Chapter Review

advertisement

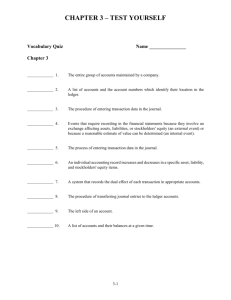

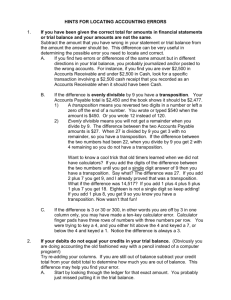

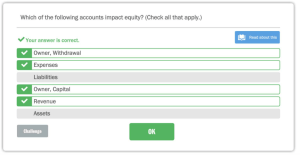

CHAPTER 2 Analyzing Business Transactions REVIEWING THE CHAPTER Objective 1: Explain how the concepts of recognition, valuation, and classification apply to business transactions and why they are important factors in ethical financial reporting. 1. 2. Before recording a business transaction, the accountant must determine three things: a. When the transaction should be recorded (the recognition issue) b. What value, or dollar amount, to place on the transaction (the valuation issue) c. How the components of the transaction should be categorized (the classification issue) Normally, a sale is recognized (entered into the accounting records) when title to the merchandise passes from the supplier to the purchaser, regardless of when payment is made or received. This point of sale is referred to as the recognition point. a. Some business events, such as the hiring of a new employee, are not recordable transactions. b. Other business events, such as payment to an employee for work performed, are recordable transactions. 3. The cost principle states that business transactions should be recognized at their original cost (also called historical cost). In this case, cost refers to a transaction’s exchange price—a verifiable measure based on the agreement between the buyer and the seller—at the point of recognition. Generally, any change in value that occurs after the original transaction is not reflected in the accounting records. 4. Ethical financial reporting requires that accountants apply generally accepted accounting principles when dealing with recognition, valuation, and classification issues. For example, when a company overstates its revenue, it has violated the guideline of recognition. When an asset is reported at an inflated dollar amount, for example, the guideline of valuation has been violated. And when expenses, for example, are treated as assets, the guideline of classification has been violated. Significant, intentional violations are viewed as fraudulent. Objective 2: Explain the double-entry system and the usefulness of T accounts in analyzing business transactions. 5. Every business transaction is classified in a filing system consisting of accounts. An account is the basic storage unit for accounting data. Each asset, liability, and component of owner’s equity, including revenues and expenses, has a separate account. 6. The double-entry system of accounting requires that one or more accounts be debited and one or more accounts be credited for each transaction and that total dollar amounts of debits equal total dollar amounts of credits. 7. A T account shows an account in its simplest form. It has three parts: a. A title that expresses the name of the asset, liability, or owner’s equity account 8. 9. b. A left side, which is called the debit side c. A right side, which is called the credit side To prepare the financial statements at the end of an accounting period, the accountant calculates the balance of each account (also called the account balance). Using T accounts to determine the account balances involves the following steps: a. Foot (add) the debit entries, and do the same with the credit entries. b. Write the footings (totals) for debits and credits in small numbers beneath the last entry in each column. c. Subtract the smaller total from the larger to determine the account balance. A debit balance exists when total debits exceed total credits; a credit balance exists when the opposite is true. To determine which accounts are debited and which are credited in a given transaction, accountants use the following rules: a. Increases in assets are debited. b. Decreases in assets are credited. c. Increases in liabilities and owner’s equity are credited. d. Decreases in liabilities and owner’s equity are debited. e. Revenues and capital invested into the business increase owner’s equity, and are therefore credited. f. Expenses and withdrawals decrease owner’s equity, and are therefore debited. 10. A normal balance for an account is determined by whether it is increased by entries to the debit side or by entries to the credit side. The side on which increases are recorded dictates the account’s normal balance. For example, asset accounts have a normal debit balance, and liability accounts have a normal credit balance. Objective 3: Demonstrate how the double-entry system is applied to common business transactions. 11. Analyzing and processing transactions involves five steps: a. Determine the effect (increase or decrease) of the transaction on assets, liabilities, and owner’s equity accounts. Each transaction should be supported by a source document, such as an invoice or a check. b. Apply the rules of double entry. c. In journal form, enter the transaction into the journal (discussed in paragraph 22). A single transaction can have more than one debit or credit; this is called a compound entry. d. Post the journal entry to the ledger (discussed in paragraph 23). e. Prepare the trial balance (discussed in paragraphs 14 and 15). 12. To record a transaction, one must obtain a description of the transaction, determine the accounts involved in the transaction and the type of each account (e.g., asset or revenue), ascertain the accounts that are increased and decreased by the transaction, and apply the rules described in paragraph 9. 13. For example, if the transaction is described as “purchased office supplies on credit,” the transaction analysis would proceed as follows: From the wording, one can determine that the accounts involved are Office Supplies and Accounts Payable. One can also determine that the transaction has increased both accounts. Applying the rules of double entry, an increase in an asset—Office Supplies, in this case—is debited, and an increase in a liability—Accounts Payable—is credited. Objective 4: Prepare a trial balance, and describe its value and limitations. 14. Periodically, the accountant must check the equality of the total of debit and credit balances in the ledger. This is done formally by preparing a trial balance. The trial balance is not a published financial statement, but simply a work-paper listing of the accounts (typically in their order of appearance in the financial statements) with their end-of-period balances (debit or credit). 15. If the trial balance does not balance, one or more errors have been made in the journal, ledger, or trial balance. The accountant must locate the errors to put the trial balance in balance. It is important to realize that certain errors will not put the trial balance out of balance (such as the accidental omission of an entry); in other words, the trial balance cannot detect all errors. a. Incorrectly recording a debit as a credit, or vice versa, will cause the trial balance to be out of balance by an amount that is evenly divisible by 2. b. Transposing two digits (for example, writing $137 instead of $173) will cause the trial balance to be out of balance by an amount that is evenly divisible by 9. Objective 5: Show how the timing of transactions affects cash flows and liquidity. 16. One of the most important objectives of management is to maintain an adequate level of liquidity. Stated simply, a business must be able to pay its bills on time. Thus, it is important to understand which transactions will generate immediate cash (or require immediate payment), and which will not. When a business generates revenue or incurs an expense, it hasn’t necessarily experienced an accompanying cash flow. Management can help manage its cash flows by, for example, giving customers incentives for paying early and doing business with suppliers who will allow them to buy now and pay later. Supplemental Objective 6: Define the chart of accounts, record transactions in the general journal, and post transactions to the ledger. 17. All of a company’s accounts are contained in a book or file called the general ledger (or simply the ledger). In a manual accounting system, each account appears on a separate page. The accounts generally are in the following order: assets, liabilities, owner’s equity, revenues, and expenses. A list of the accounts with their respective account numbers, called a chart of accounts, is presented at the beginning of the ledger for easy reference. 18. Although the accounts that companies use vary, some are common to most businesses. Typical asset accounts are Cash, Notes Receivable, Accounts Receivable, Prepaid Expenses, Land, Buildings, and Equipment. Typical liability accounts are Notes Payable, Accounts Payable, and Wages Payable. 19. The owner’s Capital account (an owner’s equity account) represents the owner’s investment at a point in time. If Dan Weber is an owner, the title of the account would be Dan Weber, Capital. If there is more than one owner, each must have a separate Capital account. 20. The owner’s Withdrawals account (also an owner’s equity account) records amounts withdrawn from the business for personal use. If Rachel Evans is an owner, the account would be called Rachel Evans, Withdrawals. As with the Capital account, there must be a separate Withdrawals account for each owner. 21. A separate account is kept for each type of revenue and expense. The exact revenue and expense accounts used vary according to the type of business and the nature of its operations. Revenues cause an increase in owner’s equity, whereas expenses cause a decrease. 22. As transactions occur, they are first recorded chronologically in a book called the journal (sometimes called the book of original entry). A separate journal entry is made to record each transaction; the process of recording the transactions is called journalizing. The general journal is the simplest and most flexible type of journal. Each entry in the general journal contains the date of the transaction, the account names, the dollar amounts debited and credited, an explanation of the transaction, and the account numbers if the transaction has been posted to the ledger. A line should be skipped after each journal entry. 23. The general journal records the details of each transaction; the general ledger summarizes these details. Each day’s journal entries must be transferred to the appropriate account in ledger account form. The process of transferring information from the journal to the general ledger, which updates each account balance, is called posting. The dates and amounts are posted to the ledger, and new account balances are calculated. The Post. Ref. columns are used for cross-referencing between the journal and the ledger. 24. Ruled lines appear in financial reports before each subtotal, and a double line customarily is placed below the final amount. Although dollar signs are required in financial statements, they are omitted in journals and ledgers. On paper with ruled columns, commas and decimal points are omitted, and a dash frequently is used to designate zero cents. On unruled paper, however, commas and decimal points are used. 25. Cash return on assets is a measure of liquidity that shows how much cash is generated by each dollar of assets. Expressed in terms of a percentage, it equals Net Cash Flows from Operating Activities divided by Average Total Assets. Summary of Journal Entries Introduced in Chapter 2 A. (LO3) Cash P. Treadle, Capital Owner invested cash into business XX (amount received) XX (amount invested) B. (LO3) Prepaid Rent Cash Paid rent in advance XX (amount paid) XX (amount paid) C. (LO3) Office Supplies Accounts Payable Purchased office supplies on account XX (purchase price) XX (amount paid) D. (LO3) Office Equipment Cash Accounts Payable Purchased office equipment, partial payment made XX (purchase price) XX (amount paid) XX (amount owed) E. (LO3) Accounts Payable XX (amount paid) Cash Made payment on a liability XX (amount paid) F. (LO3) Cash Design Revenue Received payment for services rendered XX (amount received) XX (amount earned) G. (LO3) Accounts Receivable Design Revenue Rendered service, payment to be received at later time XX (amount to be received) XX (amount earned) H. (LO3) Cash Unearned Design Revenue Received payment for services to be performed XX (amount received) XX (amount received) I. (LO3) Cash Accounts Receivable Received payment from credit customer XX (amount received) XX (amount received) J. (LO3) Wages Expense Cash Recorded and paid wages for the period XX (amount incurred) XX (amount paid) K. (LO3) Utilities Expense Accounts Payable Recorded utility bill, payment to be made at later time XX (amount incurred) XX (amount owed) L. (LO3) P. Treadle, Withdrawals Cash Owner withdrew cash from the business XX (amount declared) XX (amount paid)