+ MicrosoftWord - Louisiana State University

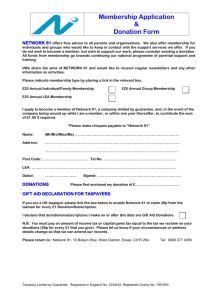

advertisement