Farmers Insurance Group of Companies

advertisement

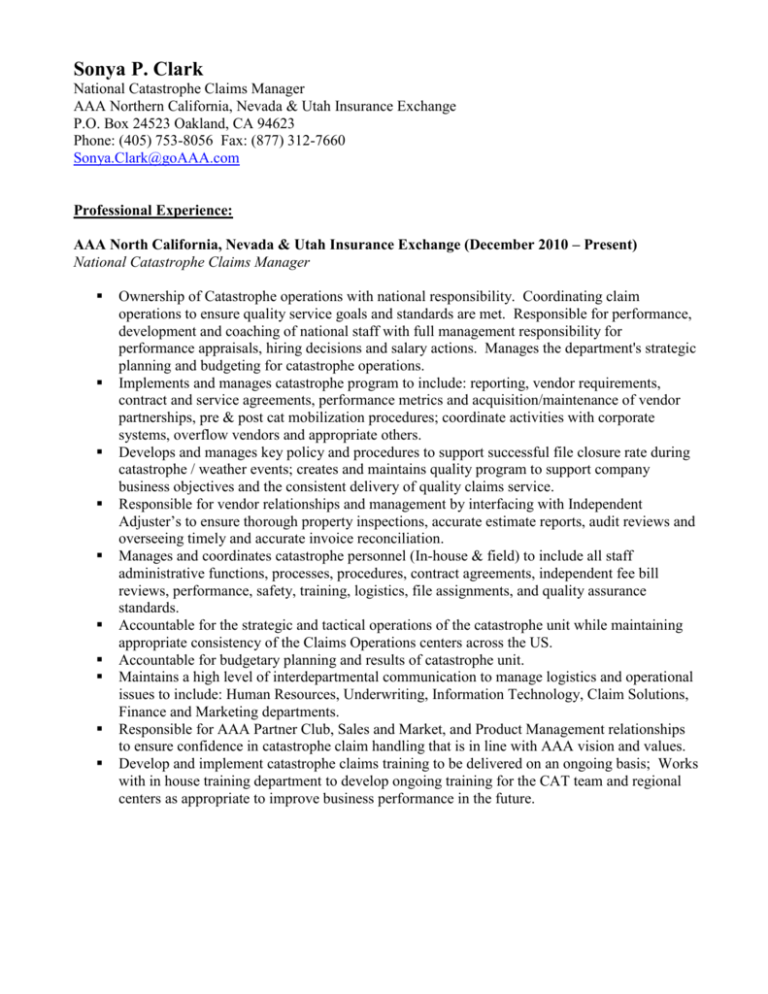

Sonya P. Clark National Catastrophe Claims Manager AAA Northern California, Nevada & Utah Insurance Exchange P.O. Box 24523 Oakland, CA 94623 Phone: (405) 753-8056 Fax: (877) 312-7660 Sonya.Clark@goAAA.com Professional Experience: AAA North California, Nevada & Utah Insurance Exchange (December 2010 – Present) National Catastrophe Claims Manager Ownership of Catastrophe operations with national responsibility. Coordinating claim operations to ensure quality service goals and standards are met. Responsible for performance, development and coaching of national staff with full management responsibility for performance appraisals, hiring decisions and salary actions. Manages the department's strategic planning and budgeting for catastrophe operations. Implements and manages catastrophe program to include: reporting, vendor requirements, contract and service agreements, performance metrics and acquisition/maintenance of vendor partnerships, pre & post cat mobilization procedures; coordinate activities with corporate systems, overflow vendors and appropriate others. Develops and manages key policy and procedures to support successful file closure rate during catastrophe / weather events; creates and maintains quality program to support company business objectives and the consistent delivery of quality claims service. Responsible for vendor relationships and management by interfacing with Independent Adjuster’s to ensure thorough property inspections, accurate estimate reports, audit reviews and overseeing timely and accurate invoice reconciliation. Manages and coordinates catastrophe personnel (In-house & field) to include all staff administrative functions, processes, procedures, contract agreements, independent fee bill reviews, performance, safety, training, logistics, file assignments, and quality assurance standards. Accountable for the strategic and tactical operations of the catastrophe unit while maintaining appropriate consistency of the Claims Operations centers across the US. Accountable for budgetary planning and results of catastrophe unit. Maintains a high level of interdepartmental communication to manage logistics and operational issues to include: Human Resources, Underwriting, Information Technology, Claim Solutions, Finance and Marketing departments. Responsible for AAA Partner Club, Sales and Market, and Product Management relationships to ensure confidence in catastrophe claim handling that is in line with AAA vision and values. Develop and implement catastrophe claims training to be delivered on an ongoing basis; Works with in house training department to develop ongoing training for the CAT team and regional centers as appropriate to improve business performance in the future. ICAT Managers/ICAT Boulder Claims – Boulder, CO (April 2005 – December 2010) Claims Manager Operations Management Lead, direct and manage the operations of the TPA claims business for Lloyds of London Syndicate 4242, ICAT’s MGA business partners and the Mississippi Wind Underwriting Association/Mississippi Residential Property Insurance Underwriting Association. Developed and manage outsourcing plan for TPA services business programs including negotiation of contracts, successful financial management of external programs, and claims supervision with P&L responsibilities. Providing training, leadership and direction to all claims staff including workflow planning, proactive identification and resolution of issues that impact workflow, customer service and the fulfillment of claims policy and procedural requirements. Successful Project Manager, through outsourcing with partner in India, to redesign and relaunch the ICAT Boulder Claims website within budget and within time parameters. Spearheaded and implemented a comprehensive Quality Assurance Program for the business unit. Assisted other business units to develop similar programs. Managing the adjustment of property and catastrophe claims, as well as, independent and third party adjusters. Highly effective leadership, communication and motivational skills which led to 100% contract staff employee retention during both 2005 and 2008 catastrophe responses while exceeding established individual and team performance standards of service and quality. Responsible for delivery of short-term and long-term strategic planning and management for the business unit. Project Manager for technology for the business unit. This includes the claims administration system development roadmap, maintenance and efficiency gain projects; leading the redesign of the IBC Website; effectively working with the IT department to establish a range of services for the success of the business. Risk Management Developed and institutionalized procedures that decreased risk to the business through both financial controls and by the use of technology. Developed and enforce best in breed process and procedures throughout the organization. Responsible for defining project scope, resources and achieving deliverables on time and within budget. Key member of the ICAT team implementing the new Solvency II program which is a comprehensive framework for risk management for defining required capital levels and to implement procedures to identify measure and manage risk levels. ICAT Managers – Houston, TX (March 2003 – April 2005) Inspection Business Unit – Field Inspector Performed commercial property risk evaluations and inspections in the South Texas region for underwriting purposes; Assisted in the development of the ICAT catastrophe response plan for the Claims Triage Program which is the Lead the IBU –Claims Triage project; Played lead role in developing the Quality Assurance program for the IBU department; Training and development of staff. Farmers Insurance Group of Companies - Houston, TX (July 1995 - February 2002) Mold Unit Lead Adjuster/Team Lead Catastrophe Claims Lead Adjuster/Team Lead Supervised 15 mold field adjusters handling 30-40 claims each; Trained and developed Independent Adjusters on Texas Claims Handling procedures; Reviewed documents and approved claims for adjusters and Lead adjusters with lesser payment authority; Acting-Supervisor in the absence of higher level managers. Traveled the US handling catastrophe property claims (tornados, hurricanes, fire, hail and windstorm); Supervised Independent Adjusters throughout the country reviewing claims, training and development of team members, as well as, Independent Adjusters; Member on the development team for CRN system (a state-of-the-art, automated national claims handling system) at home office; Developed the leadership Development Program (LDP) for The National Catastrophe Center; Handled commercial claims and supervised Independent adjusters handling commercial property claims. Handled property claims for water damage, fire damage, theft, vandalism, etc.; General customer service. Education: North Carolina State University, Raleigh, N.C. Bachelor of Arts, Business Management - May 1992 Core Competencies Operational Effectiveness Information Management Analysis and Reporting Knowledge of Property Insurance Relationship Building Coaching and Mentoring Training and Development Facilitation