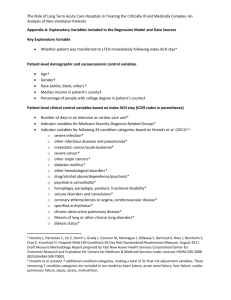

Medicare - The VCU

advertisement