China`s Input-Output Survey and Its Tabulation Method

advertisement

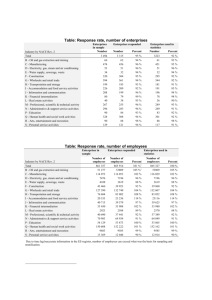

China’s Input-Output Survey and Its Tabulation Method Department of National Accounts, NBS QI Shchang After the National Bureau of Statistics of China compiled the 1987 Input-Output Tables, every 5 years, i.e., in the year ending with 2 or 7, NBS conducts the national input-output survey and compiles the benchmark input-output tables of the corresponding year. Besides that, in the year ending with 0 and 5, NBS also compiles the annual tables. So far NBS has compiled the 1987, 1992, 1997 and 2002 benchmark input-output tables, together with the 1990, 1995, 2000 and 2005 annual tables. At present, NBS has accomplished the 2007 input-output survey and is compiling the 2007 benchmark input-output tables. I. China’s Input-Output Survey In the year ending with 2 or 7, NBS with departments concerned organizes the national input-output survey. The year of 2007 is the 5th input-output survey year. 1. Survey Purpose Within the current national statistics survey system, there lacks the detailed input information that reflects the production and operating activities of the various departments of the national economy. The purpose of carrying out the input-output survey once every 5 years is to obtain information of the intermediate input and value added structures and of the investment composition of fixed assets of various input-output commodity sectors, which is needed for compiling input-output tables. 2. Questionnaires and Survey Contents In order to obtain information of the intermediate input and value added structures and of the investment composition of fixed assets of various input-output commodity sectors which is needed for compiling input-output tables, in each year of input-output survey, NBS revises The National Input-Output Survey Plan in terms of the current financial system, accounting system, statistical system, enterprise management conditions, and so on. The 2007 National Input-Output Survey Plan includes 52 input-output questionnaires for the basic units, involving various industries of national economy such as industry, construction and the investment activities of fixed assets, only agriculture being excluded. Questionnaires for the basic units are classified into 3 categories: the census questionnaires, the focused questionnaires and the typical questionnaires. The census questionnaires include questionnaires of Investment Composition of Fixed Assets and of Composition of Manufacturing Costs of the Large-Sized Industrial Enterprises above Designated Size. For survey of investment composition of fixed assets, it covers all the projects with totally planned investment of 30 million yuan and above according to the annual report of investment of fixed assets. For survey of Composition of Manufacturing Costs of the Large-Sized Industrial Enterprises above Designated Size, it covers all the large-sized industrial enterprises above designated size (with annual revenue from principal business of 5 million yuan and above), and its survey contents refer to the composition of manufacturing costs of the large-sized industrial enterprises by input-output commodity sectors. The focused questionnaires include questionnaires for the basic units of medium-sized and small-sized industrial enterprises above designated size, of construction enterprises, of railway transportation service enterprises, of road transport service enterprises, of water traffic service enterprises, of air service enterprises, of postal service enterprises, of telecommunication and other information transmission service enterprises, of computer and software service enterprises, of wholesale and retail service enterprises,of accommodation service enterprises, of food and beverage service enterprises, of financial service enterprises, of insurance service enterprises, of business service enterprises, of tourism service enterprises, of entertainment service enterprises, of other service sectors, and of administrative units and institutions. The field of investigation refers to the key-point sampled units of various industries mentioned above. In 2007 input-output survey, the number of the key sampled units is about 24 thousand, except the railway transportation and postal service enterprises. The survey contents refer to the cost composition of production and operating activities of the enterprises and institutions. For medium-sized and small-sized industrial enterprises above designated size, the survey content covers the composition of manufacturing costs. For medium-sized industrial enterprises above designated size, the composition of manufacturing costs is required to be reported by input-output commodity sectors. The typical questionnaires include questionnaires of compositions of transportation expenditures, of errand and travelling expenses, of office supply costs, of amortization of low priced and easily worn articles, of packing charges, of research and development outlays. The field of investigation refers to the selected typical sampled units. The survey contents cover the compositions of the expenses stated above. 3. Survey Methods In 2007 national input-output survey, previous survey methods have been adopted, that is, methods of integration of departments and regions at different levels have been adopted. For production and operating activities controlled by the state and its production across regions, such as railway transportation and postal service activities, Ministry of Railway and State Post Bureau of PRC are responsible for organizing their input-output surveys. The statistical departments are responsible for the other parts of the input-output survey. II. Information beyond Input-Output Survey In order to compile input-output tables, the professional or statistical information from administrative departments and statistical departments concerned is needed, as well as the input-output investigation information. For example, information of final accounts from Ministry of Finance, statistical information of import and export amount of money by commodity from General Administration of Customs of PRC, BOP from State Administration of Foreign Exchange, gross industrial output value by industry, costs and expenses of industrial enterprises, consumption expenditures of urban and rural households from NBS, etc. are needed for compilation of IOT. 1. Investigation Information of Gross Industrial Output Value by Industry Gross Industrial Output Value and Sales Volume and Output of Major Industrial Products (Table B201) is one of the questionnaires for basic units of our current national statistical survey system. Its field of statistics refers to all the industrial incorporated enterprises above the designated size. Its survey contents include indicators such as gross industrial output value, Output of Major Industrial Products, etc. For the large-sized and medium-sized enterprises above the designated size, the gross industrial output value is classified into small category by industrial industry. That is, the enterprises determine the small industrial category that their gross industrial output value is attached according to the nature of each of their industrial products. In other words, the gross industrial output value is calculated by commodity sector. Based on Gross Industrial Output Value and Sales Volume and Output of Major Industrial Products, we can get Aggregation Table of Gross Output Value of the Large-Sized and Medium-Sized Industrial Enterprises by Industry and Commodity, which is fundamental information for compiling industrial output table. 2. Investigation Information of Costs and Expenses of Industrial Enterprises In 2007, NBS set up survey system of costs and expenses of industrial enterprises above designated size, which is an important reform in the field of method and system of industrial statistics. It is of significance to improve the data quality of value added of industry and of its speed of development. In the meantime, it also provides more comprehensive and more detailed and accurate basic data for compilation of IOT. Costs and expenses belong to the category of accounting. They are reflected in plenty of detailed accounts, and referred to as the corresponding consumption in order to obtain business revenue directly or indirectly. The objects of investigation on industrial costs and expenses refer to all the large-sized and medium-sized industrial incorporated enterprises above the designated size and part of the small-sized industrial incorporated enterprises above the designated size. The survey contents cover the detailed items and their composition of manufacturing costs, operating expenses, management expenses, financial expenses, etc. of the industrial enterprises, and the correlated indicators, totally 116 indicators. III. Compilation Method of China’s IOT Restricted by the conditions of basic statistical information, we directly compile our IOT commodity by commodity. That is different from the method advocated by 1993 SNA. In 1993 SNA, supply table and use table are compiled earlier, IOT by commodity sector are then derived from them. Therefore, for China’s industrial enterprises, the large-sized and medium-sized industrial enterprises above the designated size are required to report their manufacturing costs composition according to the principle of “manufacturing costs of commodities put under the corresponding output values”. That is, the manufacturing costs composition of commodity sector corresponds to its gross output value. This kind of method is called direct decomposition method in input-output survey. The compilation procedures of China’s IOT are as follows: 1. Calculation of Gross Output (Gross Input) by Commodity Sector Since the calculation methods of gross output are different for various commodity sectors, we calculate the gross output of industrial sectors and non-industrial sectors respectively. For industrial commodity sectors, the gross output is calculated on the basis of Aggregation Table of Gross Output Value of the Large-Sized and Medium-Sized Industrial Enterprises by Industry and Commodity. For gross output of the other commodity sectors, some are calculated in commodity method (that is, quantity of commodity times its unit-price), some are calculated in accordance with revenue from principal business, some are calculated according to the current professional expenditures. The data sources include investigation information from statistical system, administrative information and information of final department accounts. 2. Calculation of Value Added and Its Composition by Commodity Sector For value added and its composition by commodity sector, some can be taken from current GDP data directly, some need to be calculated based on the related materials (such as annual report of statistical materials, financial final accounts and accounting final accounts, etc.) and to be coordinated with the current GDP data. The composition of value added is derived from value added structure taken from input-output survey and from the aggregate indicators. 3. Calculation of Composition of Intermediate Input by Commodity Sector in Purchaser’s Price Information from input-output survey and from industrial investigation of costs and expenses is the major foundation for working out the composition of intermediate input by commodity sector. First, we calculate the structure of intermediate input by commodity sector, utilizing information from input-output survey and from industrial investigation of costs and expenses. Then considering the aggregate of intermediate input by commodity sector, we calculate the composition of intermediate input by commodity sector. 4. Calculation of Final Use and Its Composition Aggregate data of final use by component are taken from GDP data by expenditure approach. Part of components need to be adjusted. For example, we need to add the value of transport service to export data that is provided for the imported commodities by China’s transportation enterprises, and we need to add the import custom duties and import commodity consumption tax to import data. For calculating composition of final use components, we mainly make use of information from rural and urban household investigation, from financial final accounts, from investigation on investment composition of fixed assets, from customs statistics, from BOP statistics, and so on. 5. Calculating gross output by commodity sector in purchaser’s price in line with information from typical investigation on margins The purpose is to get the row control total for conducting balances of IOT in purchaser’s price. The concrete method is that we get the gross output in purchaser’s price based on the gross output by commodity sector and the ratios of margins provided by investigation information of margins. 6. Going on Balancing on the Basis of IOT in Purchaser’s Price After reaching essential balances, we conduct mathematical balances by means of modified RAS when the key coefficients are fixed. 7. Compiling Matrix of Margins 8. Compiling IOT in Producer’s Price Matters of Interest and What We Hope Experts from OECD Will Introduce to Us: 1. According to 1993 SNA, supply table and use table of statistical function should be used as foundation, while the IOT (including symmetrical tables by commodity sector and by industry) is tabulated on the basis of them. And when Central Product Classification is used to classify the goods and services, the more detailed the classification is, the clearer the concept is. For produced goods and services or goods and services consumed in production process, if we adopt the suggestions by SNA, which level of the 5 levels of CPC should be used in commodity balancing for compiling accounts of goods and services and for balancing of further supply and use? Could we say the 4th or the 5th level of CPC must be adopted? As we learn, the supply and use table in US are compiled mainly dependent on information from economic census. In US, information from economic census is very rich, with detailed output data of goods and services, and the complete output data by detailed commodity can be gathered. However, for countries where there is not economic census yet, or just part of establishments has been investigated, how are the complete output data by commodity compiled, or how are the complete output data by commodity imputed? In addition, must the objects of investigation be establishments? Could the enterprises be objects of investigation, while the industry to which the enterprise is attached is determined by nature of the enterprise’s central product? In other words, for better adopting the suggestions by SNA, what are the most essential requirements? 2. As understood, there are basic statistical data with objects of investigation being establishments in the developed countries and in most of the Asian developing countries. In China, we implement survey on establishments in the economic census year, but there are only information of basic conditions and revenue. Then when we investigate by establishment, is it necessary to obtain the complete information of the incorporated unit? For instance, for an enterprise with production shops (which is assumed to produce only one kind of final product), auxiliary production shops (machine repair shop, serving for production shops) and management departments, this kind of enterprise is defined as incorporated enterprise of one-establishment in China. In that case, for this kind of enterprises, are they investigated as one establishment or as two establishments internationally? That is to say, is it necessary to treat the activities of auxiliary shops and of operating management of the enterprises as an establishment? If so, are contents of the two kinds of questionnaires different? Or are the consumption contents determined by production processes of establishments? 3. We’d like that you introduce us the main information used and compilation procedures in compiling supply and use tables through case studies of a developed country. How do you account the value added and its composition by industry when you compile the use table? Do you use investigation data of establishments to calculate the value added by production approach? Whether is the operating surplus derived by aggregate of value added minus the sum of the three components of compensation of employees, net taxes on production and depreciation of fixed assets? Or other calculation methods are adopted? 4. When supply table and use table are compiled, which level of classification by industry and by commodity is used at least? 5. How the basic price, the producer’s price and the purchaser’s price are reflected in input-output accounts? Which kinds of taxes are included in each of them? 6. How do you deal with value-added tax? Is the sales tax added to the output in basic price, and the purchase tax added to the intermediate input? Or is the “value-added tax that should be turned over to the state” added to the output in basic price, while without consideration of the purchase tax in the component of intermediate input?