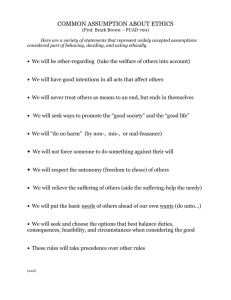

Pascal`s Wager

advertisement

Pascal’s Wager: An Example of Mathematical Modeling 1. Pascal’s Original Wager The seventeenth-century philosopher, Blaise Pascal, proposed that, even though the existence of God cannot be determined through reason, a person should “wager” as though God exists. This argument has become known as Pascal’s Wager. In short, one can behave as if God exists or as if God does not exist. If God does not exist, then it doesn’t matter which way the person behaves. If God does exist, then it matters greatly that the person behaves as if God exists. The following matrix summarizes Pascal’s argument as to the payoffs one receives based on one’s behavior and God’s existence. Table 1. Pascal’s original wager Behave As If God Exists Behave As If God Does Not Exist God Exists Positive Infinite Negative Infinite God Does Not Exist Zero Zero According to Pascal’s matrix, if God does exist, then one should behave as if God exists (and receive a positive infinite vs. negative infinite payoff), and, if God does not exist, then one receives the same payoff (zero) from behaving as if God exists vs. behaving as if God does not exist. In short, the person is at least as well of behaving as if God exists regardless of whether or not God exists. The model in this paper adapts Pascal’s wager as follows: 1. A person lives for a finite and known number of periods. 2. At the beginning of the person’s life, he chooses whether to behave well or to behave poorly. He behaves in the chosen way in each period of his life. 3. The person cannot conceive of an infinite payoff and so perceives finite payoffs for each of the combinations of conditions in Table 1. 4. It is costly for the person to behave well. 5. The person discounts future payoffs according to a fixed and known subjective discount rate. 2. Model Suppose that a person, who knows he will live N periods, receives a benefit, R, in each period of his life regardless of whether or not God exists. Let δ be the person’s subjective periodic discount rate. The present value of this stream of benefits, R , is R R R R R R ... 2 3 N 1 1 1 1 (1) The person will choose, today, whether to live the rest of his life behaving well or behaving poorly. Let there be a cost, C, each period to behaving well. If the person behaves well throughout his life, the present value of the stream of costs to behaving well, C , is C C C C C C ... 2 3 N 1 1 1 1 (2) Simplifying (1) and (2) yields: 1 N 1 Net present value from behaving well R C R C N 1 (3) 1 N 1 Present value from behaving badly R R N 1 (4) Suppose that the person perceives a probability, π, that God exists. If the person is correct and God does exist, the reward for behaving well is S and the reward for behaving badly is D. If, however, God does not exist, the reward is zero regardless of one’s behavior. This results in the following: Expected reward from behaving well S 0 1 S , S 0 (5) Expected reward from behaving badly D 0 1 D , D 0 (6) Because these expected rewards occur in the future, what are relevant are their present values. Taking the present values of (5) and (6) yields: Present value of expected reward from behaving well S 1 Present value of expected reward from behaving badly N D 1 N (7) (8) Adding (7) to (3) and (8) to (4) yields the present values of the person’s expected returns from now through eternity due to behaving well, EW , and badly, EB . We have: 1 N 1 S EW R C N N 1 1 (9) 1 N 1 D EB R N N 1 1 (10) Subtracting (10) from (9) yields the marginal benefit from behaving well versus behaving badly. We have: 1 N 1 1 N 1 S D EW EB R C R N N N N 1 1 1 1 (11) Simplifying yields: EW EB C S D 1 C (12) When (12) is positive, the rational person will behave well. When (12) is negative, the rational person will behave badly. Let us call (12) the “God difference” and denote it as Δ. As Δ increases, the person will exhibit a greater tendency to behave well. 3. Solution and Discussion Derivating (12) with respect to S and D, and recalling that π > 0 and δ > 0, yields: 0 S 1 (13) 0 D 1 (14) and These are expected results. As the person’s perception of the magnitude of reward for good behavior, S, rises or the perception of the magnitude of reward for bad behavior, D, falls, the person will have a greater tendency to behave well. Similarly, derivating (12) with respect to π, and assuming that S > D, yields: S D 0 1 (15) which is the expected result that the person’s tendency to behave well increases as the person’s subjective belief in the existence of God, π, rises. If we look at the impact on the God difference caused by a change in the cost of behaving well, we find: 1 0 C 2 (16) Specifically, as the cost of behaving well rises, the present value of eternity’s net benefit from behaving well falls (assuming δ > 0). This is consistent with Teresa of Avila’s observation: “God, if this is the way you treat your friends, it is no wonder that you have so few.” Similarly, looking at the impact on the God difference caused by a change in the subjective discount rate yields: 2 C 1 2 S D 2 1 2 (17) The relationship between δ and Δ in (12) is shown in Figure 1. The sign of (17) changes depending on δ, where C 1 2 2 S D 1 2 2 0 C C 2 C S D S D Figure 1. The relationship between δ and Δ, where S = 50, D = -50, π = 0.5, and C = 1. Examining (18) yields the conditions for the signs of the first derivative in (17). (18) C C 2 C S D 0 if S D (19) C C 2 C S D 0 if S D The second result in (19) is intuitive. As the discount rate rises (i.e., the person comes to regard the future as less important), the God difference falls. In short, as the person comes to hold the future in less regard, the benefit of the present day begins to weigh more heavily than the benefit of the afterlife, and so the benefit to behaving well falls. The first result in (19) is, at first glance, counter-intuitive. It suggests that those who “live for the moment” (i.e., those for whom δ is greater) experience a greater God difference and so, according to (12), are more likely to behave well. Intuition suggests the reverse: that the more concerned one is about the long-term (i.e., the lesser is δ), the more likely one is to behave well. However, (19) is consistent with scripture (see, for example, the parable of the rich fool in Luke 12:13-21). The result in (19) is also consistent with Jesus’ admonition (Mark 10:21) to “go sell everything you have and give to the poor, and you will have treasure in heaven. Then come, follow me.” In light of (19), an alternate translation of Mark 10:21 might be, “Woe unto you who for whom δ rises.” If we take the subjective discount rate to be a choice variable rather than a fixed parameter, (18) gives us a rule for the optimal δ. In the parable of the foolish virgins, Jesus warns against being unprepared for the future (Matthew 25:1-13). Equation (18) can then be taken as the rule for striking a balance between being a rich fool and being a foolish virgin. Equation (18) shows that there is an optimal discount rate that maximizes the God difference, i.e., the benefit of behaving well. This result is consistent with the belief that true happiness requires attaining a balance between preparing for the future and living in the present. This model suggests that that balance is found when δ satisfies equation (18). Finally, it is interesting to note that N does not appear in (12). Specifically: 0 N (20) This result implies that one’s age has no bearing on one’s behaving as if God exists. As scripture has it, both the innocent child (i.e., N >> 0) and the good thief (i.e., N ≈ 0) are called to conversion.