B221077

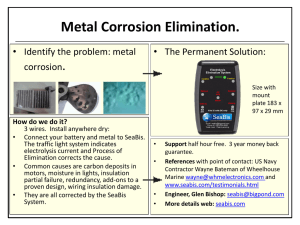

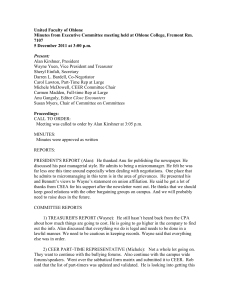

advertisement