How To Start An Artisan and Craft Business In Ontario

advertisement

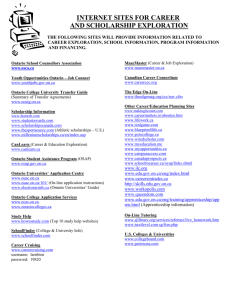

How To Start An Artisan and Craft Business In Ontario Last Verified: 2007-03-27 This guide has been prepared by the Canada-Ontario Business Service Centre (COBSC), a single point of access to information on federal and provincial government programs, services and regulations. Need more information? Click: Canada-Ontario Business Service Centre Call: 1-800-567-2345 Visit: our Regional Access Program Locations web site to locate an office near you TABLE OF CONTENTS 1. 2. 3. 4. 5. 6. 7. Basics To Getting Started Industry Overview Regulations Financing Managing Your Operation Associations Other Resources 1. Basics To Getting Started Starting a business can be a rewarding undertaking, but it comes with its challenges. Before starting a business in Ontario, it is wise to do your research. There are several issues to consider such as regulations, financing, and taxation, managing your business, advertising and much more. For further information: see these documents: Business Start-Up Info-Guide Home-Based Business Market Research It is essential that you know who your customers are, what they need or want, and how to reach them. You should have solid understanding of these if you are going to run a successful business. For further information: see the document: Market Research for Your Business visit these web sites: Study of the Crafts Sector in Canada Guide to Culture Statistics Canadian Fine Craft Niche Market Study Study on International E–Commerce Sites Travel Activities and Motivations Survey (TAMS) 2. Industry Overview Whether you call them artisans or professional craft persons you are still speaking about skilled individuals who create artefacts of singular beauty. The production of artisans' spans the creation of essentially decorative items such as jewellery, ceramics and textiles to more mechanically complex, utilitarian items such as hand-made musical instruments, customdesigned vehicles and intricate, hand-crafted mechanisms. The common thread that connects the varied types of products made by artisans is the persistent sense of "the personal touch." According to Trade Team Canada — Cultural Goods and Services , in its document Craft International Trade Action Plan , the "Canadian craft sector generated $727 million in economic activity in 2001, including over $100 million in exports." And the "majority (73%) of craft-producing members of the provincial craft councils (PCC) operate as individual craft persons; 10% have formed partnerships with others; and the remaining 17 percent have employees, ranging from a single part-time employee to over 30 employees."* The agency also reports that ten percent of people responding to the survey had craft revenues in excess of $120,000. Counted among the artisan and crafts fields are: jewellery making spinner bookbinder stained glass maker weaver carver leather worker stringed instrument maker ceramist doll maker metalworker glassworker Certain businesses might require specific training or certification, such as: carpentry interior design masonry glass blowing metal working ceramics jewellery making This is not an exhaustive list and different organisations and agencies would add to and subtract from as well as make finer distinctions among these groupings. This inconsistency in categorising artisans makes the gathering of complete data on this section of the economy difficult. Note: This guide does not address the specific requirements for staring and running a business for artisans that work in the field of specialty foods or grooming. The COBSC has created documents that may prove useful starting points for finding further information on these industries. For further information: see the documents: How to Start a Restaurant or Catering Business in Ontario How to Start a Spa or Salon in Ontario How To Start A Pet Business In Ontario Business Licences visit the web site: Service Ontario - Business information by industry 3. Training And Professional Skills Development Many of the traditional fields worked by artisans have been absorbed by large scale manufacturing industries, yet the skills needed in both remain similar if not the same. Artisans seeking training in their respective disciplines can find sources of instruction though the traditional artisan guilds and associations. Some of the basic technical skills needed by anyone starting an artisan business can be acquired not only from a master craftsperson but also through training offered to apprentices in the related industry, i.e. glass and metal sculptors could benefit from apprenticeships that target the skilled trades in the construction sector. Collegiates, and private and public, postsecondary institutions provide relevant instruction in these fields too. Ontario Ministry of Training, Colleges and Universities The Ministry of Training, Colleges and Universities’ web site has information on Ontario’s publicly funded universities as well as a list of other educational institutions that can grant degrees and a list of private career colleges that offer courses in the applied arts. Ontario Ministry of Education The Ministry of Education web site is also a good source of information on arts and arts-related courses offered though your local school board. For further information: visit these web sites: About Ontario Universities About Ontario Colleges Private Career Colleges (PCC) Minister of Training, Colleges and Universities – Apprenticeship Ministry of Education (MTCU) schools SkilledTrades.ca Professional Associations and Organizations Artisan guilds, associations, groups, clubs and circles and other arts associations give workshops and provide other means to contact, work with and learn from experienced, professional artisans and artists. Also see the list of organizations in Section 7 “Associations”. For further information: visit the web site: Canadian Crafts Federation Ontario Crafts Council Artists in Stained Glass (AISG) Metal Arts Guild of Canada (MAGC) Sculptors Society of Canada (SSC) There is a great deal of business acumen among artisans and arts organisations. Networking and making personal contacts are a very important part of finding information and acquiring business skills specific to the arts sector. Some arts organisation offer opportunities in both structured and less structured formats for artisan to get the training on the business side of the arts industry. Cultural Human Resources Council (CHRC) The Cultural Human Resources Council (CHRC) focuses on the area of cultural human resources development. CHRC aims to draw together members of the arts disciplines and cultural industries in the cultural sector to address the training and career development needs of all cultural workers from the artists, technical staff, to everyone involved in the sector in a professional capacity whether as an employee or the self-employed. Created in 1995 to strengthen the Canadian cultural workforce, CHRC is one of 28 sector councils supported by Human Resources Development Canada (HRDC). With general membership and board members drawn from within the cultural sector, CHRC specifically works in the areas of project development for a wide range of human resource management including competency development and career planning for artists; career development tools; job opportunity and virtual market place; networking resources; sector specific research and information resources; and general advocacy for the sector. The web site offers a comprehensive selection of assessment tools, guides and links to art organizations across Canada as well as CultureWorks.ca , an online job search engine. For further information: please call 1-877-699-5559 or 613-562-1535 visit these web sites: CHRC - Frequently Asked Questions CHRC - Careers in Culture CHRC - HR Tools CHRC’s Competency Charts and Profiles CHRC - Youth Internship Program (YIP) 4. Regulations For regulatory or legal questions, it may be useful to contact a lawyer through the Law Society of Upper Canada's Lawyer Referral Service. For further information: Please call (416) 947-3300 or 1-800-668-7380 visit the web site: The Law Society of Upper Canada see the document: Selecting Professional Services Municipal Regulations Each municipal government has the authority to issue its own business licenses within its jurisdiction. Since there is no uniformity throughout Ontario regarding municipal licenses for businesses, you should consult with the appropriate local officials to determine whether your business will be affected by local regulations and licensing requirements. For further information: visit the web site: Association of Municipalities in Ontario see the document: Municipal Requirements to Start a Business Building permits The Building and Development Branch administers the Building Code Act, 1992 and the The Ontario Building Code . These codes govern the construction of new buildings as well as the renovation and maintenance of existing buildings. For information on your organization's specific requirements please contact the Building and Development Branch of the Ontario Ministry of Municipal Affairs and Housing . Ontario Human Rights Code All employers in Ontario must adhere to the Ontario Human Rights Code. The code states that all Employment decisions should be based on the applicant's ability to do the job and not on factors that are unrelated to the job. For further information: please call 1-800-387-9080 or (416) 326-9511 visit the web site: Ontario Human Rights Commission Occupational Health and Safety Act Almost every worker, supervisor, employer and workplace in Ontario is covered by the Occupational Health and Safety Act and regulations. As an employer in Ontario, you have a number of obligations, including a duty to instruct, inform and supervise your workers to protect their health and safety. The Ministry of Labour produces a "Guide to the Occupational Health and Safety Act" that can help you understand the rights and duties of all parties in the workplace. This Guide is published on the Internet as Guide to the Occupational Health and Safety Act or can be purchased from Publications Ontario at (416) 326-5300 or 1-800-668-9938. Note: Some industries (such as highway and air transportation, radio and television broadcasting, banks, etc.) fall under the federal government's Canada Labour Code , rather than the Ontario regulations. For further information: please call (416) 326-7160 or 1-800-531-5551 visit the web site: Law Society of Upper Canada's Lawyer Referral Service Employee Self Help Kit see these documents: Occupational Safety and Health in Canada Employment Regulations Info-Guide Employment and Training Assistance Programs Info-Guide Employee or Self-Employed? Workplace Safety and Insurance Most industries in Ontario are covered by the Workplace Safety and Insurance Act . Employers must pay into the insurance fund of the Workplace Safety and Insurance Board (WSIB) through assessments on their payrolls. By contacting a WSIB office, you can obtain a registration kit, which includes information on assessments, coverage, accident reporting requirements and appeals procedures. Employers are required to contact the board within 10 days of hiring an employee. The Employer and the Workplace Hazardous Materials Information System - WHMIS publication describes the responsibilities of employers regarding hazardous materials used in the workplace. For further information: please call (416) 344-1000 or 1-800-387-5540 see the document Workplace Safety and Insurance Board - WSIB Note: The Office of the Employer Adviser (OEA) provides employers with advice, education, representation, mediation, negotiation and information on workplace safety insurance. For further information: please call (416) 327-0020 or 1-800-387-0774 see the document Office of the Employer Adviser - Advice For Employers Labelling Most goods produced domestically or imported into Canada require some form of consumer package labelling. Retailers should become aware of these requirements before offering goods for sale in Canada. The Labelling act(s) are enforced and administered by the Competition Bureau. For further information: please call 819-997-4282 or 1-800-348-5358 see these documents: Labelling - Packaging Consumer Products (Non-Food) Labelling - Textiles CA Number Registration and Database visit the web sites: Competition Bureau Guide to the Textile Labelling and Advertising Regulations Guide to the Consumer Packaging and Labelling Act and Regulations Bar Codes The Universal Product Code system provides manufacturers, retailers and distributors with a management and information tool to uniquely identify products and logistical units throughout the supply chain. For further information: see the document Bar Codes Precious Metals Marking The Precious Metals Marking Act provides for the uniform description and quality marking of precious metals articles (articles made with gold, silver, platinum or palladium) to help consumers make informed purchasing decisions. For further information: consult the document Precious Metals Marking Hazardous Products Act Some consumer products such as cosmetics, toys, and children's clothing are regulated by Health Canada through the Hazardous Products Act . The Regulations specify the requirements for labelling and instructions for assembling, design, construction, finish, performance, flammability and toxicity. Businesses that manufacture, retail or import consumer goods should be aware of all labelling requirements regarding their product. For further information: See the documents: Products Banned Under the Hazardous Products Act Products Regulated Under the Hazardous Products Act Non Regulated Items of Concerns Under the Hazardous Products Act 5. Financing There are programs available through the Department of Canadian Heritage and the Arts and Cultural Industries Promotion Division of the Foreign Affairs Canada (FAC) to support various activities in this area. For information on culture related federal funding programs: please call (Canada Council for the Arts) 1-800-263-5588 or (613) 566-4414 visit the web site: Grant Programs for Artists and Arts Organizations please call Canada Heritage at 1-866-811-0055 or (416) 954-0395 visit the web site: Financial Support Programs please call (Department of Foreign Affairs and International Trade) (613) 995-0674 or 1-888757-7752 visit the web site: Arts and Cultural Industries Arts Presentation Canada Arts Presentation Canada gives Canadians direct access to diverse, quality artistic experiences through financial assistance to arts presenters or the organizations that support them. Eligibility requirements Canadian, not-for-profit organizations incorporated under Part II of the Canada Corporations Act (or under corresponding provincial or territorial legislation) offers assistance to artists that present, in a professional manner, artistic experiences originating from more than one province or territory or that strengthen networking activities of Canadian performing arts presenters. Presenters that are provincial/territorial, municipal institutions or First Nation Tribal or Band Council / Inuit Organizations will also be considered. For application deadlines contact Arts Presentation Canada directly. For further information: please call 1-866-811-0055 or (416) 954-0395 Canada Council for the Arts The Canada Council for the Arts is a national arm’s length agency created in 1957 to "foster and promote the study and enjoyment of, and the production of works in, the arts." Canada Council provides grants and services to professional Canadian artists and arts organizations. Contact the Canada Council directly if you require information on a specific grant program, a program information sheet (or, if you have already decided to apply, request an application form and guidelines for that program). If you need a listing of all grants available in your particular discipline, request the summary of grants available for that discipline. For further information: please call 1-800-263-5588 visit the web sites: Canada Council for the Arts - Grant Programs Business Support for Young Artists – The Summer Company Program The Summer Company program provides hands-on business training and mentoring – together with awards of up to $3,000 – to help enterprising young people (students aged 15-29) start up and run their own summer business. Many participants of the program successfully started and managed an arts-based business (e.g., fashion design, drama programs, music instruction, etc.) Summer Company is coordinated and delivered at the community level through a network of Small Business Enterprise Centres and other program providers supported by the government of Ontario. For further information: please call 1-800-387-5656 see the document Summer Company The Canada-Ontario Business Service Centre has created documents, which provide an overview of some of the main financing options for individuals starting and operating a business in Ontario, including programs offered or supported by the government For further information: please call 1-800-567-2345 see the documents: Financing for Starting a Business Info-Guide Financing for Established Businesses Info-Guide 6. Managing Your Operation Dealing with Business Taxes All businesses must be aware of the various taxes that may apply to their product or service. Depending on the type and location of products or services being offered, federal, provincial and/or municipal business taxes may apply. For further information: visit these web sites: Provincial Tax Forms and Publications Ontario Small Business Guide Canada Revenue Agency (CRA) see the document: Taxation Info-Guide Income Tax Information Business owners must be aware of the requirements of Income tax that may apply to their product or service. There are different tax implications for incorporated and non-incorporated businesses. For information specific to your organization you should consult an accountant or financial professional. For further information: please call 1-800-959-5525 visit these web sites: Ontario Income Tax Ontario Corporations Tax Canada Revenue Agency - Topics for businesses see the document: Taxation Info-Guide The following federal tax information may be specifically applicable to the art-based business owner. IT-273R2 Government Assistance -- General Comments Employed artists T4002 Business and Professional Income 2006 Topics - Employment expenses IT-407R4 (Consolidated) Dispositions of Cultural Property to Designated Canadian Institutions IT-110R3 Gifts and Official Donation Receipts IT-257R Canada Council Grants IT-288R2 Gifts of Capital Properties to a Charity and Others IT525R-CONSOLID Performing Artists IT504R2-CONSOLID Visual Artists and Writers IT75R4 Scholarships, Fellowships, Bursaries, Prizes, Research Grants and Financial Assistance Line 130 - Scholarships, fellowships, bursaries (study grants), and artists' project grants IT490 Barter transactions Work space in home expenses IT-357R2 Expenses of Training IT120R6 Principal Residence Motor Vehicle Expenses Claimed by Self-Employed Individuals Below are links to publications that cover some of the general tax requirements for business owners in Ontario. Ontario Small Business Guide This booklet will guide you through various aspects of Retail Sales Tax, Corporations Tax and Employer Health Tax. This booklet also answers some of the frequently asked questions of small business owners regarding tax obligations. Employer Health Tax - Guide for Employers Describes the main features of the EHT (Employer Health Tax), including taxpayer rights and responsibilities under the Employer Health Tax Act. For further information: see the document: Employer Health Tax Retention/Destruction of Books and Records Explains the retention period required for Ontario tax purposes, before books and records can be destroyed. Voluntary Disclosure Explains what voluntary compliance is and the basic principles under which Ontario's tax system operates. Selecting Professional Services The use of professional services is essential to the success of a small business. Professionals can provide knowledge and expertise in the areas where you may have little. They can round out your management team to ensure your business is operating efficiently. For further information: see the document: Selecting Professional Services Accounting/Bookkeeping A good record keeping system should be simple to use, easy to understand, reliable, accurate, consistent and designed to provide information on a timely basis. Note: All staff working with cash should be trained to recognize counterfeit currency. Setting-Up a Pay System Pay administration is a management tool that enables you to control personnel cost, increase employee morale, and reduce workforce turnover. For further information: see the document: Setting Up a Pay System Setting the Right Price Setting the right price can influence what consumers will buy, which in turn affects total revenue and profit. For further information: see the document: Setting the Right Price Profit Watching Making a profit is the most important -- some might say the only objective of a business.. To make improvements, you must know what's really going on financially at all times. For further information: see the document: Checklist for Profit Watching Employing people What are the rules on working conditions in Ontario? The Employment Standards Branch of the Ministry of Labour is responsible for the administration and enforcement of the Employment Standards Act, which provides for minimum terms and conditions of employment in most industries. For further information: please call (416) 326-7160 or 1-800-531-5551 see the documents: Employment Regulations Info-Guide Employment and Training Assistance Programs Info-Guide 7. Associations Canadian Crafts Federation Canadian Gift & Tableware Association Society of Graphic Designers of Canada The Ottawa Guild of Potters Fusion: The Ontario Clay and Glass Association Canadian Doll Artist Association - Programs Potters' Guild of Hamilton and Region The Canadian Guild of Crafts Ontario Artist Blacksmith Association (OASBA) Ontario Handweavers & Spinners (OHS) Canadian Quilters’ Association Canadian Craft and Hobby Association Canadian Bookbinders and Book Artists Guild (CBBAG) 8. Other Resources SODART Société de droits d’auteur en arts visuels (in French only) The Works International Visual Arts Society SQUARE FEET The Artist's Guide to Renting and Buying Work Space Canadian Artists' Representation - CARFAC The Healthy Artist Guide to a Less Toxic Studio Related Reading List of Fact Sheets Aboriginal Business Info-Guide Your Business and the Environment Info-Guide Tourism Business Info-Guide Growing Your Business Arts and Artists Info-Guide Business Guides DISCLAIMER Information contained in this document is of a general nature only and is not intended to constitute advice for any specific fact situation. Users concerned about the reliability of the information should consult directly with the source, or seek legal counsel. Links Policy Some of the hypertext links lead to non-federal government sites which are not subject to the Official Languages Act and the material is available in one language only.