OMB CIRCULAR A-133 - National Reporting System

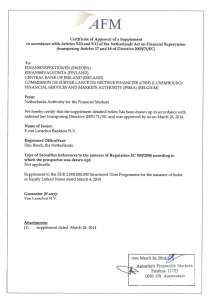

advertisement