AGREEMENT BETWEEN GOVT

advertisement

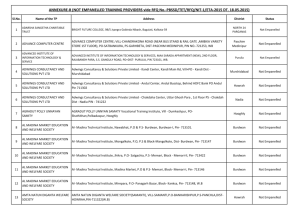

<Stamp Paper of appropriate value> SUPPLEMENTARY AGREEMENT TO THE AGREEMENT BETWEEN GOVT. OF [NAME OF THE STATE] AND [NAME OF THE INSURANCE COMPANY] UNDER RASHTRIYA SWASTHYA BIMA YOJANA (RSBY) This Agreement made at _______________ day of _________2014. BETWEEN (1) THE GOVERNMENT OF THE STATE OF [Name of the State], represented by the Secretary to the Department ________________, Government of [Name of the State], having its principal office at [insert address] (being represented by the State Nodal Agency having its principal office at [insert address] (here and after referred to as SNA or 1st party which expression shall, unless repugnant to the context or meaning thereof, be deemed to mean and include its successors and permitted assigns); AND (2) [Name of the Insurance Company], an insurance company registered with the Insurance Regulatory & Development Authority having registration number [insert number] and having its registered office at [insert address] (hereinafter referred to as the Insurer or 2nd Party which expression shall, unless repugnant to the context or meaning thereof, be deemed to mean and include its successors and permitted assigns). The State Nodal Agency and the Insurer shall collectively be referred to as the Parties and individually as the Party. There is a clear understanding between the parties to this supplementary agreement issued as a part of the “Main (existing) Agreement” and that this supplementary agreement shall be considered an integral part of “Main Agreement” between both parties (i.e. State Nodal Agency and Insurer). WHEREAS A. The "Rashtriya Swasthya Bima Yojana" (the RSBY), a Central Sponsored Scheme (CSS) 1 of the Government of India, requires Insurance Companies to provide health insurance cover to the extent of Rs. 30,000 on a floater and cashless basis through an established network of health care providers to the RSBY Beneficiary Family Units (RSBY will be known as the Scheme). B. The scheme funded by the Government of India, i.e. 75% of premium is paid by central government, while remaining 25% of premium is paid by state government (applicable changes to the above to 90% & 10% in case of north eastern states and Jammu and Kashmir, respectively). C. The Government of [Name of the State] is implementing RSBY in [Number of Districts] districts namely [Name of the Districts] through the [Name of the Insurance Company]. D. The Government of [Name of the State] has decided to include additional clauses to measure and monitor the performance of the insurance companies and include other measures under the RSBY scheme; E. There is a clear understanding between the parties to this supplementary agreement issued as a part of the “Main (existing) Agreement” and that this supplementary agreement shall be considered an integral part of the “Main Agreement” between both parties (i.e. State Nodal Agency and Insurer). NOW THEREFORE this supplementary agreement sets out the parameters to monitor the performance of the insurance company, and also related to penalties and premium refund. General Conditions 1. Definitions & Interpretation 1.1. The definitions and interpretations mentioned in the Main Agreement shall also be applicable to this Supplementary agreement. In addition to those, the following terms and expressions shall have the meaning, for purposes of this Supplementary Agreement, as indicated below: A. “Monitoring Parameters” shall mean the performance parameters to monitor the performance of the insurance company for the Insurance Companies as set out in para 2.2 and 2.3 herein below. B. “Premium Refund” shall mean the amount of premium that will be refunded by the Insurance Company as per defined guidelines, as defined in para 2.2 herein below. 2. Performance Evaluation 2.1. THAT the parties hereby agree that the Government shall monitor the performance of the Insurance Company based on the defined parameters and impose such conditions as outlined in this document. 2.2. Monitoring parameters 2.2.1. That the performance of Insurance Company shall be monitored on the parameters provided in Annexure I of this supplementary agreement. 2 2.2.2. That for the purpose of evaluation MoLE may make use of the information collected as part of implementation or monitoring of RSBY. Where there is a variance between facts as claimed by insurance company and as revealed from the data available with MoLE, decisions shall be based on the data available with MoLE, SNAs and reports from SNAs, Grievance Redressal Mechanism etc. 2.2.3. That there may be cases where condition at Sr. No 2,3 & 4 of Annexure-I related to hospital empanelment may not be fulfilled due to limited availability of the hospitals for the empanelment. In all such cases, the Insurance Company shall obtain a certificate from the District Administration regarding nonavailability of the hospitals and in such a case, if Insurance Company is able to submit the certificate, then value attached to these parameters shall not be considered while calculating the threshold limits under Annexure 1. 2.2.4. That failure to meet the minimum performance criteria of marks would render the insurance company 2.2.4.1. Liable to such deduction of premium as stipulated Annexure 1 of this document 2.2.4.2. Liable for its de-empanelment from “Empaneled List of Insurers” by MOLE when exceeding the threshold limit set in Annexure 1 of the document. 2.3. That the conditions of the Supplementary Agreement shall apply to the period of starting ___________ and ending on midnight of ____________. 2.4. That the performance evaluation of insurance company, on parameters of Annexure I of this Supplementary Agreement shall be conducted by SNA on a bi-annual basis. 3. Premium Refund 3.1. THAT the Insurance Company shall be required to refund premium as stipulated below if they fail to reach the claim ratio specified below at the full period of insurance Policy. 3.2. THAT the Premium Refund shall be as per the formula below: 3.2.1. In case the claim ratio [(Claims paid / Premium received)] is less than 70% then the Insurance Company will return the difference between actual claim ratio and 70% to SNA. 3.2.2. The claims data shall be updated by the insurance company within 30 days of submission of claims by the hospital. 3.2.3. This refund amount will be returned within 90 days of end of the policy. 3.2.4. SNA shall return back proportionate central share to MoLE once the premium is refunded by the Insurance Company. 4. Other conditions 4.1. That the insurer specifically agrees that it would abide by all the changes in operations and would deliver all its obligations as per revised guidelines/manuals issued by the MoLE. 4.2. That the insurer will provide a copy of all MIS reports as per the revised guidelines/manuals, to SNA as well as to MoLE on a monthly basis or any other information as may be requested by SNA/MoLE. 3 IN WITNESS WHEREOF, the Parties have caused this Agreement to be signed sealed and delivered by their duly authorized representatives on the day month and year first hereinabove written. 1. 2. SIGNED, SEALED and DELIVERED SIGNED, SEALED and DELIVERED FOR & ON BEHALF OF THE FIRST PARTY FOR & ON BEHALF OF THE SECOND PARTY Government of ___________ ____________________ 4 Annexure-I – Monitoring Parameters to Measure the Performance of the Insurance Company S. No 1. SLA’s Source of data Monitoring method Settlement of Claims Settlement of claims within 30 Computed from the claim The ratio of claims amount days settlement data in RSBY which have not been paid or Central Server rejected within 30 days (from the date of claims raised to the insurance company) to the total claims amount made to the insurance company. Periodicity Points criteria Based on the claim If 10% of claims remain made within 12 unpaid at the end of 30 days – months of the policy 5 Points period. If between 10% and 25% of the claims remain unpaid after 30 days – 10 Points If between 25% - 40% of the claims remain unpaid after 30 days – 15 Points 2. Empanelment and De-Empanelment of Heath Care Service Providers or Hospitals At least 2 hospitals to be List of empanelled Number of blocks with less than empanelled in each block. hospitals to be provided two empanelled hospitals. by the Insurance Blocks where district authorities Company to SNA clearly or SNA certify that two hospitals identifying hospitals in are not available for each block. The claim empanelment shall be excluded regarding non availability from assessment. of hospitals for enrolment to be verified by SNA Assessed 15 days Every block where less than 1 prior to the hospitals have been commencement of empanelled – 5 Points policy [Will not apply if no hospitals are available for empanelment as per certificate produced] Every block where more than 1 and less than 2 hospitals have been empanelled – 3 Points There should be at least one List of [Will not apply if only 1 hospitals is available for empanelment as per certificate produced] empanelled Number if beneficiaries in the Assessed 15 days If atleast 1 healthcare provider 5 hospital for every 8000 hospitals to be provided cluster of districts divided by the prior to the is empanelled in each district families enrolled in the scheme by the insurance company number of empanelled hospitals commencement of on every 8000 - 9000 families to the SNA policy enrolled till the start of policy Districts where district – 1 Point authorities or SNA certify that required numbers of hospitals If atleast 1 healthcare provider are not available for is empanelled in each district empanelment shall be excluded on every 9000 - 10000 from assessment. families enrolled till the start of policy – 3 Point If atleast 1 healthcare provider is empanelled in each district for more than 10000 families enrolled till the start of policy – 5 Point 3 There shall be at least 5 List of empanelled hospitals in the district hospitals to be provided headquarters. by the Insurance Company to SNA clearly identifying hospitals in each district. The claim regarding non availability of hospitals for enrolment to be verified by SNA Districts where district authorities or SNA certify that required numbers of hospitals are not available for empanelment shall be excluded from assessment. For number of districts with less Assessed 15 days Every district headquarters than five empanelled hospitals, prior to the where less than 3 hospitals where district authorities or SNA commencement of have been empanelled – 5 certify that five hospitals are not policy Points available for empanelment shall be excluded from assessment [Will not apply if no hospitals are available for empanelment as per certificate produced] Every district headquarters where 3 to 5 hospitals have been empanelled – 3 Points [Will not apply if only 1 hospital is available for empanelment as per certificate 6 4. 5. 6. The following specialties’ shall List of specialties in the be available through empanelled hospital to be empanelled hospitals in each provided by the insurance district. company to SNA a. General Medicine b. General surgery c. Obstetrics and Gynaecology d. Paediatrics e. Ophthalmology f. ENT g. Orthopaedic Other Issues Related to Enrolment Preparation of brochures to be A printed brochure with a given to the beneficiaries. certificate from the printer showing the number of copies printed is produced before SNA. Setting up of District Kiosk by insurance company Set up and operationalize Report from district RSBY kiosks according to the officers that kiosks as per guidelines. Concession agreement have been set up 7. Manpower requirements Human resources as per the Report from guidelines of the scheme company 8. Organizing workshops Organizing of all workshops as Report from per the guidelines company Total number of specialties Assessed 15 days available across all hospitals for prior to the each district. commencement of policy Districts where district authorities or SNA certify that required numbers of hospitals are not available for empanelment shall be excluded from assessment. produced] If 5 specialties available in each district till the start of policy – 3 Points If 3-4 specialties available in each district till the start of policy – 5 Points Brochures at least equal to the 15 days before the IF brochure not shared with number of beneficiaries is commencement of the SNA till the start of the printed and distributed to insured enrolment enrolment – 6 Points families at all enrolment stations. IF brochure not share with the SNA at all – 10 Points Kiosks as per the Concession 7 days Before agreement are set up and commencement of available for use by eligible enrolment beneficiaries IF not set up 7 days prior to the commencement of enrolment – 3 Points. IF not set up till one month from the commencement of enrolment – 5 Points insurance Details of the manpower on the At least 15 days If not appointed till the start of letterhead of the insurance before start of policy policy – 3 company to be given to SNA If not appointed till 15 days policy 5 insurance Report by insurance company to At least 7 days If not conducted till the start SNA within 7 days of workshop before start of policy of policy – 3 period If not conducted till 1 month 7 9. from the start of policy -5 District office set up by insurer District office in all districts List of offices with their District offices are established Within 15 days from If not set up within 1 month being served contact details provided to and staffed signing of contract from signing of the contract – SNA by insurance 5 points company 8 Performance severity: Threshold limit Severity 5-7 points 1% of total annual Premium amount for the concerned Insurance Company 8-13 points 3% of total annual Premium amount for the concerned Insurance Company 14- 21 points 5% of the total annual Premium amount for the concerned Insurance Company and cancellation of Renewal and insurance company debarred for one year 5% of total annual premium and Insurance Company debarred from bidding for three years More than 21 points False intimations on any of the Investigations to be called against the insurance company above parameters 9