WTMSA Sponsorship Agreement - Lubbock Adult Soccer Association

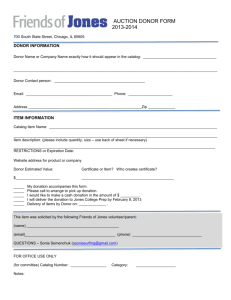

advertisement

WEST TEXAS MEN’S SOCCER ASSOCIATION SPONSORSHIP AGREEMENT Thank you for supporting soccer in Lubbock! Your contribution is fundamental to our success. The solicitation and handling of donations by the West Texas Men’s Soccer Association is governed by the Association’s (proposed) bylaws, article XIII, items B through K.* As an affiliate of, and filing jointly with, the North Texas State Soccer Association (NTSSA), a charitable organization as described in § 501(c)(3) of the Federal Tax Code, the West Texas Men’s Soccer Association (WTMSA) is eligible to receive tax-deductible contributions in accordance with § 170.** The WTMSA 1) hereby informs ____________________ (the donor) that the amount of the contribution that is deductible for federal income tax purposes is limited to the excess of any money (and the value of any property other than money) contributed by the donor over the value of goods or services provided by the Association (the charity), and 2) herein provides ____________________ (the donor) with a good faith estimate of the value of the goods or services that the donor will receive. ____________________ (donor) hereby promises to contribute $___________ to the West Texas Men’s Soccer Association (donee). In recognition of this contribution, the WTMSA promises to: 1.____________________________________________________________________________ 2.____________________________________________________________________________ 3.____________________________________________________________________________ 4.____________________________________________________________________________ 5.____________________________________________________________________________ The estimated cost of meeting the above listed obligation(s) is $___________. _____________________________ ______ _____________________________ ______ Donor Signature President, WTMSA Date Date *Article XIII (proposed). Sponsorship. B) The terms of any sponsorship of the Association shall be stated in a written agreement, negotiated and signed by the President of the Association and the sponsor. C) The statement shall include mention of the Association’s eligibility to receive taxdeductible contributions in accordance with § 170 of the Federal Tax Code, pursuant to its joint filing with the NTSSA, a charitable organization as described in § 501(c)(3) of Federal Tax Code. D) The statement shall include a good faith estimate of the value of the goods or services that the sponsor will receive from the Association. E) The terms of such an agreement may provide for, but need not be restricted to, i) the purchase of equipment or clothing for use by the Association and/or its member teams, ii) the printing of a sponsor’s logo and/or name on such equipment and/or clothing, iii) the display of sponsor advertising at a match venue, iv) the inclusion of a sponsor’s name in Association publications and/or in coverage of the Association by the news media, v) the inclusion of a sponsor’s name in the title of an Association-sponsored cup competition or tournament. F) A sponsorship agreement shall not contravene federal, state, or municipal law, the Laws of the Game, the Rules and Regulations of the USSF or of the NTSSA, or the Constitution, Bylaws, or Standing Rules of the Association. G) Sponsor names, logos, and/or advertising must be tasteful. H) Funds donated to the Association shall be collected by the Treasurer, who shall provide to the donor a receipt. I) Donated funds shall be deposited in the Association’s general fund. J) Donated funds shall be expended by the Executive Committee in accordance as far as possible with the terms of the written agreement. K) All member teams and players registered under member teams shall be encouraged to solicit sponsorship for the Association. **NB: Donors taking a deduction under § 170 are required to obtain contemporaneous written substantiation for a charitable contribution of $250 or more. To be "contemporaneous" the written substantiation must generally be obtained by the donor no later than the date the donor actually files a return for the year the contribution is made. If the donee provides goods or services to the donor in exchange for the contribution (a quid pro quo contribution), this written substantiation (acknowledgment) must include a good faith estimate of the value of the goods or services. The donee is not required to record or report this information to the IRS on behalf of a donor. The donor is responsible for requesting and obtaining the written acknowledgement from the donee. Although there is no prescribed format for the written acknowledgment, it must provide sufficient information to substantiate the amount of the contribution. For more information, see Publication 1771, which can be obtained by calling 1-800TAX-FORM (1-800-829-3676).