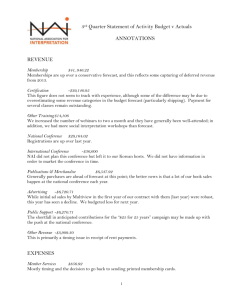

travelling queen

advertisement