice Hall, N.J. pp. 31 Hayes R.ft, Wheelwright S.C. and Clark K.B. (1988) Measuring Manufacturing. Free Press, New York, pp. 141-149. Leibensteln H. (1968) "Entrepreneurship and Development, American Economic Review. 58, pp. 72-83. McCormick Dorothy (1999) "African Enterprise Clusters and Industrialization: Theory and Reality". World Development. Vol. 27, No. 9, pp. 1531 - 1551. Schumpeter J.A. (1934) The Theory of Economic Development. Harvard University Press, Cambridge, Mass. Pp, 64. Tolentino L. Arturo (1997) Enterprise and Management Development - Training and Development of Entreprenur-Managers of Small Enterprises. Enterprise and Cooperative Department, ILO, Geneva. Walleck A.S., O. Halloran J.O and Leader C.A (1991) Benchmarking World Class Performance, The Mckinsev Quarterly. No. 1 Wood F. and Townsley J. (1983) Managerial Accounting and Finance PITMAN, London pp. 186-197.