PPP for natural catastrophe insurance in Europe

advertisement

AB 5148 (09/05)

Promoting the public/private partnerships necessary for the

development of natural catastrophe insurance in Europe

By the CEA “Property” Committee - "Natural Events" Working Group

CEA has just published a manifesto1 on its commitment to public/private partnerships (PPP) in

social issues where the interplay of market forces is insufficient to establish balanced and

durable solutions. For almost all markets, covering damage caused by natural catastrophes is

part of this category of “outstanding “2 social issues.

The CEA "Property" Committee has, over the last few years, looked at the preparation of an

inventory of cover, reinsurance systems and reserving on the different European markets

as well as the sharing of experience on mapping and zoning for flood hazards, the role of

insurance in flood prevention and the management of catastrophe claims3. It is now

entering a phase of active lobbying to try to contribute significantly, with the national

associations, to the development of insurance for natural catastrophes on their market. One

thinks obviously firstly of very exposed countries with low, not to say non-existent penetration of

this type of insurance, such as Greece, Italy, Malta, Portugal and Slovenia for earthquake risks

and almost all member countries for the various risks of floods or earth slips (see the following

map).

Consequently, CEA is merely vigorously reactivating, in today's context, the offer of cooperation

it made to the Commission ten years ago to study the conditions for developing natural risk

insurance on European Union markets where this funding solution could be used to further

advantage to indemnify damage caused by such catastrophes4.

Following a few details of a methodological nature (§ 1.) and on the context of the approach (§

2.), this article presents in § 3. the main arguments of the future discussions, in particular on the

aims of Union states on the framework for development then the correct proportion between

public and private in the different components of the partnership. Major aspects of the

discussions such as clarification of the criteria for insurability and the concept of insurable

damage, the current situation on exposure and cover requirements per market, scenarios and

requirements for cooperation and/or financial solidarity between markets per type of catastrophe

scenario will be developed elsewhere or at a later stage.

1

2

3

"Between Public and Private, Insurance solutions for a changing society", CEA, June 2005.

CEA highly welcomes in this respect the two very recent texts adopted by European Institutions ::

By the European Parleament at the sitting of Thursday 8 september 2003 (P6_TA-PROV(2005)0334 :

Resolution on natural disastrers (fires and flooods) in Europe this summer, and

among

others resolutions 15 and 22 ;

By the European Economic and Social Committee : Opinion on the Communication of the Commission

on flood risks prevention COM(2004) 472 final (OJEU 08.09.2005 C22/35-39), and especially ! 5.4.

second sentence, on the need for insurance schemes integrated in risk management policies, directly in line

with the presen paper.

Some of these documents are downloadable from www.cea.assur.org

4

In The Netherlands, because of very severe exposure to sea or river floods which threatens more than 80% of the

population, insurers do not wish and are not capable of covering floods. Legal texts cover compensation by the state

for damage caused.

CEA

Roland NUSSBAUM

1

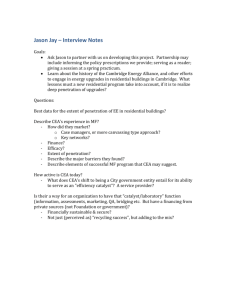

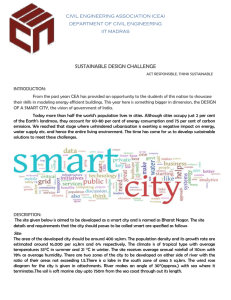

The map below shows the penetration level of natural event extended coverage according to

national markets in Europe, with three forms differentiated in colours: facultative coverage

extension in blue, compulsory in green, no object in the case of the Netherlands for flood events:

The more intense the colour, the higher the penetration of this extended coverage. One can see

with the exception of the United Kingdom, markets where facultative coverage extension

penetration of this coverage is poor as policyholders do not purchase it (anti-selection

phenomenon). Bulgaria and Romania are not on the map, although their insurance market

associations acceded to membership of CEA last June. Also very exposed to floods – like the

dramatic ones last August - and even more to earthquakes, these emerging markets for property

insurance in Europe fall fully within the scope of this initiative.

1. A voluntarist, participatory method respecting subsidiarity

Like the Commission when faced with any new project in which it invests, CEA thinks it will be

able to provide in this case the ingredients required for a salutary and unique exercise in

maieutics for each country concerned but with possibilities for "swing-wing" cooperation which

might occur along the road.

Initially, the aim is to propose a discussion framework to the administrations concerned and the

Member States' insurance associations in the presence of the Commission DGs concerned5,

MEPs and representative organisations of the civil society. CEA, as much as possible in

cooperation with the Commission services and major European reinsurers, should ensure that

these discussions lead within a reasonable time period to the preparation of a range of possible

guiding schemes, per component of the PPP, to offer to the Member States concerned a

5

DGs on Regional Development, Environment, Internal Market, Research, Information Society

CEA

Roland NUSSBAUM

2

maximum number of elements which will enable them to find answers to their specific problems.

This is the Green or White Paper methodology… without necessarily a draft directive as

well since we are not seeking harmonisation at any cost!

National associations from markets where such solutions exist and are satisfactory by total or

quasi-total saturation of the market at high levels of cover (DK, FR, NO, SP, UK…), would

obviously be invited to participate in discussions, to clarify their experiences and respective

points of view.

It is important to draw lessons and comment undogmatically on the different solutions which

have already been implemented or studied in a number of countries, depending on their

respective risk profile, from the pure provision of services with no risks carried to retention of all

or part of the latter by the private insurance or reinsurance market6:

Insurer provider of claims management services on behalf of the compensating state

(NL, USA for Californian earthquakes) and/or delegation of public state aid (draft IT law);

Insurer "fronting" for a state reinsurer (ES) or a reinsurance pool (TU for earthquakes) or

parafiscal tax collector for public compensation fund (DK, FR: agricultural calamities, NZ;

USA for NFIP7) or private (NO);

Insurer carrying a partial risk with partial cession to a state insurer (FR: catnat) or

compensation fund (USA, for hurricanes in Florida) :

Insurer carrying the risk with partial cession to a market pool (BE);

Market insurer and reinsurer (AT, CH, CZ, DE, IT, PO, SW, UK in particular).

This work could also make it possible to study the conditions for:

defining a "right to compensation" for Union citizens for damage caused by natural

catastrophes and their counterpart in terms of awareness of the various public and

private actors

wider and therefore more suitable perimeters for mutualisation to cover this type of risk,

prior to any consideration on harmonising all or part of national compensation systems.

The move towards a certain form of harmonisation of compensation systems, like other risk

management policies and tools, is justified, at the very least, for hazards of a cross-border type

by their harmful consequences on citizens and member countries' economies… There are many

examples in recent history of floods, storms, drought and even earthquakes which have affected

several countries at the same time.

2. A more favourable context today?

Ten years ago, CEA reacted to a European Parliament resolution following 1993's substantial

floods in many European countries8, by listing the situations prevailing in various countries vis-àvis insurance for natural catastrophes and by specifying the conditions for the public/private

partnership (PPP) necessary to develop flood insurance9.

6

See also François VILNET, Financement des catastrophes, Solutions de marché et captives en Europe, in

PartnerRe Etudes et Commentaires n° 4, February 2004

7

National Floods Insurance Program, see www.fema.gov NFIP section.

8

European Parliament resolution of 20 January 1994 asking the Commission in particular (point 5): "to urgently

present a proposal to harmonise insurance schemes so that damage of this nature can be covered by private

insurance" …

9

CEA position of 28 June 1995: "Floods", themselves following on from the major floods at the start of 1995 and the

abovementioned resolution. The up-to-date and relevant nature of this document can be seen where it recommended

in particular: "In countries where insurers do not, in principle, provide general cover for damage caused by natural

CEA

Roland NUSSBAUM

3

Although the Commission has not to date followed up the reflections or the proposal for

cooperation made at that time by CEA, other significant natural catastrophes have occurred

causing substantial damage to different regions of Europe. These economic and social crises

have encouraged the member countries concerned, of course, but the European institutions as

well, to take or retake initiatives for organising or coordinating strategies, policies, action plans or

preparation, warning and cooperation in the event of a crisis, but also to finance compensation

for damage and finally to prevent natural catastrophes.

Amongst the most spectacular community initiatives are:

the establishment in November 2002 of a Solidarity Fund (EUSF)10, financed by € 1

billion per year and whose extension and operation11 is currently under discussion in the

light of the first years of experience,

the proposed explicit mention among the criteria for derogating from the monetary

stability pact of expenditure incurred by Member States when indemnifying damage

caused by natural catastrophes12.

This type of initiative, like those CEA already proposed when the Fund was set up, can, if not

clearly defined in scope and objective, upset the conditions for the development of PPPs

necessary for the broadest possible funding of natural catastrophe damage. The frontier

between insurable and non-insurable damage should be made clearer as the legal

conditions in the different Member States evolve, failing which there could be an ongoing

risk of distortion of treatment between citizens, between economic actors and between

Member States13.

At the Kobe conference last January, Mr Ian Egeland, UN Undersecretary General responsible

for Humanitarian Affairs, in his inaugural speech14, listed as one of the priorities for the next 10

years the development of innovative PPP to fund natural risks in the following terms: "Poor

people should not be left to struggle alone against calamity : they deserve more access to

meaningful financial risk-sharing arrangements such as insurance and reinsurance

against disasters, through imaginative public/private partnerships". Similarly, at a plenary

disasters and where the matter is currently under discussion with the authorities, consideration could be given to

setting up state-protected methods along the following lines:

•

cover would be provided, as a priority, to householders and small industrial and commercial risks;

•

cover would be granted for named perils : floods, earthquakes, avalanches, landslides;

•

the legislation should:

o introduce general cover,

o establish solidarity between insureds and

o provide for the accumulation of tax-free technical equalization reserves;

•

provision should be made for sufficient capacity, if it is unavailable, state intervention should be

envisaged.

Insurers emphasise the importance of preventive measures…

The adverse repercussion of climate change on the frequency and severity of natural disasters deserves particular

attention.”

10

European Council Regulation N° 2010/2002, dated 11 November 2002, establishing the European Union Solidarity

Fund in the event of major disasters

11

Proposal for a regulation by the European Parliament and the Council setting up the European Solidarity Fund

presented by the Commission on 6 April 2005 – document COM(2005) 108 final

12

Apparently ruled out for the moment in favour of a wording referring to expenditure linked to humanitarian solidarity

actions the definition of which could raise the same questions as the wording referring to "uninsurable damage" in the

Council regulation establishing the European Solidarity Fund.

13

CEA note – 21.10.02 on the proposal for a European Solidarity Fund.

12

Source: http://www.unisdr.org/wcdr/media/statements/Egeland-statements.pdf

CEA

Roland NUSSBAUM

4

session of this same conference, meeting a week before under UN auspices in Mauritius, the

Barbados and Trinidad and Tobago delegates, speaking for the small developing island states,

raised the question of access to insurance for damage caused by natural catastrophes because

of the progressive pull-back by insurance companies or, at the very least, a sharp rise in costs15.

These reasons, linking sustainable development and organisation of ex ante financing to

compensate damage caused by natural catastrophes, as a component of an integrated system

to combat these catastrophes, should constitute a recommendation for proper governance for

less developed countries16. A fortiori, the same applies to EU member countries, even though

some of them have no national insurance system although highly exposed!

The Commission has begun to reform its funding instruments for regional development

(Structural Fund and Solidarity Fund), in particular incorporating a systematic aim for policies

and means to prevent natural and technological catastrophes. It is however important for the

credibility of Union and Member State policies not to overlook consideration of the development

of optimum conditions for funding natural catastrophe risks, affecting private assets and

economic activities.

Although the problem does not seem to arise explicitly from community-based policies, it

seems logical to link it to areas where the Union can decide on back-up, coordination or

additional action17. It will not be possible to ignore the reflection proposed by CEA in the years

to come, despite its complexity, given the principle of subsidiarity on the one hand and the

deregulation of the internal financial services market on the other.

The job of the insurer, sometimes qualified as a "banker for the exceptional", is done in

particularly difficult conditions when the hazards to be covered seem to be so improbable that

neither potential insureds nor their elected representatives at different levels of government

believe in them. Until, by the seriousness of the consequences which have to be managed as an

emergency, their occurrence may possibly encourage derogation from strict budgetary control.

This could make compensation, funded by resorting to public finances, an "unfair re-election

weapon!" Conversely, any state intervention, over and above limited capacity, mobilised

depending on exposure by the insurance and reinsurance markets, cannot be considered an

argument for the lack of efficiency of insurance!

In the United States in particular, certain advances have been made in this area at federal level.

They should be taken into consideration, tailored to European specificities, in our countries and

our insurance markets.

The insurance sector in Europe is economically important. Given its development potential in the

majority of member countries, the budgetary need for Member States not to cover nonexceptional damage and the ambition of being able to offer the largest number of Union citizens

15

Talking at one of the high-level round tables, the Prime Minister of Grenada made a distinction between the

following:

the fact that exposure to natural catastrophes is measured in terms of private capital diverted from

development, above all if there is no insurance,

the specific question of compensation for the poor which requires the creation of appropriate financial

instruments.

16

Cf. also in particular: "Financing the risk of Natural Disasters – a new perspective on country risk management", the

World Bank, June 2-3, 2003, Washington, D.C.

17

Article III-284 of the Treaty establishing a Constitution for Europe CIG 87/2//04

CEA

Roland NUSSBAUM

5

insurance cover suited to catastrophic events, CEA intends to launch the debate and involve all

interested parties: member countries and market players in the hope that the European

institutions will contribute significantly in

contributing to health and safety protection and the protection of the economic

interests of consumers,

encouraging cooperation between Member States to reinforce the efficiency of

natural catastrophe prevention systems… or protection against them (supporting

and completing Member State action, promoting operational cooperation between

national emergency services, encouraging coherence in action undertaken at

international level).

3. A full discussion agenda

3.1.

The aims of states and the Union in the framework of development

incorporating a "forecast" of natural catastrophes and "high-level protection"

of citizens

As referred to in the introduction18, all our states maintain considerable means of intervention in

the event of catastrophes which limit the potential of the insurance market. Although this free

assessment of "force majeure" does not derogate today from the criteria of the monetary stability

pact, it at least improvises inter-state solidarity which will inevitably and rightly occur. 19 It is not

finally very healthy from an ethical point of view since it may interfere unduly in the outcome of

votes and may affect market stability20 …

There are no longer any methodological or technological obstacles to prospective

scenarios on the economic consequences per risk basin and therefore per state21 which

would enable the need to be assessed and, in cases where market forces are insufficient, to

clearly define ex ante the fields and volumes of public intervention, and then to get them across

to the economic actors.

From an EU point of view, there could be practical consequences on several levels such as, in

particular:

- at monetary policy level, by criteria incorporating ex ante these scenarios and the relevant

economic situations per Member State with possible sanctions in the event of a breach at

budgetary policy level,

- at internal market policy and competition policy levels, to incorporate, possibly in the block

exemption regulation, pools or market solutions which might be necessary depending on the

situation of non-insurability in certain countries22

- at regional policy level, by the definition of appropriate assistance for territorial authorities in

developing contractual compensation tools for assets suffering damage from vulnerability-

18

By reference to the Kobe conference and the strategy for the decade adopted on that occasion in the UN

framework, with the support of the members of the Union: Hyogo Framework for Action 2005-2015, download

http://www.unisdr.org/wcdr/

19 Not only in crisis management but also in the funding of restoration and reconstruction over and above the

capacities of the International Financial Institutions envisaged to this effect

20 Recognised by the UNDP as a global public good like safety, justice, right to education etc.

21 Cf. in particular the report by the Commissariat Général du Plan, Prime Minister, French Republic, dated 3 May

2005: "State and insurance of new risks".

22 Facilitate in this way the unblocking of national situations where draft legislation envisaging a pool is blocked by

national competition authorities (cf decision by the Italian antitrust authority on the Italian draft law).

CEA

Roland NUSSBAUM

6

reducing structures (flood expansion fields, dikes for frequent floods) and by more forwardlooking management of the allocation of structural funds,

- at social policy and emergency service level, to define a community policy and instruments

to guarantee the economic safety of citizens by organising for example mutual-type provisions to

help victims (temporary lodging etc),

- as well as at environment (climatic change), information society (hazard mapping

disclosure), energetic (critical infrastructures) and research policies levels…

If each state clearly said what it could cover, on an ex post funding basis, directly or by using

European solidarity (EUSF), it would be possible to define its ultimate cover capacity for:

individual market exclusion situations (private assets which are not covered because of

exposure or excessive frequency) which may occur in the case of an extension of

compulsory cover;

persons who do not take out insurance, through lack of resources, on the basis of a

threshold of resources under which the state may, under certain conditions, assume the

basic insurance premium as state aid.23

The aim is no less than to make states responsible for the necessary reduction of the differences

between a supply of insurance services which exists more often than not everywhere and too

weak a demand via the absence:

of motivation and consent to pay by some of the actors,

of solvency for the others…

3.2.

The ingredients of the public/private partnership (PPP) to be optimised by

states and markets

Sharing accumulated experience between European markets highlights three essential

components for which should be established on a case-by-case basis the right proportion

and optimum conditions of intervention by the public and private sectors respectively:

Political: principles, objectives and policies of economic, social and financial

management, in the light of national criteria24 maximising insurance penetration and

minimising exclusions

Financial: structuring of ex ante risk funding capacity per region, per country and/or

possibly with a wider perimeter of mutualisation (to be defined) as far as Union level

where appropriate.

Organisational and technical, in particular via economic, regulatory and/or statutory

encouragement for prevention and governance of risk management.

A detailed analysis of existing experience in PPPs shows that although the third component

seems the most logical, it is often not sufficient.

If, for the financial component, it follows the very logic of the market economy for the

private sector to do without or limit to a maximum State intervention, the risk insurability

profile in numerous European countries and/or States' political options effectively results in

public intervention in the financial component in the form of original PPPs.

Only close cooperation between the government and the insurance sector has made it possible

to find a stable and sustainable solution.

23

As proposed in the draft Italian law on insurance for natural catastrophes.

As mainly dependent on the legal tradition, economic and social culture of the Member State, in line with the

« general interest principle » introduced in the insurance directives.

24

CEA

Roland NUSSBAUM

7

3.2.1. Political component

Competence is interministerial with arbitration at head of government level. Even though

this involves principles from the domain of national sovereignty and the general interest, the

insurance sector may help to clarify the government’s decision when fixing:

- Principles: of freedom of insurance for assets and activities, of solidarity between

insureds and definition of anti-selection, of equal treatment for citizens and activities

in the light of public policies or market exclusions, of research for international

coordination at Union level of these principles,

- Aims: of cover by the State, deductibles for accumulated damage, per category and

per prospective scenario, of programmed development of national compensation

systems,

- Policies and means: of fiscal encouragement to reduce the vulnerability of

exposure, of state aid for those who do not have the resources, with insurance as a

provider of claims management services, on behalf of the state.

3.2.2. Financial component

As mentioned, this component is self-regulating naturally by market forces when conditions

of insurability are satisfactory. On the other hand, it requires a PPP in all other cases. This

means structuring the sources of ex ante funding and predetermining their respective levels

of intervention depending on configuration per country and association of categories of risk:

Self-insurance/ insured’s deductible (individual or professional)

Collective deductible likely to be handled by a dedicated territorial authority for the

risk basin, with appropriate legal accompaniment for recognising the contractual

acknowledgment of certain public utility areas linked to implemented protection

strategies

Market insurance (including reinsurance capacity allocated to the market) with an

appropriate fiscal accompaniment for the constitution of adequate equalisation

reserves by insurance or reinsurance companies

Possible additional or floating capacity

Possible State and/or Union cover, if necessary in addition to the EUSF.

3.2.3. Organisational and technical component: from economic encouragement to

governance of risk management

Of varying competence, depending on the country, between ministries responsible for

the emergency services and the environment, there must be coordination on this

component between the former and the insurance supervisory authority to:

-

-

CEA

explain by regulatory means if necessary depending on the profile of non-insurability of

certain risks in the country, the links between insurance conditions and:

o the degree of exposure (inclusion of urban planning)

o the degree of vulnerability (conformity with technical and building prescriptions)

making territorial levels responsible for implementing legal and economically suitable

provisions for handling frequent risks

Roland NUSSBAUM

8

-

organising the share-out of information on hazards and vulnerability per risk basin which

implies in particular facilitating access to sources of information of a public nature 25 :

physical data and hazards per scenario26.

Conclusion:

The way in which recent major catastrophes have been dealt with confirms that our sector faces

a considerable challenge to contribute towards making each stakeholder perform a responsible

role, integrating ex ante financing of catastrophic risks into acts necessary for sustainable

development, both for our advanced societies and for developing countries. A fortiori, with, in the

background, the threat of mistrusting insurance coverage systems if a major catastrophe

occurred in a developed country which would still have no satisfactory indemnification solution!

If the Millennium objective is merely to reduce poverty in the world, then one of its corollaries will

be, for us, professionals of the insurance sector, to promote catastrophe insurance as a

condition for development and not only as a consequence of it. It is probably by recognising that

economic and patrimonial safety aspirations for individuals as well as activities are a global or

public good, like market stability27 for instance, that a normative ambition could possibly come

true at international level. What legitimate international institution could then help us to carry out

this mission?

The UN has not succeeded yet, since the Kyoto protocol went off in other directions, the

Hyogo28 action programme refers explicitly to PPP solutions involving insurance for improving

catastrophe resilience, but does not sufficiently interest economic and financial circles, nor state

finance, budget and monetary authorities. Closer to the latter, the International Monetary Fund is

scarcely interested in insurance, the World Trade Organization is only beginning and is perhaps

not best placed to handle this issue, but who knows… Then the international financing

organizations, like the World Bank, the Council of Europe's Development Bank, among others,

have no doubt a statutory duty to commit themselves in this direction, but their realisations have

not yet achieved the level of their ambitions… Truly they cannot succeed alone. There remains

then the European Union29!

It is for our national insurance associations to commit themselves with the help of CEA, in the

open debate surrounding such a big European project, but which it is now urgent to conclude, on

governance and financing of catastrophe risks. It is up to their member companies, insurers and

reinsurers, of course, to compete in creativity and efficiency to find solutions that each of them

might propose to their customers.

25

Proposal for a directive of the European Parliament and the Council, establishing an Infrastructure for

Spatial Information for the Environment in the Community (INSPIRE) – {SEC(2004)980 – COM(2004)516

final of July 23rd 2004, available on http://www.ec-gis.org/inspire/. The data theme “Natural Hazard prone zones” is listed N° 12 in the Annex III.

26 The CEA supports in principle the Commission in its Action plan against Floods, which mainly includes

a draft proposal for a directive on flood risk management, emphasising public information, with the help of

hazard maps, displaying at least 3 occurrence scenarios: frequent, less frequent, rare.

27 KAUL Inge, GRUNBERG Isabelle, STERN Marc A. (coordinated by), 1999, Global public goods at world

scale, international cooperation in the XXI, PNUD – Oxford University Press.

28 Cf. note 17 above.

29 And maybe eventually a dialogue between the European Union and the United States, once the crisis

following the extreme catastrophe that hit their southern coast is over! Maybe even a slightly voluntarist

integrated approach to this question at international level: with last December's tsunami just before the

Kobe conference and now the Katrina consequences, a « new deal » seems more than ever to be

constituted to get States and other stakeholders to work on the subject as a whole…

CEA

Roland NUSSBAUM

9