Ranbaxy Laboratories Q1 2009 global sales at Rs

advertisement

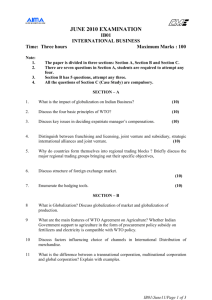

Ranbaxy Laboratories Q1 2009 global sales at Rs 15,584 mn EMERGING MARKETS STEADY DESPITE ADVERSE ECONOMIC AND MONETARY CONDITIONS The Board of Directors of Ranbaxy Laboratories Limited (Ranbaxy) at their meeting held today, took on record the unaudited results for the quarter ended March 31, 2009 (Q1’09). Key Financial Highlights: Consolidated net sales at Rs. 15,584 Mn, a de-growth of 4% (USD 313 Mn). Emerging market sales resist downward recessionary pressures in most key markets and deliver sales similar to corresponding previous period at Rs. 8,376 Mn (USD 168 Mn) contributing 54% to total sales, a de-growth of 2%. Sales in developed markets were Rs. 6,080 Mn (USD 122 Mn), 6% below corresponding previous period. The Company registered positive Operational Earnings before Interest, Tax, Depreciation, Amortisation and Forex (EBITDA) in-spite of adverse conditions in USA and several developed markets. During 2009, the Company expects to achieve sales of approx Rs. 70 Bn (USD 1.4 Bn) and PAT of approx Rs (8.0) Bn (USD (150) Mn). Consolidated Financial Performance Rs. Mn Particulars Q1 2009 Q1 2008 Change Sales 15,584 16,231 (4)% Profit After Tax* (262) 858 - *Excluding Foreign Exchange Gains/Losses and Exceptional Items The Profit After Tax for the quarter is Rs. (7610) Mn, (USD (153) Mn). Commenting on the results, Mr. Malvinder Mohan Singh, Chairman, CEO and MD, Ranbaxy, said, “This quarter has been challenging for the global economy and also the pharmaceutical industry with depreciation in several currencies and a downturn in demand and liquidity affecting performance, across sectors. Our diversified market base has helped us deal with these issues, mitigating their impact to a large extent. Synergies from our relationship with Daiichi Sankyo are starting to kick in. Early signs of this were evident as we have launched Olmesartan in India. This traction will increase as we move forward, bringing benefits to both organizations.” Global Region wise Sales Rs. Mn Region/Country Q1’09 Q1’08 Change North America 4,040 4,351 -7% India (including Consumer Healthcare) 3,549 3,366 5% Europe 2,831 3,290 -14% Asia Pacific & CIS (Excl. India) 1,995 1,978 1% Rest of the World 2,038 2,058 -1% Active Pharmaceutical Ingredients (API) and Others 1128 1,183 -5% Global Sales 15,584 16,231 -4% Key Highlights/Developments: The Company received four USFDA approvals and two from TGA-Australia, during the quarter. The Company’s largest dosage form facility at Paonta Sahib received GMP approvals from MHRA-UK, TGA-Australia and WHO, Switzerland. The Batamandi facility at Paonta Sahib was approved by PMDA-Japan. In India, the Company launched Olvance (Olmesartan), an innovative product from Daiichi Sankyo, the first Daiichi Sankyo product to be launched by the Company. The Company is shortly commencing Phase-III studies on its novel anti-malaria drug, Arterolane Maleate + Piperaquine Phosphate in India and South East Asia. The Company received a milestone payment from GlaxoSmithKline on successful initiation of Phase-I human clinical trials for a Respiratory Inflammation molecule. Sumatriptan 100mg tablets were launched in USA under an exclusivity arrangement of 180 days. Ranbaxy was awarded a tender for Rs. 739 Mn for the supply of Anti Retroviral Drugs to the National AIDS Control Organisation, India. A major part of the order was serviced during the quarter. The Company received a letter from USFDA indicating that all pending and approved ANDAs from its Paonta Sahib facility have been added to a list maintained under its “Application Integrity Policy”. Consolidated Results (Ranbaxy Laboratories Limited and Subsidiaries) Quarter ended March 31, 2009 Global Sales In Q1’09, Consolidated sales were Rs. 15,584 Mn (USD 313 Mn), a de-growth of 4% on YOY basis. Sales were slow due to poor monetary conditions, pricing pressures, an import alert on products in the USA, and the devaluation of several currencies in countries where the Company has its operations. The Company exhibited prudence in managing sales and credit on account of tight liquidity conditions. Emerging markets accounted for 54% of global sales at Rs. 8,376 Mn (USD 168 Mn), and were at comparable levels with the previous corresponding quarter (-2%). Emerging market sales were led by performance in India, Africa and Russia. Developed markets contributed 39% to global sales (Rs. 6,080 Mn; USD 122 Mn) and declined 6%. The performance in Canada and new launches in USA and Europe contributed to business in developed markets.. Dosage form sales for the quarter were Rs. 14,457 Mn (USD 291 Mn), contributing 93% to total sales. North America Sales in the region during the quarter were Rs. 4,040 Mn (USD 81 Mn), a de-growth of 7%. USA During the quarter, Ranbaxy gained four ANDA approvals from the USFDA. This includes the Company’s FTF (First-to-File) product Sumatriptan 100mg tablets. Ranbaxy will have 180 days marketing exclusivity for this product in the US market. The other USFDA approvals included Quinapril Hydrochloride + Hydrochlorothiazide tablets 10mg/12.5mg, 20mg/12.5mg and 20mg/25mg (High blood pressure); Ramipril Capsules 5mg and 10mg (Cardiovascular) and Topiramate tablets 25mg, 100mg & 200mg (Epilepsy). The Company is investing in increasing its manufacturing capacity at Ohm Laboratories, a USFDA approved facility. USA recorded sales of Rs. 3,401 Mn (USD 68 Mn) for the quarter, a de-growth of 14%. Canada During the quarter, sales grew faster than the market, to Rs. 639 Mn (USD 13 Mn) an increase of 57 %. Ranbaxy is currently ranked No. 7 with a 4% share in the generics market. Europe The region (including Romania) recorded sales of Rs. 2,831 Mn (USD 57 Mn), a de-growth of 14% over Q1’08. The de-growth was on account of difficult and uncertain market conditions prevailing in several markets and factors such as currency devaluation and channel destocking affecting demand. The positive performance in several countries limited the adverse impact. In certain markets, the product portfolio was rationalized with a focus on profitability, resulting in some loss of sales. Romania: Sales were Rs. 945 Mn (USD 19 Mn), a de-growth of 8.4% due to a devaluation of the local currency and uncertainty regarding new regulations introduced by the Ministry of Public Health. The Company continues to lead the generics + OTC segment with a No. 1 ranking (No. 7 in the total market). In France, UK and Germany the Company recorded sales of Rs. 1,224 Mn (USD 25 Mn), a degrowth of 8% over the corresponding previous period. Positive growth in France and of the generics business in the UK partly mitigated de-growth due to sharp currency depreciation in UK and the continued adverse market conditions in Western Europe. The Company received 6 product approvals, and launched 4 products. Atorvastatin was launched in Finland, the first launch of the molecule by the Company in a developed market. The Medicines and Healthcare products Regulatory Agency (MHRA) of UK, and the Therapeutic Goods Administration (TGA), Department of Health and Ageing of the Australian Government, issued Good Manufacturing Practice (GMP) certificates for the Company’s manufacturing site at Paonta Sahib (India), following a joint audit conducted in November 2008. During the quarter, following an audit conducted in November 2008, the World Health Organization (WHO), Geneva, stated that Ranbaxy’s Paonta Sahib plant complies with WHO Good Manufacturing Practice (GMP) guidelines. Asia, Middle East and CIS Sales during the quarter were Rs. 5,400 Mn (USD 109 Mn), a growth of 4%. India, Russia and several smaller countries contributed to growth in the region. Ranbaxy received an approval from the Therapeutic Goods Administration (TGA), Department of Health and Ageing of the Australian Government, for the registration of Ozidal (Risperidone) 0.5mg, 1mg, 2mg, 3mg and 4mg tablets in Australia. With the approval of Ozidal, Ranbaxy now has a total number of 27 molecules approved for marketing in Australia. Earlier during the quarter, the Company also received an approval for Sebifin® (Terbinafine) tablets in Australia. During the quarter, the Company’s manufacturing facility at Paonta Sahib was approved by TGAAustralia and its Batamandi facility was approved by PMDA-Japan. India (excluding Global Consumer Healthcare) Sales for the quarter were Rs. 3,258 Mn (USD 66 Mn), a growth of 9% over the corresponding previous quarter. The Company maintained its No. 2 rank in the Indian pharmaceutical market with a 4.8% market share. In the anti-infectives segment, the Company continues to be the market leader with 11% market share. Contribution of Chronic therapies was 24.4% with key areas such as Cardiovasculars and Anti-diabetes growing ahead of the market. The Company presently has 5 of the top 30 brands in the Indian pharmaceutical market. During the quarter, Ranbaxy launched Olvance (Olmesartan Medoxomil; antihypertensive), an original research product of Daiichi Sankyo. This is the first product from Daiichi Sankyo’s portfolio to be launched by Ranbaxy. Going forward the Company will scale up Daiichi Sankyo’s innovative product introductions in India. CIS: Russia & Ukraine The CIS region recorded Sales of Rs. 865 Mn (USD 17 Mn) during the quarter, a de-growth of 8%, which was primarily on account of sharp currency devaluation and tight and prudent credit management by the Company, following the current liquidity crunch in the market. On a constant exchange rate, sales grew by 25% in Russia. Asia Pacific The region recorded sales of Rs. 1,092 Mn (USD 22 Mn) during the quarter, a growth of 9% over Q1’08, contributed by multiple markets in the region. Africa Sales for the quarter were Rs. 1,315 Mn (USD 26 Mn), a growth of 8% over the corresponding previous period. Sales in South Africa were 58% higher than Q1’08 at Rs 716 Mn (USD 14 Mn). Sales in Nigeria grew by 15% to Rs. 245 Mn (USD 5 Mn). Latin America In Brazil, sales were Rs. 362 Mn (USD 7 Mn) during the quarter, a de-growth of 8% largely on account of foreign currency movement. Ranbaxy continues to show healthy market performance with 31% secondary sales growth as against market growth of 23%. The Company is ranked No. 6 in the generic market with 4% market share. In the rest of Latin America, sales were Rs. 214 Mn (USD 4 Mn), a de-growth of 4%, which was due to Mexico. Most other markets exhibited good growth. Global Consumer Healthcare (GCHC) Global Consumers Healthcare business recorded sales of Rs. 291 Mn (USD 6 Mn). Sales degrew by 23% due to slower uptake of stocks by the trade channels. However, within the market, the Company’s brands performed well, and all the key brands registered good growth on secondary sales / ORG sales. Revital increased its market share to 87% and is currently the 13 th largest product in the Indian pharmaceutical market. The market share of Volini also increased to 32%. Research & Development The Company is preparing to commence Phase-III studies on its new drug, an anti-malaria molecule, Arterolane Maleate + Piperaquine Phosphate. Phase-III trials will commence shortly in India and South East Asia. In the area of New Drug Discovery Research, the Company received its first milestone payment from GlaxoSmithKline on successful initiation of Phase-I human clinical trials for a Respiratory Inflammation molecule, under its alliance with that company. During the quarter the Ranbaxy made 92 filings worldwide and received 78 approvals. Outlook for 2009 During 2009, the Company expects to achieve sales marginally lower than 2008 in Rupee terms of approx Rs. 70 Bn (USD 1.4 Bn) and PAT of approx Rs (8.0) Bn (USD (150) Mn). This estimate is based on the following assumptions : a) Exchange rate of USD:INR of 50.50 b) No further impact on account of USFDA.