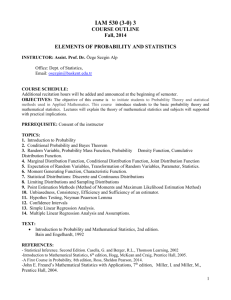

Prof - Stony Brook University

advertisement