Tackling Taxes

advertisement

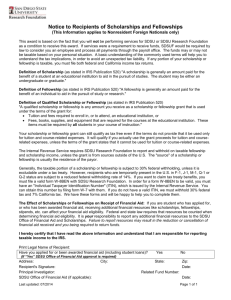

Taxation of Scholarships and Fellowships Tax Resources and Reporting - UM Tax Questions from Students Who Receive Scholarships or Fellowships What portion of a scholarship or fellowship is taxable to the student? Does the University withhold any taxes or file any reports on the student’s behalf? Are the tax consequences the same for foreign persons? Is the student obliged to file with any state agency on the taxable portion? Taxation of Scholarships and Fellowships The general rule is that any income is subject to federal taxation. Scholarships and fellowships, however, are excluded from taxation when the award is a ‘qualified scholarship’ given to the recipient who is a candidate for a degree that is made for the purpose of studying or conducting research at an educational institution. Qualified scholarship is defined to include tuition and fees required for enrollment or attendance at the educational institution and fees, books, supplies or equipment ‘required for courses of instruction’ at the institution. There has been some controversy over the meaning of the phrase ‘required for courses of instruction’ with the Internal Revenue Service (IRS) taking a narrow view. For example, the IRS has taken the position that the purchase of personal computers and payment of thesis/dissertation expenses (computer time, travel, etc.) were not ‘qualified’ uses of scholarship funds. Further, the student may be subject to self-employment taxation or FICA taxes if the student either performs services for the educational institution as a condition for receiving the scholarship or fellowship grant or is required to perform services for the grantor in return for the educational assistance provided. Tax Payments and Filing Requirements If any portion of the scholarship or fellowship grant does not meet the exception as a ‘qualified scholarship’ payment and, thus, is deemed to be taxable income, a payment and reporting responsibility typically arises. Please note that if the payment constitutes ‘wages’ paid to an employee, the University Payroll department will withhold taxes and make FICA payments for the taxable portion on the student’s behalf and will issue a form W-2, Wage and Tax statement, both to the IRS and to the student at the end of the year. An example includes those students who 1 Taxation of Scholarships and Fellowships Tax Resources and Reporting - UM perform services for the University as a condition for receiving the scholarship or fellowship. When these payments, however, do not constitute wages, the tax burden shifts to the students. Unlike most situations in which the recipient receives some notification from the educational institution for payments made, such as, a form 1099-Misc, miscellaneous income, the IRS has precluded universities from bearing any withholding or reporting obligations accordingly. Thus, importantly, the student is solely responsible to inform the IRS of the taxes due and to make these payments on a quarterly basis throughout the current tax year. Estimated taxes for the calendar year end are due in four installments; April 15th, June 15th, September 15th of the current year and January 15th of the following year. Payments should accompany a form 1040-ES with the student’s social security number listed on the form. Failure to make these payments timely may result in the assessment of underpayment penalties. To avoid this penalty the student may (1) pay at least 90% of the tax shown on the current year’s return, (2) pay 100% of the tax shown on the prior year’s return assuming that the return represents a 12 month period, or (3) make payments on a current basis using the annualized income installment method. Note that no penalty for failure to pay estimated taxes will apply to an individual whose tax liability for the year, after credit for withheld taxes, is less than $1,000. Scholarship and fellowship recipients should retain fee statements, textbook receipts and similar records to support their calculations of the nontaxable and taxable portions of their awards. Foreign Persons Special rules apply to foreign persons classified as non-resident aliens. The IRS requires educational institutions to report scholarship and fellowship grants to non-resident aliens on form 1042S-Foreign Person’s U.S. Sourced Income Subject to Withholding. Prior to 2001, schools were required to report the nontaxable scholarship or fellowship amounts, but beginning with payments made in 2001, reporting of these payments is no longer required. Accordingly, it is the responsibility of the foreign person to determine that the withheld amount is correct, i.e. whether a tax treaty exemption applies, whether the reduced withholding rate applies, etc. State Filing Requirements State taxing agencies tend to follow the Internal Revenue Code (IRC) when taxing income and, thereby, recognize the exception for scholarships and fellowships. The corollary is that the income that the IRC deems subject to taxation is also subject to taxation by these states agencies unless a specific exception is applied. If the student files a federal return, he or she will most likely file a corresponding state return. 2 Taxation of Scholarships and Fellowships Tax Resources and Reporting - UM The student may file more than one state income tax return if the state in which the scholarship was earned is different from the student’s state of domicile. Domicile is determined by the student’s intent to reside. The student should be sure to file a credit form with the ‘domicile’ return to avoid double taxes. Also, if the student moved during the year to the state in which the grant was earned, he or she may have to file two state income tax returns as a part-year resident in both states. Under these circumstances, no credit form is necessary. More Information WWW.IRS.GOV includes publications that provide further information. For specific information please refer to the following publications; IRS Publication 17 – Your Federal Income Tax IRS Publication 505 – Tax Withholding and Estimated Tax IRS Publication 515 – Withholding of Tax on Nonresident Aliens and Foreign Entities IRS Publication 519 – U.S. Tax Guide for Aliens IRS Publication 970 – Tax Benefits for Education Please check the Tax Department internal website at http://tax.umich.edu for out-of-print publications IRS Publication 4 - Student's Guide to Federal Income Tax IRS Publication 520 - Scholarships and Fellowships Although no longer in print, the rules have not changed. Students may still find these documents very useful. 3