IRS ADMINISTRATIVE GARNISHMENT

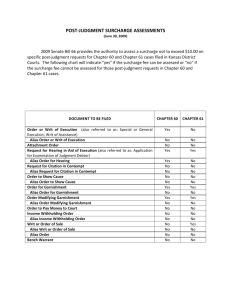

advertisement

All, I'm not sure that any of this information has succeeded or will succeed in stopping an administrative "garnishment" by the IRS, but the information should at least form the basis of some questions to all responsible parties that certainly deserve an answer. ICE ************************** Date: Tue, 10 Aug 1999 19:45:37 –0500 From: "Timothy I. McCrory" <tmccrory@kskc.net To: "Timothy I. McCrory" <tim_mccrory@bigfoot.com Subject: SOLU: IRS ADMINISTRATIVE GARNISHMENT] The subject of Internal Revenue Service administrative garnishment has come up in most discussion groups I subscribe to, and in private transmissions from across the country. It should be obvious that an administrative garnishment is patently illegal. The key fifteen words in the Fifth Amendment preclude such foolishness: No person shall be deprived of life, liberty or property without due process of law. However, revenue agents and employers don't seem to grasp the meaning of the Fifth Amendment: It is a complete ban against seizure of any kind without a judgment by an Article III court of the United States. Unfortunately, people have routinely been subjected to administrative garnishment because they didn't know how to defend against it. This is where people such as Pat Patton, Marcia Doerr, and others have helped to gain focus and understanding. They concentrate on law and evidence, taking us out of the speculative to the concrete. Assuming IRS had jurisdiction to assess and collect taxes in the Union of several States, what process is required? Here is a laundry list of essentials necessary to garnish wages: 1. Whoever is subject to this process must have been notified that he or she is required to keep books and records, and file returns, per 26 U.S.C. 6001 and 26 CFR 1.6001-1(d) & 31.6001-6. 2. There must be a lawful assessment, per 26 CFR 301.6203-1. 3. Subsequent to the assessment, there must be a 10-day notice and demand letter, per 26 CFR 301.6303-1. 4. In the event the assessment is contested, or there is failure or refusal to pay, there must be a General Accounting Office determination of liability, per 26 U.S.C. 7401 & E.O. 6166. 5. If there is a GAO determination of liability, the Attorney General may initiate or authorize a civil action for collection of delinquent tax, per 26 U.S.C. 7401 & E.O. 6166. (A U.S. Attorney cannot unilaterally initiate civil or criminal proceedings relating to taxes.) 6. Thereafter, a civil action may be filed on behalf of the United States in a district court of the United States, per 26 U.S.C. 7402. 7. In the event of favorable judgment, the United States may file a judgment lien in accordance with provisions of 28 U.S.C. 3201. 8. In the event of failure to pay, the United States may secure a writ of garnishment in compliance with requirements of 28 U.S.C. 3205. Unless or until every element of this process is in place, there can be no garnishment. But how do those threatened or subjected to IRS administrative garnishment stop the process long enough to secure a remedy? Fortunately, the Internal Revenue Code provides a safety valve that stops administrative initiatives dead in the water. I would recommend the following: First, use a Privacy Act or FOIA request to secure documentation to prove or disprove process above. A model is posted on the Law Research & Registry web site: http://www.LawResearch-Registry.org/ Second, seek protection of the Taxpayer Advocate, a/k/a Ombudsman, under authority of 26 U.S.C. 7811. (1) Claim your right to remedies under 26 U.S.C. 7804(b), and if there is reason to believe the revenue officer has not complied with statutory and regulatory requirements, (2) point out that you believe there is reason to seek criminal prosecution under provisions of 26 U.S.C. 7214. Include a copy of the FOIA or Privacy Act request to reinforce allegations of unlawful claims and administrative procedure. It wouldn't hurt to review 1998 legislation that imposes stricter disclosure and compliance standards on IRS. I haven't looked into how it applies to the Taxpayer Advocate yet, but GAO recently made a lengthy report on difficulties in that area so the new legislation evidently fortifies the role. Dan Meador