Acquisition and Disposal Policy

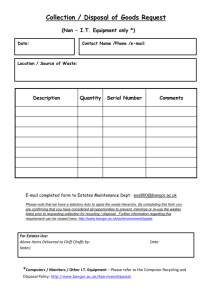

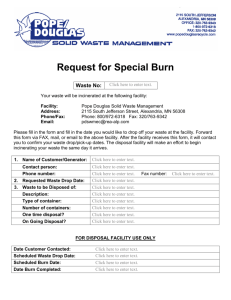

advertisement

APPENDIX B4 Acquisition and Disposal Policy for Land and Property Contents 1.0 Introduction 2.0 Acquisition of land and property 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 3.0 Options for acquisition of land and property. Compulsory Purchase Acquisition of land or property for service delivery. Acquisition of land or property for investment purposes. Acquisition of land for strategic acquisition for future development in line with Council priorities and objectives. Financial criteria for acquisitions Money Laundering Internal and External Audit Disposal of land and property 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 3.9 3.10 3.11 3.12 3.13 3.14 3.15 3.16 3.17 Options for disposal of land and property Determination of the method of disposal. Open Market disposal Criteria for consideration of a private treaty sale Joint development Disposal by short tenancy Obtaining best consideration and disposal at an undervalue Determination of sites for disposal or redevelopment Definition of a site for redevelopment Disposal of sites identified as suitable for redevelopment Definition of surplus asset for disposal Disposal of surplus asset by freehold or leasehold interest Financial criteria for disposals Community Asset Transfer Valuations for disposal for inclusion in Asset Register Money laundering Internal and External Audit Appendix A Statute law relating to acquisition and disposal APPENDIX B4 1.0 Introduction 1.1 The purpose of the Council’s Acquisition and Disposal policy is to set out the principles and rules by which the Council will acquire and disposal of land to inform Officers, Members and also other interested parties. 1.2 The Council’s Scheme of Delegation for Land and Property sets out the financial levels for delegation in the decision making process. 1.3 This policy together with the Scheme of Delegation are key documents in the overall management of the Council’s land and property portfolio. 1.4 To be read in conjunction with the Scheme of Delegation to Officers and Members, Financial Rules, Anti money laundering policy, Procurement Rules and Strategy, the Capital Strategy and the Asset Management Plan including property key considerations and property appraisal framework. 1.5 Any Service Manager considering or identifying the need to acquire or disposal of land or property for service delivery purposes must consult the Property Services Manager at the earliest opportunity and prior to any commitment being made on behalf of the Council. 1.6 This policy deals with acquisition and disposal in line with scheme of delegation. Any acquisitions or disposals proposed which fall outside this policy would need to be reported on an individual basis to Cabinet or Council for approval, dependant on the values involved. APPENDIX B4 2.0 Acquisition of land and property 2.1 Options for acquisition of land and property. 2.1.1 The Council can choose to acquire property in any of the following forms: 2.1.2 Freehold Leasehold (more than 7 years) Short tenancy (less than 7 years) The reasons for the Council to acquire land or property would be: Service delivery Investment Strategic acquisition for future development in line with Council priorities and objectives 2.1.3 Prior to the purchase of any site a full option appraisal, including whole life costing, should be carried out which would involve appraisal of all the options for delivery of the final objective. Consideration should be given to all other Council owned property and its suitability prior to any acquisition. 2.1.4 All option appraisals should take into account the on-going cost of ownership of the property over its life time and ensure that any decision to acquire land is informed by both the capital and revenue implications of ownership and the risks associated. 2.1.5 VAT implications must be considered as part of the appraisal process prior to any decisions being made. Financial Services to be consulted with regard to VAT implications. 2.1.6 If the Chief Executive seeks to exercise his/ her emergency powers under Council Procedure Rule 38 for the acquisition or disposal of property, the decision must only be taken following consultation with the Asset Management Group. 2.2 Compulsory purchase 2.2.1 The Council may consider, where appropriate the acquisition of land through its compulsory purchase powers. 2.2.2 Powers of Compulsory Purchase are conferred on public authorities by legislation. They enable the authorities authorised to compulsorily purchase land which is required to carry out a function which Parliament has decided is in the public interest. These powers will be used where the owner or occupier of the land required is not willing to sell by agreement or where agreement cannot be achieved. 2.2.3 There are a number of stages in the Compulsory Purchase Procedure and the approval of the relevant Government Minister is required before such powers can be used. When deciding whether or not to exercise Compulsory Purchase powers the Council must take into account all relevant considerations (including, but not exclusively), the rights of the affected landowner(s) under the Human Rights Act 1998. 2.2.4 Where Compulsory Purchase powers are used, the land owner or occupier is generally entitled to compensation. APPENDIX B4 2.2.5 Legal Services to be consulted at the earliest opportunity if consideration is being given to acquisition in this way. 2.2.6 Authority for the decision to pursue a compulsory purchase of any land or property would be taken by Cabinet/ Council as necessary. 2.3 Acquisition of land or property for service delivery. 2.3.1 Land or property may be acquired for the purpose of service delivery in line with the scheme of delegation, subject to the following criteria: i. Authority from Corporate Team confirming that the level of service delivery is required. ii. An option appraisal has been carried and reported to the Asset Management Group, the result of which identifies the requirement for the land or property for service delivery. iii. The on-going revenue costs are contained within an approved budget which has been confirmed as appropriate by the Financial Services and Audit Manager, and/ or an appropriate budget is approved by Cabinet. iv. Where acquisitions will result in an asset to be recognised on the Council’s Balance Sheet; the purchase must be subject to the Council’s Capital Appraisal Scheme and a capital budget approved by the Cabinet or Council in accordance with the Financial Rules. v. Advice on whether a leasehold or short tenancy should be included on the Balance Sheet must be obtained from the Financial Services and Audit Manager. vi. VAT has been considered and the Financial Services have been consulted on the implications on VAT and that these are included in the option appraisal. 2.4 Acquisition of land or property for investment purposes. 2.4.1 Land or property may be acquired for the purpose of investment in line with the scheme of delegation, subject to the following criteria: i. Net return of 6% plus ii. Minimal tenant risk/ Strong covenants – so other Local Authorities, Primary Care Trust or similar. iii. Modern properties in generally good condition on full repairing and insuring leases. iv. Location of property - prime location potentially anywhere in the UK. v. Single let or multi let, but preference away from management intensive properties. APPENDIX B4 vi. The on-going revenue costs are contained within an approved budget which has been confirmed as appropriate by the Financial Services and Audit Manager, and/ or an appropriate budget is approved by Cabinet. vii. Where acquisitions will result in an asset to be recognised on the Council’s Balance Sheet; the purchase must be subject to the Council’s Capital Appraisal Scheme and a capital budget approved by the Cabinet or Council in accordance with the Financial Rules and/ or any delegated authority. viii. Advice on whether a leasehold or short tenancy should be included on the Balance Sheet must be obtained from the Financial Services and Audit Manager. ix. VAT has been considered and the Financial Services have been consulted on the implications on VAT and that these are included in the Capital Appraisal Scheme and report for decision. 2.5 Acquisition of land for strategic acquisition for future development in line with Council priorities and objectives. Land or property may be acquired for the purpose of future strategic development in line with Council priorities and objectives and in line with the scheme of delegation and subject to the following criteria: i. An option appraisal has been carried and reported to the Asset Management Group, the result of which identifies the land as suitable for current or future strategic development in line with Council priorities and objectives. ii. The on-going revenue costs are identified as part of the review and contained within an approved budget which has been confirmed as appropriate by the Financial Services Manager, and/ or an appropriate budget is approved by Cabinet. iii. Where acquisitions will result in an asset to be recognised on the Council’s Balance Sheet ; the purchase must be subject to the Council’s Capital Appraisal Scheme and a capital budget approved by the Cabinet or Council in accordance with the Financial Rules. iv. VAT has been considered and the Financial Services have been consulted on the implications on VAT and that these are included in the option appraisal. 2.6 Financial and other criteria for acquisitions 2.6.1 The Council needs to take a strategic approach to land and property acquisitions. The requirement to invest in land and property for any of the purposes identified in 2.3 to 2.5 should be identified as part of the Council’s procedures for developing its Medium Term Financial Plan, Capital Programme, Corporate Plan and Service Delivery Plans. 2.6.2 Service Managers will be required to take a medium to long term view when planning delivery of their services and will need to identify any requirement to acquire APPENDIX B4 land and property or any opportunities to dispose of surplus assets in order that these changes can be incorporated in the Council’s financial planning systems. 2.7 Money Laundering All transactions should be carried out in accordance with the Council’s AntiMoney Laundering Policy. All cash transactions must be within the limits set out in the Anti-Money Laundering Policy. Legal Services must make checks for all purchasers and ensure that vendors solicitors, and any solicitors employed to act on behalf of the Council, have an upto date Anti-Money Laundering Policy and that they are registered with the Law Society. 2.8 Internal and External Audit Audit trails of all acquisitions will need to be maintained and accessible by Internal/External Audit to verify actions/values and how the authority made the decision to acquire/dispose. Any appointment of a third party consultant must reserve the right of access to their records in relation to the transaction. This will need to be dealt with by way of appropriate contract conditions. APPENDIX B4 3.0 Disposal of land and property 3.1 Options for disposal of land and property 3.1.1 Disposal under the Local Government Act 1972 deals with all types of disposal, freehold, leasehold and short tenancy agreements. 3.1.2 The disposal of the Councils land and property could therefore be progressed in a number of ways and does not necessarily have to result in a freehold sale. The following options are available: i. Freehold disposal - The sale of the property with or without future covenants to restrict or protect future use. ii. Permanent grant of rights over land – i.e. easement in fee simple. iii. Leasehold disposal – Leasehold interest can be agreed for any time period. A leasehold interest of 7 or more years has to be registered as an interest in land with the Land Registry. All leasehold disposals will be agreed outside the Landlord and Tenant Act 1954 to exclude business protection, unless the property is categorised as an investment property where terms will be agreed based on advice from an Independent Valuer to seek best consideration for the lease. iv. Non permanent grant of rights over land – i.e. access licence, way leave etc. v. Short tenancy – tenancy for a term of less than 7 years or the assignment of a term which at the date of the assignment has not more than 7 years to run. All short tenancy disposals will be agreed outside the Landlord and Tenant Act 1954 to exclude business protection. 3.2 Determination of the method of disposal. 3.2.1 Except where certain criteria applies, open market disposal will be the preferred method of disposal. 3.2.2 Methods of disposal are: i. ii. iii. Open Market disposal Private Treaty disposal Joint Development 3.2.3 The method for the disposal of assets will be assessed and determined on a case-by-case basis by reviewing all of the options and completing an option appraisal. 3.2.4 All issues relating to the land or property, including social, environmental and economic benefit and legal issues and agreements, will need to be taken into account when determining the method of disposal. 3.2.5 The authority for determining the method of disposal will align with the delegated authority for the disposal. APPENDIX B4 3.2.6 Property Services Manager, Estates Officers and Strategic Development Officer will seek advice from Legal Services and external surveyors and valuers, where necessary, on the type and method of disposal. 3.2.7 In principle the Council will choose the method of disposal which provides best consideration, this may be more than just financial consideration and can include social, environmental and economic considerations, and will be the method which best secures the desired objectives/ outcomes for the land and/ or property. 3.3 Open Market Disposal 3.3.1 The decision to dispose will be taken in line with the scheme of delegation. 3.3.2 For freehold disposal and leasehold interests over 7 years the properties will be advertised, bids invited in the form of sealed bids by an agreed date or through open auction. 3.3.3 Whenever possible the Council will advertise for the disposal. This will be by way of an advert placed in an appropriate media and on the Councils website. Where appropriate recommendations will be sought on appropriate terms, including rent, from an independent agents/ Valuer and where necessary will be appointed to make recommendations on which they consider to be the best consideration taking into account both financial and non-financial benefits. 3.3.4 When appropriate independent agents will be appointed to manage the advertisement and the disposal of the land or property and report to the Council the value of the bids received and recommend which they consider to be the best consideration taking into account both financial and non-financial benefits. 3.3.5 For short tenancies of less than 7 years where appropriate independent agents/ valuers will be appointed to recommend appropriate terms including rent. The property will be advertised by the Council directly via its website, or when appropriate by an independent agent. The Council will enter into a tenancy with the first tenant which is willing to agree terms and has an acceptable covenant strength and/ or rent deposit acceptable to the Council. 3.3.6 All proposed tenants to be subject to a financial health check carried out by Financial Services and Audit teams. 3.4 Criteria for consideration of a private treaty disposal 3.4.1 In certain circumstances the Council will consider disposing of an asset by Private Treaty Sale. This involves the Council negotiating with a single third party to agree terms for the disposal. This can be used for freehold disposal, leasehold interests over 7 years and short tenancies for less than 7 years where appropriate. 3.4.2 If Private Treaty can be justified then for a freehold or a leasehold of more than 7 years an independent Agent/ Valuer will be appointed to advise or negotiate on the Councils behalf. For short tenancies of less than 7 years then an independent agent will be appointed where necessary. Appropriate Legal advice, up to and including Counsel’s opinion, where necessary, as to the legality of the proposed APPENDIX B4 arrangements, with particular reference to all relevant Local Government Acts and Regulations will be obtained. 3.4.3 In order to justify a Private Treaty freehold disposal, the proposal must meet one, or more of the following criteria:i. The proposed disposal involves both Council land or buildings and an adjoining property or piece of land owned or controlled by the prospective purchaser. ii. The disposal to a third party who, whilst not an adjoining landowner, would bring additional social, environmental or economic benefit “to the table”. (An example would be a sale to an existing major employer who could otherwise leave the area or a sale to a new major employer who would move into the area. Also the sale to a Community Association who could provide wider community benefits or Parish and Town Council in line with Council priorities) iii. To enable a third party to relocate within the area, from a site that is “inappropriate”, usually in Land Use terms, e.g. a light industrial unit adjacent to residential properties, to a site that is more suitable, e.g. an industrial estate or out of town location. iv. To enable the purchase of another site, which the Council considers necessary to meet its priorities and objectives. v. The disposal to an existing tenant. vi. For the grant of permanent and non-permanent rights, as by definition these are normally a request from a third party. 3.4.4 In all circumstances a private treaty disposal would seek to produce financial and/ or non-financial benefits, such as increased capital receipt through marriage value of an adjoining site, social, economic or environmental benefits, which would be at least equivalent to those obtainable through an open market disposal, in the opinion of an independent valuer/ agent. 3.4.5 Any decision to pursue a private treaty disposal is entirely at the discretion of Cotswold District Council and is the exception rather than the general rule. The satisfaction of one or more of the criteria for justifying a private treaty sale does not guarantee that the Council will choose to dispose via a private treaty disposal if other options are available. 3.5 Joint development 3.5.1 Where a redevelopment proposal includes Council land or property and adjoining land, the Council may choose to pursue a joint development with the adjoining landowner and/ or Developer or Registered Social Landlord (RSLs). 3.5.2 The details of a joint development arrangement are likely to differ from scheme to scheme but will broadly involve sharing the cost, risk and return from the project. APPENDIX B4 3.5.3 The benefits and risks of pursuing this method of disposal would require detailed assessment as part of the appraisal for the development. This is likely to be a viable option for large redevelopment projects only. 3.5.4 This form of development may result in EU procurement legislation becoming applicable. Any joint development proposal should be discussed with Legal Services regarding EU legislation. 3.5.5 Joint development proposals to be approved by Cabinet or Council only. 3.6 Disposal by short tenancy 3.6.1 Although not required within the Local Government Act 1972 best consideration should be obtained for all short tenancy agreements unless less than best consideration can be justified by way of social, economic or environmental benefits. 3.6.2 All short tenancy disposals will be agreed outside the Landlord and Tenant Act 1954 to exclude business protection. 3.6.3 Where appropriate an Independent Agent/ Valuer to be appointed to recommend appropriate terms, including rent. 3.6.4 Property to be advertised in accordance with section 2.3 on Open Market Disposal unless criteria for a private treaty disposal can be justified and is deemed to be the most viable option. 3.7 Obtaining best consideration and disposal at an undervalue. 3.7.1 The Council should seek, for all disposals, to achieve the best financial consideration available for the type of property and the agreed terms. 3.7.2 However where appropriate the Council can consider non-financial benefits as part of the consideration for a disposal. 3.7.3 The Council has the power within the Local Government Act 1972: General Disposal Consent (England) 2003, which considers the sale of land for less than best consideration to dispose of any asset at less than best consideration, without the requirement for approval from the Secretary of State, at up to £2million below open market value if it can justify the undervalue by the virtue of other benefits either social, environmental or economic. See Appendix relating to statute law. 3.7.4 Valuations for the land or property should be carried out by an independent valuer appointed by the Council and the valuation must be carried out in accordance with the Local Government Act 1972: General Disposal Consent (England) 2003. This requires valuations of the restricted sale value (allowing for all the conditions which the Council has placed on the sale and including non-financial benefits) and an unrestricted sale value. APPENDIX B4 3.8 Determination of sites for disposal or redevelopment. A number of the Council’s assets are categorised as surplus assets for disposal or development. Each of these sites needs to be classified as either a disposal or as having potential for future redevelopment. In the first instance this will be carried out by the Property Services Manager in consultation with the Community, Health and Housing Manager and the Portfolio Holders for Corporate Resources and Corporate Planning. This will be followed in due course by confirmation or re-categorisation following a property review and option appraisal of the land or property. If in the first instance it is unclear as to whether future development may be viable then for disposal purposes it should be assumed that development may be viable. 3.9 Definition of a site for redevelopment. 3.9.1 A site may become suitable for redevelopment due to one or more of the following criteria: i. ii. iii. iv. v. No longer being required for service delivery and as part of a property review and option appraisal redevelopment is identified as an option. Site is identified by the Community, Health and Housing Manager following consultation with Development Control, Forward Planning and/ or independent Planning Agents, as having future potential for market or affordable housing development. Site is identified within the Council’s Local Development Framework as a site for redevelopment. If an existing tenancy comes to an end consideration should be given to the option for potential redevelopment of the site prior to the site just being relet. The site is a verge/ other area which has potential for access to another site, inside our outside the Council’s ownership. 3.9.2 The Council will need to determine following a property review and option appraisal whether the Council will redevelop the site for investment purposes or community benefit, or whether the site will be disposal of with development potential. The review should consider the costs and benefits of disposal of the site with appropriate planning consent for redevelopment. 3.10 Disposal of sites identified as suitable for redevelopment. 3.10.1 Prior to disposal for redevelopment purposes any short term intermediate use shall be by way of a short tenancy with a term of less than 7 years, with a landlord break clauses at no more than 6 months notice. This will ensure that redevelopment can be progressed when viable. 3.10.2 All disposals should be outside the Landlord & Tenant Act 1954 to exclude business protection. 3.10.3 Any disposal of freehold interest or leasehold interest of more than 7 years would require Cabinet/ Council decision, dependant on values involved. APPENDIX B4 3.11 Definition of surplus asset for disposal A site will be determined as surplus for disposal following a property review and option appraisal if it meets all of the following criteria: i. ii. iii. iv. v. 3.12 It makes no contribution to the delivery of the Council’s services and is unlikely to be required for service delivery in the future. It is no longer appropriate for service provision. It has no potential for future strategic or regeneration/ redevelopment purposes (including affordable housing) The net income generated from the site is below that which could be achieved from disposing of the site and investing the capital receipt/ proceeds. The land or property is not adjacent to a larger area of land or property in the ownership of the Council. Disposal of surplus assets by freehold or leasehold disposal 3.12.1 The Council should plan to dispose of all surplus land or property identified for disposal within its portfolio subject to the following criteria: i. ii. iii. iv. v. That the disposal does not have a negative impact on the MTFP. Terms to be approved by an independent Valuer where appropriate. Best financial consideration to be obtained unless social, environmental or economic benefits are provided. The method of disposal will be determined on a case by case basis. Any leasehold disposal transfers all liabilities to the tenant. 3.12.2 Prior to final disposal any short term intermediate use shall be by way of a short tenancy with a term of less than 7 years, with a landlord break clause at no more than 6 months notice. This will ensure that disposal can be progressed when viable. 3.13 Financial criteria for disposals 3.13.1 An option appraisal should be carried out which assesses the capital and revenue implications of each option, includes the impact of the current economic conditions (e.g. should we hold the asset until market conditions improve?) and the VAT implications. 3.13.2 Valuations should be obtained for all viable options, provided by an independent Valuer. 3.13.3 Once sites are approved as being suitable for disposal and a programme for disposal has been agreed this should be included on a disposal plan which is then used to inform the MTFP. However until exchange/ completion of contracts has taken place, or the lease has been completed, there will always be a risk that the disposal will not take place in the time periods programmed. APPENDIX B4 3.14 Community Asset Transfer 3.14.1 The purpose of community asset transfer is to enable the transfer of under-used land and buildings from the public sector to community ownership and management - helping organisations to develop those assets and deliver long-term social, economic and environmental benefits which may not otherwise be achieved. 3.14.2 The Council will consider any request for an asset transfer to a Community organisation where the organisation can provide an adequate business case and where the transfer would meet the Councils priorities and objectives. 3.14.3 The Council will seek best consideration for the transfer unless social, environmental or economic benefits are provided. 3.14.4 The Council may, where appropriate, agree covenants or overage clauses to deal with additional development. 3.15 Valuations for disposal for inclusion in Asset Register. The Financial Services Team must be provided with copies of valuation documents and details of the following values when a property is disposed of by freehold sale: 3.16 i. Unrestricted value ii. Restricted value (if relevant) iii. Actual disposal value Money Laundering All transactions should be carried out in accordance with the Council’s AntiMoney Laundering Policy. All cash transactions must be within the limits set out in the Anti-Money Laundering Policy. Legal Services must make checks for all purchasers and ensure that vendors solicitors, and any solicitors employed to act on behalf of the Council, have an upto date Anti-Money Laundering Policy and that they are registered with the Law Society. 3.17 Internal and External Audit Audit trails of all acquisitions will need to be maintained and accessible by Internal/External Audit to verify actions/values and how the authority made the decision to acquire/dispose. Any appointment of a third party consultant must reserve the right of access to their records in relation to the transaction. This will need to be dealt with by way of appropriate contract conditions. APPENDIX B4 Appendix Main Statute Law relating to Acquisitions The Local Government Act 1972 section 120 empowers a principal council to acquire by agreement any land inside or outside its area (1) For the purposes of: (a) for the purposes of its functions under any enactment, or (b) for the benefit, improvement or development of its area, (2) A principal council may acquire by agreement any land for any purpose for which they are authorised by this or any other enactment to acquire land. Notwithstanding that the land is not immediately required for that purpose; and, until it is required for the purpose for which it was acquired, any land acquired under this subsection may be used for the purpose of any of the council’s functions. Local Government Act 2003 section 12 gives local authorities’ power to invest. It provides that a local authority may invest: (a) (b) for any purpose relevant to its functions under any enactment, or for the purposes of the prudent management of its financial affairs. Main Statute Law relating to disposal The Local Government Act 1972 section 123(1) gives the council the power to dispose of land and property. It states that ‘a principal council may dispose of land held by them in any manner they wish’ subject to a number of provisions, which are as follows. 123(2) except with the consent of the Secretary of State, a council shall not dispose of land under this section, otherwise then by way of a short tenancy, for a consideration less than the best that can reasonably be obtained. The Council shall not dispose of land under this. However, The Local Government Act 1972: General Disposal Consent (England) 2003 gives consent to disposal of land otherwise than by way of a short tenancy by a local authority in England for less than best consideration subject to specified circumstances. The Council can therefore sell at an under value without the requirement for approval from the Secretary of State in line with the following specified circumstances: (a) The local authority considers that the purpose for which the land is to be disposed is likely to contribute to the achievement of any one or more of the following objects in respect of the whole or any part of its area, or of all or any persons resident or present in its area; (i) (ii) (ii) The promotion or improvement of economic well-being; The promotion or improvement of social well-being; The promotion or improvement of environmental well-being; and (b) The difference between the unrestricted value of the land to be disposed of and the consideration for the disposal does not exceed £2 million pounds. See section 3.7 relating to disposal of land at less than best consideration. APPENDIX B4 123 (2A) A principal council may not dispose under subsection (1) above of any land consisting or forming part of an open space unless before disposing of the land they cause notice of their intention to do so, specifying the land in question to be advertised in two consecutive weeks in a newspaper circulating in the area in which the land is situated, and consider any objections to the proposed disposal which may be made to them. 123 (2B) Where by virtue of subsection (2A) above a council dispose of land which is held – (a) for the purpose of section 164 of the Public Health Act 1875 (pleasure grounds); or (b) in accordance with section 10 of the Open Spaces Act 1906 (duty of local authority to maintain open spaces and burial grounds. The land shall by virtue of the disposal be freed from any trust arising solely by virtue of its being land held in trust for enjoyment by the public in accordance with the said section 164 or, as the case may be, the said section 10. 123 (7) For the purposes of this section a disposal of land is a disposal by way of a short tenancy if it consists – (a) of the grant of a term not exceeding seven years, or (b) of the assignment of a term which at the date of the assignment has not more than seven years to run and in this section “public trust land” has the meaning assigned to it by section 122 (6) above. Property Misdescriptions Act 1991 and The Property Misdrescriptions (Specified Matters) Order 1992. This Act makes it an offence for estate agents or property developers to make false or misleading statements in the course of their business about a number of property related matters (including, amongst other things: the location or address of the property; its aspect; accommodation; measurements and sizes; physical or structural characteristics; availability of services; proximity of services; etc.). Whilst compliance with this Act will primarily be the concern of the selling agent appointed by the Council, the practical effect of this is that any information supplied by the Council must be accurate and must not be misleading. Furthermore, all reasonable steps should be taken to check the accuracy of information before it is disclosed.