+ MicrosoftWord - Louisiana State University

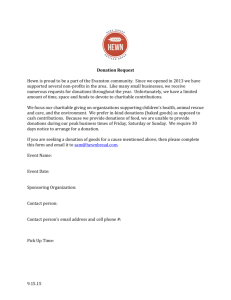

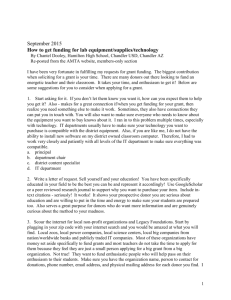

advertisement