2. The Australian Wine Sector - Department of Foreign Affairs and

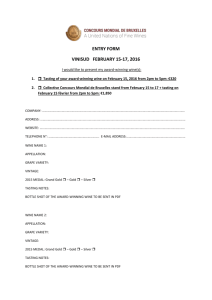

advertisement