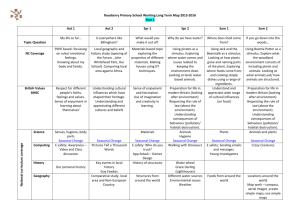

Seasonality

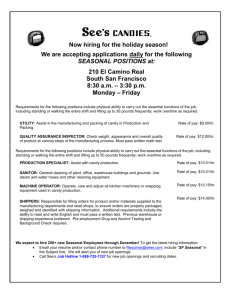

advertisement

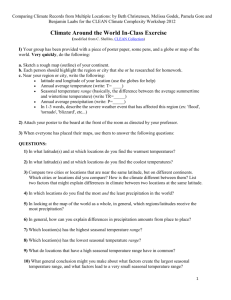

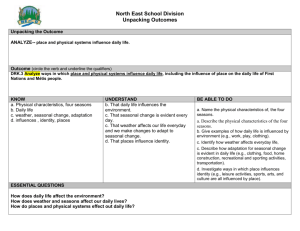

Seasonality Look actual time series data Retail sales NYS bonuses paid CPI The main causes of the seasonal swings are Timing of public holidays School vacations Timing of payments (wages, dividend…) Tax year or accounting periods Effects of weather There are many ways of smoothing the seasonal components of an economic series, but they all basically aim to produce a series that appears to be nonseasonal. However, some of the proposed methods of seasonal adjustment are not suitable in a forecast framework as they are designed only to remove a seasonal component from a set of historical data and in doing so some observations are lost. Growth rate for not seasonally adjusted series gt 100*(Yt / Yt s 1) For monthly data, s=12, for quarterly data, s = 4. Note that this type of year-overyear growth rate tends to miss turning points. Seasonal Adjustment (Smoothing) Type of data series Additive, Yt Tt It St Ct where Tt is trend, I t is irregular, St is seasonal, and Ct is cyclical. Multiplicative Yt Tt I t St Ct Smoothing a time series using moving average Moving average or centered moving average m 1 Yt* Yt j 2m 1 j m For example, taking m 2 , we have 1 Yt * (Yt 2 Yt 1 Yt Yt 1 Yt 2 ) 5 Notice that 2 observations lost at the beginning and two at the end. Also smoothing is centered and it is average (not real value). Simple average vs. weighted average The simple average is given above. The weighted average, for example, could take the form 1 Yt * (Yt 2 2Yt 1 4Yt 2Yt 1 Yt 2 ) 10 Another example (3X3 moving average): 1 Yt * (Yt 1 Yt Yt 1 ) 3 1 Yt** (Yt*1 Yt* Yt*1 ) 3 then we have 1 Yt ** [(Yt 2 Yt 1 Yt ) / 3 (Yt 1 Yt Yt 1 ) / 3 (Yt Yt 1 Yt 2 ) / 3] 3 1 (Yt 2 2Yt 1 3Yt 2Yt 1 Yt 2 ) 9 Then define Ratio: Seasonal indices: Seasonal factors: rt Yt ** / Yt im average (rt ) for month i s j i j /(i1 , i2 ,...im ) 1 m j 1, 2,...m (scaling factor) Seasonal adjusted series Yt / s j Issues: 1. Missing Observations. X11-ARIMA or X12_ARIMA 2.The estimation of seasonal factors is an iterative process. But how to separate different components is very difficult. 3.Irregular (I) could distort the seasonal factors (S). Modeling Seasonality Regression with seasonal dummies: s Yt i Dit t i 1 Dit is a series whose value = 1 when the season is i and = 0 otherwise for the entire period t , t 1, 2,...T , which is called sometimes seasonal dummy variable. Notice that if there is an intercept in the model then you only use s 1 seasonal dummies. Trend may be included s Yt * t i Dit t i 1 Other calendar effects: holiday and trading-day Holiday: Easter dummy, which = 1 if the month contains Easter, otherwise = 0 Trading-day (different business days): dummy variable whose value equals to the number of trading days for that month Forecasting future values using the regression model. Example