4-H Finances and Insurance Outline - Indiana State 4-H

advertisement

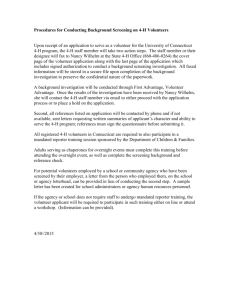

1 4-H Insurance & Finances 2012 4-H Youth Development Skills Café 3:30-5 p.m. Tuesday, February 28 & 10:30-12 p.m. Wednesday, February 29, STEW 214 D The information provided in this document is NOT designed to be widely distributed to 4-H Volunteer audiences. Rather, it should serve as a resource to help Extension Educators better understand the basics of 4-H Financial and Insurance issues as they provide guidance to local 4-H entities. 4-H Insurance Guidelines Note: Purdue University Extension Educators are not insurance professionals and have only been provided with this information in order to help local 4-H entities understand some of their risks associated with general operations, owning property, and hosting events and activities on their property or in their facilities. A local insurance professional should be consulted for specific insurance issues. Policies which are purchased should be reviewed by someone in the purchasing entity to be certain they include desired coverage. It is recommended that each entity complete an insurance audit with your insurance professional every six months or at least annually. Your insurance professional is your ally in loss control and risk financing. I. Limited Accident/Injury Insurance Policy A. Provider: American Income Life Insurance, based out of Indianapolis, provides coverage for 4-H and Extension groups across the country - http://www.americanincomelife.com/. 4-H participant’s personal or family health insurance will be primary. B. Policy options: 1. Annual Policy: $1/year for 4-H members and volunteers ($2/year for Horse & Pony members and volunteers) Provides limited, supplemental, coverage for accidents or injuries incurred by 4-H participants during a 4-H activity/event. Illnesses are NOT covered by this policy. Statewide blanket policy purchased annually with funds from the State 4-H Program Fee for: Each 4-H Member Each 4-H Volunteer (who is registered in ED) Each Mini/Exploring/Cloverbud Member (Grades K-2) – (NOTE: educational programming for groups younger than K should NOT be reported in the ES237, but should be reported in SAM.) 2 Coverage includes: Up to $2,500 for medical/surgical treatment, x-rays, hospital stay, ambulance Up to $500 for dental services Up to $5,000 for loss of life (within 100 days of accident) Up to $10,000 for loss of hands, feet, sight (within 100 days of accident) Coverage exclusions: Illness that may occur during the event that is not the result of an accident/injury – that coverage IS provided by the Special Events policy described below Eyeglass replacement, dentures, suicide, hernia, skiing/sledding injuries, air travel 2. Special Events Policy 3 coverage options – recommend Option C @ $.30/person/day; provides higher levels of coverage. Each event has an $8 minimum payment. Up to $5,000 for medical/surgical treatment, x-rays, hospital stay, ambulance Up to $1,000 for dental services Up to $1,500 for medical and hospital expenses related to ILLNESS while policy is in force (Illness examples: heat exhaustion, appendicitis, allergic reaction…that could cause an emergency situation when youth are away from home. The $1/year plan covers localized events where youth could return home if ill.) Up to $5,000 for loss of life (within 100 days of accident) Up to $10,000 for loss of hands, feet, sight (within 100 days of accident) Application available online Can apply for up to 10 events on one application (note: multiple events on one application should be paid for from the same account) Estimate the number of participants (you’ll pay for the exact number of participants after the event is held) Include the number of days the coverage will be in place (matching the length of the event) An e-mail confirmation of coverage will be provided along with a policy number Once the event has concluded, submit a check for payment for the actual number of participants covered, along with a copy of the policy confirmation. Policy is in place during the event, as well as to and from the event A Special Events Policy for youth and adults should be secured by a 4-H Club or County for… Any overnight event Any event that is held outside of the county 3 Any event that involves non-4-H participants in what could be perceived as a risky activity (e.g., open shows, tack sales, enrollment nights, pool parties, etc.) Counties/Clubs would likely NOT need a special events policy for items that would be placed in a relatively low risk category such as: 4-H Club Meetings Rehearsals for Share-the-Fun Team practice for Career Development Event Areas should take out a policy for area-wide events such as CDE’s, Share-theFun, Camps, Jr. Leader Retreats, etc. State Special Event policies are in place for state-wide events such as 4-H Congress, Science Workshops, Round-Up, State 4-H Jr. Leader Conference, Indiana State Fair Youth Leadership Conference, etc. County Extension Offices may also secure Special Events policies for any/all Extension activities, including Extension Homemaker and Master Gardener functions. C. What happens in the event of a claim? 1. Help the family realize that this is a supplemental insurance policy; their family health insurance will be primary and should be provided initially to the medical provider. 2. Complete a claim form within 48 hours of the incident (found on the AIL Web site: http://www.americanincomelife.com/wpcontent/themes/ailspecialrisk/documents/ClaimForm.pdf) Submit by fax (317-849-2793) or mail to: Special Risk Division P.O. Box 50158 Indianapolis, IN 46250 Questions regarding claims can be directed to: 800-849-4820 Part #1 – policy information (the number for the annual policy will be coming from the State 4-H Office); Part #2 – patient information Part #3 – injury report (for $1/year plan); illness report (for Special event policy plan); assistance will likely be needed from the family or a volunteer who was present when the accident occurred. Part #4 – verification of information by supervisor of event (4-H volunteer, staff member) Part #5 – assignment of payment to medical provider or family (may need to be completed at a later date); all receipts must be submitted before payment will be made. A family member should date and sign this section. 3. Keep a copy of this claim report, fax/mail one to AIL, and provide a copy to the family for their records. 4. ALSO…within 48 hours, complete the Purdue University Cooperative Extension Service Accident/Incident Report Form (RM 27) 4 http://www.purdue.edu/business/risk_mgmt/pdf/rm27.pdf. This form should be filed with Risk Management, the CES Director’s Office, and your District Director. D. Examples of claims that have been covered by AIL include: 1. A 4-H member participating in a county fair was fatally injured while riding on a tram. He fell from the tram under the wheels and was treated by emergency medical personnel at the fairgrounds. After being transported to a local hospital, he died. The American Income Life Special Risk Division paid a loss of life benefit to the family as well as the ambulance charges and emergency room fees. 2. A 13-year-old 4-H member was watering his calf while at the local 4-H fairgrounds when the animal knocked him against a concrete barrier. He required treatment in the emergency room for a broken wrist. AIL paid the policy maximum for medical expenses related to the injury. 3. A group of 4-H horse club members were practicing in the arena after a county show. One rider lost his seating and fell off. The 14-year-old was in extreme pain, so he was transported to the hospital by ambulance. X-rays found he had suffered a broken collarbone. Maximum benefits were paid under the 4-H club policy, which paid for the ambulance charge and contributed to the emergency room, hospital, and physician charges. [NOTE: had the injured individual been a non-4-H member or a 4-H parent, these expenses would NOT have been covered, unless a special events policy had been secured prior to the event.] II. Information for 4-H Entities Regarding Risks and Insurance Running an association and/or owning property and equipment creates hazards that 4-H entities should insure against. County 4-H Fair Associations and 4-H Councils (those organized with 4-H in their name or having a 4-H purpose) that are in operation and/or those that own real-estate need to provide liability protection from events that may occur due to organizational or individual actions. As of the 2010 4-H program year, Purdue University, The Trustees of Purdue University, and the Purdue Cooperative Extension Service are required to be named as an additional insured on Fair Association and 4-H Council insurance policies. A. Types of Liability 1. General liability insurance protects your entity from bodily injury and property damage to others associated with your entity’s negligence. Some other coverages may be mixed in, but it is not a coverage for all wrongful acts for which an entity may become liable. 2. Auto liability coverage provides your entity with bodily injury and property damage coverage for liability associated with the use of organizationally-owned vehicles (NOT endorsing 4-H entities purchasing vans/buses, etc.). You can secure coverage for non-owned vehicles as well. This coverage generally does not apply to vehicles belonging to individuals 5 who volunteer for, or are employed by, your organization. Individuals are always responsible for their personal vehicles. 3. Directors and officers coverage generally provides coverage for a broad spectrum of liability for wrongful acts to which the entity and its officers may become liable. (See III A for further D&O information.) 4. Property renter and building owner policies provide physical damage coverage to contents and buildings you may own. You normally can choose from policies ranging from basic minimum coverage, up to an open peril policy which offers the most protection. Coverage can be purchased at depreciated value or at replacement cost. Your agent or broker can explain the differences to you. 5. Workers compensation and employer liability coverage protects your entity against liability associated with employee injuries on the job. Does NOT apply to 4-H Volunteers. But does cover Extension Educators working within the scope of their duties. 6. Employee dishonesty coverage protects your entity from theft by employees and other dishonest acts that are generally excluded in a basic property policy. B. Risks for 4-H Fair Entities 1. Risks Associated with Property Ownership or Use Injuries on owned premises from third parties (slips and falls) Property damage to 4-H entity owned property from natural hazards (fire, wind, hail, etc.) as well as human element hazards like theft and vandalism. Other liabilities associated with hosting events on your premises (lack of supervision, premises maintenance, or crowd control) Contractual liability 2. Other General Risks Associated with Day to Day County Entity Operations Employment related risk (one of your employees sues you alleging wrongful termination) Employee dishonesty (one of your employees embezzles money or property from you) Personal and advertising injury (someone from your organization harms the reputation of someone else) Contractual liability risk (a contract you or your entity enters into may require you to take on certain liabilities) Event host liability risk (you or your entity may be found liable for the actions of others you invite to an event you host) Negligent supervision (you neglect to provide adequate supervision) Child molestation accusations Actions by directors and officers (negligent actions of directors and officers) 6 Property damage to the property of others (you damage someone else’s property in your care and control) Auto liability if your entity owns or uses non-owned vehicles (i.e., borrowed trucks, tractors) The above list is by no means exhaustive; however it gives you good examples of some of the everyday exposures. C. Considerations for Insurance Policies 1. Basic Guidelines It is strongly advised that you sit down and review your insurance needs on at least an annual basis with an insurance professional in your community. When considering the purchase of a policy, be certain your local insurance agent or broker is aware of all of your lease/rental agreements. You will want to be certain that any insurance requirements that may exist in those agreements are met. When considering the addition of new events and activities during the fair or at other times during the year, check with the insurance professional via email to determine whether or not the event is covered. Doing so via email provides documentation of the reply regarding availability of coverage. Be aware that some activities and events may be excluded from coverage in your policy. Of the insurance policies purchased by 4-H entities and reviewed by Purdue Risk Management (for purposes of establishing a baseline of information), the policies now available by K & K Insurance of Fort Wayne (available from local Farm Bureau Insurance agents) is recommended for the types of activities conducted. Caution: you should read the policy carefully and look for exclusions. We discovered a policy that included exclusions for all exhibitions as well as carnivals, circuses, and fairs. Policies with carnival, circus and fair exclusions are common. If you plan to host such events, you can usually work with your insurance professional to have the exclusions removed from the policy. An extra premium will likely be charged that is commensurate with the extra risk exposure to the insurance company. Carnivals or other attractions including food vendors that are brought in to participate at 4-H fairs should provide their own insurance. Your 4-H fair entity should require proof of insurance from these vendors and request the following be named as additional insureds on that policy: Your county 4-H fair entity, and Purdue University, The Trustees of Purdue University, your county Commissioners, your county Cooperative Extension Service, and the trustees, officers, appointees, agents, employees, and volunteers of those organizations. All policies should be primary and non-contributing by other insurance that may exist through your entity or Purdue. Proof of insurance should be in the form of a certificate of insurance 7 and that document should clearly indicate the above requested features. These protections are of significant importance to your entity and Purdue. 2. Coverage Limits The types of coverage and limits your entity purchases for any of the above exposures should factor in the type and magnitude of loss exposures you have. If you have a larger organization with significant exposure to loss, you should purchase a greater amount of coverage. Your local insurance professional can assist you with that decision. Most entities should not purchase less than $1 million in coverage for any one occurrence. Purdue University Extension or 4-H sponsored educational events have liability coverage provided by Purdue University. Other activities that occur in the course of county fairs or yearround events/activities that are conducted as fund-raising, entertainment, income producing activities should have liability coverage in place. Outside groups or entities to which you may rent facilities for activities should be providing you with a certificate of insurance evidencing that they have coverage. 3. Additional Recommendations The following points can help keep you out of court and save you money on legal fees in the long run. Read all contracts carefully and have them reviewed by an attorney. Some attorneys will do work at a reduced fee for not-for-profit entities. This is time and money well spent on the front end. When hiring a vendor or leasing premises from others, never take on liability for risks you cannot or do not directly control. As a general and very basic risk management and loss control premise, if you don’t control it, don’t take responsibility for it. Whoever controls the risk should be responsible for it and insure it. Most insurance policies do not provide coverage for liability you assume by contract, so be very careful in this regard. You should require vendors and other service providers coming onto your premises to provide you with proof of insurance applicable to the specific service to be provided. They should name your entity, Purdue University, and The Board of Trustees of Purdue University as additional insured. Their coverage should be primary and not contributing by any other coverage you might have. This is very important. They should provide you with a Certificate of Insurance that clearly indicates all of this. Verbal acknowledgements are not enough. If you don’t get it in writing, you can assume it does not exist. You don’t want their lack of insurance and care to become your legal nightmare. III. Additional Insurance-Related Issues A. Directors & Officers (D&O) Liability 8 1. D&O coverage provides protection for wrongful acts associated with the decisions and actions of the board, its directors, and officers. It is advisable that you review this potential exposure with your local insurance professional. 2. 4-H entities, such as 4-H Councils and 4-H Fair Boards, should purchase D&O liability insurance coverage. This coverage is important for organizations that enter into agreements and or contract for services that have no direct bearing on the 4-H educational mission/purpose of the organization. Examples of such agreements include, but are not limited to, carnivals, entertainment, food vendors, buildings, rental space/facilities, etc. 3. Purdue University does NOT provide D&O Liability insurance to cover decisions that volunteer boards make as a group, such as entering into contracts or agreements – when outside the educational mission of 4-H. 4. As a specific example, let’s say that the Council entered into a contract with a carnival to provide rides at the County 4-H Fair. This contract has nothing to do with the educational mission of the 4-H program, so would be beyond the coverage provided by Purdue University to the volunteers serving in the 4-H program. A fair visitor is injured while riding one of the carnival rides and decides to sue for damages. The suit names the carnival company, the 4-H Council (since it was the organization who entered into the agreement with the carnival), and likely the individual members of the 4-H Council. D&O Liability Insurance would provide coverage of the group’s (4-H Council’s) decision to enter into this agreement. Similar examples could include illness sustained after eating at a food vendor stand that the Council has contracted with, an entertainer who fails to fulfill a contract to perform, etc. Again, the decisions covered by D&O are the ones that are not 4-H-program related. 5. Recommendations from an insurance professional regarding the need for D&O insurance include: Not for profit organizations are six times more likely to have claims brought against them than for profit boards because of the lack of structure to these boards. There is often no formal training for board members on how to professionally run an organization, establish and adhere to by-laws, and record and store meeting minutes. Directors may be held liable for the nonperformance of the organization. Directors and officers may be held liable for claims made against the council at meetings and with the fair functions (I see the livestock auction and the exchange of money through that account as a big risk in itself). Not for profit organizations are frequently regulated by many statutes, rules and regulations with which directors aren’t familiar with. Many times by-laws aren’t kept current and followed in accordance to their charter. Minutes may not be recorded accurately and stored effectively. Board decisions may be seen as being made in a biased or unfair manner. Directors and officers may not realize secret profits or unfair gain from the use of the organization’s materials and nonpublic information. 9 All directors and officers can be held personally liable for the actions of any one person acting outside of his/her duty of care to the organization. Ignorance is not a defense in many cases when someone (like a new member) isn’t aware of any wrongdoing. B. Bonding Organizational Treasurers It is strongly advised that individuals who serve as the treasurer for county organizations such as 4-H Fair Boards or 4-H Councils should be bonded. Bonds may be purchased from a variety of bonding underwriters. Again, you should address this issue and exposure with your local insurance professional who can help assess your organization’s exposure and assist you with procuring a product to protect the organization from loss due to dishonesty and fiscal malfeasance. C. What coverage is available through 4-H if a 4-H member’s animal hurts someone? There is no Purdue coverage for individuals whose animals injure someone else. Individuals are responsible for the actions of their own animals. (e.g., if your dog was to bite someone, you would be responsible for the damages caused.) D. How do we handle a request for a Certificate of Insurance in order to use facilities for a 4-H event? If you have a 4-H group sponsoring or participating in an official 4-H activity using non-4-H owned facilities, you may be asked by the property owner to provide proof of insurance for any liability which may result from your group’s actions ( i.e. injury to, or damage to property of, a third party). This is a common request, and enables the premises owner to establish that your group has liability coverage which would respond in the event of a loss. These are examples of circumstances which may prompt a request for evidence of coverage: • Use of a community meeting hall, school, or church for a meeting or series of meetings. • Having an informational booth at a local shopping mall, fair, or festival. • Taking a group of students on a plant visit or field trip. NOTE: A Certificate of Insurance typically will NOT be issued to a private homeowner (who may be asked to host a 4-H pool party, for example). In those instances, the homeowner’s personal insurance policy would be in effect. COI would also NOT be issued for individuals who choose to house animals that belong to other families/4-H members. Liability coverage is always in force for approved university events. Proof of coverage is provided via a certificate of insurance issued by the University’s liability insurance carrier. A certificate of insurance only needs to be issued when one is requested by the premises owner. The certificate will state the amount of coverage in force and that your particular event is covered. In order to request a certificate, complete an RM02 Form along with a copy of any agreement or contract which pertains to the activity. NOTE: This memo and form, along with other information concerning property and casualty insurance, can be accessed via the Risk Management website at: http://www.purdue.edu/Risk_MGMT/. 10 When completing the RM02, your information goes in the Requestor’s section, and the premises owner’s information goes in the Certificate Holder’s section. If you will be holding multiple activities throughout the year at a particular location, or if you plan to repeat an activity at the same location, please indicate that under the Certificate Purpose. We will word the certificate such that you will not need to request an additional certificate for each event. Whenever possible, please complete the RM02 electronically and forward it as an MS-Word document to the appropriate email address indicated on the form. All CES requests must be routed through the CES Director’s Office for approval. To assure timely delivery of your COI, please submit your RM02 at least three (3) working days prior to the activity. This information is provided by Mark Kebert, Risk Manager for Purdue University and Renee McKee, Assistant Director Purdue Cooperative Extension Service/State 4-H Program Leader at Purdue. 11 4-H Financial Guidelines NOTE 1: 4-H Extension Educators are NOT trained financial advisors. Therefore, contact a professional financial advisor (Certified Public Accountant, tax advisor, etc.) to address specific financial issues. NOTE 2: If a County 4-H Council or 4-H Fair Board does NOT have a professional tax/financial advisor, is it in their best interests to find one! Extension staff members and 4-H Volunteers are NOT expected to be up-to-date with all tax laws and financial accounting procedures. We are, however, expected to ensure that the process is completed. Hence, the use of a professional!! Financial Records, Audits/Reviews, EIN’s I. General Financial Guidelines A. 4-H Club/Unit Financial Checklist 1. Checklist found in 4-H Policies & Procedures, Financial Management Forms Section. 2. Checking/savings accounts do not have personal Social Security numbers on them. Each account should be opened with a unique Employer Identification Number Banks may ask the individual opening the account for a SSN to verify that the person is who they say they are; however, that SSN should NOT be tied to the bank account. 3. Checking account is a duplicate check system. Providing a physical record of each check that was written. 4. Checking account has two signatures (not related persons). For the protection of the volunteers, club, and 4-H Program If a child of a 4-H Volunteer is elected Treasurer, the 4-H Volunteer should remove his/her name from the account for the time their child is Treasurer. Some banks are now charging for having two signatures on an account. If that is the case, have the second signature put on the Memo line. Some banks no longer allow for individuals under 18 to be listed as a signatory. That should NOT prohibit 4-H members from serving as Treasurer…they can still prepare Treasurer’s reports, write the checks (but not sign them), keep the checkbook balanced, etc. 5. List of receipts and expenses is maintained. 6. Original receipts for purchases are maintained. 7. Treasurer’s report is presented at each meeting. 8. An official receipt for donations is provided to donors. Sample receipt master is provided in Financial Management Forms section (will be revised once we have the new Purdue Group Exemption Number in place) 9. The annual 4-H Club/Unit Financial Report is completed and submitted to the Extension Office in a timely manner. 12 II. Financial Reporting Requirements A. Annual Financial Report 1. Filed each year by each 4-H Club, Affiliate, and other 4-H-related groups (including committees, boosters, auctions, etc…) These reports should be filed according to the schedule established by the Extension Office; typically within a few weeks of the end of the accounting year 2. Template for report form is available in 4-H Policies & Procedures – Financial Management Forms section 3. Sample letter to request this information is provided in the same location 4. Information currently requested on this report includes: EIN included on the account, basic demographic information Beginning and ending balances for checking and savings accounts Total receipts/expenses for the year (Jan 1 – Dec 31 accounting year) 5. Additional information may be requested based on the new PU GEN, likely to include a value of the entity’s assets…specifics will be announced when they become available. 6. Keep financial reports submitted by entities on file for 7 years. If there are any accounts that experience “issues” or have special circumstances, then they should be held longer. B. Audits/Financial Reviews 1. An audit/financial review should be conducted on 1/5 of the 4-H units (clubs, affiliates, other) on an annual basis. 2. Over the course of 5 years, all of the units will have their finances reviewed. 3. If the leaders/treasurers of additional units change, those units should be added to the audit list. 4. Template for Financial Review/Audit is included in 4-H Policies & Procedures – Financial Management Forms section 5. Sample letter to notify unit they will be reviewed/audited is included in the same section. It is recommended that these notification letters be sent early in the year so the unit has time to gather the necessary information. 6. Information requested on this report includes: a. Financial Checklist b. 1 year of bank statements c. Checkbook and/or savings account registers d. Lists of receipts and expenses e. Copies of receipts f. Treasurer’s reports g. List of tangible assets (property, equipment, etc.) 7. Audit/Financial Review of 4-H Clubs may be completed by a committee of the 4-H Council. Or, if the Council has a good working relationship with a local CPA who would conduct the audits at little or no cost, that would be a good option to consider. The reason that we call them audit/financial reviews is that we are not requiring that a formal audit be conducted of the smaller 4-H Clubs (such as would be conducted by a CPA). Typically, a committee of volunteers can identify if basic financial accounting 13 procedures have been followed and make suggestions for appropriate improvements in future years. 8. For larger groups such as a 4-H Council or Fair Board, an audit completed by a professional accountant is recommended on an annual basis. This individual may also be asked to file the IRS Form 990 on behalf of the Council (assuming the Council has gross receipts of over $50,000.) 9. The Audit/Financial Review should be seen as an educational opportunity for both the Adult Volunteer and the Treasurer. Suggestions will be given that will help the unit keep more accurate financial records in the future (which can be translated to personal finances as well). The Review committee may wish to have a face-to-face meeting with the Adult Volunteer/Treasurer to share the findings of the review and answer any questions that may arise. 10. The Audit/Financial Review should NOT be perceived as a punitive or disciplinary action, but rather as a normal, responsible financial accounting procedure. C. Unit Activity Report 1. Found in 4-H Policies & Procedures, Financial Management Forms Section 2. Lists date, name of activity, attendance, summary/accomplishments of each event held by the unit during a year 3. Should be submitted prior to the first event being held in a year 4. Can be updated throughout the year; a final report can be submitted after the last activity has been held 5. Providing this list enables the Extension Office to know about the activities before they happen, ask any necessary questions, and to verify the activity is a 4-H-sponsored event should questions arise. D. Tax Reports with IRS 1. See below E. What if a unit does not submit the required reports? 1. Educate a. As each 4-H Volunteer is recruited, screened, oriented, and trained, emphasis on following 4-H Policies & Procedures, including financial reporting, should be made clear. b. 4-H funds are public funds…they do not belong to any one individual. We have a responsibility to report accurately and in a timely fashion c. Share with volunteers early on what is asked of them and how to complete the forms (there are times that volunteers honestly don’t know how to complete the information requested, and instead of being embarrassed by asking, they just neglect/ignore the request) d. Enable the volunteers to delegate the task to another volunteer if this is an area they are uncomfortable with. 2. Communicate a. Notify volunteers well in advance of the requests to submit the needed information. 14 b. Notification can be by letter, in a meeting, e-mail, Facebook post, personal communication. c. Include a date by which you need the information to be submitted. d. Follow-up after the initial communication with a reminder a week or so before the deadline. e. After the deadline has passed, contact the stragglers again…see if they have questions or need assistance with completing the request. Be sure they have the forms needed to meet the request. f. Be persistent with the volunteers (just as we’ve had to be persistent with Educators regarding the current PU GEN transition). g. Remind volunteers that they agreed to follow 4-H Program Policies & Procedures when they signed their annual ABE and that they agreed to take direction from the Extension Educator. 3. Eliminate a. Those unable to comply with the request after multiple good-faith efforts have been made will be asked to leave their volunteer position. 4. Prosecute a. Funds unaccounted for from an individual 4-H unit can be retrieved from some local banks (depending upon your relationship with these banks) b. Or, we have the responsibility to file criminal charges with the prosecutor to seek the recovery of funds which are the property of the 4-H program III. Tax Reporting Requirements NOTE: It is not the responsibility of the Extension Educator to complete the filing for any of the entities, but it is our responsibility to be certain that volunteers with each entity know their legal obligation to file. A. Definitions 1. Gross Receipts – a total of all income received by an entity during a fiscal year 2. Federal tax exemption – exempt from paying taxes on income received during the year; enables donors to make tax-deductible donations to the organization 3. State sales tax exemption – exempt from paying state sales tax on purchases NOTE: 4-H Clubs are NOT exempt from paying states sales tax. B. 4-H Entities earning $50,000 or less in gross receipts annually 1. File an IRS 990 e-Postcard by May 15th for the previous tax year (Jan 1 – Dec 31) 2. Available at IRS Web site: http://epostcard.form990.org/ 3. Information requested: EIN, contact name, verification that the entity earned $50,000 or less in gross receipts in the previous tax year 4. If IRS does not recognize EIN, print a copy of the notification and keep on file with other tax records as proof of attempt to file 5. Instructions for 4-H entities to file for the 2011 tax year have not yet been announced. There is a chance that we will once again have an exemption since we’re still in the transition to the new PU GEN…stay tuned! 15 C. 4-H Entities earning more than $50,000 in gross receipts annually 1. File an IRS Form 990 series by May 15th for the previous tax year (Jan 1 – Dec 31) 2. Preparation and submission of this form should be completed by a professional tax preparer. Staff and volunteers should NOT attempt to file these forms on behalf of the organization. 3. NOTE: some entities serve as “pass through” organizations for livestock auctions. In these cases, where the funds are taken in by the entity, then immediately returned to the 4-H member, those funds are NOT considered part of the organization’s gross receipts. If the organization withholds an administrative fee (e.g., 2% advertising fee) from the member’s auction check, then only these fees would be considered part of the organization’s gross receipts. D. State Tax Reporting 1. 4-H Councils or 4-H Fair Boards that have applied to be exempt from paying Indiana Sales tax with the Indiana Department of Revenue complete the NP-20 State Form by May 15th. 2. Those who wish to be exempt from State Sales Tax may submit a NP-20A application form. Visit with tax professional prior to submitting this application. 3. Forms are available at: http://www.in.gov/dor/3506.htm . 4. This process would NOT be recommended for 4-H Clubs. Paying sales tax is a cost of doing business and a good civic education lesson. For large purchases, 4-H Clubs may consider asking the 4-H Council to pay the bill using their state sales tax exempt number and then reimbursing the Council (with their approval of course). E. Business Entity Reporting 1. Those entities that are incorporated with the Indiana Secretary of State (some 4-H Councils and 4-H Fair Boards) file a Business Entity Report annually with the Indiana Secretary of State. 2. Form available at: http://www.in.gov/ai/appfiles/sos-berf/ 3. A reminder notice from the Secretary of State should be received by the individual who is listed as the contact. 4. Reports are due in the anniversary month when they were first granted authority to do business in the State of Indiana. 5. Non-profit groups have a $7.14 filing fee (if using a credit card). 6. Entities that have not filed for several years will be administratively dissolved. Reinstatement instructions are available at: http://www.in.gov/sos/business/files/domestic_packet.pdf F. Transition to Purdue Group Exemption Number 1. Purdue will apply for a Group Exemption Number (GEN) for all 4-H Clubs and Affiliates that have completed the required paperwork. 2. Those entities that have not submitted the required paperwork or obtained a unique EIN will not be included in the application for the GEN and will be considered taxable entities in 2012. 16 3. Once the new GEN is in place, new tax determination letters and donor receipts can be generated. 4. Entities that have disbanded or joined a parent organization for IRS purposes will have their EINs dissolved with the IRS. 5. Specific filing instructions for 4-H entities for the 2011 tax year have not yet been announced by 4-H National Headquarters and the IRS. We’ll share that information as soon as it becomes available. 6. Purdue looking to build a case for irrelevancy for each of the 4-H Affiliates joining the PU GEN (meaning that we would NOT have to collect annual financial reports and submit them to PU for audit). That decision is yet to be made by the Comptroller and Accounting Offices at PU. IV. 4-H Fundraising Guidelines A. Need prior approval from 4-H Youth Development Extension Educator B. Should NOT be the primary purpose of the 4-H Club/Entity C. Must follow all guidelines related to the use of the 4-H Name and Emblem 1. 4-H National Headquarters Fact Sheet: http://www.csrees.usda.gov/nea/family/res/pdfs/using_the_4h_name.pdf 2. Approved vendors are listed at: http://www.csrees.usda.gov/nea/family/res/youthdev_res_emblem.html D. May NOT be considered a game of chance (e.g., Bingo, raffles, etc…) E. Examples of appropriate 4-H Fund raisers include… 1. Plant sale 2. Pre-packaged food sales 3. Candy, popcorn, cookie, etc. sales 4. T-shirt sales 5. Auctions 6. Craft sales 7. Walk-a-thon 8. Festivals V. Tax Deductible Donations (Livestock Auctions and W-9s) A. Requests for W-9s 1. When requests for W-9’s are made, the Treasurer of the 4-H organization may complete the W-9 forms on behalf of the organization and return them to those who have made the requests. 2. The 4-H organization’s contact information and EIN should be included. The 4-H Educator should not be the one to complete the forms. 3. The W-9 does not stipulate whether or not a tax-deductible contribution was made. B. Livestock Auction purchases When a business/individual purchases an animal at a 4-H livestock auction, the purchaser likely did NOT make a tax-deductible contribution. Although the 4-H organization likely collected the funds, the money was actually paid directly to the 4-H member, benefiting the 17 individual, not the organization. The 4-H organization was just a conduit for the sale of the animal. There are a couple of fact sheets on the 4-H National Headquarters Web site that help to explain the guidelines. They are located at: http://www.csrees.usda.gov/nea/family/res/youthdev_policy_factsheets.html. Look for: “Livestock Sales, Auctions and Similar Events” and “IRS 4-H Livestock Sale FAQs”.