Class 10 General Equilibrium 1. What is the Production Possibility

advertisement

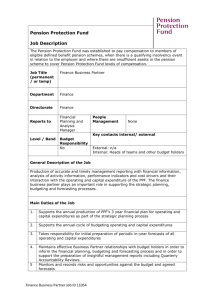

Class 10 General Equilibrium 1. What is the Production Possibility Frontier? PPF is the furthest frontier beyond which production cannot go, keeping the disposable inputs fixed. The shape and the slope of the PPF curve depends on the returns on the factor of production. The slope of the PPF is given by MRT (Marginal Rate of Transformation) which is equal to the ratio of marginal costs in production of these 2 goods. 2. Deduct PPF when returns on the factor are decreasing. PPF when returns are decreasing is obtained in the following way: Let us draw a production function for good X (or Y) if only one factor changes (K or L), keeping the other fixed (figure 10.1). Now we switch the axis (figure 10.2). Then we multiply K (or L) with its price (r, rent, or w, wage). We obtained a cost function (figure 10.3). When we differentiate a cost function, we get marginal cost function, which is actually a supply curve (figure 10.4). X, Y K,L X 0, Y 0 K*,L* K*,L* 0 K,L Figure 10.1 0 X,Y Figure 10.2 C=Kr, C=Lw K*r, L*w 0 Figure 10.3 X0, Y0 X,Y 0 X,Y Figure 10.4 (Analogy holds for the combinations: X can be switched by Y, r by w, and K with L) This is how we define the slope of the PPF (it combines both supply function, hence PPF shows the supply-side): S MC X x. MCY Sy Look at the point A: When only Y is produced, X equals 0, and MCx is 0 when X is 0 (you can see it from the graph). It makes MRT = ∞, since: MC X 0 (†) lim 0, x 0 MC MC Y Y and it means that the tangent on PPF is horizontal at that point. (*) MRT If we are in the B point, only X is produced, and hence Y is 0. Then MCY is 0, and MRT = ∞: MC X MC X lim x 0 MC 0 Y Therefore the tangent is perpendicular. And at any other point, MC’s are positive and greater than 0, which makes MRT positive and greater than 0 too (look at the point C). Y Y0 A C B 0 X0 X Figure 10.5 3. Draw a PPF curve which reflects constant returns to factor: If returns on the factor are constant, production function is a straight line, keeping one factor constant (figure 10.6). When transforming a production function into a cost function, again we get a straight line (figure 10.7). Derivation of a line is a constant, hence MC curve is a horizontal line (figure 10.8). Since both MCx and MCy are constant, their ratio, MRT, is a constant too, which makes PPF a straight line (figure 10.9): X,Y Kr,Lw X0,Y0 K*r,L*w 0 Figure 10.6 K*,L* K,L 0 Figure 10.7 X0,Y0 X,Y Sx=MCx, Sy=MCy, Y Y0 MCx, MCy 0 X,Y 0 X0 X Figure 10.8 Figure 10.9 (Analogy holds for the combinations: X can be switched by Y, r by w, and K with L) 4. Do the same analysis when returns are increasing. Again we deduct a cost function from the production function (which is needed to determine the returns). We see that it has concave increasing form (figure 10.11), so its derivation must be a downward-sloping line (figure 10.12). When only Y is produced, MCy equals 0, hence MRT goes to infinity. When only X is produced, MCx equals 0, hence MRT equals 0 (look at (*)). When both X and Y are produced, MRT is a real number. One can deduct a shape of a PPF curve from these data (Figure 10.13) X,Y Kr,Lw X0,Y0 K*r,L*w 0 K*,L* 0 K,L Figure 10.10 X0,Y0 X,Y Figure 10.11 Sx=MCx, Sy=MCy Y Y0 0 Figure 10.12 X,Y 0 Figure 10.13 X 0, X 5. Construction of a PPF curve covers a supply side of the general equilibrium. Now deduct a demand side. Demand is deducted from decreasing marginal utility of consumption of a good. If utility function is u(x,y), then marginal utility is: u MU x x u MU y y It leads us to: u MU x x u MU y y MU x x MU y y y MU X MRS XY x MU Y The last expression represents the slope of an indifference curve (derivation of y over x tells us we are in the system where X and Y are on the axis. This is the system where PPF and indifference curves are mapped). Therefore, a demand for goods X and Y is expressed through indifference curves. 6. Using PPF and a map of indifference curves, show an autarkic general equilibrium, where only 2 products are produced and consumed, and has 2 factors of production. This is what we get: Y A MA 0 Figure 10.14 IA X Equilibrium point is point A. Optimal production and consumption are formed at the point A where PPF touches the highest indifference curve possible. If we approximate this PPF by an ellipse, we have: x2 y2 1 , where x0 and y0 represent the maximal quantities of X and Y that an economy x02 y 02 can produced with the given factors of production. If utility function is u ( x, y) x y 1 , then when we maximize utility subject to PPF, we get: Max u ( x, y) x y 1 Subject to: x2 y2 1 x02 y 02 Solution can be obtained by Lagrange method and gradients (1st derivation vector) of functions: u ( x, y ) f 1 (1) 2x x2 x y 0 2y (1 ) x y y2 0 Variables are x, y and λ, and equations are: 1st and 2nd row of the condition, and an ellipse equation. From that we get stationery points: x x0 1 1 y y0 1 In words, production and consumption in autarky depend on propensity towards some good (α, 1-α) and on its maximal production. The slope of the indifference curve and PPF in point A tells us how the price of these goods is formed (only the ratio of prices). In autarky PPF and CPF (consumption possibility frontier) is one and the same curve, since one cannot consume some combination that is not possible to produce within the borders of a country. 7. If the borders open and the international trade becomes free, show the effects graphically. Y P1 A C1 IF MA 0 IA MF X Figure 10.15 If there’s a liberalization of an international trade, world prices become the actual prices. Their ratio is px/py. As long as there’s a difference between the ratio of domestic prices, and the ratio of the world prices, international trade makes sense. First we have to find a point where MRT = px/py. It is the point of production, P1. We draw a tangent through that point, and get the budget line, MF. Then we maximize utility according to this budget constraint (we can afford any combination on MF ). Indifference curve that corresponds to the highest utility level attained is IF. At the point where MRS = px/py, we get a consumption point C1. Blue dashed line is imported, and red dashed line is exported. MF becomes a CPF. 8. How tarrifs, quotas and subsidies affect the economy? They change the ratio of prices, and it affects negatively both export and import. It decreases the overall welfare, so we attain the lower indifference curve. The ratio of prices becomes somewhere between the autarkic ratio and the free trade ratio. The greater the constraint, the nearer is economy to autarky, hence the lower the utility. 9. If the Government decides to impose import tariffs on X or export tariffs on Y (show that it is one and the same thing!), draw a new equilibrium. The state decides to tax the import of X (so the new price will be px(1+t), and it makes X expensier) or export of Y (the new price will be py/(1+t), since the export good has to become cheaper to face the foreign competition). The price ratio in both cases is px(1+t)/py, and this slope is between the slopes of budget lines MF and MA. We know that the new consumption point will be on the ICC line (Income Consumption Curve, blue). ICC is constructed in the following way: Find C’, a point on the IF at which MRS = px(1+t)/py. Pull a ray from the origin through that point. This is ICC point. (Figure 10.16). Y P1 M’’T A C’ ICC C1 IF IA MA 0 MF X Figure 10.16 Y P1 M’’T C’2 P2 A C’ C’2 C1 IF I’T IA 0 Figure 10.17 MA M’T MF X The red line, M’T, is the highest budget line with slope px(1+t)/py attainable by PPF. At the P2 production will be optimal for the distorted prices. More X is produced. On the first sight one might say we attain I’T and consume at C’2, but it would be wrong, because it would imply that the world prices changed. However, we charge the customs, and that money remains in the country. On the world market we still trade at the world prices. Throgh financing of the public goods Government returns the money in the economy. It implies that the indifference curve will be somewhere between I’T and IF. Y P1 M’’T C’2 P2 A C’ C’2 C1 IF I’T IA MA 0 M’T MFT MF X Figure 10.18 That is why we will evaluate production P2 at the world prices, at which the goods are exported and imported. It is a green line, MFT. A decrease in efficiency is now more obvious, since this line intercepts PPF. Y P1 M’’T P2 A C’ C’2 C2 C1 IT I’T IF IA 0 Figure 10.19 MA M’T MT MFT MF X At the intercept of ICC and MFT we get the real consumption point, C2, through which we draw a budget line with tariffs, MT (violet), in order to construct IT (since at that point, like on the any other point on ICC, the line with slope px/(1+t)py is a tangent on the indifference curve). Now we produce P2, and consume C2. We export less Y, and export less X. 10. Let the State decide to subsidize the export. Show the effects graphically. Y P2 M’’T P1 A C’2 C1 C’ MA 0 Figure 10.20 C2 IA IF MF X When subsidizing the export, the price ratio is improved to help the exporters. Triangle of trade is bigger, but since in the world the price remained unchanged, the production optimized according to domestic conditions, is traded at the world conditions. At the point where the budget line (with world prices) intercepts the ICC, we obtain C2, the consumption point. Through that point we draw a line with slope equal to the ratio of subsidized prices, in order to get a indifference curve. 11. Since export subsidy is forbidden by WTO, the state introduces production subsidy. Show the general equilibrium. Since whole production is subsidized, and not only the export, there is no substitution effect, hence the green indifference curve that passes through P2 intercepts the starting ICC at C2, and not at C''2. It brings the consumers on a higher indifference curve than it was in the export subsidy case. At production subsidy the trade triangle is smaller than in export subsidy. Y P2 M’’T P1 A C’2 C2 C1 MA C’’2 IA C’ IF 0 Figure 10.21 MF X 12. Find the difference between general and partial equilibrium. Partial equilibrium observes only 1 market, ignoring the other markets. General equilibrium observes the effects of combined markets, where prices are given relatively (ratio of prices). At partial equilibrium prices are given as absolute numbers. 13. What is MRT? MC X MRT XY MCY MRT is the PPF slope. MRT is the slope that tells us how one good is transformed into another good by redirecting the inputs from production of 1 good into production of another. Total cost of all inputs remains constant since the country has fixed L and K. 14. Why is it not efficient to consume when MRT≠MRS? MC X p Where MRT≠MRS there X . Pareto optimal reallocation is obtained when MCY pY MCX = pX, and MCY = pY. Then their ratio has to be equal too. If it’s not the case, reallocation is not optimal. 15. Can PPF be non-concave? If returns are not decreasing, PPF doesn’t have to be concave. 16. Let us presume Gold (G) and Silver (S) are substitutes, since we use them against inflation. Let us also presume their supplies are fixed (QG=75 and QS=300), and demand is as follows: PG=975-QG+0,5PS and PS=600-QS+0,5PG a) Find the equilibrium gold and silver prices. In the short run the quantity of gold is fixed (QG=75). We solve for QG in the formula: PG=975-75+0,5PG In the short run quantity of silver is fixed at 300. We solve for QS and get: PS=600-300+0,5PG Now we have 2 equations with 2 variables: PS=600-300+(0,5)(900-0,5PS)=1.000 USD Now we find the price of silver: PG=975-75+(0,5)(100)=1.400 USD b) Presume that new researches led to duplication of the gold supply. How will it affect the prices of gold and silver? Since a quantity changed, we have to solve a system of equation for the new data: PG=975-150+0,5PS, ili PG=825+(0,5)(300+0,5PG)=1.300 USD Price of silver is: PS=600-300+(0,5)(1300)=950USD 17. Country A and country B produce wine and cheese. Coutry A has 800 units of labour, while B has 600 units of labour. Before the trade, A consumed and produced 40 units of cheese and 8 units of wine, and B consumed and produced 30 units of cheese and 10 units of wine. Country A Country B Units of labour per unit of cheese 10 10 Units of labour per unit of wine 50 30 a) Which country has a comparative advantage in which good? For every additional unit of wine A needs 50 units of labour, hence they can produce 5 units of cheese less. Opportunity cost of production of 1 unit of wine is 5 units of cheese. B’s opportunity cost of production of wine is 3 units of cheese. Since B has smaller opportunity cost, it should produce wine, and A should produce cheese. b) Define PPF curve for each country. PPF for country A is 10S + 50V = 800 or S = 80 – 5W. PPF for B is 10C + 30W= 600, or C = 60 - 3W. The slope of PPF for country B is -5 (price of wine over price of cheese). The slope of PPF for country B is -3. In other words, wine costs 5 cheese in country A, and 3 cheese in country B. After the trade the price will be somewhere in between. The point of production after the exchange is in the point where the slope of joint PPF is equal to the slope of the world prices (e.g. -4). Country A will produce only cheese (80), and country B only wine (20). If they had specialized wrongly, B would have produced 60 cheese, and A 16 wine (E2). Each country can consume a quantity which used to be beyond its PPF reach (CPF is broader than PPF) C 80 C A 140 60 B E1 80 60 E2 B 16 A 20 16 20 W Slika 10.22a 36 W Slika 10.22b c) Proove that both countries are better off in the free trade. In total, they spend more goods then before (cheese: 80>(40+30), wine: 20>(10+8)). 18. We have the following PPF curve: Y Y0 0 Figure 10.23 X0 X a. If productivity in production of X increased, draw a movement. Y Y0 0 X0 X0' X Figure 10.24 b. If productivity in production of Y decreases, draw a movement. Y Y0 Y 0' 0 X0 X Figure 10.25 c. If all factors increase, draw a movement: Y Y 0' Y0 0 Figure 10.26 X0 X0' X 19. What is the difference between CPF and PPF curve? In autarky those 2 curves are identical, since we consume as much as we produce. In open economy we produce within our PPF at the point where MRT is equal to the ratio of the prices on the market. The tangent through that point is a budget line that tells us which combinations we can afford with our production (CPF). As you can see on the picture, in autarky we consume in the green area, and in open economy in the green area plus the orange area. Y CPF PPF Y0 P 0 Figure 10.27 X0 X