AAPLTitles Workshop-OKC-8-3-12

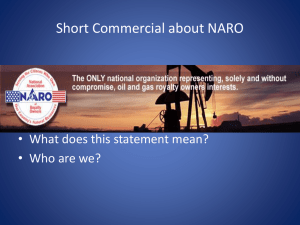

advertisement