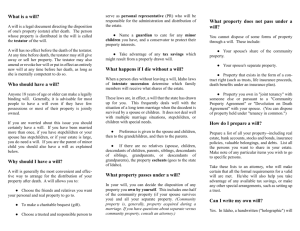

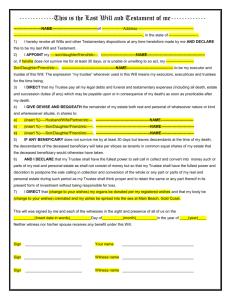

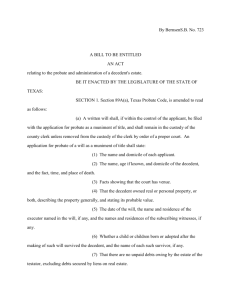

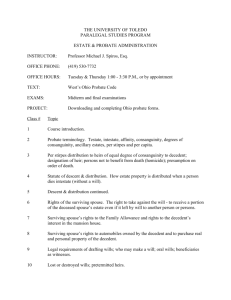

Trusts & Estates: Probate, Intestacy, Estate Planning

advertisement