Word - University of Southern California

advertisement

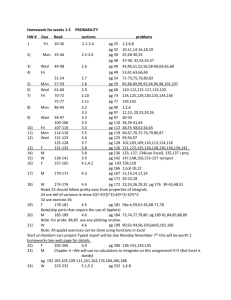

SYLLABUS ISE 563 - FINANCIAL ENGINEERING Spring 2014 Instructor: Phone: E-mail: Class times and Places: Office Hours: Teaching Assistant: Phone during office hours: E-mail: Office Hours: John Schroeder (949) 922-3264 cell john.schroeder@usc.edu Early section Mondays & Wednesdays 3:30 – 4:50 in OHE 132 Later section – Mondays & Wednesdays 5:00-6:20 PM in GFS 118 Wednesdays 1:00pm to 3:00pm in GER 2016C and by appointment DEN students can arrange telecons as needed. Phone during office hours: (213) 740 0867 or cell: (949) 922 3264 TBD TBD tbd tbd Textbook: Options, Futures, and other Derivatives 8th Edition by John C. Hull ISBN 9780132777421 or ISBN 9780132164948 (international edition) Class Notes: Lecture slides will be posted on the Distance Education Network (DEN). They are posted by 12:00 noon the day of class. If revisions occur after posting, they are re-posted the day after class. Additional Reading Assignments: Supplemental reading will occasionally be required. Such material will be posted on DEN prior to the assignment. Website: DEN Website: http://den.usc.edu Blackboard: http://learn.usc.edu Administrative: DEN Technical Support DEN Homework DEN Exams and Proctoring DEN Administrative Questions Mary Ordaz, Student Services Advisor Norma Orduna, Student Services Assistant 213-821-1321 213-740-9356 213-821-3136 213-740-4488 213-740-4886 213-740-8935 Course Objectives: To become familiar with financial markets, derivative contracts, the mathematical basis for the evaluation of derivatives, and the use of derivatives in risk mitigation and investing. This class will prepare the student for future classes in the Financial Engineering Masters Program and/or help prepare him for a vocation as an investment analyst. Numerous examples are presented and analyzed of using derivatives in successful investing. Topics by Class and Reading Assignments: CLASS DAY 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 DATE Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed 13-Jan 15-Jan 20-Jan 22-Jan 27-Jan 29-Jan 3-Feb 5-Feb 10-Feb 12-Feb 17-Feb 19-Feb 24-Feb 26-Feb 3-Mar 5-Mar 10-Mar 12-Mar Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Wed Wed 24-Mar 26-Mar 31-Mar 2-Apr 7-Apr 9-Apr 14-Apr 16-Apr 21-Apr 23-Apr 25-Apr 30-Apr Final Exam Wed Fri TOPICS Overview of ISE 563 Markets and Derivatives Martin Luther King Birthday Holiday Interest Rates and Present Value Analysis Interest Rates and Present Value Analysis Stocks and Properties of Stocks Stock Options Part 1 of 2 Stock Options Part 2 of 2 Futures and Forwards Mechanics of Futures Presidents Day Holiday Options on Futures Options-Part 4 Trading Strategies Historical Volatility and Midterm Preview MIDTERM 1 Review of Midterm & Class Project Intro Volatility: Implied Arbitrage Spring Recess March 17-22 Portfolio Insurance Normal Random Variables Binomial Trees Weiner Processess Options Pricing Models Options Metrics: More on Delta Options Metrics: Delta, Gamma, Theta, Rho Technical Analysis Credit Derivatives & Preview of Midterm 2 Lessons Learned MIDTERM 2 Review of Midterm Class Projects Papers Due Mon 5-May 9am 7-May Presentations - 5PM Section: 4:30-6:30 PM 9-May Presentations - 3:30 Section: 2:00-4:00 PM READING BEFORE CLASS none Hull, Chapter 1 Hull Sections 4.1, 4.2 Hull Remainder of Ch 4 To Be Provided Hull Chapter 9 Hull Chapter 10 To Be Provided Hull Ch 2 HOMEWORK ASSIGNED: H/W 1 H/W 2 H/W 3 CME and NFA Options Guides Hull Ch 11 H/W 4 Hull section 14.4 none none Ch 5 sections 1,4, & 9 none To Be Provided Hull Chapter 12 Hull Chapter 13 Hull Chapter 14 Hull Chapter 18 Hull Chapter 18 none Hull Chapter 24 none Charts due 9am day of presentation location: Usual Classroom location: Usual Classroom Class Projects will be presented in summary form during the time allocated for a final exam. H/W 5 H/W 6 H/W 7 HOMEWORK: Each homework assignment will be described in the last slides of the preceding lecture. There will be 6 homework assignments. Typically they are assigned on Wednesdays for completion and submission by the beginning of class on the following Monday. Submission Of Homework by both DEN and On Campus Students: DO NOT email submissions to DEN (denhw@usc.edu), the professor, or the TA, they will not be accepted. Assignments will be posted and submitted through the course website. Students are strongly encouraged to verify each assignment was successfully submitted to the DEN system. To confirm your assignment was received, go to “Tools” > “My Grades”. All your submissions will be recorded here, if you do not see a link to a “score” or a “!” symbol, your submission was not successful. If you have any technical issues with the submission process, email the TA immediately. Assignments should follow the file naming convention (last_name, first_name HWX.doc or .ppt or .xls). “X” should be replaced with the corresponding assignment number. All submissions should be in the Microsoft Word (.doc), PowerPoint (.ppt), or Excel (.xls) format; do not submit assignments in the PDF (.pdf) format. The grade for any homework assignment will be reduced by one letter grade per week unless prior arrangement is made with the instructor. USC Grading Policies are followed. MIDTERM EXAMINATIONS: The first midterm examinations will cover all of the course material covered prior to class 12. The second midterm examination will cover the material from classes 13 thru 25. It will also repeat one question from midterm 1. Midterm 1 ise closed book. Calculators are allowed and one 4 x 6 card with handwritten notes. No electronic devices are allowed. Midterm 2 is open source: text, laptops, notes, etc. No electronic communications. If you are a DEN student, it is your responsibility to coordinate your exam time/location with the DEN office. FINAL EXAMINATION: The Final Examination will consist of the class project and the presentations CLASS PROJECTS: Class projects are 8 to 10 page papers on a topic associated with financial derivatives. Students are grouped into teams of 5 people each. The teams may pick from suggested topics or suggest one of their own choosing. Each team will present an overview of their paper to the class per the schedule for final exams. GRADING METHOD: The class grade is based on a combination of the homework, midterm, class project and final examination. The weight for each category is as follows: Homework 30% Mid Term 1 25% Mid Term 1I 25% Class Project (Final Exam) 20% 100% ACADEMIC INTEGRITY STATEMENT -"“The Viterbi School of Engineering adheres to the University's policies and procedures governing academic integrity as described in SCampus. Students are expected to be aware of and to observe the academic integrity standards described in SCampus, and to expect those standards to be enforced in this course”. STUDENTS WITH DISABILITIES: "Any Student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me (or to TA) as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m. - 5:00 p.m., Monday through Friday. The phone number for DSP is (213)740-0776”.