Your Business Documents

advertisement

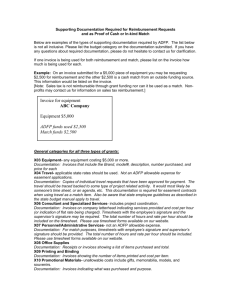

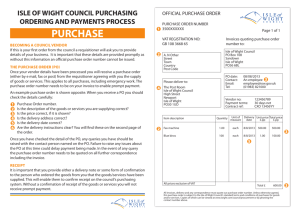

1 YOUR BUSINESS DOCUMENTS Business Stationery Every company must have its name mentioned in legible characters in all business letters, notices and other official publications of the company, and in all bills of exchange, promissory notes, endorsements, cheques, orders, bills of parcels, invoices, receipts and letters of credit of the company. In addition, under the European Communities Act 1972, every company must show in all business letters and order forms, the place of registration of the company, and the number with which it is registered; the address of its registered office; and in the case of a limited company exempt from the obligation to use the word ‘limited’ as part of its name, the fact that it is a limited company. Also, if there is a reference on stationery to share capital, the reference must be to paid-up share capital. If the names of any of the directors of the company appear on a business letter (other than as part of the text or as a signatory) the names of all other directors must also appear on the letter, in legible characters. Where all the names are required, they must include the forename or initial and surname of every individual director, and the corporate name of every corporate director. This requirement applies to (a) every company registered under the Companies Act since 22 November 1916 and (b) every company incorporated outside Great Britain and having an established place of business within Great Britain (unless it had established such a place of business prior to 23 November 1916). There are special requirements relating to European economic Interest Groupings, Welsh name companies, charitable companies, unregistered companies, insolvent companies, employment agencies and businesses, and investment businesses. Further information appears in the BPIF booklet, ‘Business Stationery: a Guide to Legal Requirements’. NOTE: These notes are intended to provide helpful information, best practice, general ideas and suggestions. Always speak to your BPIF Business Centre for advice, assistance or training available via BPIF advisers, consultants and training courses. For advice on any technical issues – reviewing equipment, productivity, and investment in new technology, consult your BPIF National Technical Adviser © May 2003 2 Business Names The law relating to business names is derived mainly from two statutes: 1) Business Names Act 1985 - This Act is relevant to any persons who have a place of business in Great Britain and carry on business from it in a name which: a) In the case of a partnership does not consist of the surnames (Christian names or initials may be included) of all the partners who are individuals or corporate bodies b) In the case of an individual does not consist of his surname (Christian name or initials may be included) c) In the case of a company does not consist of its corporate name 2) Companies Act 1985 - This Act relates to companies incorporated in Great Britain. Businesses Where a business is carried on in a name other than that of the individual, partners or company, it shall display in a prominent position so as may be easily read the following: a) In the case of an individual, his name and address b) In the case of a partnership, the name and address of each partner. Partnerships of 20 partners or more are excluded from the requirement to list partners if the document states the address of the partnership's principal place of business and that a list of the partners is open to inspection at that place. c) In the case of a company, its corporate name and address at which documents may be served The same shall be stated in legible characters on all business letters, written orders for goods or services to be supplied to the business, invoices and receipts issued in the course of business and written demands for payment of debts arising in the course of business. It should be noted that there is no legal requirement for business names to be registered. © May 2003 3 Companies A company must have a registered office in the UK to which notices may be sent. At the registered office the name of the company must be displayed in a prominent place. A company must mention in legible characters on its business letters and order forms the following: a) The place of registration b) The registered number (As shown on the certificate of incorporation) c) The address of the registered office d) If the company is exempt from using the word limited in its name, the fact that it is limited e) Where relevant, the fact that the company is an investment company f) Where there is reference to share capital it must be paid-up share capital A company must display all or none of its directors on its documents, it may not be selective as to which directors' names it shows. If directors' names are shown then Christian names or initials must be shown. The corporate name of every corporate director must be shown. NB. The term 'director' includes shadow directors. Passing Off If your business name is very similar or the same as another business, they may have a right of action against you if they can show that any benefit may be derived from using their name. © May 2003 4 VAT Invoices Where a business is registered for VAT it is required to supply a tax invoice to a customer (NB a retailer is not required to supply a tax invoice unless the customer requests it). Where an invoice is requested it should be a full invoice unless the consideration is less than £100 in which case a less detailed tax invoice may be used. All tax invoices must include the following: a) the name, address and registration number of the supplier b) the time of supply (Tax Point) c) a description sufficient to identify the goods or services supplied d) the total amount payable including VAT e) the rate of tax in force at the time of supply The further information to be included on a full tax invoice is: f) the date of issue of the document (not always the tax point) g) an identifying number h) the name and address of the customer i) the type of supply by reference to the following categories: by sale on hire purchase or any similar transaction by loan by way of exchange on hire, lease or rental of goods made from customers’ materials by sale on commission on sale or return or similar terms j) for each description in "c" above, the quantity of the goods or extent of the services , the rate of tax and amount payable, excluding tax, expressed in sterling k) the gross amount payable, excluding tax l) the rate of any cash discount offered m) each rate of tax chargeable (including zero rate) and the amount of tax at each rate n) the total amount of tax chargeable © May 2003 5 © May 2003