m/s. duke corporate educatuin india pvt ltd.

advertisement

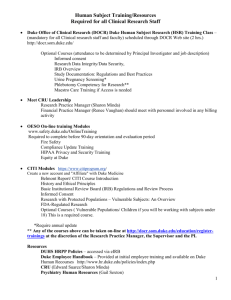

2

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

BRIEF FACTS OF THE CASE

1.

M/s Duke Corporate Education India Private Limited having its business

premises at Ground Floor, Academic Block, IIM, Vastrapur, Ahmedabad-380015

(hereinafter referred to as the said service provider) is registered with Service Tax

Commissionerate, Ahmedabad under the category of Management Consultants,

Commercial Training and Coaching, Business Auxiliary Services, Intellectual Property

Rights Services and Legal Consultancy Services and is holding service tax registration

number AACCD5507EST001.

2.

Audit of the records of the said service provider for the F.Y. 2007-08 to 2008-09

was carried out and vide Revenue Para – 2 of the audit report No. 184/09-10 dated

10.03.2010 it was observed that:“During the course of audit, it was observed that the assessee has charged Rs.7,68,339/- during the year

2007-08 and Rs.70,02,035/- during the 2008-09 to their Holding Company M/s Duke CE, USA for support

services provided by the assesse. On verification of the invoice and Annexure to the invoices, issued by the

assesse to M/s Duke CE, USA, it appears that the assesse has provided support services in India. The

taxable service “Commercial training or Coaching” is defined under Section 65(105)(zzc). In the Export of

Services Rules, 2005, Commercial Training or Coaching service is classified under category (ii) and service

performed outside India wholly or partly is to be treated as export of Service. The assesse has not

produced any evidence to establish that services are performed outside India or partly performed outside

India. Further in rule (2)(a) of Export of Services Rules, 2005, it is provided that “such service is performed

from India and used outside India”. Any service provided from India and used outside India is considered

as export of services. In the present case it appears that services provided by the assessee are used in

India. Therefore, support services provided to M/s Duke CE, USA cannot be considered as Export of Service

and service tax is required to be paid. The service tax liability is worked out as under:Year

Amount Received

Taxable Value

Service Tax

2007-08

7,68,339/-

6,83,819/-

84,520/-

2008-09

70,02,035/-

62,31,786/-

7,70,249/-

TOTAL

8,54,769/-

(Source:- Audit Report No. 184/09-10 dated 10.03.2010)

3.(i) In this regard letters from JRO were issued to the said service provider seeking

clarification with regard to the audit observations and the replies to the same were

received in the Range Office.

(ii) Also, summons dated 11.10.2012 & 17.10.2012 were issued to the service provider

and in response to which statement of Shri Nikhil Raval, authorized person of the said

service provider was recorded on 18.10.2012 by the Range Office under the provisions

of Section 14 of the Central Excise Act, 1944 made applicable to service tax matters

vide section 83 of the Finance Act, 1994.

(iii) The observations of the Range Office derived from the correspondences and

statement recorded are as follows:(I) Scope of the Impugned Activites/Services:(a) The said service provider vide letter dated 05.10.2012 had stated regarding the

scope of “Exchanges of Program Support” under which the impugned services were

provided by the said service provider. The same is reproduced as below:“Duke Corporate Education is the foremost global provider of custom corporate education services that

helps organizations address their business challenges. The Company was created to provide intensively

customized corporate education services focused on addressing business challenges. The Company

focuses education on what the client's people need to know, do and believe in order to address current or

anticipated challenges and attain specific business objectives.

3

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

The organization helps its clients implement their strategies through development of their people and

differs from a traditional business school or professional services firm in that the organization is not solely

dependent on the organization's or any single university's faculty. To meet the broad range of client

needs, Duke CE utilizes quality faculty from numerous business schools, other external professionals and

Duke CE experts from across the company. The approach of utilizing the best resources to meet the needs

of a client is central to Duke CE's business model.

This approach requires the exchange of services and support across all parts of Duke CE in a fair and

equitable manner. To achieve this, Duke CE has employed the following standard:

A. The parties shall upon request make commercially reasonable efforts to provide to one another

program support (including faculty). Such faculty shall remain employees or independent contractors of

the party providing the faculty.

B. The parties shall pay one another for program support as follows:

i.

To the extent Duke CE provides to Duke India program support (including faculty), Duke India shall

pay Duke CE for the costs of such program support at an amount equal to (A) the fee charged to the client

for such support, in the case of support provided by Duke CE though its employees, or (B) the actual cost

to Duke CE of such support, in the case of support provided by Duke CE through independent contractors.

ii.

To the extent IIM-A provides to Duke India program support (including faculty), Duke India shall

pay IIM-A for the costs of such program support at an amount equal to (A) the fee charged the client for

such support, in the case of support provided by IIM-A through its employees and (B) the actual cost to

IIM-A of such support, in the case of support provided by IIM -A through independent contractors.

This approach has been supported across Duke CE as well as with third party partner schools.

(b) Also vide letter dated 28.09.2012, the said service provider stated that:“Duke CE, USA is a global learning and development company that provides learning methods, process

and educators to help organizations achieve their goals. Duke CE educates and develops people at every

entry level so that they can contribute to business success. Duke CE delivers corporate education in 63

countries around the world.

In certain occasions, Duke CE, USA requires to provide certain support services from Duke CE India. In

this regard, personnel’s of Duke CE, India executes the said support services.

(c) During the course of recording of the statement on 18.10.2012, Shri Nikhil

Raval, Authorised person of the said service provider deposed that:“M/s Duke Corporate Education (India) Pvt. Ltd. is an Indian Counterpart of M/s Duke CE USA which is a

globally reputed company in the area of executive training. We are engaged in providing specialized

executive training to the officials of our clients.

There are three ways in which we are getting our clients i.e., we earn our revenue from

(a) Company’s who wish to provide executive training to their employees / key personnel’s contact

us for the same.

(b) We ourselves approach the company’s to have orders from them for training their executives.

(c) Sometimes our parent company i.e., M/s Duke USA during the course of providing the services

to their clients requires support from M/s Duke Corporate Education (India) Pvt. Ltd. in certain

manner. These may include specialized training in context of Indian Subcontinent or the areas of

specialization of M/s Duke India.

In the first two cases, we enter into written agreement with the clients directly whereby the scope of

the services, time of services, due date of delivery, consideration / professional fees to be paid etc.

are agreed upon.

4

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

In case of the third case i.e., cases where support in required by M/s Duke USA from us, we normally

agree upon the scope of the services vide our inter-company correspondences only. No written

agreement has been entered for these support services.”

(II) Monetary Consideration Charged / Received for the Impugned Activites /

Services:(a)

The details regarding the invoices raised for providing the said services was

submitted by Shri Nikhil Raval, Authorised signatory of the said service provider

during the record of the statement on 18.10.2012.

(b)

Further, Shri Nikhil Raval, authorized signatory of the said service provider

during the record of statement submitted that:“In cases where the services are provided to clients directly by entering the agreements with them, the

consideration is received directly from the clients in our bank accounts either by cheque or wire

transfers.

While in third case where the services to the clients of M/s Duke USA are provided by us, the

consideration is received from M/s Duke CE, USA in our bank accounts.”

(c)

As per the details submitted by the said service provider, the invoices raised for

the said services from the F.Y.2007-08 and F.Y.2011-12 are as under:TABLE-1

S.

No.

F.Y.

Export

Invoice Date

Export Invoice

Number

Name of the

Party

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

2007-08

2008-09

2009-10

2009-10

2009-10

2010-11

2010-11

2010-11

2010-11

2010-11

2010-11

2010-11

2010-11

2011-12

2011-12

2011-12

2011-12

March-08

March-09

30-Apr-09

31-Aug-09

31-Mar-10

31-May-10

31-Jul-10

31-Aug-10

30-Sep-10

31-Oct-10

31-Jan-11

28-Feb-11

31-Mar-11

31-Oct-11

12-Dec-11

12-Mar-12

12-Mar-12

DCEI/2007-08/0001

DCEI/2007-08/0001

DCEI/2010-10/2010

DCEI/2010-02/2010

DCEI/2010-09/2010

DCEI/2011-11/2010

DCEI/2011-01/2011

DCEI/2011-02/2011

DCEI/2011-03/2011

DCEI/2011-04/2011

DCEI/2011-07/2011

DCEI/2011-08/2011

DCEI/2011-09/2011

2011 C March

2011 D March

2012 D March

2012 E March

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

S.No.

Amount Billed

(in F.C.)

Amount Billed

(in INR)

18990.00

768339

169475.08

7002035

-4500.00

-226358

18461.54

891862

1550.00

69797

15500.00

719591

12000.00

557300

5538.46

257437

1538.46

69063

7700.00

348387

2960.00

137586

1480.00

67356

9483.08

428752

19303.53

896923

20121.24

919180

20857.36

971338

25462.52

1256877

345921.27

15135463

(d) As per the details submitted by the said service provider, the receipt of the said

invoices reflected in Table-1 are as under:

Export

Export Invoice

Invoice Date

Number

1

March-08

2

March-09

DCEI/200708/0001

DCEI/200708/0001

TABLE-2

Amount

Name of the

Received

Party

(in INR)

Receipt

Date

FIRC No.

FIRC Date

Duke CE, USA

768339

15-Dec-11

103293

16-Aug-12

Duke CE, USA

7002035

15-Dec-11

103293

16-Aug-12

5

3

30-Apr-09

4

31-Aug-09

5

31-Mar-10

6

31-May-10

7

31-Jul-10

8

31-Aug-10

9

30-Sep-10

10

31-Oct-10

11

31-Jan-11

12

28-Feb-11

13

31-Mar-11

14

15

16

17

31-Oct-11

12-Dec-11

12-Mar-12

12-Mar-12

DCEI/201010/2010

DCEI/201002/2010

DCEI/201009/2010

DCEI/201111/2010

DCEI/201101/2011

DCEI/201102/2011

DCEI/201103/2011

DCEI/201104/2011

DCEI/201107/2011

DCEI/201108/2011

DCEI/201109/2011

2011 C March

2011 D March

2012 D March

2012 E March

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

Duke CE, USA

-226360

15-Dec-11

103293

16-Aug-12

Duke CE, USA

891862

15-Dec-11

103293

16-Aug-12

Duke CE, USA

69797

15-Dec-11

103293

16-Aug-12

Duke CE, USA

719591

15-Dec-11

103293

16-Aug-12

Duke CE, USA

557300

15-Dec-11

103293

16-Aug-12

Duke CE, USA

257437

15-Dec-11

103293

16-Aug-12

Duke CE, USA

69063

15-Dec-11

103293

16-Aug-12

Duke CE, USA

348387

15-Dec-11

103293

16-Aug-12

Duke CE, USA

137586

15-Dec-11

103293

16-Aug-12

Duke CE, USA

67356

15-Dec-11

103293

16-Aug-12

Duke CE, USA

428752

15-Dec-11

103293

16-Aug-12

Duke CE, USA

Duke CE, USA

Duke CE, USA

Duke CE, USA

896923

919180

971338

1256877

15135462

15-Dec-11

15-Dec-11

29-Mar-12

30-Mar-12

103293

103293

20120901965

20120911933

16-Aug-12

16-Aug-12

30-Mar-12

31-Mar-12

(e)

Moreover, as per the details submitted by the said service provider, the place of

performance of the said services are as follows:TABLE-3

Location

Export

Name of the

of the

Place of

Export Invoice

S.No.

Invoice

Duke CE India

Client Name

Ultimate

performance by

Date

Date

Resource

Service

Duke CE Resource

Receiver

DCEI/2007Duke CE, USA

1

March-08

Mehta

UK

United Kingdom

08/0001

(Project Bosch)

Duke CE, USA

2

Pshastri

UK

India

(Project Bosch)

Duke CE, USA

3

Bbigoness

Hungary

India

(Project Genpact)

Duke CE, USA

4

Pshastri

(Project Ingersoll

USA

China

Rand)

Duke CE, USA

India & North

5

Mehta

USA

March-09

DCEI/2007(Project Medtronic)

Carolina, USA

08/0001

Duke CE, USA

6

Bbigoness

India

India

(Project Oil India)

Duke CE, USA

United Kingdom &

7

Pshastri

Netherland

(Project Rabobank)

India

Duke CE, USA

8

Pshastri

India

India

(Project Satyam)

Duke CE, USA

9

Pshastri

India

India

(Project Satyam)

6

10

11

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

Bbigoness

30-Apr-09

DCEI/201010/2010

12

Pshastri

Pshastri

31-Aug-09

DCEI/201002/2010

13

Smehta

DCEI/201009/2010

DCEI/201111/2010

DCEI/201101/2011

14

31-Mar-10

15

31-May-10

16

31-Jul-10

17

31-Aug-10

DCEI/201102/2011

Nraval

18

30-Sep-10

DCEI/201103/2011

Nraval

19

31-Oct-10

DCEI/201104/2011

Pshastri

20

31-Jan-11

21

28-Feb-11

DCEI/201107/2011

DCEI/201108/2011

22

Pshastri

Pshastri

Nraval

Pshastri

Pshastri

Nraval

23

31-Mar-11

24

DCEI/201109/2011

P Shastri

P Shastri

25

P Shastri

26

Nraval

27

31-Oct-11

2011 C March

P Shastri

28

Smehta

29

P Shastri

30

12-Dec-11

2011 D March

31

32

S Bardrudin

The Taj

12-Mar-12

2012 D March

Nraval

Duke CE, USA

(Project Schaeffler)

Duke CE, USA

(Project Ingersoll

Rand)

Duke CE, USA

(Project Black Mgmt

Forum)

Duke CE, USA

(Project Black Mgmt

Forum)

Duke CE, USA

(Project Bosch)

Duke CE, USA

(Project Bosch)

Duke CE, USA

(Project IBM)

Duke CE, USA

(Project Duke NUS

GMS)

Duke CE, USA

(Project First Gulf

Bank Managers

Prgm)

Duke CE, USA

(Project United

Media Grp Ltd.)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Aegon)

Duke CE, USA

(Project Aegon)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Duke NUS

GMS and IBM)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Black Mgmt

Forum)

Duke CE, USA

(Project Aegon)

Duke CE, USA

(Project Aegon)

Duke CE, USA

(Project Amgen)

Duke CE, USA

(Project IBM)

Germany

North Carolina,

USA & Germany

USA

China

South

Africa

India

South

Africa

India

UK

UK

UK

UK

USA

Singapore

Singapore

Singapore

UAE

USA

UK

India

Malaysia

Malaysia

Malaysia

Malaysia

UK

India

UK

India

Malaysia

Malaysia

Malaysia

Malaysia

Singapore

Singapore

Malaysia

Malaysia

South

Africa

India

UK

India

UK

India

USA

India

USA

Singapore

7

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

33

P Shastri

34

Sonia Karnani

35

Nraval

36

37

12-Mar-12

2012 E March

P Shastri

Deenky Shah

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project Internal)

Duke CE, USA

(Project ERAMET)

Duke CE, USA

(Project Petronas)

Duke CE, USA

(Project ERAMET)

Malaysia

Malaysia

USA

UK

France

France

Malaysia

Malaysia

France

France

It is also on record that ( vide the statement recorded) that

“Location of the ultimate service receiver” reflects the location from where the orders/ contract were

received by Duke CE USA from the clients.

“Place of performance by Duke CE Resource” reflects the place from where the client of M/s Duke CE

USA has been served.

4.

Now the facts mentioned above are to be interpreted in terms of service tax

liability as per provisions contained in the Finance Act, 1994 as amended from time

to time.

4.1

CLASSIFICATION OF THE TAXABLE SERVICES

4.1.1 Vide the said audit report dated 10.03.2010, the audit party was under belief

that the impugned services fall under the category of Commercial Coaching and

Training Services. However, on detailed scrutiny of the scope of the services provided

by the said service provider, it is observed that in service tax matters service provider

and service receiver relationship is of prime importance. In the subject case the

service provider is M/s Duke Corporate education India Pvt. Ltd. whereas the service

receiver is M/s Duke CE, USA. The invoices for the subject services are raised to M/s

Duke CE, USA and the payment for the same is also received from M/s Duke, CE,

USA.

The subject services would have been classifiable under the category of

Commercial Coaching & Training services in case the said services were provided

directly to M/s Duke CE, USA i.e., on a principal to principal basis.

However, in this case the services have been provided to various clients who were

in-fact clients of M/s Duke CE, USA hence the said services are provided on behalf of

M/s Duke CE, USA.

4.1.2 As per Section 65(105)(zzb) of the Finance Act, 1994 as applicable from time to

time, the term “taxable service” means services provided or to be provided

“to a client, by any person in relation to business auxiliary service.”

4.1.3 As per section 65(19) of the Finance Act, 1994, (as amended from time to

time)

‘(19) “business auxiliary service” means any service in relation to, —

(i) promotion or marketing or sale of goods produced or provided by or belonging to the

client; or

(ii) promotion or marketing of service provided by the client; or

(iii) any customer care service provided on behalf of the client; or

8

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

(iv) procurement of goods or services, which are inputs for the client; or

Explanation.— For the removal of doubts, it is hereby declared that for the purposes of this

sub-clause, “inputs” means all goods or services intended for use by the client; ‘;

(v) production or processing of goods for, or on behalf of, the client; or

(vi) provision of service on behalf of the client; or

(vii) a service incidental or auxiliary to any activity specified in sub-clauses (i) to (vi), such

as billing, issue or collection or recovery of cheques, payments, maintenance of accounts

and remittance, inventory management, evaluation or development of prospective customer

or vendor, public relation services, management or supervision,

and includes services as a commission agent, but does not include any information technology

service and any activity that amounts to “manufacture” within the meaning of clause (f) of

section 2 of the Central Excise Act, 1944 (1 of 1944).

Explanation. — For the removal of doubts, it is hereby declared that for the purposes of this

clause, —

(a) ”commission agent” means any person who acts on behalf of another person and causes

sale or purchase of goods, or provision or receipt of services, for a consideration, and includes

any person who, while acting on behalf of another person —

(i)

deals with goods or services or documents of title to such goods or services; or

(ii)

collects payment of sale price of such goods or services; or

(iii)

guarantees for collection or payment for such goods or services; or

(iv)

undertakes any activities relating to such sale or purchase of such goods or

services;

(b) “information technology service” means any service in relation to designing, developing

or maintaining of computer software, or computerised data processing or system networking, or

any other service primarily in relation to operation of computer systems;

4.1.4 Interpretation of the above definitions leads to inference that in case any

person provides services on behalf of its client then such services would amount to be

a taxable service under section 65(105)(zzb) of the Finance Act, 1994 as amended

from time to time.

4.1.5 In the present case, from the “Scope of the Impugned Activities/Services”

discussed in para 3 supra, it is explicit that impugned services are provision of

services by the service provider (i.e., Duke, India) of behalf of its client (i.e., Duke

USA), hence squarely classifiable under the category of Business Auxiliary Services

and the service provider (i.e., Duke, India) has received consideration for the same

from M/s Duke, USA.

4.2 CHARGE OF SERVICE TAX

4.2.1 According to section 66 of the Finance Act, 1994 as amended from time to time

service tax at the rate of twelve percent was required to be levied on the value of the

taxable services referred to in sub-clause (zzb) of clause (105) of section 65 and such

amount was to be collected in such manner as may be prescribed.

9

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

4.2.2 The effective rate was reduced to ten percent vide Notification No. 8/2009-S.T.,

dated 24-2-2009.

4.2.3 Thus, there was charge of service tax at the rate of twelve percent (for the

period from 2007-08 to 2008-09) & ten percent (for the period from 2009-10 to 201112) on the taxable service of Business Auxiliary Services. The same was to be

collected along with applicable Education and Higher Education Cess.

4.3

CRITERIA FOR EXPORT OF SERVICES

4.3.1 Vide Rule 4 of Export of Service Rules, 2005 (as amended from time to time) it

is provided that, “Any service, which is taxable under clause (105) of section 65 of the Act,

may be exported without payment of service tax.”

4.3.2 As per Rule 3 of the Export of Service Rules, 2005, the taxable services are

classified in three categories as far as criterion for a taxable service to be called as

export of service is concerned. The same is reproduced as below:-

3. Export of taxable service. –

(1) Export of taxable services shall, in relation to taxable services, (i) specified in sub-clauses (d), (p), (q), (v), (zzq), (zzza), (zzzb), (zzzc), (zzzh), (zzzr),

(zzzy), (zzzz) and (zzzza) of clause (105) of section 65 of the Act, be provision of such

services as are provided in relation to an immovable property situated outside India;

(ii) specified in sub-clauses (a), (f), (h), (i), (j), (l), (m), (n), (o), (s), (t), (u), (w), (x), (y),

(z), (zb), (zc), (zi), (zj), (zn), (zo), (zq), (zr), (zt), (zu), (zv), (zw), (zza), (zzc), (zzd), (zzf),

(zzg), (zzh), (zzi), (zzl), (zzm), (zzn), (zzo), (zzp), (zzs), (zzt), (zzv), (zzw), (zzx), (zzy),

(zzzd), (zzze), (zzzf) and (zzzp) of clause (105) of section 65 of the Act, be provision of

such services as are performed outside India:

Provided that where such taxable service is partly performed outside India, it shall be

treated as performed outside India;

(iii) specified in clause (105) of section 65 of the Act, but excluding, –

(a) sub-clauses (zzzo) and (zzzv);

(b) those specified in clause (i) of this rule except when the provision of taxable

services specified in sub-clauses (d), (zzzc) and (zzzr) does not relate to

immovable property; and

(c) those specified in clause (ii) of this rule,

when provided in relation to business or commerce, be provision of such services to a

recipient located outside India and when provided otherwise, be provision of such

services to a recipient located outside India at the time of provision of such service:

Provided that where such recipient has commercial establishment or any office relating

thereto, in India, such taxable services provided shall be treated as export of service

only when order for provision of such service is made from any of his commercial

establishment or office located outside India.

4.3.3 From the provisions explained in para 4.3.2, it is explicit that “ Commercial

Training or Coaching services” falls under category prescribed in Rule 3(1)(iii) of the

Export of Service Rules, 2005 and the same would be considered as Export of Service

when

(a) are provided in relation to business or commerce, be provision of such

services to a recipient located outside India and

10

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

(b) order for provision of such service is made from commercial establishment

or office located outside India (in case the recipient has commercial

establishment or any office relating thereto, in India) and

(c) Conditions as per Rule 3(2) are satisfied.

4.3.4 As per Rule 3(2) of the Export of Service Rules, 2005, the conditions for a

taxable service to qualify as export of service are provided. The same is reproduced as

below:-

‘(2) The provision of any taxable service specified in sub-rule (1) shall be treated as export of

service when the following conditions are satisfied, namely:(a) such service is provided from India and used outside India; and

(b) payment for such service is received by the service provider in convertible foreign

exchange.

4.3.5 Thus, the activity of the said service provider or the services provided by the

said service provider would qualify as export of service if it is proven that the said

services were used outside India and the payment of same is received in convertible

foreign exchange.

4.3.6 The said service provider has submitted the sheets wherein the details of

ultimate location of the service receivers was reflected (Table-3 supra), however on

being asked during the record of the statement, regarding the evidences to prove the

same the said service provider submitted that

“sometimes the services are provided virtually by way of teleconferencing, video conferencing & in

person (as required). At the present juncture, I submit that we may be in possession of bills of travelling,

hotel stay etc. in case of travel of a person to provide such services. However, in other cases it would be

difficult to produce any evidences on account of service being in-tangible in nature.”

4.3.7 Moreover, on perusal of the remittance certificates submitted by the said

service provider it was observed that the amount was reflected in INR only not in

foreign exchange.

On being asked during the record of the statement, regarding the same the said

service provider submitted that

“The said amount was received in convertible foreign exchange in support of the same I hereby again

produce the copy of the FIRC’s against the same.

Further, I want to submit that in case of Rs.1,29,07,247- received by us on 13.12.2011, the payment was

made by M/s DUKE CE USA through a bank account in USA. However, due to some unavoidable reasons,

the said transaction was routed through a Intermediatery Bank i.e., State Bank of India. The said

amount was then transferred to our account maintained in UTI / Axis Bank by State Bank of India.

However, further two remittances amounting to INR 9,71,338.17 & 12,56,876.70 were received directly

in our bank account maintained in HSBC Bank.”

4.3.8 In view of the above discussions it is observed that the said service provider failed to

prove the fact that the impugned services were used outside India and payment for the same was

received in convertible foreign exchange and hence could not be given the benefit of export

of service.

4.4 VALUATION OF THE TAXABLE SERVICES

4.4.1 According to section 67 of the Finance Act, 1994 as amended from time to time

where service tax is chargeable on any taxable service with reference to its value, then

such value shall be the gross amount charged by the service provider for such service

provided or to be provided by him.

11

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

The gross amount charged for the taxable service shall include any amount

received towards the taxable service before, during or after provision of such service.

Gross amount charged includes payment by cheque, credit card, deduction

from account and any form of payment by issue of credit notes or debit notes and

book adjustment, and any amount credited or debited, as the case may be, to any

account, whether called “Suspense account” or by any other name, in the books of

account of a person liable to pay service tax, where the transaction of taxable service

is with any associated enterprise.

4.4.2 Thus, the value to be considered for calculation of service tax was the gross

amount charged for providing the taxable services.

4.4.3 The said service provider was not paying the service tax on the gross amount

charged for the taxable services rendered. In other words they were paying service tax

on part of the gross amount charged / received for the taxable services. As per

observation raised by the audit officers and the details submitted during the record of

the statement, it appears that the said service provider has not paid the service tax

on the following:

S.

No.

F.Y.

1

2

3

4

5

2007-08

2008-09

2009-10

2010-11

2011-12

Amount

Charged /

Received for

Taxable

Services

(including

Service Tax )

768339

7002035

735300

2585471

4044318

15135463

Rate of

Service

Tax

12.36%

12.36%

10.30%

10.30%

10.30%

Table-2

Amount

Charged /

Received for

Taxable

Services

(excluding

Service Tax )

683819

6231786

666637

2344035

3666653

13592930

Basic

Service

Tax

Payable

Education

Cess

Payable

Higher

Education

Cess

Payable

Total

Service

Tax

payable

82058

747814

66664

234404

366665

1497605

1641

14956

1333

4688

7333

29952

821

7478

667

2344

3667

14976

84520

770249

68664

241436

377665

1542533

4.4.4 Thus, the said service provider undervalued the taxable services to the tune of

Rs.1,35,92,930/- rendered by him and accordingly not discharged the service tax

liability amounting to Rs.15,42,533/- on the same.

4.5

PAYMENT OF SERVICE TAX

4.5.1 According to section 68(1) of the Finance Act, 1994 as amended from time to

time “every person providing taxable service to any person shall pay service tax at the

rate specified in section 66 in such manner and within such period as may be

prescribed.”

4.5.2 The said service provider was required to pay the service tax amounting to

Rs.15,42,533/- under section 68(1) of the Finance Act, 1994 read with Rule 6 of the

Finance Act, 1994 for the taxable services rendered but the said service provider

failed to do so.

4.6

FURNISHING OF RETURNS

4.6.1 As per Section 70 of the Finance Act, 1994 as amended from time to time every

person liable to pay the service tax shall himself assess the tax due on the services

provided / received by him and shall furnish a return in such form and in such

manner and at such frequency as may be prescribed.

12

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

4.6.2 The said service provider did not disclose correct information about the taxable

services provided to a service receiver located outside India.

4.6.3 Thus, the said service provider failed to self-assess the taxable value and

service tax liability as prescribed under Section 70 of the Finance Act, 1994.

5.

In view of the Para 4 above, it can be deduced that:-

(a) The said service provider under-valued the amount of Rs.1,35,92,930/- received

towards the taxable services provided by way of mis-declaring the same under the

Export of Services, thereby contravening the provisions of Section 67 of the Finance

Act, 1994.

(b) The said service provider did not pay the applicable service tax to the tune of

Rs.15,42,533/- under section 68(1) of the Finance Act, 1994 read with Rule 6 of the

Finance Act, 1994 for the taxable services rendered thereby contravening the

provisions of Section 68(1) of the Finance Act, 1994. Also, the said service tax is liable

to be recovered from the said service provider.

(c) The said service provider failed to self-assess the service tax liability due upon it

thereby contravening the provisions of Section 70 of the Finance Act, 1994 read with

Rule 7 of the Service Tax Rules, 1994.

6.

PROVISIONS OF RECOVERY OF SERVICE TAX AND PENAL PROVISONS

THEREOF

6.1

According to Section 73(1) of the Finance Act, 1994(as amended from time to

time, where any service tax has not been levied or paid or has been short-levied or

short-paid or erroneously refunded by reason of —

(a) fraud; or

(b) collusion; or

(c)

wilful mis-statement; or

(d) suppression of facts; or

(e) contravention of any of the provisions of this Chapter or of the rules made

thereunder with intent to evade payment of service tax, Central Excise Officer may,

within Five year from the relevant date, serve notice on the person chargeable with

the service tax which has not been levied or paid or which has been short-levied or

short-paid or the person to whom such tax refund has erroneously been made,

requiring him to show cause why he should not pay the amount specified in the

notice.

6.2

According to Section 75 of the Finance Act, 1994(as amended from time to

time), every person, liable to pay the tax in accordance with the provisions of section

68 or rules made thereunder, who fails to credit the tax or any part thereof to the

account of the Central Government within the period prescribed, shall pay simple

interest at such rate as is for the time being fixed by the Central Government, by

notification in the Official Gazette for the period by which such crediting of the tax or

any part thereof is delayed.

6.3

According to Section 76 of the Finance Act, 1994 as amended from time to

time, any person, liable to pay service tax in accordance with the provisions of

Finance Act, 1994 fails to pay such tax and the interest on that tax amount, shall be

liable to pay, a penalty which shall not be less than two/one hundred rupees for

every day during which such failure continues or at the rate of two/one per cent of

such tax, per month, whichever is higher, starting with the first day after the due

date till the date of actual payment of the outstanding amount of service tax.

6.4

According to Section 77(2) of the Finance Act, 1994 as amended from time to

time, any person, who contravenes any of the provisions of this Chapter or any rules

13

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

made thereunder for which no penalty is separately provided in this Chapter shall be

liable to a penalty which may extend to Ten Thousand Rupees.

6.5

According to Section 78 of the Finance Act, 1994 as amended from time to

time, where any service tax has not been levied or paid or has been short-levied or

short-paid or erroneously refunded, by reason of —

(a) fraud; or

(b) collusion; or

(c)

wilful mis-statement; or

(d) suppression of facts; or

(e)

contravention of any of the provisions of this Chapter or of the rules made

thereunder with intent to evade payment of service tax,

the person, liable to pay such service tax or erroneous refund, shall also be liable to

pay a penalty, in addition to such service tax and interest thereon, if any, payable by

him, which shall not be less than, but which shall not exceed twice, the amount of

service tax so not levied or paid or short-levied or short-paid or erroneously refunded.

7.

In view of the provisions detailed in the para-6 supra, it appeared that

7.1

Since the said service provider short paid the service tax to the tune of

Rs.15,42,533/- due upon him, hence the said amount was liable to be recovered

under the provisions of section 73(1) of the Finance Act, 1994 as amended from time

to time.The invocation of extended period for recovery of service tax was justified in

the present case as the said service provider mis-declared the information about the

said services (on which service tax is demanded) in the statutory ST-3 returns with

intent to evade the payment of service tax. It is worth mentioning that had the

accounts of the said service provider not been audited by the service tax department

such evasion of service tax would have gone unnoticed.Thus, it appeared that, there

was deliberate withholding of essential information from the department by misstatement about said services provided and value realized. It appears that all these

material information have been concealed from the department deliberately,

consciously and purposefully to evade payment of service tax. Therefore, in this case

all essential ingredients exist to invoke the extended period in terms of Section 73(1)

of Finance Act, 1994 to demand the service tax short paid.

7.2

Interest on the said amount as per applicable rate is also liable to be paid

under section 75 of the Finance Act, 1994 as amended from time to time.

7.3

As the said service provider has not paid the due service tax, it has made itself

liable for penalty under section 76 of the Finance Act, 1994 as amended from time to

time.

7.4

Also, as the the said service provider did not disclosed proper & correct

information in the statutory ST-3 returns as prescribed under section 70 of the

Finance Act, 1994 hence, failed to comply with the Statutory provisions of the said

act and became liable for penalty under Section 77 of the Finance Act, 1994.

7.5

All the above acts of contravention on part of the said service provider seemed

to have been committed willfully with intent to evade payment of service tax rendering

them liable for penalty under Section 78 of the Finance Act, 1994.

8.

Now therefore, M/s Duke Corporate Education India Private Limited, Ground

Floor, Academic Block, IIM, Vastrapur, Ahmedabad-380015 was hereby called up on

to Show Cause no.STC/4-48/O&A/12-13 dated 4.06.2013 by

the Additional

Commissioner of Service Tax, Service Tax, Ahmedabad, having its office at 1 st Floor,

Central Excise Bhavan, opp. Polytechnic, Ambawadi, Ahmedabad-380015 as to why:-

14

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

1) the amount of Rs.1,35,92,930/- received should not be treated as taxable

value under the category of ‘Commercial Training or Coaching Service’

(consequently denied the benefit of export of service) and applicable service tax

amounting to Rs.15,42,533/- (Rupees Fifteen Lakhs Forty Two Thousand Five

Hundred Thirty Three only) should not be demanded and recovered from them

under the provisions of the Section 73 (1) of the Finance Act, 1994.

2) Interest as applicable rate on the amount of Service Tax liability should not be

demanded and recovered from them for the delay in making the payment

under Section 75 of the Finance Act, 1994 ;

3) Penalty should not be imposed upon them under Section 76 of the Finance Act

1994, for the failure to make the payment of Service Tax in prescribed time

limit ;

4) Penalty should not be imposed upon them under Section 77(2) of the Finance

Act, 1994 for the failure to self-assess the correct taxable value and misdeclaration regarding export of services in ST -3 returns.

5) Penalty should not be imposed upon them under Section 78 of the Finance

Act, 1994 for suppressing the value of taxable services provided by them before

the department with intent to evade payment of service tax.

DEFENCE REPLY

9.

The assessee vide their letter dated 19.7.2013 has denied the allegations made

in the SCN and submitted that :

9.1

The service have not been provided outside India

They submitted that they have provided the ultimate location from which the

performance of service has taken place for the period between FY 2007-2008 to FY

2011-2012.Moreover Mr. Nikhil Raval in his recorded statement has stated that :

“Sometimes the services are provided virtually by way of teleconferencing, video

conferencing and in person ( as required). He submitted that they may be in

possession of bills of traveling, hotel stay, etc in case of travel of a person to

provide such services. However, in other cases it was difficult to produce any

evidences on account of service being in tangible in nature.”

10.

The Ministry in Order to clarify this issue has issued a Circular No

111/05/2009-ST dated 24.2.2009 which is reproduced below :

In terms of rule 3(2) (a) of the Export of Services Rules 2005, a taxable service shall

be treated as export of service if ‘ such service is provided from India and used

outside India”. Instances have come to notice that certain activities, illustrations of

which are given below, are denied the benefit of export of services and the refund of

service tax under rule 5 of the Cenvat Credit Rules 2004 ( Notification No 5/2006-CE

(NT) dated 14.3.2006 on the ground that these activities do no satisfy the condition

‘used outside India’.

(i) Call centres engaged by foreign companies who attend to calls from customers or

prospective customers from all around the world including from India,.

(ii) Medical transcription where the case history of a patient as dictated by the doctor

abroad is typed out in India and forwarded back to him,.

(iii) Indian agents who undertake marketing in India of goods of a foreign seller. In this case,

the agent undertakes all activities within India and receives commission for his services from

15

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

foreign seller in convertible foreign exchange,.

(ill) Foreign financial institution desiring transfer of remittances to India, engaging an Indian

organisation to dispatch such remittances to the receiver in India. For this, the foreign

financial institution pays commission to the Indian organisation in foreign exchange for the

entire activity being undertaken in India.

The departmental officers seem to have taken a view in such cases that since the activities

pertaining to provision of service are undertaken in India, it cannot be said that the use of the

service has been outside India.

2. The matter has been examined Sub-rule (1) of rule 3 of the Export of Services Rules, 2005

categorizes the services into three categories :

(i) Category (I) Rule 3(1)(i) .. For services (such as Architect service, General Insurance

service, Construction service, Site Preparation service) that have some nexus with

immovable property, it is provided that the provision of such service would be 'export' if they are

provided in relation to an immovable property situated outside India.

(ii) Categorv (II) Rule 3(I)(ii) : For services (such as Rent-a-Cab operator, Market Research

Agency, set-vice, Survey and Exploration of Minerals service, Convention service, Security

Agency service, Storage and Warehousing service) where the place of performance of

service can be established, it is provided that provision of such set-vices would be 'export' if

they are performed (or even partly performed) outside India.

Categorv (III)IRule 3(1)(iii) : For the remaining services (that would not fall under

category I or II), which would generally include knowledge or technique based services, which

are not linked to an identifiable immovable property or whose location of performance

cannot be readily identifiable (such as, Banking and Other Financial services, Business .

Auxiliary services and Telecom services), it has been specified that they would be `export',(a) If they are provided in relation to business or commerce to a recipient located outside

India; and

(b) If they are provided in relation to activities other than business or commerce to a

recipient located outside India at the time when such services are provided.

It is an accepted legal principle that the law has to be read harmoniously so as to avoid

contradictions within a legislation. Keeping this principle in view, the meaning of the term

'used outside India' has to be understood in the context of the characteristics of a particular

category of service as mentioned in sub-rule (1) of rule 3. For example, under Architect

service (a Category I service [Rule 3(1)(W), even if an Indian architect prepares a design

sitting in India for a property located in U.K. and hands it over to the owner of such property

having his business and residence in India, it would have to be presumed that service has

been used outside India. Similarly, if an Indian event manager (a Category II service [Rule

3(I)(ii)fl arranges a seminar for an Indian company in U.K. the service has to be treated to

have been used outside India because the place of performance is U.K. even though the

benefit of such a seminar may flow back to the employees serving the company in India.

For the services that fall under Category III [Rule 3(1)(iii)], the relevant factor is the

location of the service receiver and not the place of performance. In this context, the

phrase 'used outside India' is to be interpreted to mean that the benefit of the service

should accrue outside India. Thus, for Category III services [Rule 3(1)(iiiil, it is possib le

that export of service may take place even when all the relevant activities take place in

India so long as the benefits of these services accrue outside India. In all the illustrations

mentioned in the opening paragraph, what is accruing outside India is the benefit in terms of

promotion of business of a foreign company. Similar would be the treatment for other

Category III [Rule 3(1)(iii)] services as well.

11.

As stated in Para 3 of the above circular, in case of services provided by Duke India to Duke

CE, USA which can be classified as BAS services falling under third category of export services, the

following conditions needs to be satisfied.

a. The service should be provided to a recipient located outside India –

As per the said Rule 3(1)(iii), location of the service recipient is the criteria to determine

export of service, meaning thereby if the location of the service recipient is outside India,

provision of service will be considered as export of service. Further, they wished to bring to

the notice that the place of performance of service is not a criteria to determine export of

16

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

service unlike in Rule 3(1)(i) or Rule 3(i)(ii) of Export Rules. Hence the noticee which has

provided services to Duke CE, USA , located outside India and has fulfilled the criteria of

export of services under the category of Business Auxilliary Services.

b. Though all the services are provided within India, its benefits should accrue outside India.

11.1 As stated in the above Circular, even though all services are completed in India, in case the

benefit is accrued outside India, the same can still be termed as export of services. We would like to

submit that in most of the cases we have provided our services to Duke CE, USA outside India by

sending our experts outside India. In certain cases the services have been provided through video

conferencing activity, but the ultimate benefit has accrued to Duke CE, USA, situated outside India,

has the same as enabled them to fulfill their contractual liability with their clients.

12.

Because of the confusion that was building on the interpretation of Export of Service Rules,

GOI amended Export Rules vide Notification 6/2010-ST dated February 27, 2010 and also issued

Circular vide Letter D.O.E. No. 334/1/2010-TRU dated February 26, 2010. Some relevant extracts

from the letter are given below:

7. AMENDMENT TO EXPORT OF SERVICE RULES, 2005

7.1 Export of Service Rules, 2005 have been amended as follows:

The taxable service, namely 'Mandap Keeper Service' has been shifted from the list under

rule 3(1) (it) [i.e. performance related services] to the list under rule 3(1)(i) [immovable

property related services] and three taxable services, namely 'Chartered Accountant

Services', 'Cost Accountant Services' and 'Company Secretary's Services', have been shifted from

the list under rule 3(1) (ii) [i.e. performance related services] to the list under rule

3(1)(iii) [residual category of services]. Notification No. 6/2010-ST, dated 27th

February2010 refers. Identical changes have been made under the Taxation of services

(Provided from Outside India and Received in India) Rules, 2006 as well (Notification

No.16/2010-ST, dated 27th February 2010 refers);

"The condition prescribed under rule (2) (a) i.e. 'such service is provided from India

and used outside India' has been deleted (Notification No.6/2010-ST, dated 27th February

2010 refers)."

13.

At this juncture, we would like to submit that CBEC had issued another Circular No.

141/10/2011 dated May 13, 2011, wherein referring to the clarification provided through Circular

111/05/2009, it was mentioned that to determine as to whether the service is actually used outside India

or not, the effective use of services is an important aspect and not the accrual of benefit. Therefore,

as per the circular, for considering a service as export out of India it is the place of effective use of

such services which has to be looked at rather than the accrual of benefit.

14.

Further, Board's circular No. 56/05/2003 St dated 25-04-2003 has specified that whether a

service is export or not should be based on the fact whether the service was done by the principle

service provider or the secondary service provider:

". Another question raised is about the taxability of secondary services which

are used by the primary service provider for the export of services, Since the

secondary services ultimately gets consumed/merged with the services that are

being exported no service tax would be leviable on such secondary services.

However in case where the secondary service gets consumed in part or toto for

providing service in India, the service tax would be leviable on the secondary

service provider. For this purpose both primary and secondary service

providers would maintain the records deemed fit by them to identify the

secondary services with services that are being exported”.

15.

This has to be decided strictly in accordance with the provisions of Export of Services Rules,

2005. In case of services in respect of immovable property, mentioned in Rule 3(1)(i), the services will

be treated as export if the same have been provided in respect of an immovable property located

abroad. In case of performance based services mentioned in Rule 3(1)(ii), the service is to be treated

as export if it has been performed abroad. In case of other services mentioned in Rule 3(1)(iii) when

17

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

performed in India in relation to business or commerce, the services shall be treated as export if the

business is located abroad. Though for period till 28- 2-2007 there was a condition in this regard in

Rule 3(2) of Export of Services Rules, 2005 that "the service is delivered outside India and is used

outside India - and from 1-3-2007 to 26-2-2010, the condition was that "the service has been used

outside India", with effect from 26-2-2010 these conditions have been deleted, as according to

Board's Letter No. 334/1/2010-TRU, dated 26-2-2010 this change has been carried out keeping in

view of certain difficulties that were faced by the trade while following this rule. This, amendment

has to be treated as clarificatory in nature and hence retrospective in nature, as the trade and the

Board have always understood the Rule 3(2)(a) to mean that as long as the party aboard is deriving

benefit from services in India, it is export of services. This is clear from the Board's Circular No.

111/05/09-S.T., dated 24-2-2009. In any case, throughout the period of dispute, since it is Duke CE,

US who had received the services in question, was the beneficiary of the same and had used this service

for their business of professional training for the intended beneficiaries of their clients abroad, the

services have to be treated as delivered abroad and used abroad.

Considering the above, Large Bench of Delhi Tribunal in the case of Paul Merchants

Limited Vs. CCEx, Chandigarh (2013-29-STR-257) has held that what constitutes export of service

is to be determined strictly with reference to the provisions of Export of Service Rules, 2005. Not

doing so and leaving this question to be determined by individual tax payers or tax collectors for

each service, based on their deductive ability would result only in total confusion and chaos.

Accordingly, money transfer service is being provided by the Western Union from abroad to their

clients who approached their offices or the offices of their Agents for remitting money from to

friends/relatives in India. The service being provided by the agents and sub agents is delivery of

money to the intended beneficiaries of the customers of WU abroad and this service is "business

auxiliary service", being provided to Western Union. It is Western Union who is the recipient and

consumer of this service provided by their Agents and sub-agents, not the persons, receiving money

in India. Hence, these services so provided by the agents and/or sub-agents would be classified as

exports of service as per the principles of 'Export of Service Rules, 2005' since the consumer of

services provided by the agents and sub-agents of Western Union in India was actually Western Union entity

located abroad, who used their services for their money transfer business and not the persons who received

money in India.

16.

In addition, in the case of Blue Star Limited v. CCE, Bangalore (2008-TIOL-716-CESTATBangalore) where the assessee was engaged in booking orders for its principals situated in US,

UK and other foreign countries. The assessee booked orders in India for which it

received commission. The role of the assessee, as an agent, was confined to taking orders from

domestic buyers and passing the same to foreign suppliers. After the orders were booked,

the buyers used to directly get in touch with foreign suppliers, who exported the goods to India

and received payments for sale, directly from the buyers. The assessee was considering the

services as exports under the taxable head Business Auxiliary Services. The service tax

authorities took the view that such services were being provided in India and therefore, cannot

be said to have been exported. Considering the facts of the case and the relevant legal

provisions, the CESTAT held that booking of orders in India on behalf of the foreign suppliers,

which resulted in a sale of goods by the foreign suppliers to customers in India, shall be

considered as if the service has been used outside India and accordingly qualify as export

in terms of the Export Rules.

17.

Further, in the case of ABS India Ltd v. Commissioner of Service Tax, Bangalore (2008TIOL-2102-CESTAT-Bangalore), the assessee was a Company incorporated in India having a

subsidiary company in Singapore. The assessee booked orders for the sales of goods

manufactured by the subsidiary situated in Singapore. As per the assessee, these services fall

under the taxable category of Business Auxiliary Services and qualify as exports. The claim

18.

18

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

of export was rejected by the service tax authorities and the matter eventually reached

before the CESTAT. Considering the facts of the case, the CESTAT held that when the

recipient of the service is Singapore Company, it cannot be said that service is delivered in India.

Due to booking of orders, the Singapore Company gets business; therefore, the service is also

utilized abroad, In terms of the Export Rules the service rendered is indeed a service, which

has been exported. In such circumstances, the appellant is not required to pay the Service tax.

Further, relying on the case of Paul Merchants (supra) produced by the larger bench

of the New Delhi CESTAT, the Mumbai CESTAT in the case of M/s. Vodufone Essar

Cellular Ltd. v. CCE, Pune-Ill (2013-TIOL-566-CESTAT-MUM) took a similar

view. In the Vodafone case, the appellant entered into an agreement with foreign telecom

service partner wherein the appellant agreed to provide telecom services to the

subscribers of foreign telecom service partners when such subscribers visit India and use

appellant's telecom network. The appellant was to receive consideration for such services

from foreign telecom service partner only and not from the subscribers. In this case, the

department contended that the services were provided by the appellant to the subscribers in

India; hence, the benefit of export of service is not available to the appellant. However, the

Hon'ble CESTAT held that since the contract for supply of telecom services was between

the appellant and foreign telecom service partner, who paid for the services rendered by the

appellant, it is the foreign telecom service partner, who is the recipient of services

provided by the appellant. Accordingly, the CESTAT allowed the benefit of export of services to

19.

the appellant.

20

.In the present facts, since Duke India has provided its services to Duke US which have been

used in the provision of services by Duke CE, US outside India, we believe that the services are

used outside India by Duke CE, US. Hence, in view of the above referred judicial pronouncements read

with the CBEC Circular No. 111/05/2009 dated February 24, 2009, we humbly submit that the services

provided by the Noticee to Duke CE, US were used outside India and accordingly qualified as export

of service.

21.

Notwithstanding the above, assuming that the services provided by Duke India is

classifiable as 'Commercial Training or Coaching services' which is classified as

performance based service in the Export of Service Rules, 2005. This would mean that when

even a part of the service is provided outside India, then the whole service would be

considered as export of services for the purpose of levy of service tax. Accordingly, those

projects where the place of performance is specified as outside India

22.

Sub –rule (1) of rule 3 of Export of services Rules 2005 categortizes the service into three

categories.

(ii) Category (II) [Rule 3(I)(ii)I : For services (such as Rent-a-Cab operator, Market

Research Agency service, Survey and Exploration of Minerals service, Convention

service,Security Agency service, Storage and Warehousing service) where the place

of performance of service can be established, it is provided that provision

of such services would be export if they are performed ( or even partly

performed ) outside India.

22.1 On the basis of the above circular, Tribunals in the following cases have held that even if

a part / portion of the services have been provided outside India then the service classified under

the performance based criteria in the Export of Service Rules, 2005 would be considered as export of

service for the purpose of taxability.

(1) Manish Agarwal vs. Commissioner of Service Tax, Ahmedabad ( 2012)-27 –STR-155 Tri-

19

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

Ahmd).

(2) KSH International (P) Ltd v/s. Commissioner of Central //exci8se, Belapur (2010-215STT-307-Mumbai CESTAT)

23.

Further it was submitted that even the FIRC issued by the SHSBC reads as under :

"In the case where foreign currency amount has been mentioned as "INR" in the FIRC, it is being

confirmed that the bank has received the funds in "INR" to the debit of Vostro account and that such

proceeds are received in fully convertible foreign exchange."

Thus, it is submitted that it is due to the above banking transaction mechanism, that the bank of the

noticee issued the FIRCs indicating equivalent INR amount only. However, as mentioned earlier,

the fact that the bank has issued FIRC itself goes to support the fact that the bank received foreign

currency.

24.

Since the term ‘ convertible foreign exchange ‘ has not defined in the service

tax legislation, reference is made to the exchange control regulations in India, as

contained in the foreign Exchange Management Act, 1999. As per Section 2 (n) of the

FEMA “ foreign exchange” means foreign currency and includes –

a. Deposits credits and balances payable in any foreign currency.

b. Drafts, travelers cheques, letters of credit or bills of exchange, expressed or

drawn in Indian currency but payable in any foreign currency.

c. Drafts, travellers cheques, letters of credit or bills of exchange drawn by banks,

institutions or persons outside India, but payable in Indian currency.

25.

In light of the above, it was submitted that FEMA defines foreign currency

which includes deposits, credits and balances payable in any foreign currency, drafts,

travelers cheques, letters of credit or bills of exchange, expressed or drawn in Indian

currency but payable in any foreign currency and also draft, travelers cheques, letters

of credit or bills of exchange drawn by banks, institutions or persons outside India,

but payable in Indian currency.

26.

In view of the above, they submitted that the demand proposed in the SCN is

baseless and against legal provisions and various judicial precedents and liable to set

aside.The Noticee submitted that it is a well settled proposition in law that imposition

of penalty is the result of quasi-criminal adjudication. It is submitted that penalty can

be levied only if it is proved that there is presence of guilty, dishonest and willful

intent either to defraud revenue or evade payment of Tax on Noticee part.

27.

The decision of Supreme court in union of India vs. Rajasthan Spinning and

weaving Mills 2009 (238) ELT 3 (SC) held clearly that element of mensrea is essential

for imposition of penalty.

27.1 The decision of the Supreme court in the case of M/s. Hindustan Steel Ltd vs.

State of Orissa 91978) ELTJ 159 SC has categorically held that :

“ the discretion to impose a penalty must be exercised judicially. A penalty will

be ordinarily imposed in cases where the party acts deliberately in defiance of

the law, or is guilty of contumacious or dishonest conduct, or acts in conscious

disregard of its obligation, but not in cases where there is a technical or venial

breach of the provisions of Act or where the breach flows from a bonafide belief

that the offender is not liable to act in the manner prescribed by the statute.”

28.

Further the noticee relied on the decision of Mundra Port & Speical Economic

Zone Ltd v/s. CCE Rajkot [ 2009 (13) STR 178 ( Tri Ahmd)] wherein it was observed

that if the intention of the noticee is bonafide penal provisions cannot be invoked. In

view of above submission, it is clear that in absence of mensrea no penalty under

Section 78 can be levied on Noticee.

20

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

28.1 With respect to simultaneous levy of penalty under Section 76 and 78, Punjab

and Haryana High court in the case of CCE vs. first flight courier Ltd (2011 -22-STR622) has held that penalties under section 76 and 78 are not simultaneously

imposable. Section 78 provides for higher amount of penalty and is more

comprehensive. Penalty under Section 76 is not justified if penalty is already imposed

under Section 78. No question of law arises and as such revenue appeal was

dismissed.

29.

Without prejudice to above, Section 80 of the Finance Act provides that

nothwithstanding anything contained in provisions of Section 76 and Section 78,

penalty cannot be imposed if assessee proves that there was reasonable cause for the

said failure. In the instant case the following are the grounds on which they claim

reasonable cause.

a. Duke India has provided services to the client’s of Duke CE, USA on behalf of

the later;

b. Regular audits have been conducted by service tax authorities.

30.

Further they have submitted that as per Section 75 of the Finance Act, 1994

as amended, every person who fails to pay service tax or any part thereof to the

credit of Central government within the prescribed period shall pay simple interest at

the rate fixed by the Central government for the period by which payment of such tax

or part of tax thereof is delayed. Therefore as per Section 75 interest is payable only

when a person has delayed or has not paid service tax on due dates.

31.

In the instant case the Noticee submitted that in view of above various factual

and legal submission, the Noticee has rightly classified the service under the category

of “ Business Auxiliary service” and accordingly the question of payment of interest

does not arise and requested to drop the proceedings in the SCN.

32.

Shri Hardik Shah, Consultant for the noticee, appeared for personal hearing on

23.9.2013. He submitted that he filed written brief of his arguments which is taken on record.

He reiterated the submissions made in written reply filed by them. Another hearing was held

on 11.12.2013, wherein Shri Hardik Shah, Consultant submitted a written brief/synopsis of the

PH conducted. They reiterated the submissions made earlier and in their written reply.

DISCUSSIONS AND FINDINGS

33.

I have carefully gone through the facts on records, the show cause notice under reference

and submissions made by the noticee vide their letter dated 19.07.2013 and during the personal

hearings.

34.

Before proceeding with the case, I would like to narrate the nature of services provided

by the noticee. The services provided by the noticee have been synopsized as under, in view of

their submissions to the Department vide letters dated 05.10.2012, 28.09.2012 and also the

statement of Shri Nikhil Raval, Authorised signatory recorded on 18.10.2012:

M/s Duke Corporate Education (India) Pvt. Ltd. or the noticee, is an Indian Counterpart

of M/s Duke CE USA which is a globally reputed company in the area of executive

training.

The noticee focuses on education on what the client's people need to know, do and

believe in order to address current or anticipated challenges and attain specific business

objectives.

The noticee helps its clients implement their strategies through development of their

people and differs from a traditional business school or professional services firm in that

21

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

the organization is not solely dependent on the organization's or any single university's

faculty.

To meet the broad range of client needs, the noticee utilizes quality faculty from numerous

business schools, other external professionals and Duke CE experts from across the company.

The approach of utilizing the best resources to meet the needs of a client is central to noticee’s

business model.

This approach requires the exchange of services and support across all parts of Duke CE/noticee in

a fair and equitable manner. To achieve this, the noticee has employed the following standard:

A. The parties shall upon request make commercially reasonable efforts to provide to one

another program support (including faculty). Such faculty shall remain employees or

independent contractors of the party providing the faculty.

B. The parties shall pay one another for program support as follows:

i.

To the extent Duke CE provides to the noticee program support (including

faculty), the noticee shall pay Duke CE for the costs of such program support at an

amount equal to (A) the fee charged to the client for such support, in the case of support

provided by Duke CE though its employees, or (B) the actual cost to Duke CE of such

support, in the case of support provided by Duke CE through independent contractors.

ii.

To the extent IIM-A provides to the noticee program support (including

faculty), the noticee shall pay IIM-A for the costs of such program support at an amount

equal to (A) the fee charged the client for such support, in the case of support provided

by IIM-A through its employees and (B) the actual cost to IIM-A of such support, in the

case of support provided by IIM -A through independent contractors.

Duke CE educates and develops people at every entry level so that they can contribute to

business success. Duke CE delivers corporate education in 63 countries around the world.

In certain occasions, Duke CE, USA requires to provide certain support services from Duke CE

India. In this regard, personnel’s of Duke CE, India executes the said support services.

There are three ways in which the noticee gets their clients i.e., they earn revenue from

(a) Companies who wish to provide executive training to their employees / key personnel’s contact

the noticee for the same.

(b) The noticee themselves approach the company’s to have orders from them for training their

executives.

(c) Sometimes their parent company i.e., M/s Duke USA during the course of providing the services

to their clients requires support from M/s Duke Corporate Education (India) Pvt. Ltd. in certain

manner. These may include specialized training in context of Indian Subcontinent or the areas

of specialization of M/s Duke India.

In the first two cases, they enter into written agreement with the clients directly whereby the

scope of the services, time of services, due date of delivery, consideration / professional fees

to be paid etc. are agreed upon.

In case of the third case i.e., cases where support in required by M/s Duke USA from us, they

normally agree upon the scope of the services vide our inter-company correspondences only.

No written agreement is entered for these support services and the consideration is received

from M/s Duke CE, USA in their bank accounts.

(Emphasis Supplied)

34.1 On the basis of the above, I find that that the services provided by the noticee can be

briefly stated as under:

22

OIO No. 29/STC/AHD/ADC(JSN)/2013-14

(i)

(ii)

The service is in relation to commercial and specialized training.

The service of training is provided to the clients by the noticee for a

consideration.

(iii)

The noticee utilizes quality faculty from numerous business schools, other

external professionals to meet the needs of their clients.

The training focuses on education on what the client's need to know, do and

believe in order to address current or anticipated challenges and attain specific

business objectives.

(iv)

(v)

(vi)

The training imparted by the noticee includes skill, knowledge, lessons

and almost every kind of imparting of information on various subjects

related to commerce and industry.

Any institute or establishment providing commercial training or

coaching for imparting skill or knowledge or lessons on any subject or

field with or without the issuance of a certificate is commercial training

or coaching centre.

35.

Further as per Wikipedia, the word

“Training” means the acquisition

of knowledge, skills, and competencies as a result of the teaching of vocational or practical

skills and knowledge that relate to specific useful competencies.

35.1 Now, the definition of taxable services namely: Commercial Training or Coaching

Service as per Section 65 (105) (zzc) of the Finance Act, 1994 read with Section 65 (26) and 65

(27), is reproduced below:

“(26) “commercial training or coaching” means any training or coaching provided by a

commercial training or coaching centre;

(27) “commercial training or coaching centre” means any institute or establishment

providing commercial training or coaching for imparting skill or knowledge or lessons

on any subject or field other than the sports, with or without issuance of a certificate and

includes coaching or tutorial classes but does not include pre-school coaching and

training centre or any institute or establishment which issues any certificate or diploma

or degree or any educational qualification recognized by law for the time being in force;

“Explanation. — For the removal of doubts, it is hereby declared that the expression

“commercial training or coaching centre” occurring in this sub-clause and in clauses