SAP HR Payroll India: INVAL Module & 40ECS Feature

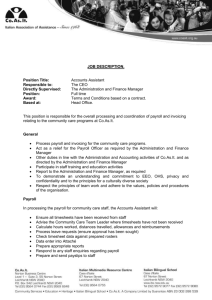

advertisement