Tax Relief for Contaminated Land

advertisement

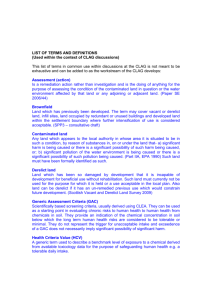

UNITED KINGDOM ENVIRONMENTAL LAW ASSOCIATION CONTAMINATED LAND WORKING PARTY COMMENTS ON THE FINANCE BILL 2001- TAX CREDIT FOR REMEDIATION OF CONTAMINATED LAND 1. UKELA submits the following comments and observations regarding the proposals in the Finance Bill 2001 to provide tax credits to companies undertaking remedial works on contaminated land. The Bill provides a welcome financial incentive for the remediation and re-use of contaminated land. 2. There is no formal consultation on the Bill, however, these comments are made in order to highlight the significant implications of the Bill as currently drafted. The adverse consequences could be easily avoided. Definition of contaminated land 3. UKELA’s primary concern is the definition of contaminated land which is adopted in Schedule 22 to the Bill: Land in a contaminated state 3. - (1) For the purposes of this Schedule land is in a contaminated state if, and only if, it is in such a condition, by reason of substances in, on or under the land, that(a) harm is being caused or there is a possibility of harm being caused; or (b) pollution of controlled waters is being, or is likely to be, caused. 4. This definition is similar, but different in an important respect, to the definition of contaminated land in Part IIA of the Environmental Protection Act 1990, which defines contaminated land (in section 78A(2)) as: ...any land which appears to the local authority in whose area it is situated to be in such a condition, by reason of substances in, on or under that land, that (a) significant harm is being caused or there is a significant possibility of such harm being caused; or CO:840931.1 (b) pollution of controlled waters is being, or is likely to be, caused. 5. The key difference between the two definitions is in the omission of “significant” in respect of harm. Further, there is no reference to the Statutory Guidance published as Annex 3 to DETR circular 2/2000 and, in particular, to Tables A and B of Part 2 or Chapter A of that guidance. This is a detailed statement of what constitutes significant harm and seeks to put into practice two principles: 5.1 that land is remediated which is not suitable for use and hence that only land is remediated when necessary for the intended use; 5.2 that any assessment of contaminated land is on the basis of risk of harm and the setting of standards and targets which describe the level of risk which is acceptable as a matter of policy. 6. Because no reference is made to significance of harm nor to the substantial body of guidance on the subject, the Bill as drafted could be properly interpreted to mean that remedial works which alleviate perceived risks or potential common law liabilities should attract the tax credit. That may, of course, be the intention of the Bill, but if so, then it should make such policy clear beyond doubt because it would be a fundamental change in contaminated land policy and practice. 7. There is a second issue in the definition as to the pollution of controlled waters. This part of the definition of contaminated land has given rise to problems in the interpretation of Part IIA EPA. Amendments to the primary legislation have been drafted and consulted upon, the purpose of which is to introduce a test of significance to the pollution of the controlled waters. This is aimed at avoiding land becoming "contaminated land" simply by virtue of the presence of an insignificant quantity of contamination. 8. The provisions in the Finance Bill regarding the pollution of controlled waters do not contain a similar threshold. This may be intended, as a matter of policy, in order to encourage site remediation and redevelopment. However, there is a real risk that enforcing authorities will seek, as a matter of practice, to operate some de minimis threshold in applying the definition of contaminated land to controlled waters. This could give rise to considerable uncertainty in the application of the regime and involve the enforcing authorities making judgements as to what contamination is material. CO:840931.1 Entitlement to the deductions 9. Paragraph (5) of Schedule 22 states that companies will not be entitled to any deductions so far as the land concerned is contaminated "wholly or partly as a result of anything done or omitted to be done at any time by the company or a person with a relevant connection to the company". Our concern relates to companies which may potentially lose the benefit of any deductions as a result of their failure to take any action. For instance, a company may be aware of contamination (and have the ability to clean it up) but that contamination has not yet not triggered a clean-up liability. It may therefore decide not to take immediate action to clean-up. Is it the intention that such a company would be penalised as a result of those omissions and/or would not be able to make deductions in relation to contaminants which have deteriorated or spread during that period of inactivity? It may be preferable to remove the reference to omissions altogether. 10. Likewise, these provisions would appear to allow a company to claim the tax deduction where the clean-up expenditure has been required under an environmental permit. This is most likely to arise where a permit requires some remediation prior to it being surrendered to the authorities (such as a waste management licence or PPC permit). Such remediation may cover contaminants which the licence holder is not responsible for (due to its acts or omissions) and which fall outside the exclusion in paragraph (5). If this is not intended as a matter of policy, the legislation should be revised. Richard Kimblin and Matthew Townsend UKELA Contaminated Land Working Party 10th May, 2001 CO:840931.1