Introducing the Creative Grid - Tom Fleming Creative Consultancy

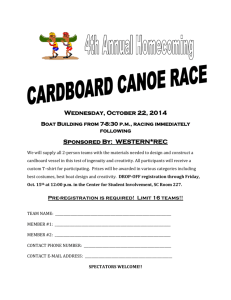

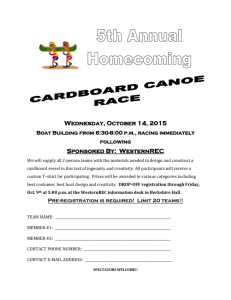

advertisement