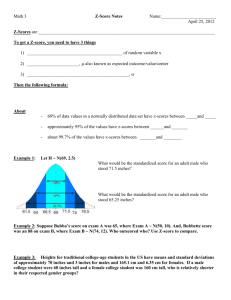

areaundercurve

advertisement

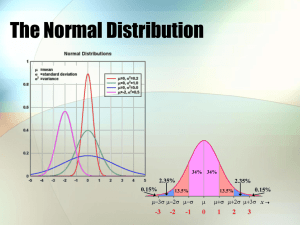

9. QUANTIFYING UNCERTAINTY copied from Sketches in Finance page 22-23 The Gaussian (or Normal) Distribution (or even sometimes the “bell curve”) is one of the more useful and oft used statistical tools in financial analysis and is the basis for measuring risk in stocks and bonds as well as assessing capital projects. The distribution is completely described (or, “fully specified”) with two variables – the expected value and the standard deviation. In a financial application, for example capital budgeting, the expected value might be the most likely dollar value of NPV and the standard deviation would be the measure of how tightly clustered around the expected value possible outcomes will fall. Note: In finance, the units of interest are usually dollars or returns. Other disciplines use other units. 9.1 The Curve and its Area: The bell curve sits above a horizontal axis. The axis represents a continuum of all possible outcomes, ranging from negative infinity through to positive infinity. The distribution is bilaterally symmetrical (by definition) such that a vertical line drawn exactly down through the middle of the curve, the center-line(CL), creates two equally sized areas: the area to the left of a center line which is 50% of the total area under the curve, and the area to the right which is also 50%. These two areas illustrate the notion that there is a 50% probability of getting an outcome less than the expected value, and a 50% probability of getting more than the expected value from this project. The percentage of the area of interest relative to the total area under the curve is a surrogate for the probability of getting an outcome between the right and left bounds of the area of interest. 9.2 Application: Here is a typical application of the Normal Distribution applied to a capital budgeting project. Assume that a capital project has an expected NPV of $100K with a standard deviation of $20K. What is the probability of getting a NPV from the project of more than $75K? Here are the steps required to answer the question: 9.3 Draw the curve. Being able to visualize the different areas beneath the curve is helpful in determining the total area of probability. In this example, one might start by drawing a horizontal line (the continuum of outcomes), then drawing the curve such that the high point (the hump) crests at the expected value, and then drawing the vertical center line down through the hump and through the continuum, passing through the expected value. Note that on the extreme right and left sides the continuum line is assumed to continue forever and that the line of the curve gets closer and closer but never quite touches the horizontal continuum of outcomes. The lines are said to have an asymptotic relationship. 9.4 Draw the Line(s) of Interest”: The sample question (above) addresses probabilities of “more than $75K”. Therefore a vertical line at $75K will bound an area of interest- that is, the area under the curve and to right of the “line of interest”. The upper (right hand) bound is at positive infinity. 9.5 Label the Areas: Label the discrete areas (those areas bounded by a vertical line or infinity) from left to right. [Different questions with different parameters will have different area designations.] In this question, Area A (to the left of the $75K line) represents the probability of getting less than $75K from this project. Area B (between the $75K line and the center line) represents the probability of getting between $75K and $100K. Area C (to the right of the center line) represents the probability of getting more than $100K. 9.6 Calculate the Areas: Determining the size of an area is a 3-step process that can be summarized as: 1) calculate dollars, 2) convert dollars to z-score, 3) convert z-score to area. 1) Determine the distance in dollars on the continuum between the Center Line [@$100K] and the point/dollars of interest [@ $75K], or $100K-$75K=$25K; 2) Convert the dollars in step 1 to a z-score, or number of standard deviations. The calculation is “the continuum length of interest in dollars divided by one standard deviation (in dollars)”; $25K/$20K = 1.25 3) Find the area related to the z-score. While there are several methods to convert z-score to area, let’s use the MS Excel function “=NORMSDIST(z-score)-.5”. In this example: “=NORMSDIST(1.25)-.5” yields an area of .3944. This is the area, i.e. the probability, of getting an outcome between $75K and $100K. The probability of getting over $100K is 50% (.5000) by definition, plus the probability of getting between $75K and $100K is 39.44%, so the probability of getting over $75K is 89.44%. 9.7 Finding Areas (alternatives): There are three popular methods of determining area, given a z-score: 1) Using an MSExcel function, 2) using a table, and 3) using a TI-83 calculator. 1) NORMSDIST(z-score), the Excel function, returns the area from the far left (negative infinity) to a vertical line (the vertical line of interest). Positive z-scores are assumed to be that number of standard deviations to the right of the center line, such that any positive z-score inserted into this Excel function will return an area that includes all the area to the left of the center line (.5000) plus the area from the center line to the vertical line of interest. Negative z-scores are assumed be measured to the left of the center line, such that NORMSDIST(z-score) will return an area that is less than .5000. 2) Table: There is a z-score table available at http://oz.plymouth.edu/~harding/FINANCE/normsdist.xls. Use the left-hand column to look up z-scores given to one place past the decimal. View to the right (in the same row) to narrow the z-score to two places past the decimal. Caveat: Areas shown in the table relate to positive standard deviations and areas adjacent to the center line. 3) TI – 83: Use [2nd] function key, plus [VARS] key to get a menu. Cursor down to the 2nd option. Enter. This yields “Normdistcdf(… “. The (upperlimit, lowerlimit) of the area of interest are entered into the parenthesis as z-scores, where the z-score of the centerline is 0.00 and the z-score of infinity is expressed in engineering notation as “ 1E99” [Note: [2nd] + [EE]= “E”]