Herbert Credit Union Services Brochure 2013

advertisement

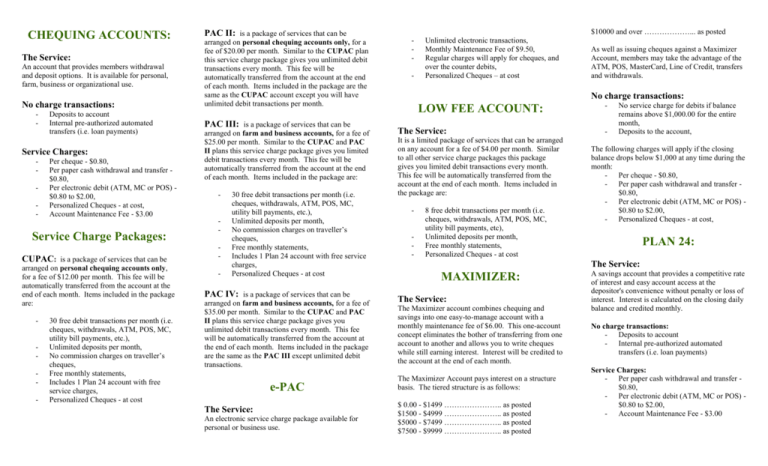

CHEQUING ACCOUNTS: The Service: An account that provides members withdrawal and deposit options. It is available for personal, farm, business or organizational use. No charge transactions: - Deposits to account Internal pre-authorized automated transfers (i.e. loan payments) Service Charges: - Per cheque - $0.80, Per paper cash withdrawal and transfer $0.80, Per electronic debit (ATM, MC or POS) $0.80 to $2.00, Personalized Cheques - at cost, Account Maintenance Fee - $3.00 Service Charge Packages: CUPAC: is a package of services that can be arranged on personal chequing accounts only, for a fee of $12.00 per month. This fee will be automatically transferred from the account at the end of each month. Items included in the package are: - - 30 free debit transactions per month (i.e. cheques, withdrawals, ATM, POS, MC, utility bill payments, etc.), Unlimited deposits per month, No commission charges on traveller’s cheques, Free monthly statements, Includes 1 Plan 24 account with free service charges, Personalized Cheques - at cost $10000 and over ………………... as posted PAC II: is a package of services that can be arranged on personal chequing accounts only, for a fee of $20.00 per month. Similar to the CUPAC plan this service charge package gives you unlimited debit transactions every month. This fee will be automatically transferred from the account at the end of each month. Items included in the package are the same as the CUPAC account except you will have unlimited debit transactions per month. PAC III: is a package of services that can be arranged on farm and business accounts, for a fee of $25.00 per month. Similar to the CUPAC and PAC II plans this service charge package gives you limited debit transactions every month. This fee will be automatically transferred from the account at the end of each month. Items included in the package are: - - 30 free debit transactions per month (i.e. cheques, withdrawals, ATM, POS, MC, utility bill payments, etc.), Unlimited deposits per month, No commission charges on traveller’s cheques, Free monthly statements, Includes 1 Plan 24 account with free service charges, Personalized Cheques - at cost PAC IV: is a package of services that can be arranged on farm and business accounts, for a fee of $35.00 per month. Similar to the CUPAC and PAC II plans this service charge package gives you unlimited debit transactions every month. This fee will be automatically transferred from the account at the end of each month. Items included in the package are the same as the PAC III except unlimited debit transactions. e-PAC The Service: An electronic service charge package available for personal or business use. - Unlimited electronic transactions, Monthly Maintenance Fee of $9.50, Regular charges will apply for cheques, and over the counter debits, Personalized Cheques – at cost As well as issuing cheques against a Maximizer Account, members may take the advantage of the ATM, POS, MasterCard, Line of Credit, transfers and withdrawals. No charge transactions: LOW FEE ACCOUNT: The Service: It is a limited package of services that can be arranged on any account for a fee of $4.00 per month. Similar to all other service charge packages this package gives you limited debit transactions every month. This fee will be automatically transferred from the account at the end of each month. Items included in the package are: - - 8 free debit transactions per month (i.e. cheques, withdrawals, ATM, POS, MC, utility bill payments, etc), Unlimited deposits per month, Free monthly statements, Personalized Cheques - at cost - - No service charge for debits if balance remains above $1,000.00 for the entire month, Deposits to the account, The following charges will apply if the closing balance drops below $1,000 at any time during the month: - Per cheque - $0.80, - Per paper cash withdrawal and transfer $0.80, - Per electronic debit (ATM, MC or POS) $0.80 to $2.00, - Personalized Cheques - at cost, PLAN 24: The Service: MAXIMIZER: The Service: The Maximizer account combines chequing and savings into one easy-to-manage account with a monthly maintenance fee of $6.00. This one-account concept eliminates the bother of transferring from one account to another and allows you to write cheques while still earning interest. Interest will be credited to the account at the end of each month. The Maximizer Account pays interest on a structure basis. The tiered structure is as follows: $ 0.00 - $1499 ………………….. as posted $1500 - $4999 ………………….. as posted $5000 - $7499 ………………….. as posted $7500 - $9999 ………………….. as posted A savings account that provides a competitive rate of interest and easy account access at the depositor's convenience without penalty or loss of interest. Interest is calculated on the closing daily balance and credited monthly. No charge transactions: - Deposits to account - Internal pre-authorized automated transfers (i.e. loan payments) Service Charges: - Per paper cash withdrawal and transfer $0.80, - Per electronic debit (ATM, MC or POS) $0.80 to $2.00, - Account Maintenance Fee - $3.00 REGISTERED PLANS: CU AUTOMATED TELLER SERVICE: RRSP's: A Registered Retirement Savings Plan (RRSP) is a government approved plan through which you save money for your retirement years. Your contributions are tax deductible and the income earned is tax sheltered. Saskatchewan Credit Union ATM's: - RRIF's: With a Registered Retirement Income Fund (RRIF) you can convert your RRSP savings into a vehicle to provide a regular income, while at the same time continue to maintain maximum control over your tax sheltered retirement investment. The flexibility of the RRIF makes it the ideal investment. HERITAGE ACCOUNT: The Service: Heritage accounts are available to all consumer members 60 years of age and over, and are provided automatically once you reach your 60th birthday. As a Heritage member you are entitled to the following benefits: - - - Free cash withdrawals, cheque processing, transfers, and electronic debits on your regular Chequing and Plan 24 accounts, No commission charges on traveller’s cheques or utility payments, No monthly maintenance fee on your regular Chequing unless the balance drops below $1,000 at anytime during the month, then a maintenance fee of $5.00 will be charged, Personalized Cheques – at cost $5.00 discount on Safety Deposit Box rentals, No interest penalty on monthly interest payments for non-redeemable terms over $5000 (Minimum 2 year term). In the case of a joint account, only one member must qualify for you both to receive all the benefits of our Heritage accounts. If you have a Maximizer account, the regular conditions will still apply. No charge for deposits to accounts No charge for account balance inquiries Service charges will apply for withdrawals and transfers as outlined under the various accounts. All other ATM's: - Per withdrawal - $2.00 plus user fee if applicable. Trust accounts are subject to all regular service charges. OTHER CHEQUING CHARGES: Overdrafts: Per each paid item - $5.00 Per mail notice or phone call - $10.00 Overdraft Interest – 24% NSF Cheques - $30.00 each Certification of Cheques: Issuer - $10.00 Holder (3rd party) - $20.00 Stop Payment Requests (each) - $15.00 2.5" x 5" - $40.00/year 2.5" x 10" - $60.00/year Transfer account to another FI - $50.00 Estate Administration Fee - $50.00 Bank Confirmations - $25.00 Duplicate Statement - $5.00 Account History Printout (banking system) - $1.00/page Utility Payments: Members - $0.80 Non-members - $2.00 Photo Copies - $0.25 per copy or per side Debit Card or Payment Card: Initial Card - Free Replacement Card (i.e. lost or damaged) - $10.00 Search for Records - $30.00 per hour (minimum $30.00) Charge Backs - $7.00 Rolling Coin - $0.50 per roll Personalized Cheques - cost Faxes - $1.00 per page (received or sent) RRSP Transfer Fees - $50.00 per transfer Account Maintenance Fee - $3.00 Inactive Accounts - $10.00/year Non-members exchanging foreign currency – 2% commission (over the posted rate) YOUTH ACCOUNTS: All members of the Herbert Credit Union who are 18 years of age and younger will have access to all services and accounts with free deposits and 20 debit transactions per month on Youth Accounts. A monthly fee of $6.00 will apply if the member exceeds 20 debit transactions in a month. All other service charges will apply. GRADUATE ACCOUNTS: OTHER SERVICES Non-member Cheque Cashing – 1% of cheque with $5.00 minimum US fund cheques drawn on Canadian $ accounts - $5.00 each Items sent on Collection - $10.00 Money Orders (each) - $6.00 Foreign Currency Drafts - $10.00 Manager's Trust Cheques: Members - $10.00 Wire Transfers: In Canada - $20.00 USD - $35.00 International - $50.00 Received - $20.00 Safety Deposit Box Rental: All members of the Herbert Credit Union who are 25 years of age and younger and enrolled in a post secondary school as a full time student have access to all services and accounts with free deposit and 20 debit transactions per month on a Graduate Account, with personalized cheques at cost. A monthly fee of $6.00 will apply if the member exceeds 20 debit transactions in a month. All other service charges will apply. It is the responsibility of the student to give the credit union confirmation of enrollment each semester. Line of Credit Renewal Fees: Consumer Lines of Credit - $10 to $40 Agriculture and Commercial - $50 to $200 (Annual renewal fees are based on the line of credit limit) Services Information Effective August 1, 2013 This brochure is a general outline of the various types of accounts, payment services and related Fees and Charges of the Herbert Credit Union. The intent is to assist you in understanding the options that are available allowing you to arrange your financial affairs and keep charges to a minimum