Closing Sponsored Projects Accounts

advertisement

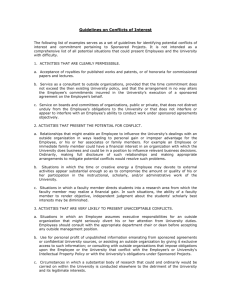

Research Development and Administration Sponsored Projects Administration 2525 S.W. 1st, Suite 220 Portland, OR 97201 Mailcode AD220 (503) 494-0355 Fax (503) 494-1191 CLOSING SPONSORED PROJECTS ACCOUNTS Checklist In order for OHSU to be compliant with OMB A-110 “UNIFORM ADMINISTRATIVE REQUIREMENTS FOR GRANTS AND AGREEMENTS WITH INSTITUTIONS OF HIGHER EDUCATION, HOSPITALS, AND OTHER NON-PROFIT ORGANIZATION,” closeout procedures should be established and adhered to. The Federal regulations indicate the institution shall liquidate all obligations incurred under the award not later than 90 calendar days after the funding period or the date of completion as specified in the terms and conditions of the award or in agency implementing instructions. Currently, there are several hundred accounts with expired budget end dates that need to be closed. In order to close these accounts and ensure compliance with Federal regulations and OHSU’s “Chart of Account Disabling Procedures,” principal investigators and unit administrators need to help SPA with the following: UNALLOWABLE EXPENSES – In accepting grants and contracts from the Federal government, OHSU agrees to abide by the regulations governing the use of these funds. In order to comply with OMB A-21 guidelines and the Cost Accounting Standards – CAS 502 and 505, OHSU must ensure expenses charged directly to sponsored projects are reasonable, allocable, treated consistently, allowable and that there are available sponsor funds. To help ensure OHSU is compliant and consistently follows disclosed accounting practices, the following six object codes have been established to classify expenses that are normally reimbursed by the Federal government through the indirect cost rate. Any expenses directly charged to sponsored projects in the following six object codes have to be justified as to why they are atypical and should be directly charged: Office and Administrative Supplies Books, Periodicals, Subscriptions Postage Telecommunication Duplicating and Copying Memberships in Professional Organizations OVERDRAFTS – In order to comply with OHSU’s Policy No. 04-40-005 on “OVERDRAFTS ON SPONSORED ACCOUNTS”, principal investigators and unit administrators must ensure the reasonableness and appropriateness of all charges on the projects, incur expenditures within authorized limits, and appropriately resolve unfunded balances. If a project has ended and there are expenses in excess of the budget which will not be reimbursed by the sponsor, an overdraft has occurred. The overdraft must be absorbed by a non-sponsored account. PAYROLL DISTRIBUTION - Sponsored projects that have an expired budget end date and still have payroll distributed to it can’t be disabled and closed. Disabling an account in Oracle will forbid future postings to the account. Closing the account is necessary to properly account for the status of an account and ensure it has a zero balance. SPA will e-mail unit administrators on a monthly basis with a listing of accounts that need to be disabled and closed, but still have payroll distributed to it. The unit administrators need to prepare the necessary paperwork to remove these individuals from the expired sponsored project account. INVOICE ON HOLDS – Sponsored projects that have “invoices on hold” problems after the budget expiration date can’t be disabled and closed. Unit administrators need to print the “Invoices on Hold by Fund/Org Report” and work with Accounts Payable and Purchasing to resolve these problems. OPEN PURCHASE ORDERS – Sponsored projects that have “open purchase orders” after the budget expiration date can’t be disabled and closed. Unit administrators need to print the “Open Purchase Orders Report” and work with Purchasing to resolve. SPA appreciates the principal investigators’ and unit administrators’ efforts in ensuring sponsored projects are closed in a timely manner. Further, this will help reduce the risk of any government refunds and/or fines and possible loss of Expanded Authorities.