Travel-CME Expense Reimbursement Guidelines April 2012

advertisement

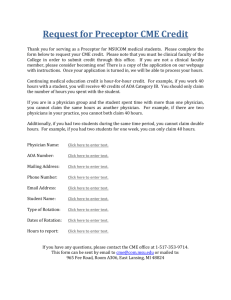

CME Expense Reimbursement Guidelines and Procedures Community Hospital Emergency Physicians (Does Not Apply to Tertiary ED Physicians) (Effective April 1, 2007) (Revised April 3/12) The new collective agreement for Community Hospital Emergency Physicians signed July 1, 2007 has the following wording in paragraphs 20:01 & 20:02 “Upon the completion of twelve (12) months of service with the WRHA, the WRHA shall, on an annual basis, grant an educational leave to each physician of five (5) days (40 hours) with pay at the non-clinical hourly rate as set out in Schedule “1”. The WRHA shall, upon presentation of receipts, reimburse each physician for CME expenses (including conference costs, travel and accommodation expenses, educational materials, journals, etc.) up to a maximum of $3,200.00 per year.” The following guidelines and procedures indicate how reimbursement will be applied: 1. If a CME event is being held on a day(s) that the ED Physician is scheduled to work, then that ED Physician must ensure that appropriate alternate medical coverage is arranged with his / her Medical Director before attendance can be approved. 2. A maximum of $3,200 for reimbursement of CME expenses will be available for each salaried physician for each fiscal year starting April 1, if that physician has committed to at least 0.25 EFT (350 worked hours per year). 2.1. A newly hired physician is eligible for reimbursement of the $3200 pro-rata to the amount of time in the emergency program, relative to the 12 months prior to the educational events or purchases. Example: If the physician started his/her commitment to the Emergency Program on November 1, 2006 and attended an Emergency Medicine conference on September 1, 2007, then he/she would be entitled to 10 / 12 x $3200 = $2667 of reimbursed expenses for that event. (If the event occurred November 1, 2007, then he/she would be entitled to the full $3200, which would use up all of the entitlement for Apr 1/07 to Mar 31/08. Also, if the event occurred on September 1, 2007 and then, after November 1, 2007 but before April 1, 2008 he/she had other CME expenses, those additional expenses would eligible for reimbursement up to $3200 - $2667 = $533). 2.2. An unpaid leave of absence will not reduce the $3,200 available, unless this is for a physician who has not yet worked for a full 12 months in the Emergency Program at the time the LOA starts. 2.3. Unused portions of the eligible amount as at March 31 of any given fiscal year cannot be carried forward into the next fiscal year. 2.4. Any expense related to an educational event / conference will be included in the fiscal year in which the event actually took place. If the event started at the end of March and finished in the beginning of April, the physician has the option of including the full amount in either fiscal year or it can be allocated to both years pro rata to actual days. Page 1 of 5 3. Expenses are only eligible for reimbursement by the Emergency Program if they are incurred directly by the physician and will not be reimbursed by any other party AND if they relate to CME associated with the practice of Emergency Medicine. If there is any doubt as to whether or not an educational event would be considered as relevant to the practice of Emergency Medicine, then the physician should apply to have CME expenses reimbursed in advance of committing to attend an educational event or make an educational purchase. If the CME event/expense clearly relates to Emergency Medicine, then advance approval is not necessary. 3.1. When obtaining advance approval, the Physician should complete a "Travel Request Form" (copy attached) with total cost estimates prior to committing to an educational event or purchase 3.2. The “Travel Request Form” should be signed by the physician’s site Emergency Department Medical Director to indicate that the educational event or purchase is relevant to the work in the Emergency Department. 3.3. The completed form should be sent to the Laurie Perkins, Admin Assistant, WRHA Emergency Program, c/o St. Boniface Hospital, Room L1019, 409 Tache Avenue, Winnipeg, R2H 2A6. 4. After the educational event or purchase is complete, original receipts totaling the amount of reimbursement (excluding the per diem meal allowances) must be sent to the Laurie Perkins (see address in 3.3 above) with a signed “Expense Claim Form”. 4.1. Note that if the purchase is made over the internet and an e-mail receipt is received, the Finance Department requires that the original credit card statement be submitted as proof of payment, otherwise they will not reimburse the expense. This credit card statement will be returned by Finance, if such a request accompanies the Expense Claim Form. 5. Reasonable expenses include: 5.1. Registration fees / tuition / examination fees to courses, seminars or conferences that are relevant to the work of an Emergency Physician. 5.2. Economy airfare and ground transportation to attend an approved event. (A physician may use their automobile for travel when other transportation in unavailable or if the per kilometer allowance of $0.41 per kilometer (starting Apr 1/12 and previously $0.40 per kilometer effective Jan 1/11) is less expensive than commercial carrier – reimbursement will not exceed the amount that would have been paid for travel with a commercial carrier at economy fares). 5.3. Single-occupancy, standard room hotel accommodation for the days of the event plus the night before (at the lowest conference discount rates advertised), 5.4. Per diem meal allowance (no receipts required) for the days of the event (if at least one over-night stay is required) as per the table below. Prior to January 1, 2011: Per Diem Day of Travel to Event (if the day before the event) $22 Day(s) of Event $45 minus the following for any meals provided by the event: -breakfast $7 -lunch $10 -dinner $20 Day of Travel Returning from Event (if the day after the event) $22 Page 2 of 5 Per Diem Rates Effective January 1, 2011 (no receipts required) Hours Canada Canada (Claim only if traveling during (Below 53rd (Above 53rd noted times) Parallel) Parallel) U.S. (U.S.$) Meals 7 – 9 a.m. $10 $12 $10 Lunch 11 a.m. – 1 p.m. $13 $14 $13 Dinner 5 – 7 p.m. $27 $29 $27 Incidentals For every 24 hour period away $10 $10 $10 Per Diem Total for 24 hours $60 $65 $60 Breakfast Notes: minus above amounts for meals provided by event Meals - Traveling time (+ 1 hour before departure & after arrival) must include all of the Hours noted above in order to claim the corresponding meal. Incidentals - Travelers must be away for the entire 24-hours in order to claim for that day 5.5. Prior to January 1, 2011 the per diem rate does not apply to one-day trips outside of Winnipeg where actual expenses with original receipts will be reimbursed up to the following maximums: Breakfast $7 Lunch $10 Dinner $20 Effective January 1, 2011 where the Traveler is away for less than 24 hours the per diem allowance shall only be paid for meals worked through, as set out in the January 1, 2011 table above. 5.6. Educational material including books, journals, PDA’s with medical software, initial cost of Blackberry (or equivalent hand held devices including electronic tablets) for accessing on-line medical reference web-sites and / or medical software (but not monthly operating costs of Blackberry/equivalents), on-line subscriptions for journals or medical reference web-sites, or medical computer software to run on a PC (but does not include the cost of a PC or laptop computer nor the cost of an internet connection). CME Questions Answered: 1. Is a percentage of home/office internet access costs considered allowable as a CME reimbursement cost? NO. Page 3 of 5 2. If an online subscription to a CME website is purchased in one fiscal year but is more than two years in duration, can we include half the subscription cost as a reimbursement cost for the subsequent year? YES – WE COULD EITHER INCLUDE THE FULL 2 YEAR COST IN THE YEAR THAT YOU MADE THE PAYMENT, OR WE COULD SPLIT IT OVER THE 2 (OR MORE) YEARS PRO RATA TO THE NUMBER OF DAYS THAT THE SUBSCRIPTION FALLS INTO EACH FISCAL YEAR – WHICHEVER YOU CHOOSE. 3. If we did not use the CME program in a prior fiscal year, how long can we go back to submit the unused expenses? ie: I did not use any CME reimbursement for 2009-2010, can I still submit costs for that year? YES – YOU CAN GO BACK AND CLAIM COSTS INCURRED IN PRIOR YEARS – WE DON’T HAVE A TIME LIMIT, BUT WOULD STILL REQUIRE ORIGINAL RECEIPTS. 4. The CME payments that I have submitted for 2010 and for which you reimbursed me, in which box do they appear on the T4 slip, Box 14 or 40? Revenue Canada requested more info and wanted to know if I am eligible to deduct those payments? – ANSWER: As we require you to send us the original receipts, we do not include the reimbursement in your T4 at all. Since the reimbursement is not included in taxable income, you cannot claim the original (reimbursed) CME cost as an expense against your taxable professional income. 5. Can we include part of our CAEP membership dues as educational expenses under journals for the emergency medicine journal CAEP publishes much in the same way Doctors Manitoba allows CMA deduction for the CMAJ? – NO (SAME FOR CCFP DUES AND FRCP DUES) AS THIS IS CONSIDERED PRIMAMILY A MEMBERSHIP DUE AS OPPOSED TO THE COST OF A JOURNAL. 6. A number of practice eligible physicians will need to obtain the CCFP family practice designation prior to challenging the CCFP (EM) exam. There is currently an Alternate Route to Certification (ARC) available for the CCFP. This route exempts physicians from sitting the Family Practice exam, and instead offers a self-directed computer base CME program, completion of which results in CCFP certification (see: http://www.cfpc.ca/ARC/). It must be completed within an 18-month period and in addition to certification, results in 15 Mainpro-C and 15 Mainpro M1 CME credits. I was wondering if community emergency physicians could use there WRHA CME stipend to cover the registration fee (~$2228.00)? – YES (SINCE THIS IS A FIXED 18-MONTH PERIOD, THE PHYSICIAN COULD OPT TO HAVE THE FULL AMOUNT CLAIMED IN ANY FISCAL YEAR IN WHICH THE 18-MONTH PERIOD FALLS, OR TO HAVE IT PRO RATED TO FISCAL YEARS BASED ON THE NUMBER OF DAYS IN EACH FISCAL YEAR FOR THAT 18-MONTH PERIOD) Page 4 of 5 7. Is the CCFP (E.M.) exam itself (registration fee $2422.00) eligible for reimbursement since studying for the exam is felt to be a CME exercise in and of itself, and 25 MainproC CME credits are awarded upon completion. In addition to the registration fee, there are travel costs, as the exam is only held in Toronto. So, would community emergency physician be able to use there WRHA CME fund to off-set the cost of the registration and/or travel expenses for this examination? – ANSWER: YES; however, the physicians should be careful to ensure that the payment for the on-line course (and at least some of the course’s duration) falls in one fiscal year (ending March 31) and the exam date falls in a subsequent fiscal year. This is because we use the date of the educational event to determine which year’s $3200 CME allowance gets charged (but if a single educational event falls over 2 fiscal years, the physician can choose either of the 2 fiscal year’s to make the claim or allocate the cost over all of the affected fiscal years pro rata to the actual days of the educational event). 8. A group of ER docs from our site are interested in starting a "practice based small group" for CME and in particular to earn Mainpro C credits to maintain our CCFP(EM) status. I have attached the registration form for the Foundation for Medical Practice Education, which describes the process. This organization exists solely to provide CME. In return for membership you get access to their CME materials and recognition of your CME activities as qualifying for Mainpro C credits required for maintenance of qualification with the College of Family Physicians (including the maintenance of one's CCFP(EM) status) providing you meet their criteria and follow their process. The fee is $310 per member and $305 for the facilitator. Plus the facilitator must travel to one of the training sites for initial training. Can our group get reimbursed for both registration fees and for travel expenses for the facilitator? ANSWER: YES – since the ongoing membership fee provides access to on-going training material that isn’t otherwise available. 9. The airline that I flew charges extra for each checked bag – is that claimable? IF THE AIRLINE CHARGES FOR THE 1ST CHECKED BAG, WE WILL REIMBURSE FOR THE 1ST BAG. HOWEVER, WE WON’T REIMBURSE FOR ANY CHARGES RE A 2ND BAG (EVEN IF THE 1ST BAG WAS CHECKED FOR FREE). Page 5 of 5