Consultation Paper “Three-year Revenue and Capital Settlements”

advertisement

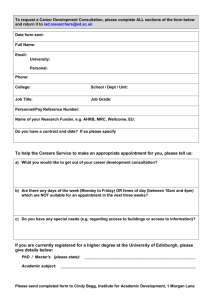

FINANCIAL POLICY PANEL 8 FEBRUARY 2005 ITEM 4 CONSULTATION PAPER ON THREE YEAR REVENUE AND CAPITAL SETTLEMENTS Report of the: Director of Finance Contact: John Turnbull Urgent Decision?(yes/no) No If yes, reason urgent decision required: Annexes/Appendices (attached): Annexe 1: Annexe A to the Consultation Paper – summary of questions. Other available papers (not attached): ODPM Consultation Paper “Three-year Revenue and Capital Settlements” dated December 2004 This report introduces the latest finance consultation paper from the ODPM on three year grant settlements Notes RECOMMENDATION S That the Panel:(1) Notes the receipt of the consultation paper on three year grant settlements; (2) Agrees that the consultation response is prepared by the Director of Finance and submitted by the Chairman, following receipt of comments from Panel members.. 1. Implications for Community Strategy, the Council’s Key Corporate Objectives and the Committee’s Key Service Priorities 1.1. None for the purpose of this report 2. Introduction 2.1. The ODPM issued a consultation paper in December on three year revenue and capital finance settlements 2.2. The deadline for response is 11 March 2005. 3. Objectives of the Consultation Paper 3.1. The ODPM’s stated objectives are: Page 1 of 3 There should be greater certainty in funding for local services delivered by local, police and fire and rescue authorities. Authorities should know earlier than they do now how much funding they will receive from Government and should have as much certainty as possible about funding for the second and third years of the Spending Review period. D:\106749269.doc FINANCIAL POLICY PANEL 8 FEBRUARY 2005 ITEM 4 Authorities should use this greater certainty to considerably strengthen their financial management, especially forward planning and using resources more efficiently. A longer financial horizon will give authorities more clarity about what is affordable and provide a firmer basis for making decisions about priorities. Organisations and projects that rely on authorities for funding should also benefit and authorities should introduce their own multi-year approach to funding. It would be beneficial for organisations other than Government that fund local authorities, for example Regional Development Agencies, also to provide threeyear funding certainty to authorities. There should be better management of risks at the local level, leading to greater stability in council tax. Keeping budget and council tax increases to a reasonable level will remain essential and authorities should be expected to mirror greater stability in funding with greater stability in both of these. Increasing flexibility, autonomy and accountability at the local level. Giving authorities funding certainty over three years will offer them greater freedom to plan, and give council tax payers greater certainty on future levels of council tax. 3.2. The consultation paper raises questions on the operation the proposed system in relation to the following : The formula grant settlement Specific revenue grants Capital Allocations Three year budget and council tax information 3.3. A copy of the 38 page consultation paper has been placed in the Members’ room. Copies can also be accessed on-line on the ODPM website at the following address http://www.odpm.gov.uk . 3.4. The questions asked in the consultation paper are summarised at Annexe A to the consultation paper and have been included at Annexe 1 to this report for ease of reference. 4. Proposals 4.1. The Director of Finance is discussing the questions raised in this paper with relevant finance advisory bodies (LGA finance and the IPF Finance Advisory Network) so that the potential impact on the Council can be assessed before responding. 4.2. Some of the issues that are causing concern on the current annual process and that the Council would want to be addressed in any outcome from consultation are outlined below. 4.3. Changes to the grant formula have left the Council ‘protected’ by grant floors so that there should not be revenue support grant loss. This reflects a situation where central government has reassessed our grant entitlement at a lower level than we previously Page 2 of 3 D:\106749269.doc FINANCIAL POLICY PANEL 8 FEBRUARY 2005 ITEM 4 received. In practice, formula grant changes, such as. the recent change on housing and council tax benefit subsidy, have not resulted in the Council being fully protected by the grant floor. 4.4. The Council is currently receiving less capital funding support than others in relation to some of its expenditure on statutory investment:4.4.1. On disabled facilities grants the capital reimbursement was previously 60% of all expenditure with the Council meeting the cost of the remaining 40%. Central Government grant is now cash limited and the significant increase in entitlement to mandatory DFG payments has not been reflected in the latest cash allocations, possibly because the allocations are based on historic levels of expenditure rather than current and projected costs. 4.4.2. On contaminated land capital costs the government is planning to reimburse notional debt charges through the revenue support grant formula. As identified above, this will increase our grant entitlement calculation but will not result in any real contribution to costs because the actual revenue support grant is only increased at the floor (or minimum increase) for District Councils. 4.5. Finally, on the three-year budget and council tax information the paper discusses controls to restrict departure from three-year budget plans. Whilst the Council has been pro-active in preparing three (and four) year budget forecasts and publishing these, the impact of enforcement of those plans is one that the Council is likely to find unacceptable. Council Tax currently contributes some £4m per annum of the Council’s turnover of around £30 million. This ‘gearing’ combined with recent changes in the grant formula have put significant pressures on district council budgets with increasing use of working balances and other reserves, in particular to manage unforeseen loss of income or increased expenditure. Further government-imposed constraints on council tax will result in less flexibility for Councils and will have an adverse impact on service and financial management unless a successful outcome to the ‘Balance of Funding’ review is achieved. 5. Proposal 5.1. The deadline for consultation responses is unfortunately just before the next meeting of the Panel which is on 15 March 2005. To ensure this deadline is met it is proposed that: 5.1.1. the Director of Finance prepares a draft response and circulates it to Panel members for their comments; 5.1.2. A response is then submitted by the Chairman; 5.1.3. A copy of the response is sent to all Panel members. 6. Financial and Manpower Implications 6.1. None for the purpose of this item. WARD(S) Affected: All Page 3 of 3 D:\106749269.doc