Chapter 4: Managers and boards

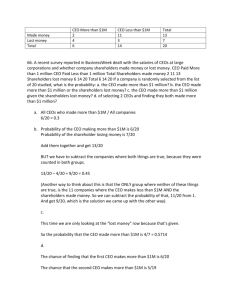

advertisement